Is PRIME FX safe?

Pros

Cons

Is Prime Fx Safe or a Scam?

Introduction

Prime Fx is a forex broker that has positioned itself in the competitive landscape of online trading, offering services that attract both novice and experienced traders. However, the increasing number of scams in the forex market necessitates that traders conduct thorough due diligence before engaging with any broker. This article aims to provide an objective analysis of Prime Fx's credibility and safety by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our investigation relies on a comprehensive review of various sources, including regulatory databases, user feedback, and financial analysis, to ensure an accurate portrayal of the broker's standing in the forex market.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its safety and legitimacy. Brokers that operate under strict regulatory frameworks are generally more trustworthy, as they are subject to rigorous oversight and must adhere to high standards of conduct. Unfortunately, Prime Fx does not appear to be regulated by any recognized financial authority, which raises significant concerns regarding its operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation from top-tier authorities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) indicates that Prime Fx operates in a high-risk environment. This lack of oversight can lead to issues such as fund mismanagement, fraudulent practices, and inadequate investor protection. Historical compliance issues have been noted in reviews of Prime Fx, with numerous reports of clients facing difficulties in withdrawing their funds and experiencing misleading marketing tactics. As such, it is prudent for potential investors to exercise extreme caution when considering whether Prime Fx is safe for trading.

Company Background Investigation

Prime Fx's company history and ownership structure play a vital role in assessing its credibility. Established in 2022, the broker claims to operate from a registered address in Brussels, Belgium. However, the lack of transparency surrounding its ownership and management team raises red flags. There is little information available regarding the qualifications and experience of the individuals behind Prime Fx, which further complicates the assessment of its legitimacy.

Moreover, the company's website has faced accessibility issues, leading to speculation about its operational status. A trustworthy broker typically provides clear information about its management, regulatory compliance, and operational history. The opaque nature of Prime Fx's operations, coupled with its failure to disclose essential details about its management team, suggests a lack of commitment to transparency.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is its trading conditions, which encompass fees, spreads, and overall trading costs. Prime Fx advertises competitive trading conditions, but a closer examination reveals potential pitfalls. The broker's fee structure is not straightforward, and various reports indicate that clients may face hidden fees or unfavorable trading conditions that deviate from industry norms.

| Fee Type | Prime Fx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Unspecified | Specified |

The lack of clarity in Prime Fx's fee structure can lead to unexpected costs for traders, which is a significant concern when assessing whether Prime Fx is safe. High spreads and unclear commission policies can diminish trading profitability and create an unfavorable trading environment. Furthermore, the absence of a demo account limits traders' ability to test the platform and understand the fee structure before committing real funds.

Customer Funds Security

The safety of customer funds is paramount in the forex trading landscape. Prime Fx's lack of regulation raises serious concerns regarding the security measures in place to protect client funds. Regulated brokers are typically required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This practice protects clients in the event of bankruptcy or financial mismanagement.

Unfortunately, Prime Fx does not provide clear information regarding its policies on fund segregation, investor protection, or negative balance protection. The absence of such measures increases the risk of financial loss for traders. Additionally, there have been reports of withdrawal issues, where clients have struggled to access their funds, further highlighting the potential risks associated with trading with Prime Fx.

Customer Experience and Complaints

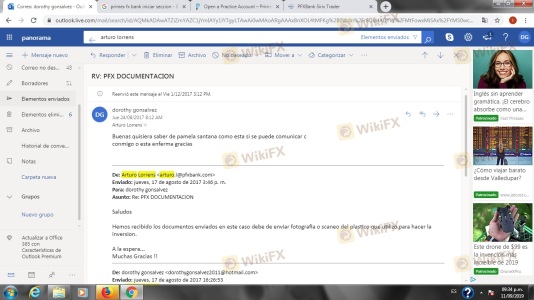

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Prime Fx reveal a pattern of negative experiences among users, primarily concerning fund withdrawals and customer support. Many clients have reported difficulties in accessing their funds, with some alleging that the broker employs tactics to delay or deny withdrawal requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Marketing | High | Non-responsive |

Typical complaints include long response times from customer support and unfulfilled promises regarding trading conditions. One notable case involved a trader who was unable to withdraw their funds after multiple attempts, leading to frustration and financial loss. Such complaints raise significant concerns about whether Prime Fx is safe for trading, as they indicate systemic issues within the company's operations.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. Prime Fx offers the widely used MetaTrader 4 (MT4) platform; however, user reviews suggest that the platform may experience stability issues and delays in order execution. Reports of slippage and rejected orders have been noted, which can adversely affect trading outcomes.

The quality of trade execution is essential for traders, particularly in the fast-paced forex market. Delays or errors in order processing can lead to missed opportunities and financial losses. Furthermore, any signs of potential platform manipulation, such as sudden spikes in spreads or unexplained account freezes, should be taken seriously. These factors further complicate the assessment of whether Prime Fx is safe for traders.

Risk Assessment

Engaging with Prime Fx carries inherent risks that potential traders must consider. The lack of regulation, unclear trading conditions, and negative customer feedback contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant regarding any unusual activities on their accounts. Seeking out brokers with established regulatory frameworks can also provide an added layer of security.

Conclusion and Recommendations

In summary, the evidence gathered suggests that Prime Fx exhibits several characteristics commonly associated with untrustworthy brokers. The lack of regulatory oversight, transparency issues, and negative customer experiences raise significant concerns about whether Prime Fx is safe for trading.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities, such as the FCA or ASIC. Brokers like FXTM or AvaTrade have established positive reputations and provide the necessary investor protections. In light of the risks associated with Prime Fx, potential investors should exercise extreme caution and prioritize their financial safety when engaging with any trading platform.

Is PRIME FX a scam, or is it legit?

The latest exposure and evaluation content of PRIME FX brokers.

PRIME FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRIME FX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.