Discover 2025 Review: Everything You Need to Know

In 2025, Discover stands out as a financial services provider, offering a range of products, including credit cards, personal loans, and banking services. However, user experiences are mixed, with some praising their customer service and rewards programs, while others express dissatisfaction with fees and account management. This review aims to provide a comprehensive overview of Discover, highlighting key features, user feedback, and expert opinions.

Note: It's important to recognize that Discover operates in various regions, and the user experience may vary significantly based on the specific entity interacting with customers. This review synthesizes information from multiple sources to ensure fairness and accuracy.

Ratings Overview

How We Score Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data related to Discover's services.

Broker Overview

Founded in 1985, Discover Financial Services has evolved into a significant player in the financial sector, particularly known for its credit card offerings. The company operates a user-friendly online platform that supports various asset classes, including stocks and bonds. However, it lacks robust regulatory oversight, which raises concerns about its trustworthiness. Discover primarily operates under U.S. regulations, with a focus on providing accessible financial products to a broad audience.

Detailed Analysis

Regulated Geographic Regions

Discover operates primarily in the United States, where it is subject to federal regulations. However, it does not have a strong regulatory presence in other regions, which could impact user trust and security.

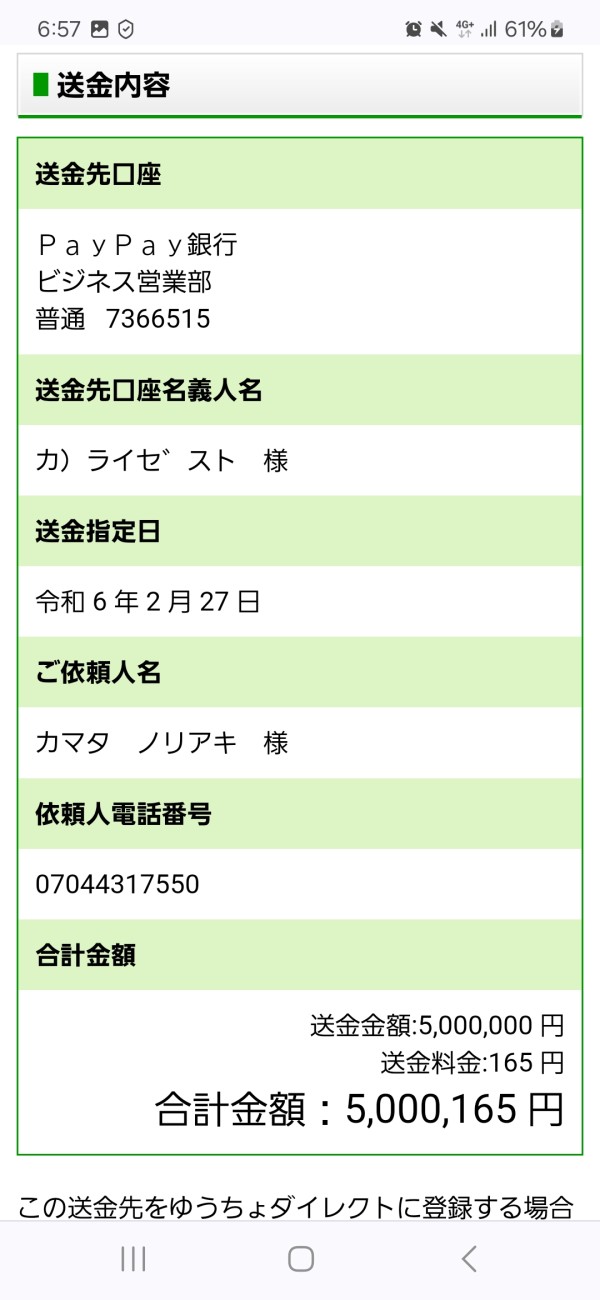

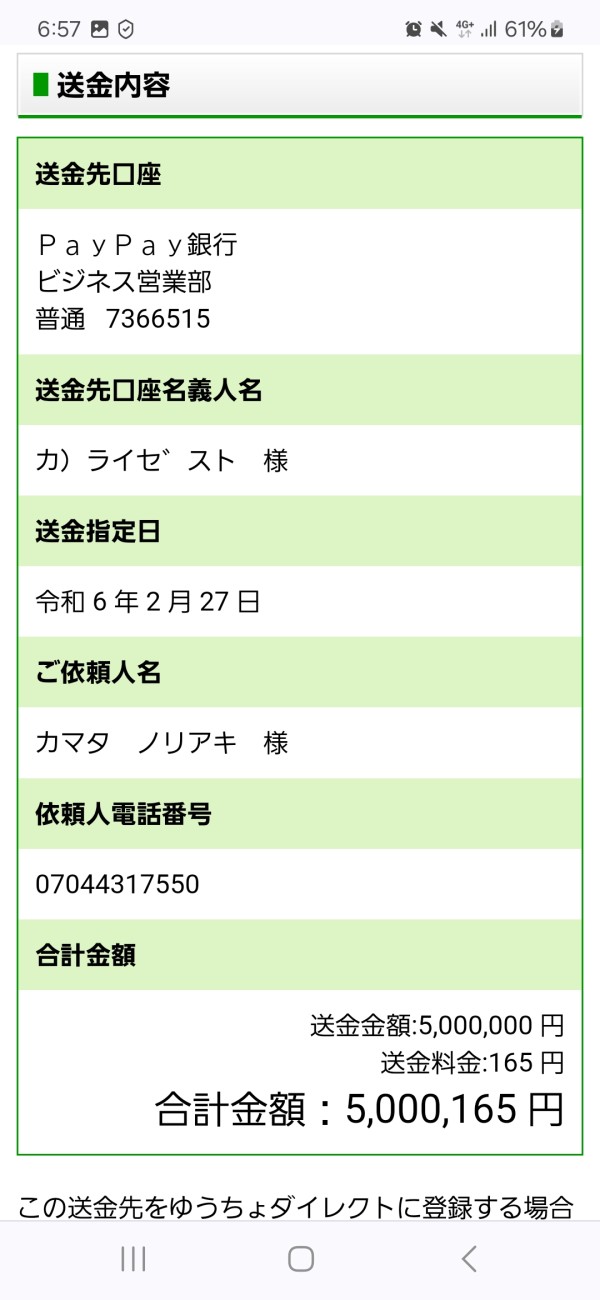

