Ingot Brokers 2025 Review: Everything You Need to Know

Summary

This comprehensive ingot brokers review gives you a fair look at a broker that has worked since 2006. The broker offers a mixed experience for traders around the world, with both good and bad points that matter for your trading success. Based on careful study of user feedback, regulatory information, and trading conditions, Ingot Brokers gets a neutral rating with strong points in trading tool variety and account flexibility, but serious problems in customer satisfaction scores.

The broker's best features include very high leverage up to 1:5000 and a low minimum deposit of just $10 USD. These features make it appealing for both retail and wholesale clients who want to start trading without spending much money. Ingot Brokers works under multiple regulatory frameworks including ASIC, JSC, FSA, and CMA, which provides oversight across different areas of the world.

However, user ratings show a big problem, with Trustpilot reviews averaging 3.2 out of 5 stars. This rating points to inconsistent service quality and customer experience issues that you should think about carefully before opening accounts.

Important Notice

This ingot brokers review knows that Ingot Brokers works through different companies across various areas, which may create different service offerings, trading conditions, and regulatory protections depending on where you live. The broker keeps offices in Australia, Seychelles, Nairobi, and Jordan, with each potentially offering different terms and conditions that could affect your trading experience.

Our evaluation method combines official broker information, verified user feedback from multiple review platforms, regulatory filings, and industry standard benchmarks. All assessments reflect publicly available information as of 2025, and traders should verify current conditions directly with the broker before making investment decisions that could affect their financial future.

Overall Rating Framework

Broker Overview

Established in 2006, Ingot Brokers has built its reputation as an Australian-headquartered brokerage firm. The company works through Straight Through Processing (STP) and Electronic Communication Network (ECN) business models that connect traders directly to the market. The company positions itself as a provider of direct market access services, connecting traders to liquidity providers without dealing desk intervention that could create conflicts of interest.

With nearly two decades of operation, Ingot Brokers has expanded its presence across multiple continents. The broker maintains regulatory compliance in several key financial areas around the world, which helps protect traders in different regions.

The broker's technology infrastructure supports over 1000 trading instruments across eight major asset categories. These include foreign exchange, equities, indices, cryptocurrencies, ETFs, precious metals, energy commodities, and agricultural products that give traders many options. This extensive offering is delivered through industry-standard platforms including MetaTrader 4, MetaTrader 5, and WebTrader, providing traders with familiar and robust trading environments they already know how to use.

According to trading platform reviews, the broker maintains regulatory oversight from the Australian Securities and Investments Commission (ASIC), Seychelles Financial Services Authority (FSA), Jordan Securities Commission (JSC), and Capital Markets Authority (CMA). This creates a multi-jurisdictional regulatory framework that provides different levels of protection depending on where you trade.

Regulatory Jurisdictions: Ingot Brokers operates under supervision from ASIC in Australia, FSA in Seychelles, JSC in Jordan, and CMA. This provides regulatory coverage across multiple regions with varying levels of trader protection and compensation schemes that may help if something goes wrong.

Minimum Deposit Requirements: The broker offers accessible entry points with minimum deposits starting from $10 USD. This positions the broker competitively for new traders and those with limited initial capital who want to start trading without risking much money.

Bonus and Promotional Offers: Specific promotional information was not detailed in available sources. This suggests traders should inquire directly about current bonus structures and promotional campaigns that might be available to new or existing clients.

Available Trading Assets: The platform provides access to over 1000 instruments spanning forex pairs, individual stocks, market indices, digital currencies, exchange-traded funds, precious metals including gold and silver, energy commodities, and agricultural products. This wide selection gives traders many ways to diversify their portfolios and find trading opportunities in different markets.

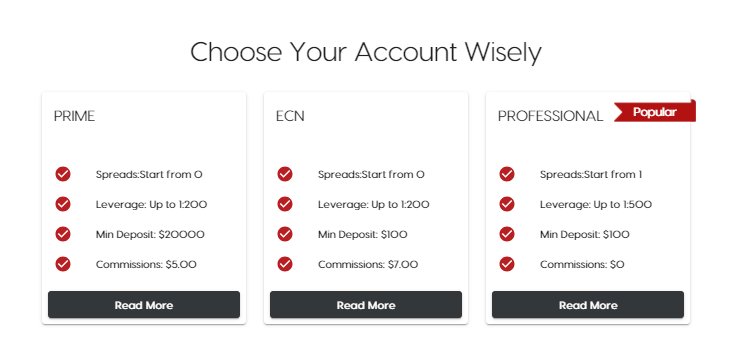

Cost Structure: Ingot Brokers employs a variable spread pricing model with commissions starting from $0. However, detailed fee schedules and typical spread ranges require direct verification with the broker for accurate trading cost calculations that will affect your profitability.

