Intervate 2025 Review: Everything You Need to Know

Executive Summary

This Intervate review looks at Intervate Capital Management Limited. It's a forex broker that has gotten mixed feedback from traders. Based on user reviews and third-party checks, Intervate shows a complex picture for potential traders.

WikiFX calls the broker a "reliable choice," especially for traders who want UK-based brokerage services. But user experiences tell a different story about customer service quality. The biggest red flag from user feedback is customer service.

Multiple reports call it "absolutely the worst customer service" that traders have experienced. This creates a strange contrast between what institutions say and what users actually experience. Despite these service problems, Intervate still operates as a regulated company.

It mainly targets users who want to work through regulated channels for trading. For traders thinking about Intervate, this review gives important insights into what you can expect from this broker. It helps you make a smart decision based on real user experiences and market data.

Important Notice

This review uses limited public information and user feedback from 2022. We don't have detailed regulatory information in our sources. This might mean different rules apply to users in different places.

Potential traders should check current regulatory status and terms of service before opening accounts. Our review method uses user stories, third-party reviews, and industry reports. Since we have limited information, this review focuses on documented user experiences and verified third-party reviews rather than detailed feature analysis.

Rating Framework

Broker Overview

Intervate Capital Management Limited works as a forex brokerage service provider in the competitive online trading market. The company has set itself up as a trading platform that offers forex services to retail and possibly institutional clients. The broker focuses on providing regulated trading access.

This matches growing market demands for compliant trading environments. The company's market position shows a commitment to regulatory compliance. However, we have limited details about founding dates, ownership structure, and corporate history in available documentation.

Current information suggests Intervate targets traders who want to work within regulated frameworks. This might mean giving up service quality based on user feedback. For trading infrastructure and asset offerings, this Intervate review must note that we don't have comprehensive details about trading platforms, available instruments, and business model specifics.

The broker seems to operate within standard forex market parameters. Traders who want detailed information about spreads, execution models, or platform technology would need to contact the broker directly for current specifications.

Regulatory Status: We don't have specific regulatory information in available source materials. However, WikiFX's assessment suggests the broker operates under some form of regulatory oversight.

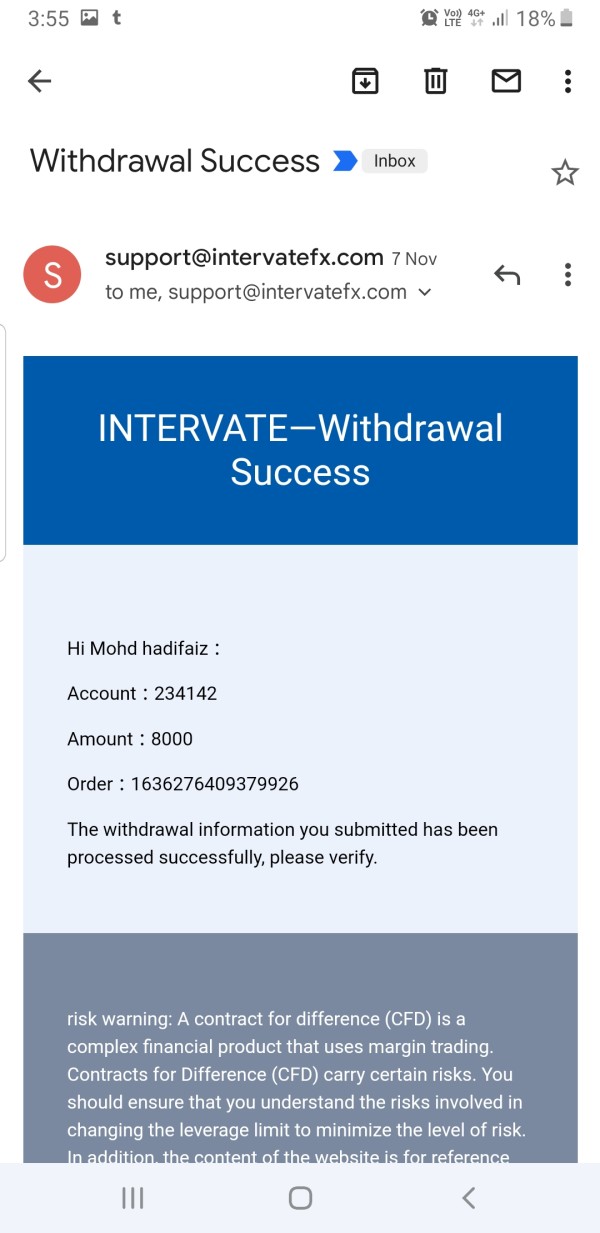

Deposit and Withdrawal Methods: Current payment processing options and withdrawal procedures are not specified in available documentation.

