Is jimeiwo safe?

Business

License

Is Jimeiwo Safe or Scam?

Introduction

Jimeiwo is a relatively new player in the forex market, positioning itself as an online trading platform that offers a variety of financial instruments including forex, stocks, indices, commodities, and cryptocurrencies. As with any trading platform, it is crucial for traders to exercise caution and perform thorough due diligence before entrusting their funds to a broker. This article aims to assess whether Jimeiwo is a safe trading option or a potential scam.

To arrive at a well-rounded conclusion, we will examine multiple aspects of Jimeiwo, including its regulatory status, company background, trading conditions, client fund safety measures, customer experiences, platform performance, and overall risk assessment. The evaluation is based on a comprehensive review of user feedback, expert analyses, and information from reputable financial websites.

Regulation and Legitimacy

The regulatory status of a trading platform is a primary indicator of its legitimacy and reliability. In the case of Jimeiwo, it operates without any significant regulatory oversight, which raises several red flags. The National Futures Association (NFA) has classified Jimeiwo as a "suspicious clone," indicating that it may be imitating the identity of a legitimate financial entity, often for deceptive purposes.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0556772 | USA | Suspicious Clone |

The lack of regulation means that Jimeiwo is not subject to the stringent oversight that protects traders from fraud and malpractice. Unregulated brokers often lack the necessary consumer protections, making it significantly riskier for traders. Furthermore, the absence of a regulatory authority means that traders have limited recourse in case of disputes or issues with fund withdrawals.

In summary, the unregulated status of Jimeiwo raises concerns about its operational integrity and the safety of client funds. Therefore, it is essential for traders to carefully consider these factors when evaluating if Jimeiwo is safe for trading.

Company Background Investigation

Jimeiwo is headquartered in Canada and has been operational for less than a year. While the company claims to offer a range of trading services through popular platforms like MetaTrader 4 and MetaTrader 5, its relatively short history raises questions about its stability and reliability.

The management team behind Jimeiwo lacks publicly available information, making it challenging to assess their qualifications and experience in the financial market. Transparency is a crucial factor for any trading platform, and Jimeiwo's limited disclosure raises concerns about its commitment to ethical practices.

Furthermore, the absence of verifiable information regarding the ownership structure adds another layer of uncertainty. Reliable brokers typically provide clear information about their ownership and management, allowing clients to assess their credibility. The lack of such transparency in Jimeiwo's case makes it difficult to ascertain whether it operates with the best interests of its clients in mind.

In conclusion, the limited company background and transparency issues make it difficult to determine if Jimeiwo is safe for traders seeking a trustworthy broker.

Trading Conditions Analysis

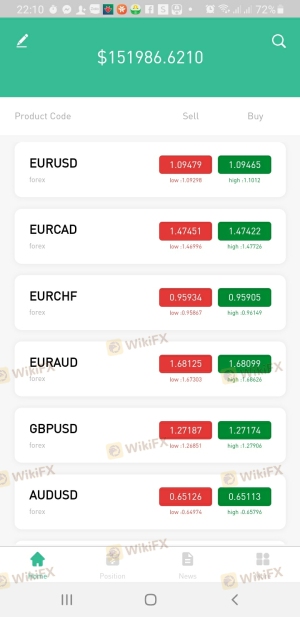

When evaluating a trading platform, the fee structure and trading conditions are vital components to consider. Jimeiwo offers a variety of account types, including standard, ECN, and VIP accounts, each with varying spreads and commission structures. The minimum deposit requirement is set at $100, which is relatively accessible for new traders.

However, the overall fee structure is concerning. Jimeiwo has been reported to impose unusual withdrawal fees, including $20 for bank transfers and $5 for wire transfers, which can add up for frequent traders. Additionally, the spreads offered, while competitive at times, may not be sustainable, leading to hidden costs that could affect overall profitability.

| Fee Type | Jimeiwo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | Varies | Fixed |

| Overnight Interest Range | High | Moderate |

The potential for hidden fees and the lack of clarity in the commission structure raises questions about the overall trading experience. Traders should be wary of any broker that does not provide transparent information about its fees, as this can be a sign of underlying issues.

Given these factors, it is prudent for traders to question whether Jimeiwo is safe for trading, especially considering the financial implications of its fee structure.