Leverage Ratios: Maximum leverage reaches 1:5000, which represents extremely high leverage that significantly amplifies both potential profits and losses. This requires careful risk management consideration because high leverage can quickly destroy your account if trades go against you.

Platform Options: Trading is facilitated through MetaTrader 4, MetaTrader 5, and WebTrader platforms. These provide desktop, mobile, and browser-based access to markets with comprehensive charting and analysis tools that most traders are familiar with.

Geographic Restrictions: Specific regional limitations were not detailed in available information sources.

Customer Support Languages: Multi-language support details were not specified in reviewed materials.

This ingot brokers review continues with detailed analysis of each evaluation dimension based on available information and user feedback patterns.

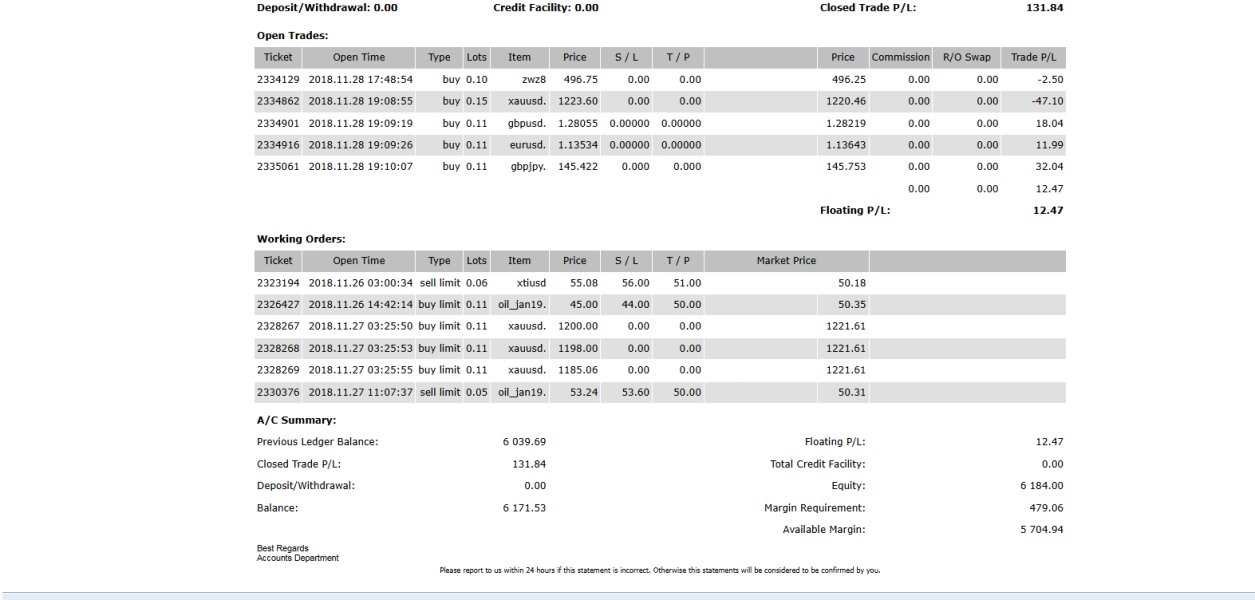

Account Conditions Analysis

Ingot Brokers demonstrates competitive positioning in account accessibility with its $10 minimum deposit requirement. This is significantly lower than many industry competitors who typically require $100-$500 initial deposits, making trading more accessible to beginners. This low barrier to entry makes the broker particularly attractive for beginning traders or those seeking to test services with minimal financial commitment that won't hurt their budget if things don't work out.

User feedback generally acknowledges this accessibility advantage. Several reviewers note the ease of account opening for small-scale trading activities, which helps new traders get started without major financial stress.

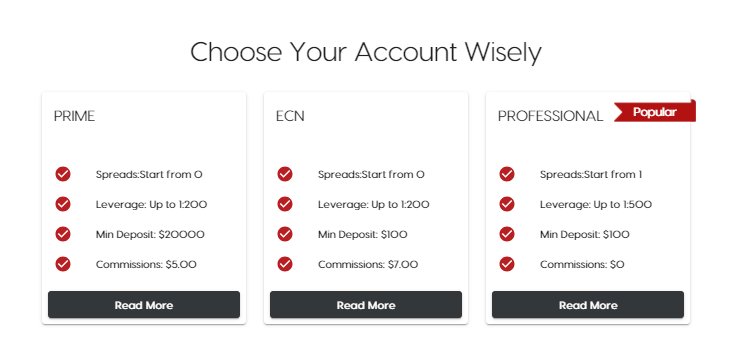

The broker offers multiple account types designed to accommodate different trading styles and capital levels. However, specific account tier details require direct verification with the broker to understand what features you get with each account type. Commission structures starting from $0 provide flexibility, particularly beneficial for traders focusing on major currency pairs where spread-only pricing may be more cost-effective than commission-based models that charge fees on every trade.