Minimum Deposit Requirements: We don't mention specific minimum deposit amounts in source materials.

Bonuses and Promotions: Information about current promotional offerings or bonus structures is not available in reviewed materials.

Trading Assets: We don't specify details about available currency pairs, commodities, indices, or other trading instruments in current documentation.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources for this Intervate review.

Leverage Ratios: We don't mention specific leverage offerings and margin requirements in source materials.

Platform Options: Information about trading platform choices, whether proprietary or third-party solutions, is not available in current documentation.

Geographic Restrictions: We don't detail specific information about regional availability or restrictions in available materials.

Customer Support Languages: Details about multilingual support options are not specified in reviewed sources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Intervate's account conditions faces big limitations due to insufficient information in available source materials. We don't have detailed documentation of account types, minimum deposit requirements, or account opening procedures. This Intervate review cannot provide comprehensive analysis of the broker's account structure.

What remains unclear includes the variety of account tiers potentially offered. We don't know whether the broker provides different account types for various trader experience levels. We also don't know what specific features or benefits might distinguish different account categories.

The absence of information about Islamic accounts, demo account availability, or special account features limits our ability to assess how well Intervate serves diverse trader needs. For traders considering Intervate, the lack of transparent account condition information represents a significant concern. Professional brokers typically provide detailed account specifications, fee structures, and clear terms of service.

The limited availability of such information may indicate either poor marketing transparency or suggest that potential clients need to engage directly with the broker to obtain basic account details. We don't have user feedback specifically addressing account opening experiences, ongoing account management, or satisfaction with account features. This review cannot provide meaningful assessment of how Intervate's account conditions compare to industry standards or meet trader expectations.

Assessment of Intervate's trading tools and educational resources cannot be completed due to insufficient information in available source materials. Modern forex brokers typically offer comprehensive trading tools including technical analysis software, economic calendars, market research, and educational content. However, we don't have specific details about Intervate's offerings in these areas documented.

The absence of information about research capabilities, analytical tools, or educational resources raises questions about the broker's commitment to supporting trader development and success. Professional trading environments usually include access to market analysis, trading signals, expert advisors, and comprehensive educational materials ranging from beginner guides to advanced trading strategies. We don't have documented evidence of automated trading support, API access, or third-party tool integration.

Traders interested in sophisticated trading setups cannot assess whether Intervate meets their technical requirements. The lack of information about mobile trading capabilities, charting tools, or real-time market data access further limits evaluation possibilities. For traders who prioritize comprehensive trading support, research capabilities, and educational resources, the limited available information about Intervate's tools and resources represents a significant evaluation challenge that would require direct broker contact to resolve.

