Is GPP safe?

Business

License

Is GPP Safe or a Scam?

Introduction

GPP, an emerging player in the forex market, has garnered attention for its trading services and platform offerings. Established in New Zealand, GPP markets itself as a reliable broker catering to both novice and experienced traders. However, the forex market is rife with potential risks, and traders must exercise caution when selecting a broker. The importance of thoroughly evaluating a brokers legitimacy cannot be overstated, as many traders have fallen victim to scams in the past. This article aims to investigate the safety and reliability of GPP by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk assessment.

To conduct this analysis, we utilized multiple sources, including user reviews, regulatory databases, and expert opinions. Our evaluation framework focuses on key areas that determine the trustworthiness of a forex broker, ensuring a comprehensive overview of GPP's operations.

Regulatory and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. GPP claims to be registered and regulated in New Zealand, which is overseen by the Financial Markets Authority (FMA). Regulatory bodies like the FMA impose strict guidelines to ensure brokers operate fairly and transparently, which is vital for protecting traders' interests.

Here‘s a summary of GPP’s regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Markets Authority (FMA) | FSP509766 | New Zealand | Verified |

While GPP is registered with the FMA, the quality of regulation is essential. The FMA requires brokers to maintain a minimum operational capital, ensuring they have sufficient resources to handle client funds responsibly. However, its important to note that GPP has faced scrutiny and complaints regarding its operations, raising questions about its compliance history. Traders should be aware that while a broker may be registered, this does not guarantee it is free from issues or complaints.

Company Background Investigation

GPP was established in 2017 and has positioned itself as a forex broker in New Zealand. However, the companys ownership structure and management team remain somewhat opaque. Transparency in ownership and management can significantly impact a broker's credibility.

The management teams background is crucial; ideally, they should possess extensive experience in the financial services sector. Unfortunately, GPP has not provided detailed information about its management team, which raises concerns about its operational transparency.

Moreover, the level of information disclosure plays a significant role in assessing a broker's reliability. A trustworthy broker should provide clear information about its operations, including its business model, fee structure, and terms of service. GPPs lack of detailed disclosures may lead to doubts about its commitment to transparency and compliance.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a traders experience. GPP claims to provide competitive spreads and a user-friendly trading platform. However, it is essential to scrutinize the fee structure and ensure there are no hidden costs that could affect profitability.

Here‘s a comparison of GPP’s core trading costs:

| Fee Type | GPP | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 1.4 pips | 1.0 - 2.0 pips |

| Commission Structure | $7 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While GPP‘s spreads are competitive, the commission structure raises some concerns. The $7 commission per lot is on the higher end, which could deter some traders. Additionally, the broker’s overnight interest rates were not clearly specified, which is a critical factor for traders who hold positions overnight. Such lack of clarity may indicate potential hidden fees, leading to a negative trading experience.

Client Fund Security

Client fund security is paramount in assessing whether GPP is safe. A reputable broker should implement robust security measures to protect client funds. GPP claims to segregate client funds from its operational funds, which is a standard practice that enhances security. However, the effectiveness of these measures remains unverified.

Furthermore, investor protection schemes are essential in safeguarding traders interests. GPP has not provided clear information regarding any investor protection policies or compensation schemes in case of insolvency. Historical issues related to fund security, including complaints about withdrawal difficulties, have been reported. These incidents raise significant concerns about the safety of client funds with GPP.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a brokers reliability. An analysis of user experiences with GPP reveals a mixed bag of reviews. While some users report satisfactory experiences, numerous complaints have surfaced regarding withdrawal issues and poor customer support.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

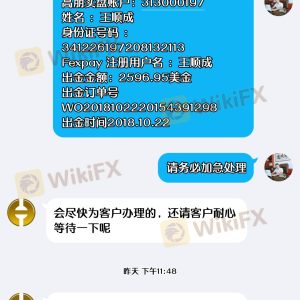

| Withdrawal Issues | High | Slow or inadequate response |

| Slippage and Execution Problems | Medium | Inconsistent response |

| Customer Support Delays | High | Long waiting times |

Typical complaints include difficulties in withdrawing funds, with some users reporting that their requests were ignored or delayed. Such issues are alarming and suggest a lack of proper customer service and operational efficiency.

Platform and Execution

The trading platform is a vital component of the trading experience. GPP utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and functionality. However, the platform's performance and stability are crucial for effective trading.

An analysis of order execution quality at GPP reveals concerns about slippage and rejections. Users have reported instances of significant slippage during high volatility, which can negatively impact trading results. Additionally, any signs of platform manipulation should be thoroughly investigated, as they pose a severe risk to traders.

Risk Assessment

Using GPP carries inherent risks, and it is essential to evaluate these risks comprehensively. Heres a summary of the key risk areas associated with trading with GPP:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Registered but with complaints |

| Fund Security Risk | High | Withdrawal issues reported |

| Execution Risk | High | Slippage and rejections noted |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as setting stop-loss orders and limiting exposure to any single trade. Additionally, it may be prudent to diversify trading accounts across multiple brokers to reduce reliance on a single entity.

Conclusion and Recommendations

In conclusion, while GPP presents itself as a legitimate forex broker, several red flags warrant caution. The regulatory status is a positive aspect, but the presence of numerous complaints and issues related to fund security and customer service raises significant concerns.

Traders should be vigilant when considering GPP as their broker. Given the potential risks, it is advisable to conduct thorough due diligence and consider alternative brokers with a proven track record of reliability and customer satisfaction.

If you are looking for safer alternatives, consider brokers that are regulated by top-tier authorities and have a strong reputation for customer service and fund security. Always prioritize due diligence to ensure a safe trading experience, as the question of "Is GPP safe?" remains a matter of concern based on the current evidence.

Is GPP a scam, or is it legit?

The latest exposure and evaluation content of GPP brokers.

GPP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GPP latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.