However, account holders should carefully review terms and conditions across different regulatory entities, as account features may vary depending on jurisdiction. Some user reviews indicate confusion about account specifications and fee structures, suggesting the need for clearer communication of account terms that traders can easily understand. The variable spread model means trading costs can fluctuate with market conditions, potentially affecting profitability calculations for active traders who make many trades per day.

Overall, while the basic account conditions offer attractive entry points, traders should thoroughly understand the complete fee structure and account limitations before committing significant capital. This ensures alignment with their trading strategies and expectations for long-term success.

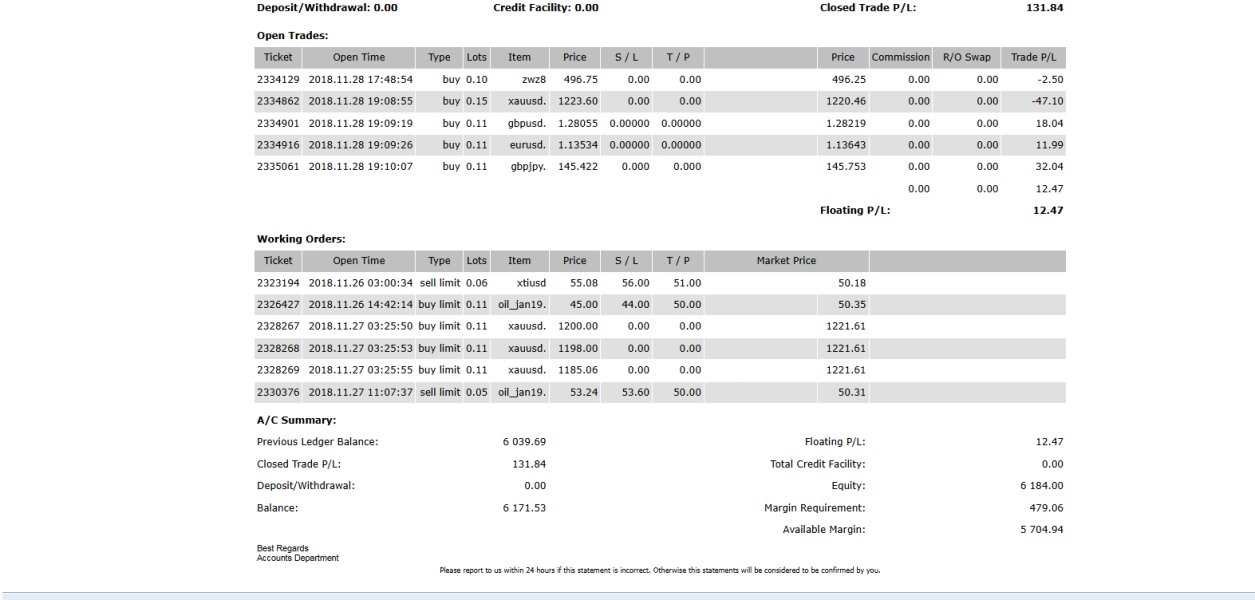

The platform's strength lies in its comprehensive instrument selection, offering over 1000 tradeable assets across eight major categories. This extensive range provides traders with substantial diversification opportunities, from traditional forex pairs to emerging cryptocurrency markets that can help spread risk across different types of investments. The inclusion of stocks, ETFs, and commodities creates a one-stop trading environment that can accommodate various investment strategies and market preferences without needing multiple broker accounts.

MetaTrader 4 and MetaTrader 5 integration ensures access to advanced charting capabilities, technical indicators, and automated trading functionality through Expert Advisors (EAs). These platforms are industry standards, providing familiar interfaces for experienced traders while offering comprehensive educational resources for newcomers who need to learn the basics. The WebTrader option adds convenience for traders who prefer browser-based access without software downloads that take up computer space.

User feedback regarding trading tools shows mixed responses. Traders appreciate the instrument variety but have concerns about execution quality and platform stability during volatile market conditions when prices move quickly. Some traders report satisfactory experiences with automated trading capabilities, while others note occasional technical issues that impact strategy implementation and can cost money when trades don't execute properly.

Research and analytical resources were not extensively detailed in available information, representing a potential gap in value-added services. Educational materials and market analysis provisions require direct inquiry with the broker to understand what learning resources are actually available. The absence of detailed information about proprietary tools or unique research offerings suggests a focus on platform access rather than comprehensive trading support services that help traders make better decisions.