Customer Service and Support Analysis

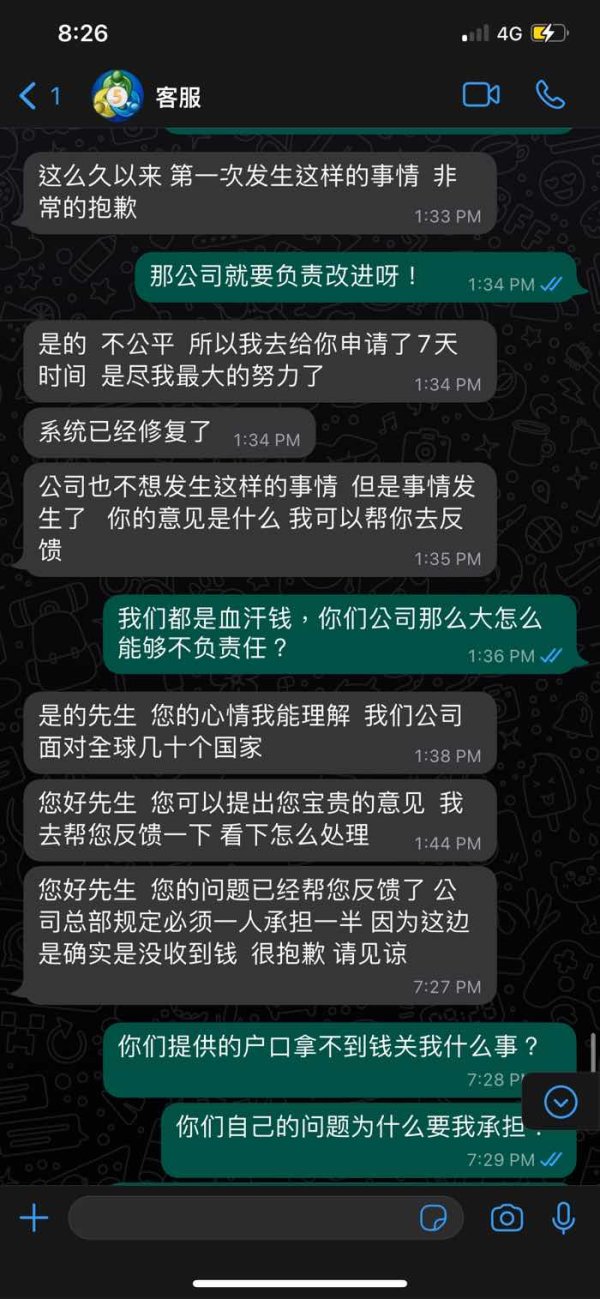

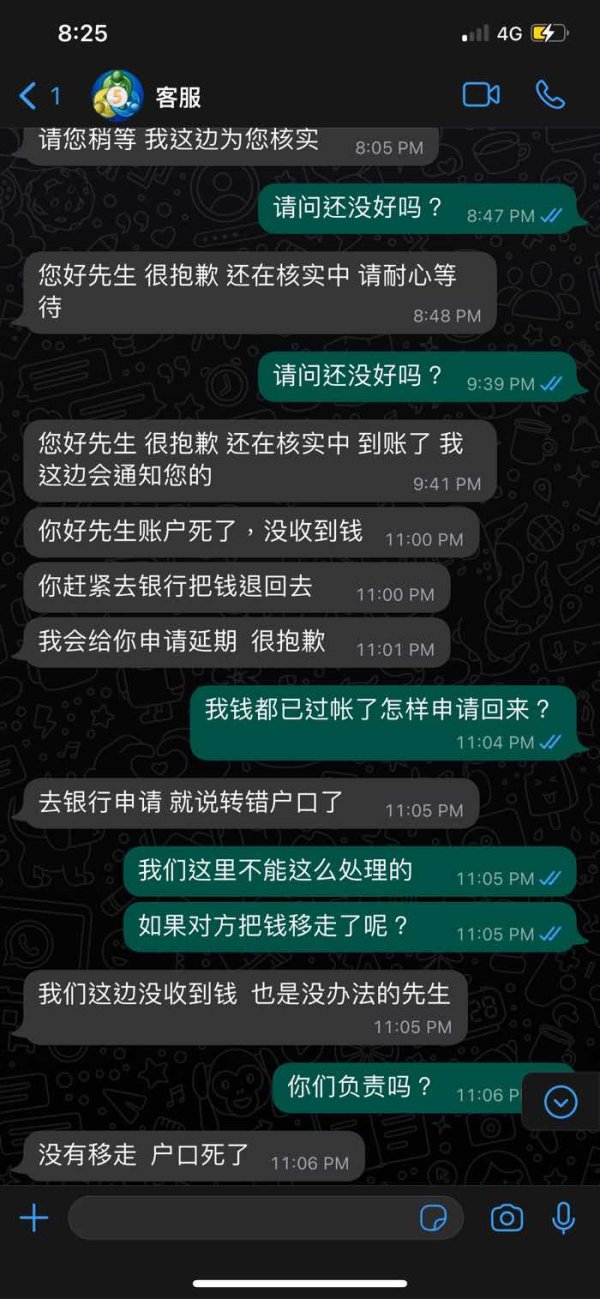

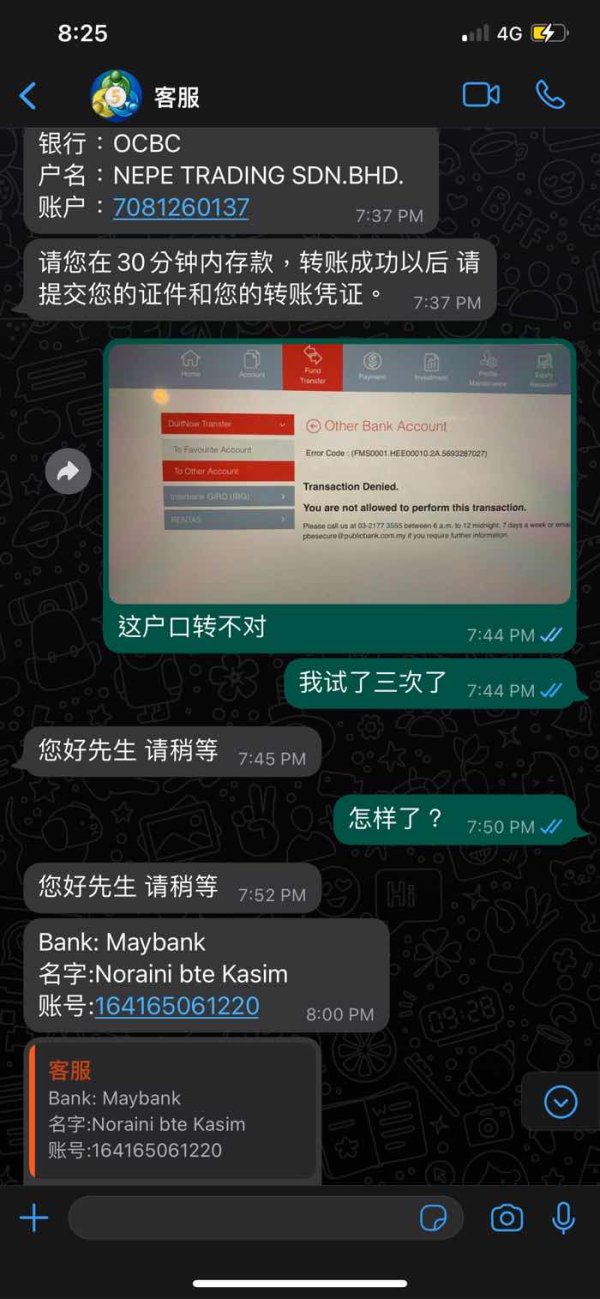

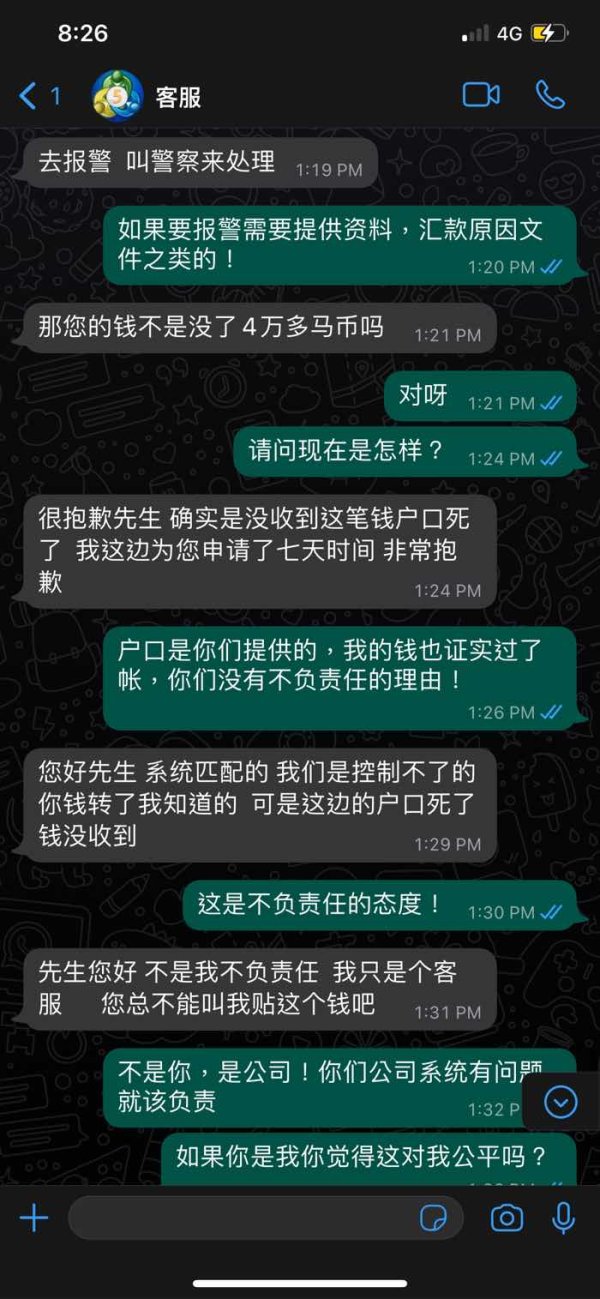

Customer service represents Intervate's most significant documented weakness based on available user feedback. Multiple user reports consistently describe the broker's customer service as problematic. At least one user characterizes it as "absolutely the worst customer service" they have experienced.