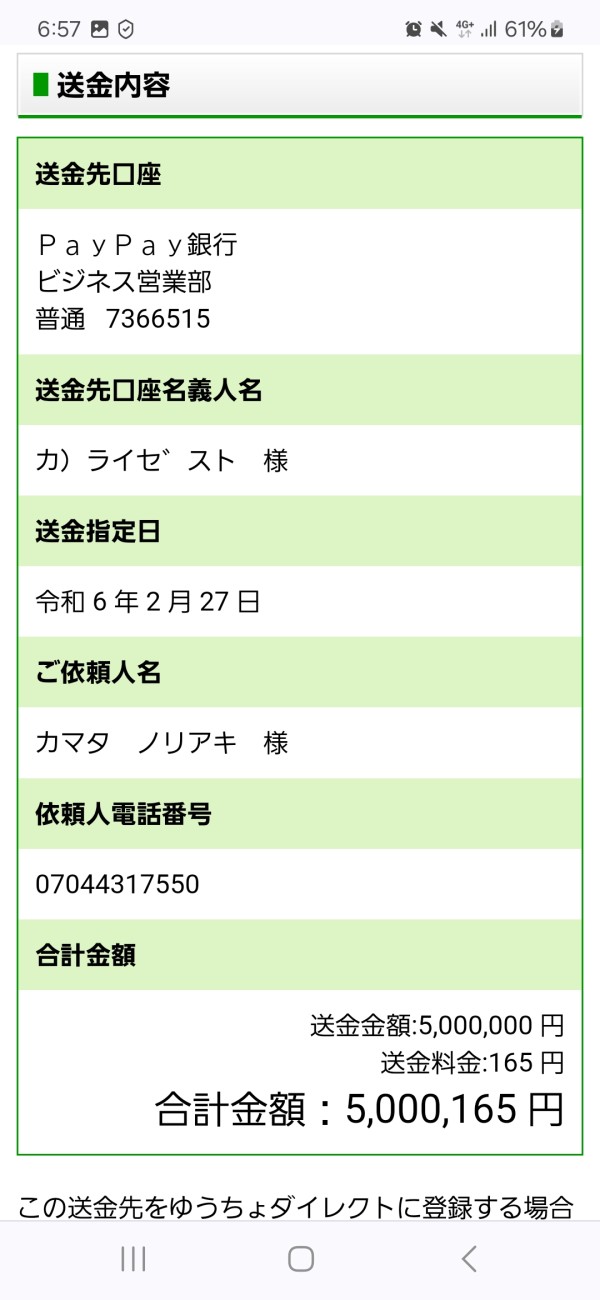

Deposit/Withdrawal Currencies/Cryptocurrencies

Users can make deposits and withdrawals in USD, but the platform does not currently support cryptocurrency transactions. This limitation may deter users interested in diversifying their investment portfolios.

Minimum Deposit

The minimum deposit required to open an account with Discover is $2,500, which may be a barrier for new investors or those with limited funds.

Discover offers various promotions, including cash back on credit card purchases. However, specific bonuses for new accounts may vary and are not consistently highlighted in reviews.

Tradable Asset Classes

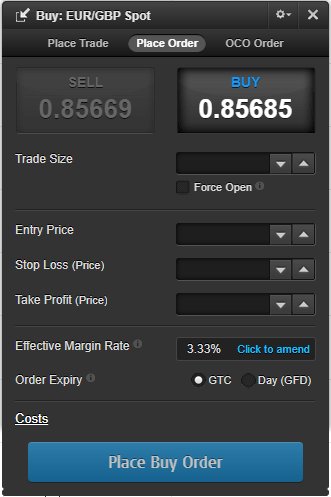

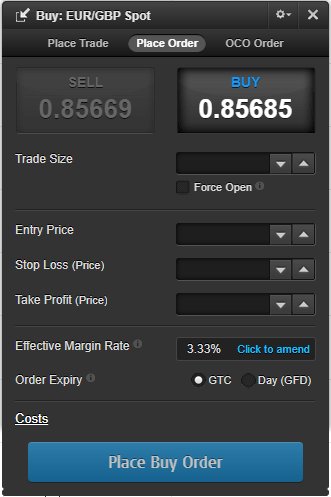

Discover allows trading in a limited range of assets, primarily focusing on stocks, bonds, and mutual funds. The lack of options for trading forex or cryptocurrency may limit its appeal to more diverse investors.

Costs (Spreads, Fees, Commissions)

Users have reported varying experiences regarding fees, with some noting high interest rates on credit products. According to Bankrate, Discover does not charge an origination fee for personal loans, but it does impose a $39 late fee. This fee structure could be a deterrent for those concerned about hidden costs.

Leverage

Discover does not offer leverage for trading, which may disappoint more experienced traders looking for higher-risk investment opportunities.

Discover primarily operates through its proprietary online platform, which is designed for ease of use. However, it lacks compatibility with popular trading platforms like MT4 or MT5, which could deter seasoned traders.

Restricted Regions