Customer Service and Support Analysis

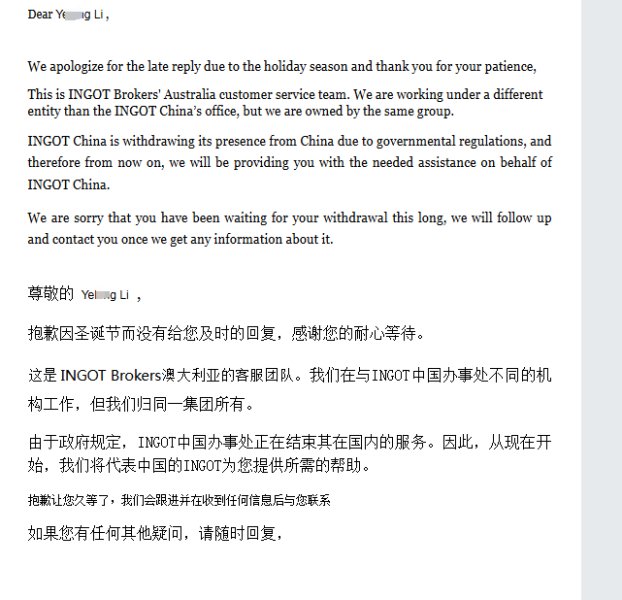

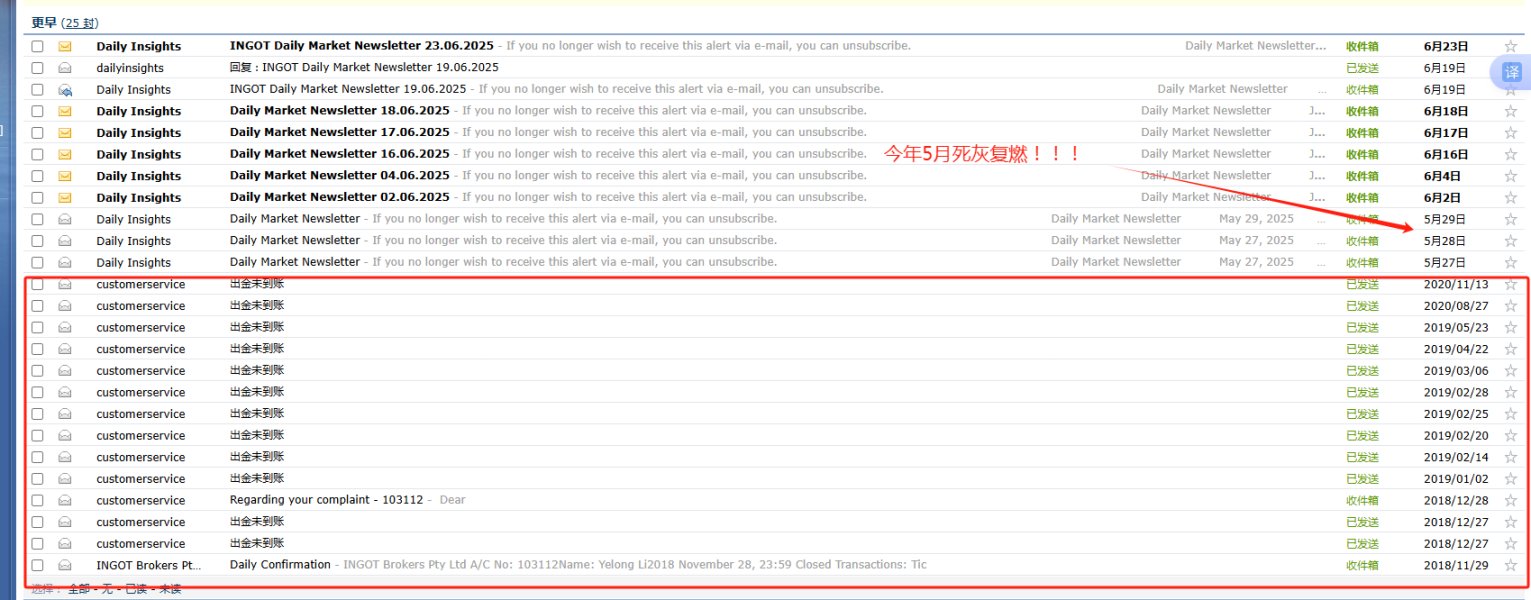

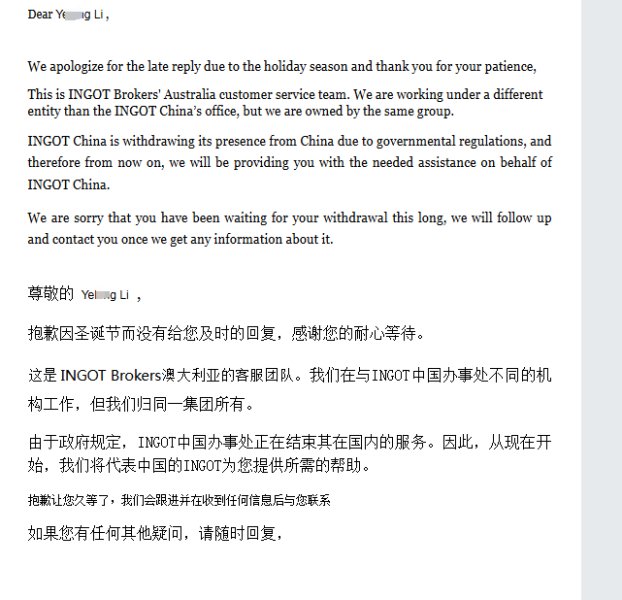

Customer service represents a significant challenge area for Ingot Brokers, as reflected in user review patterns and satisfaction ratings. Multiple communication channels including email, telephone, and live chat are available, but user experiences reveal inconsistent response quality and resolution effectiveness that can frustrate traders when they need help. Trustpilot reviews frequently cite customer service issues as primary concerns, with complaints ranging from delayed responses to inadequate problem resolution that leaves traders feeling abandoned.

Response time feedback indicates variability depending on inquiry complexity and communication method. While some users report satisfactory support experiences, a substantial portion express frustration with extended wait times and repetitive follow-up requirements for account or technical issues that should be resolved quickly. The multi-jurisdictional structure may contribute to support complexity, as different regional offices may handle inquiries differently with varying levels of expertise and authority.

Language support capabilities were not comprehensively detailed in available sources. This potentially limits accessibility for non-English speaking traders who need help in their native language. This represents a notable gap for a broker operating across diverse geographic markets where multilingual support would enhance user experience significantly and help traders understand important account information.

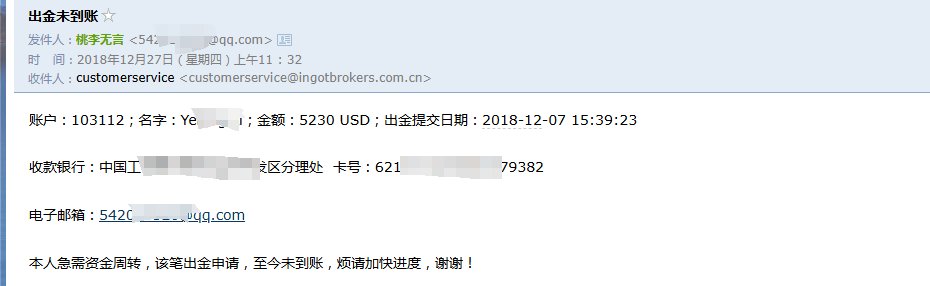

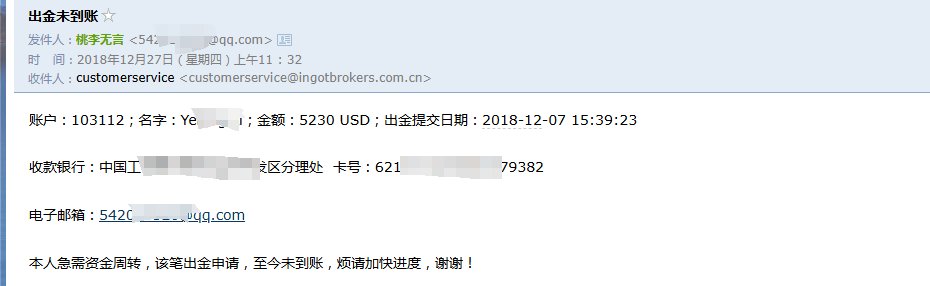

