Is INTERVATE safe?

Business

License

Is Intervate Safe or a Scam?

Introduction

Intervate is a forex broker that has positioned itself as a player in the competitive landscape of online trading. With promises of advanced trading platforms and attractive trading conditions, it aims to appeal to both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities makes it imperative for traders to thoroughly evaluate the legitimacy and safety of their chosen trading platforms. This article investigates whether Intervate is a safe trading option or if there are underlying concerns that merit caution. Our investigation draws on various sources, including customer reviews, regulatory information, and expert analyses to provide a comprehensive assessment of Intervate's credibility in the forex market.

Regulation and Legitimacy

One of the most critical factors in determining the safety of any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to strict guidelines designed to safeguard client funds and maintain market integrity. Intervate claims to be regulated, but further scrutiny reveals discrepancies in its regulatory claims. Below is a summary of the core regulatory information regarding Intervate:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

As shown in the table, Intervate lacks any verified regulatory oversight, which raises significant red flags. The absence of regulation means that traders have no recourse in the event of disputes or issues with fund withdrawals. Furthermore, unregulated brokers often operate without the necessary safeguards that protect client funds, making them susceptible to mismanagement or outright fraud.

The lack of oversight also raises questions about the quality of Intervate's operations and its compliance history. A broker without a regulatory framework is not held accountable for its actions, which can lead to unethical practices. Therefore, in the context of the question, "Is Intervate Safe?" the answer leans heavily towards skepticism, as the broker's regulatory status is a crucial determinant of its legitimacy.

Company Background Investigation

Intervate's history and ownership structure offer further insight into its credibility. Established as a forex broker, it claims to provide a wide range of trading services. However, detailed information about its founding, ownership, and management team is limited. The lack of transparency surrounding these crucial aspects raises concerns about the broker's operational integrity.

A robust management team with relevant experience is vital for any broker's success and reliability. Unfortunately, Intervate does not provide sufficient information about its leadership, making it difficult for potential clients to evaluate the expertise behind the platform. Moreover, the absence of clear contact information and a physical address further obscures the company's legitimacy.

In terms of transparency, reputable brokers typically disclose their financial information, business model, and operational practices. Intervate's failure to provide such details leaves potential clients in the dark, raising questions about its trustworthiness. Overall, when assessing whether "Is Intervate Safe," the lack of company background and transparency is alarming and warrants caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. Intervate presents itself as a broker with competitive fees and attractive trading conditions. However, a closer examination of its fee structure reveals potential issues. Below is a comparison of core trading costs:

| Fee Type | Intervate | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 3.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3.0% |

The absence of specific data regarding Intervate's fees is concerning. A lack of clarity in fee structures can lead to unexpected charges that may significantly impact a trader's profitability. Furthermore, brokers that do not disclose their fee models may be attempting to hide unfavorable terms or exploit traders through hidden fees.

Additionally, traders should be wary of any unusual fee policies that could indicate a lack of integrity. For example, excessive withdrawal fees or minimum trade volume requirements for accessing bonuses are common tactics used by unscrupulous brokers. Thus, when considering whether "Is Intervate Safe," the ambiguity surrounding its trading conditions raises significant concerns.

Client Fund Security

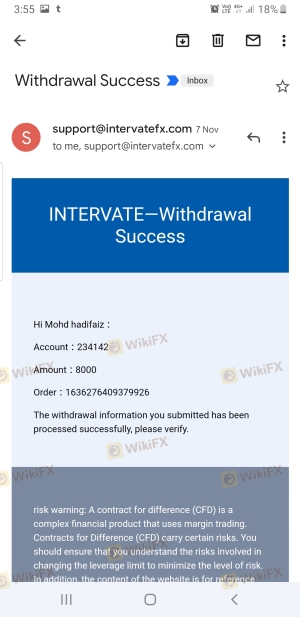

The safety of client funds is a paramount concern for any trader. A trustworthy broker should implement robust security measures to protect client deposits. In the case of Intervate, there is limited information available regarding its fund security protocols.