While Discover operates mainly in the U.S., users in other regions may face restrictions when trying to access its services. This limitation could lead to frustration for international investors.

Available Customer Service Languages

Discover's customer service is primarily offered in English, which may pose challenges for non-English speaking users seeking assistance.

Ratings Recap

Detailed Breakdown

-

Account Conditions (6/10): The minimum deposit requirement of $2,500 may deter entry-level investors. Additionally, the lack of diverse account types can limit user engagement.

Tools and Resources (7/10): Discover provides a user-friendly online platform with basic tools for managing finances. However, it lacks advanced trading tools that experienced traders might expect.

Customer Service and Support (5/10): User reviews indicate mixed experiences with customer service, ranging from helpful to frustrating. This inconsistency in support may affect user satisfaction.

Trading Experience (6/10): While the platform is easy to navigate, the limited asset classes and lack of leverage may disappoint active traders looking for more dynamic trading options.

Trustworthiness (4/10): The absence of strong regulatory oversight raises concerns about user safety and security. Users should be cautious and consider potential risks before engaging with Discover.

User Experience (5/10): Overall user experience is average, with some praising the cash back rewards while others criticize the customer service and fee structures.

In conclusion, the Discover review for 2025 presents a mixed bag of user experiences, regulatory concerns, and service offerings. While it provides a solid foundation for credit and banking services, potential users should weigh the pros and cons carefully before engaging with the platform.