The absence of detailed support hours and escalation procedures in reviewed materials suggests potential transparency issues in customer service operations. User feedback indicates particular challenges with withdrawal processing support and technical issue resolution, areas critical for trader confidence and satisfaction that directly affect whether traders can access their money when needed. Improvement in customer service consistency and responsiveness appears essential for enhancing overall broker reputation and user retention in a competitive market.

Trading Experience Analysis

Platform performance feedback reveals mixed experiences regarding stability and execution quality. While MetaTrader 4 and MetaTrader 5 provide robust technical capabilities, user reports indicate occasional connectivity issues and platform freezes during high-volatility periods when traders most need reliable access. These stability concerns can significantly impact trading outcomes, particularly for scalpers and day traders who depend on consistent platform performance to make quick profits from small price movements.

Order execution quality receives varied feedback from users. Some users report satisfactory fill rates and minimal slippage on major currency pairs, while others note concerns about execution delays and requotes during news events when market conditions change rapidly. The STP and ECN business models should theoretically provide competitive execution, but real-world performance appears inconsistent based on user experiences that matter more than theoretical advantages.

Spread variability represents both an advantage and challenge for traders. Competitive spreads during normal market conditions can widen significantly during volatile periods, which affects trading costs when you need predictable pricing most. This characteristic requires careful consideration for traders using strategies sensitive to spread fluctuations that can turn profitable trades into losses.