This represents a serious concern for potential traders who may require support for account issues, trading problems, or technical difficulties. The severity of customer service complaints suggests systemic issues rather than isolated incidents. Poor customer service can significantly impact trading experiences, particularly during critical moments such as technical issues during market volatility, account funding problems, or dispute resolution needs.

When traders cannot rely on responsive, competent support, their overall trading experience and potential profitability can suffer substantially. We don't have specific information about customer service channels, response times, or available support hours. This evaluation cannot provide detailed analysis of support infrastructure.

However, the consistently negative user feedback indicates that regardless of the channels offered, the quality of service delivery falls well below acceptable standards for professional forex trading environments. For traders considering Intervate, the documented customer service issues represent a significant risk factor that should weigh heavily in broker selection decisions. This is particularly true for those who anticipate needing regular support or who trade in ways that might require customer service intervention.

Trading Experience Analysis

Evaluation of Intervate's trading experience cannot be completed comprehensively due to limited information about platform performance, execution quality, or user interface design in available source materials. Trading experience encompasses critical factors including platform stability, order execution speed, slippage rates, and overall system reliability during various market conditions. We don't have documented user feedback about platform performance during high-volatility periods, order execution quality, or system downtime incidents.

This Intervate review cannot assess how well the broker's infrastructure supports active trading. Professional traders require reliable platforms that execute orders accurately and maintain stable performance during critical market moments. The absence of information about mobile trading capabilities, platform customization options, or advanced order types limits assessment of whether Intervate meets modern trading requirements.

Today's traders often require sophisticated platform features, multi-device synchronization, and advanced charting capabilities that may or may not be available through Intervate's systems. Given the documented customer service issues, traders might reasonably be concerned about how technical problems or trading disputes would be resolved. Poor customer service combined with potential platform issues could create particularly challenging situations for active traders who depend on reliable broker support.

Trust and Reliability Analysis

Intervate's trust and reliability assessment presents mixed signals based on available information. On the positive side, WikiFX has evaluated Intervate as a "reliable choice." This suggests some level of institutional confidence in the broker's operational integrity and regulatory compliance.

This third-party assessment provides some reassurance about the broker's fundamental business practices and regulatory standing. However, the contrast between WikiFX's positive assessment and documented user service complaints creates a complex trust picture. While regulatory compliance and business reliability are important factors, poor customer service can significantly undermine user confidence and practical trading experiences.

Traders need to balance institutional assessments against real user experiences when evaluating trustworthiness. The limited availability of detailed regulatory information, transparent business practices documentation, or comprehensive company background information makes independent trust verification challenging. Professional brokers typically provide extensive transparency about their regulatory status, company ownership, financial reporting, and business practices.

We don't have detailed information about client fund protection measures, segregated account policies, or dispute resolution procedures. Traders cannot fully assess how well their interests would be protected. The combination of limited transparency and documented service issues suggests elevated caution is warranted when considering Intervate for trading activities.

User Experience Analysis

Overall user experience assessment for Intervate is significantly hampered by limited feedback data and the absence of comprehensive user interface or process documentation. However, the available information suggests user experience challenges, particularly in customer service interactions that form a crucial component of overall broker satisfaction. The documented "absolutely worst customer service" feedback indicates that user experience issues extend beyond simple interface design or navigation problems to fundamental service delivery failures.

Poor customer service can overshadow even excellent trading platforms or competitive pricing, as traders need reliable support for account management, technical issues, and problem resolution. We don't have specific information about account registration processes, verification procedures, funding experiences, or withdrawal processes. This review cannot assess how user-friendly Intervate's operational procedures are compared to industry standards.

Modern brokers typically streamline these processes to minimize user friction and enhance satisfaction. The target user base appears to be traders who prioritize regulatory compliance over service quality. This suggests that Intervate may appeal to users who are willing to accept service limitations in exchange for regulated trading access.

However, this represents a significant compromise that many traders would find unacceptable in today's competitive brokerage environment.

Conclusion

This Intervate review reveals a broker with significant service quality challenges despite some institutional recognition. While WikiFX rates Intervate as a "reliable choice," documented user experiences paint a concerning picture of customer service failures that could substantially impact trading experiences. The stark contrast between institutional assessment and user satisfaction creates a complex decision environment for potential traders.

Intervate might suit traders who prioritize regulatory compliance above service quality and who have minimal customer support requirements. However, most traders would likely find better alternatives in today's competitive forex market. The documented customer service issues represent a substantial risk factor that outweighs potential benefits for most trading scenarios.

The primary advantage appears to be WikiFX's reliability assessment. The critical disadvantage centers on consistently poor customer service that could create significant problems during important trading situations or account management needs.