Reputable brokers typically segregate client funds from their operational funds, ensuring that client money is protected in the event of insolvency. However, without verification of Intervate's practices, it is unclear whether client funds are adequately safeguarded. Additionally, the absence of investor protection schemes, such as those offered by regulated brokers, further exacerbates concerns about fund security.

Moreover, the lack of a negative balance protection policy is alarming. This policy prevents traders from losing more money than they have deposited, providing an essential safety net during volatile market conditions. The absence of such protections at Intervate raises the question of whether traders could face significant financial losses without any recourse.

In summary, when evaluating "Is Intervate Safe," the lack of information regarding client fund security measures is a critical concern that potential traders should consider before engaging with the broker.

Customer Experience and Complaints

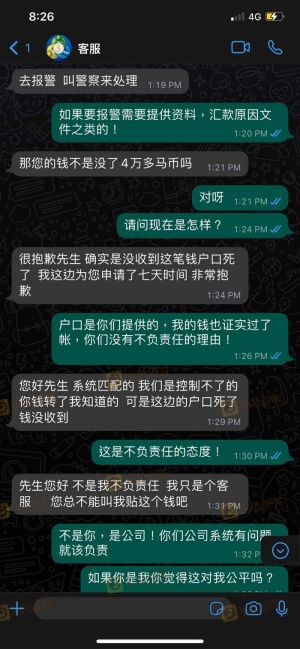

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews and complaints can provide insight into a broker's operational practices and customer service quality. In the case of Intervate, numerous negative reviews have surfaced, indicating a pattern of issues that potential clients should be aware of.

Common complaints include difficulties in withdrawing funds, poor trade execution, and unresponsive customer service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Trade Execution | Medium | Unresolved |

| Customer Service | High | Unresponsive |

Two notable case studies exemplify the challenges faced by Intervate's clients. One trader reported being unable to withdraw their funds for several months, citing vague excuses from customer service. Another user expressed frustration over poor trade execution, leading to significant financial losses. These experiences highlight the potential risks associated with trading with Intervate.

When considering whether "Is Intervate Safe," the overwhelming negative customer experiences suggest that traders may encounter significant challenges when dealing with this broker.

Platform and Execution

The performance and reliability of a trading platform are crucial for successful trading. A robust platform should offer stability, user-friendly interfaces, and efficient order execution. In the case of Intervate, there is limited information available regarding the performance of its trading platform.

Reports of slippage and high rejection rates for orders have emerged, raising concerns about the broker's execution quality. Traders expect timely and accurate order fulfillment, and any signs of manipulation or inefficiency can severely impact their trading experience.

In conclusion, when evaluating "Is Intervate Safe," the lack of detailed information about its platform performance and execution quality raises significant concerns for potential traders.

Risk Assessment

Using Intervate as a trading platform carries inherent risks. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No verified regulatory oversight |

| Fund Security Risk | High | Lack of information on fund protection |

| Customer Service Risk | Medium | Numerous complaints about responsiveness |

| Execution Risk | High | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough research before engaging with Intervate. Consider using a demo account to test the platform's performance and customer service responsiveness before committing significant capital. Additionally, diversifying investments across multiple brokers can help spread risk and enhance overall trading security.

Conclusion and Recommendations

In conclusion, the investigation into Intervate raises significant concerns regarding its safety and legitimacy as a forex broker. The lack of regulatory oversight, transparency in operations, and numerous customer complaints suggest that traders should exercise extreme caution when considering this platform.

Given these findings, it is advisable for traders to seek alternative, reputable brokers with established regulatory frameworks and positive customer feedback. Some reliable options may include brokers like Interactive Brokers or other well-regarded firms that prioritize client safety and transparency.

Ultimately, the question "Is Intervate Safe?" leans towards a negative response, and traders are encouraged to prioritize their financial security by choosing well-regulated brokers instead.

Is INTERVATE a scam, or is it legit?

The latest exposure and evaluation content of INTERVATE brokers.

INTERVATE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INTERVATE latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.