The high leverage availability up to 1:5000, while attractive for aggressive strategies, demands sophisticated risk management to prevent account devastation. This extreme leverage can multiply small market movements into large gains or losses that can quickly wipe out trading accounts if not managed properly.

Mobile trading functionality through MetaTrader mobile applications generally receives positive feedback for basic trading operations. However, some users report synchronization issues between desktop and mobile platforms that can create confusion about account status and open positions. The WebTrader option provides additional flexibility, though performance may lag compared to desktop applications during complex analysis tasks that require multiple charts and indicators.

Overall trading experience quality appears heavily dependent on market conditions, trading style, and individual account specifications. Ingot brokers review feedback suggests significant room for improvement in consistency and reliability that would benefit all types of traders.

Trust and Reliability Analysis

Regulatory oversight from ASIC, FSA, JSC, and CMA provides a foundation of legitimacy for the broker. However, the effectiveness and scope of protection vary significantly across these jurisdictions, with some offering much stronger trader protections than others. ASIC regulation offers the strongest trader protections, including compensation scheme participation and strict operational requirements, while other regulatory frameworks may provide more limited safeguards that don't fully protect trader funds.

The multi-entity structure, while providing regulatory diversification, can create complexity in understanding applicable protections and dispute resolution procedures. Traders should carefully verify which entity holds their account and the corresponding regulatory protections available in their jurisdiction to understand what help they can get if problems arise.