Client Fund Safety

Client fund safety is paramount when evaluating any trading platform. Jimeiwo claims to implement various safety measures; however, the lack of regulation significantly undermines these assurances. The absence of robust investor protection mechanisms, such as segregated accounts and negative balance protection, raises alarms for potential investors.

Without regulatory oversight, there is no guarantee that Jimeiwo will adhere to industry standards for fund safety. Reports from users have indicated issues with fund withdrawals, with some claiming that their funds were frozen or subjected to excessive fees. Such complaints highlight the potential risks associated with trading on an unregulated platform.

Furthermore, Jimeiwo's practice of using personal bank accounts for deposits and withdrawals instead of corporate accounts is a significant red flag. This practice can expose traders to risks of fraud and misappropriation of funds.

In summary, the lack of regulatory oversight and the questionable practices surrounding fund management make it difficult to conclude that Jimeiwo is safe for traders concerned about the security of their investments.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a trading platform. Many users have reported negative experiences with Jimeiwo, particularly regarding withdrawal issues and customer service. The absence of readily available support channels, such as live chat or phone support, has left many traders feeling stranded when they encounter problems.

Common complaints include difficulties in withdrawing funds, lack of response from customer support, and unclear communication regarding fees. The following table summarizes the types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Poor |

| Fee Transparency | Medium | Poor |

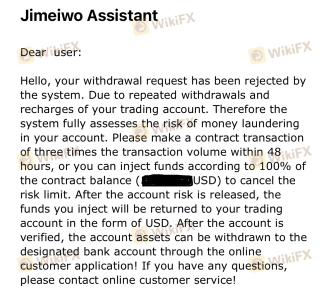

One notable case involved a trader who reported being unable to withdraw their funds after multiple attempts, resulting in significant financial distress. The trader claimed that Jimeiwo imposed unexpected fees and delays, which were not communicated upfront.

Given this feedback, it is evident that there are substantial concerns regarding the quality of customer experience at Jimeiwo. Therefore, it is reasonable to question whether Jimeiwo is safe for traders who value reliable support and timely access to their funds.

Platform and Trade Execution

The performance of a trading platform is critical for an optimal trading experience. Jimeiwo offers both MetaTrader 4 and MetaTrader 5, which are widely recognized for their user-friendly interfaces and comprehensive features. However, user reports indicate concerns regarding platform stability and execution quality.

Traders have highlighted issues such as slippage and order rejections, which can significantly impact trading outcomes. A reliable platform should ensure that orders are executed promptly and at the desired price, but many users have reported experiencing delays and inconsistencies.

Additionally, the lack of transparency regarding how Jimeiwo handles order execution raises concerns about potential manipulation or unfair practices. Without clear information on how trades are processed, traders may be at risk of experiencing unfavorable trading conditions.

In conclusion, while Jimeiwo offers popular trading platforms, the reported issues with execution quality and stability raise doubts about whether Jimeiwo is safe for traders seeking a reliable trading environment.

Risk Assessment

Using Jimeiwo as a trading platform comes with a variety of risks. The absence of regulation, questionable fund safety practices, and negative customer feedback all contribute to an elevated risk profile. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises concerns. |

| Fund Safety | High | Lack of investor protection measures. |

| Customer Support | Medium | Poor response to complaints. |

| Trading Conditions | Medium | Unusual fees and potential slippage. |

To mitigate these risks, traders should consider using a smaller initial deposit to test the platform before committing larger amounts. Additionally, thorough research and monitoring of user feedback can help identify potential issues before they escalate.

In summary, the overall risk associated with trading on Jimeiwo is significant, leading to questions about whether Jimeiwo is safe for potential investors.

Conclusion and Recommendations

In conclusion, the evaluation of Jimeiwo reveals several concerning factors that suggest it may not be a safe trading option for investors. The lack of regulatory oversight, questionable fund safety practices, negative customer feedback, and potential issues with trading conditions raise significant red flags.

For traders seeking a reliable and trustworthy broker, it is advisable to explore alternative options that are regulated by reputable authorities and have a proven track record of customer satisfaction. Some recommended alternatives include well-established brokers that offer robust consumer protections and transparent fee structures.

Ultimately, while Jimeiwo may offer attractive trading conditions, the associated risks and concerns suggest that potential investors should exercise caution and carefully consider whether Jimeiwo is safe for their trading needs.

Is jimeiwo a scam, or is it legit?

The latest exposure and evaluation content of jimeiwo brokers.

jimeiwo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

jimeiwo latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.