Is IFDC safe?

Pros

Cons

Is IFDC Safe or a Scam?

Introduction

IFDC, short for IFDC Capital Management LLC, positions itself as a player in the forex market, offering trading services in foreign exchange, commodities, and cryptocurrencies. However, the rise of online trading has also seen an increase in fraudulent brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of whether IFDC is a safe trading option or a potential scam. Our investigation is based on a review of regulatory status, company background, trading conditions, customer experiences, and risk assessments, all of which are critical in determining the trustworthiness of a forex broker.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical indicators of its legitimacy. IFDC claims to hold a general financial license from the National Futures Association (NFA) in the United States. However, there are concerns regarding the scope of this license, as it may not cover all the operations that IFDC engages in. Below is a summary of the regulatory information pertaining to IFDC:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0514623 | United States | Unauthorized |

The NFA is a critical regulatory body that oversees the derivatives industry in the U.S. While the existence of a license is a positive sign, the fact that IFDC operates beyond the scope of its license raises red flags. Furthermore, the lack of a robust regulatory framework can expose traders to significant risks, including the potential for fraud. Historically, brokers with questionable regulatory oversight have been involved in numerous compliance issues, which can jeopardize client funds. Therefore, when assessing whether IFDC is safe, the lack of stringent regulation is a significant concern.

Company Background Investigation

IFDC was established in 2019, which makes it a relatively young player in the forex market. The company's brief history raises questions about its stability and reliability. Information regarding its ownership structure and management team is limited, which adds to the opacity surrounding the broker. A transparent company typically provides information about its founders, key personnel, and their backgrounds. In the case of IFDC, there is a noticeable lack of available data about its management, which is a potential warning sign for prospective clients.

The absence of detailed disclosures can lead to questions about the company's operational integrity and commitment to ethical practices. A thorough investigation of the management team's qualifications and experience is crucial, as a well-rounded team with a history of success in financial services can inspire confidence in a broker's reliability. Given the limited information available about IFDC, traders should approach this broker with caution.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer are a critical consideration. IFDC's fee structure is reportedly opaque, with little information provided about spreads, commissions, and other trading costs. A lack of transparency in these areas can be indicative of hidden fees that may negatively impact traders' profitability. Below is a comparison of key trading costs associated with IFDC:

| Fee Type | IFDC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.1 - 1.5 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Typically 0.5% - 1.5% |

The above table highlights that IFDC's spreads appear to be higher than the industry average, which could lead to increased trading costs for clients. Additionally, the lack of clarity regarding commissions and overnight interest raises further concerns about the overall cost of trading with IFDC. Traders should be wary of brokers that do not provide clear and comprehensive information about their fee structures, as this can lead to unexpected expenses that diminish trading profits.

Client Funds Security

The security of client funds is paramount when assessing the safety of a forex broker. IFDC claims to implement measures to protect client funds, but details on these measures are sparse. Effective fund protection typically includes segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, the lack of transparency regarding IFDC's security measures raises concerns about the safety of client funds.

Without clear information on how client funds are managed and protected, traders could be at risk of losing their investments in the event of a broker failure or fraud. Historically, brokers with insufficient fund security measures have faced significant issues, leading to client losses that could have been avoided with proper safeguards in place. As such, it is crucial for traders to ensure that their broker has robust security protocols before opening an account.

Customer Experience and Complaints

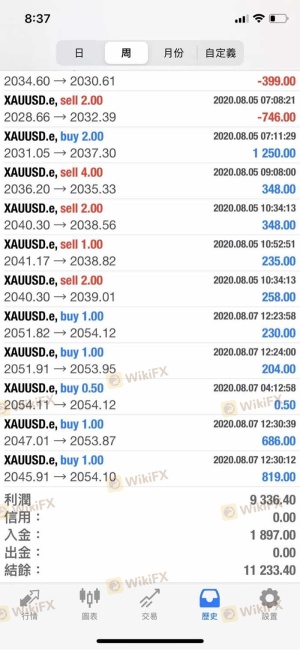

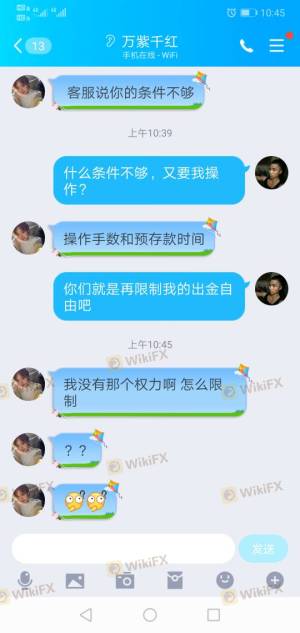

Customer feedback is a vital component in assessing the reliability of a forex broker. Reviews and testimonials from users can provide insights into the broker's service quality, responsiveness, and overall customer satisfaction. In the case of IFDC, there have been several complaints regarding issues such as withdrawal delays and poor customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Service | Medium | Inconsistent support |

| Misleading Information | High | Lack of clarity in communication |

The high severity of complaints related to withdrawal delays and misleading information is particularly concerning. Traders rely on timely access to their funds, and any issues in this regard can lead to significant frustration and financial loss. Furthermore, the inconsistency in customer support raises questions about the broker's commitment to addressing client concerns effectively. Prospective clients should take these complaints seriously and consider the potential risks associated with trading with IFDC.

Platform and Trade Execution

The trading platform's performance and execution quality are crucial for a successful trading experience. IFDC offers the widely used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading features. However, concerns have been raised regarding order execution quality, including instances of slippage and order rejections. Traders should be aware of the potential for these issues, as they can significantly impact trading outcomes.

If any signs of platform manipulation or unfair trading practices are detected, it could indicate a lack of integrity on the broker's part. A reliable broker should provide a stable trading environment with minimal disruptions and transparent order execution processes. Therefore, traders should proceed with caution and consider the potential risks associated with IFDC's trading platform.

Risk Assessment

Using IFDC as a trading platform comes with inherent risks that traders must acknowledge. Below is a concise risk scorecard summarizing the key risk areas associated with trading with IFDC:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns about legitimacy. |

| Financial Risk | Medium | High spreads and unclear fees can impact profitability. |

| Security Risk | High | Insufficient information on fund protection measures. |

| Customer Service Risk | Medium | Complaints about withdrawal delays and support issues. |

Given these risks, traders should approach IFDC with caution. It is advisable to implement risk mitigation strategies, such as limiting exposure and diversifying investments, to protect against potential losses.

Conclusion and Recommendations

In conclusion, while IFDC presents itself as a forex trading option, several concerning factors suggest that it may not be a safe choice for traders. The lack of robust regulation, combined with a history of customer complaints and insufficient transparency regarding trading conditions, raises significant red flags. Therefore, it is crucial for traders to conduct thorough due diligence before engaging with IFDC.

For those seeking reliable alternatives, it may be wise to consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Ultimately, the decision to trade with IFDC should be made with careful consideration of the associated risks and the broker's overall trustworthiness.

Is IFDC a scam, or is it legit?

The latest exposure and evaluation content of IFDC brokers.

IFDC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFDC latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.