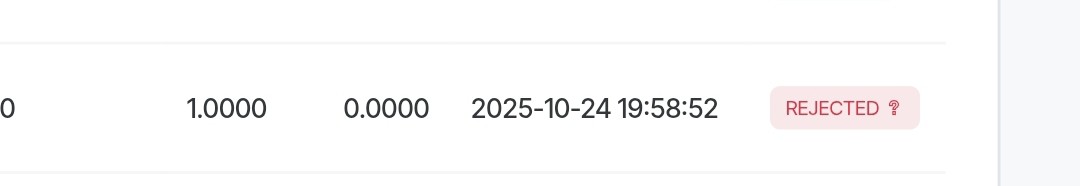

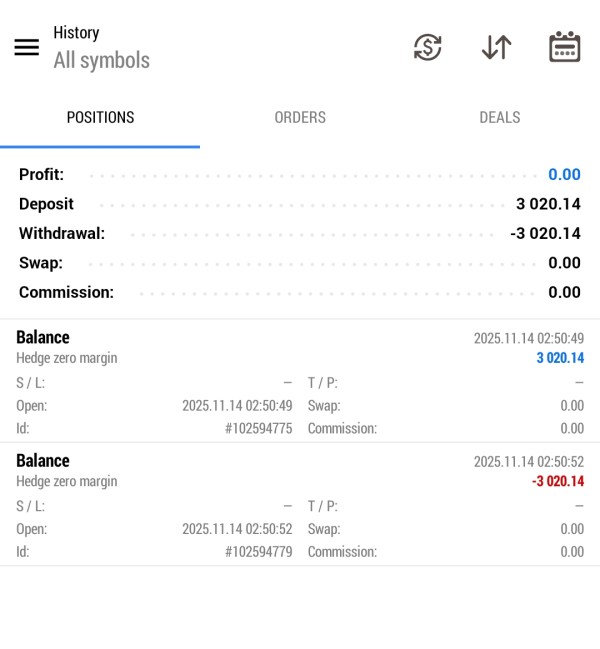

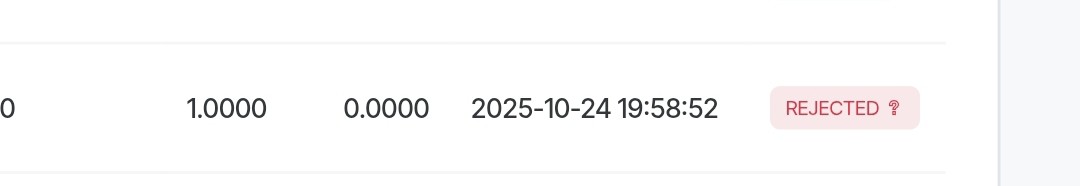

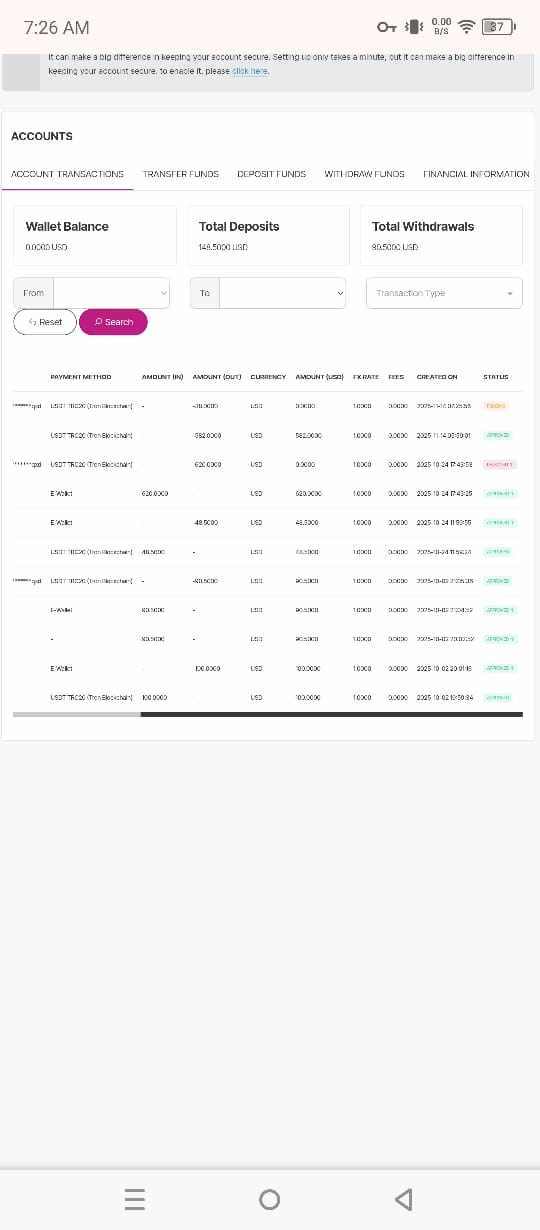

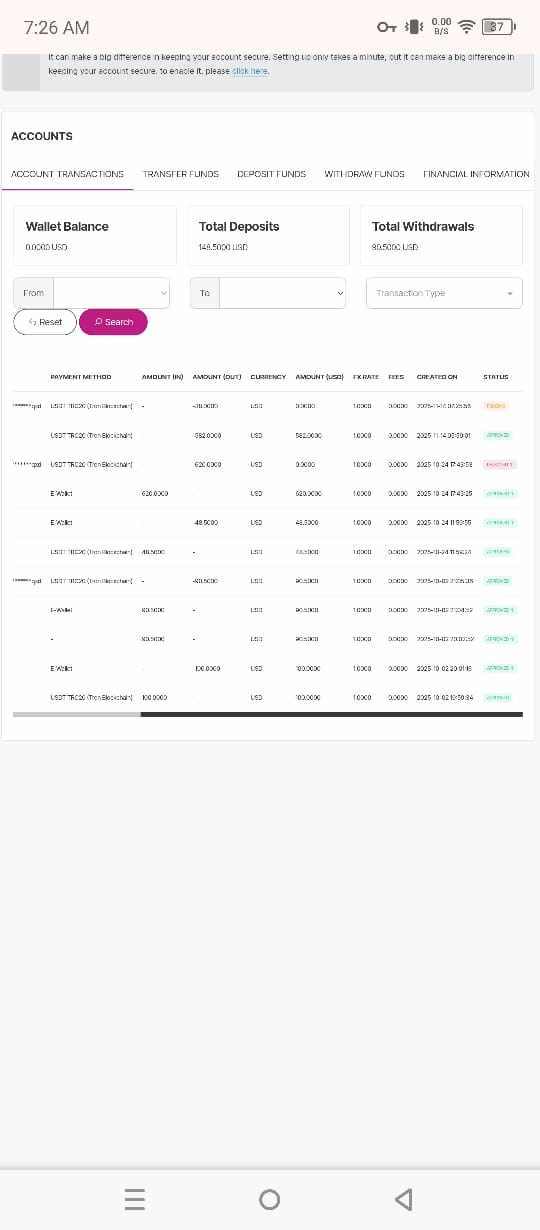

User trust indicators present concerning patterns. Trustpilot ratings averaging 3.2 out of 5 stars reflect widespread dissatisfaction with various service aspects that affect daily trading operations. Common complaints include withdrawal processing delays, customer service inadequacies, and platform reliability issues that collectively impact confidence in the broker's operational capabilities and ability to serve traders properly.

Company transparency regarding ownership structure, financial reporting, and operational procedures was not comprehensively available in reviewed sources. This information gap may concern traders seeking detailed due diligence before account opening to understand who really controls their money. The absence of detailed information about client fund segregation, insurance coverage, and audit procedures represents additional transparency challenges that make it hard to assess true safety levels.

Long-term operational history since 2006 provides some stability indication. However, recent user feedback suggests potential deterioration in service quality that warrants careful consideration by prospective clients who want reliable long-term trading relationships.

User Experience Analysis

Overall user satisfaction metrics indicate significant challenges for the broker. The 3.2 out of 5 Trustpilot rating reflects widespread concerns about various service aspects that affect daily trading activities. User feedback patterns reveal a polarized experience base, with some traders expressing satisfaction with basic trading functionality while others report substantial frustrations with customer service, platform reliability, and account management processes that make trading difficult and stressful.

Interface design and usability generally receive neutral to positive feedback through MetaTrader platforms. These provide familiar and comprehensive trading environments that most traders already know how to use effectively. However, the broker's proprietary interfaces and account management systems appear less polished based on user comments about navigation difficulties and unclear information presentation that makes simple tasks more complicated than necessary.

Registration and account verification processes were not extensively detailed in available sources. User feedback suggests standard industry procedures with occasional delays in document processing and account approval that can frustrate traders eager to start trading. The multi-jurisdictional structure may contribute to verification complexity depending on trader location and chosen account entity, which can create confusion about requirements and timelines.

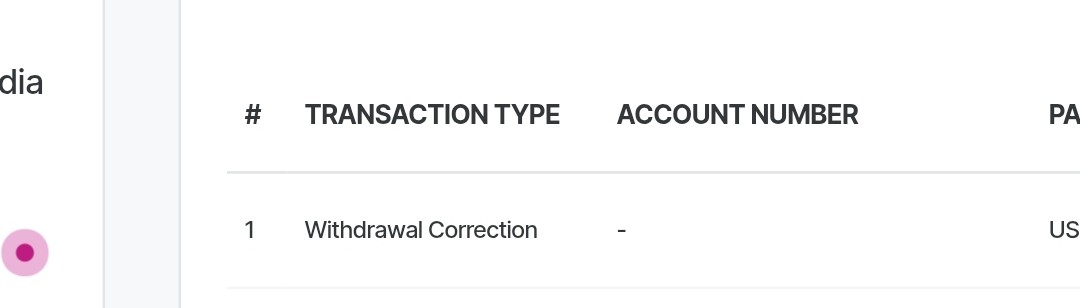

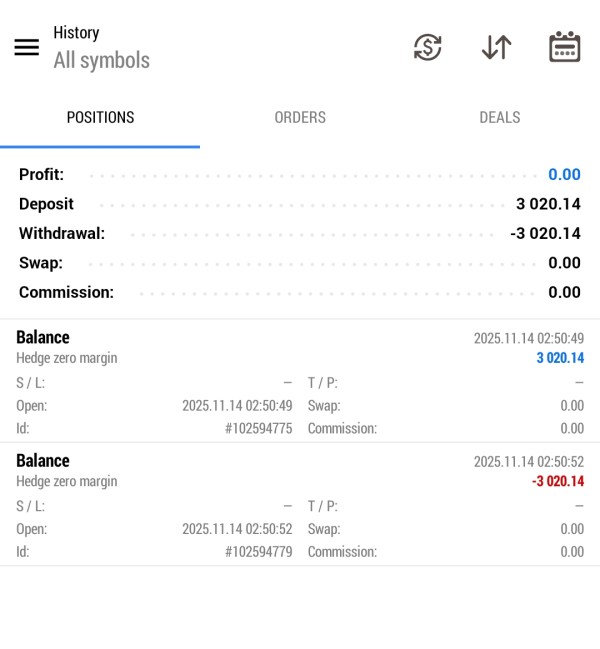

Funding and withdrawal experiences represent major user experience challenges. Multiple reports describe processing delays, unclear fee structures, and communication gaps during transaction processing that make it hard to access your own money when needed. These issues significantly impact trader confidence and operational efficiency, particularly for active traders requiring frequent account access to manage their trading capital effectively.

Common user complaints center on customer service responsiveness, platform stability during volatile markets, and transparency in fee calculations. Positive feedback typically focuses on instrument variety and basic platform functionality, suggesting adequate core services undermined by operational and support deficiencies that hurt the overall experience. Most traders want reliable service more than fancy features, and this broker seems to struggle with the basics that matter most.

Conclusion

This comprehensive ingot brokers review reveals a brokerage firm with significant potential undermined by execution and service quality issues. While the broker offers attractive features including low minimum deposits, extensive instrument selection, and high leverage options, persistent user satisfaction challenges and service quality concerns limit its overall appeal to serious traders. The gap between what the broker promises and what it delivers creates frustration for many users who expect professional service.

Ingot Brokers may suit traders prioritizing instrument variety and flexible account conditions over premium service quality. This is particularly true for those with limited initial capital seeking market access without high minimum deposits. However, traders requiring reliable customer support, consistent platform performance, and transparent operational procedures should carefully evaluate alternatives before committing funds to avoid potential problems.

The broker's main advantages include competitive account accessibility and comprehensive trading tool selection that appeal to cost-conscious traders. Primary disadvantages center on inconsistent customer service quality and mixed user satisfaction ratings that suggest ongoing operational challenges requiring attention from management. These service issues can significantly impact your trading success and overall experience, making it important to weigh the pros and cons carefully before deciding if this broker meets your needs.