UFX 2025 Review: Everything You Need to Know

Executive Summary

UFX started in 2007 as a global forex and CFD trading broker. The company has gotten a lot of attention in the trading community, but not for good reasons. This ufx review shows concerning facts about how the broker stands in the market today. UFX has won over 20 global awards during its time in business and uses special MassInsights technology to make trading better. However, the broker now faces big problems that have made many users unhappy.

The platform mainly targets investors who want forex and CFD trading chances. It offers access to different types of assets like foreign exchange, contracts for difference, ETFs, and cryptocurrencies such as Bitcoin. User feedback shows a troubling picture though. The broker gets a disappointing 1-star rating from traders, which means UFX is not recommended for new investors right now. Even though it has regulatory presence in multiple areas and uses new technology, there is still a big gap between what the broker promises and what users actually experience. This makes our evaluation very important for potential clients who are thinking about their trading choices.

Important Notice

UFX operates in multiple areas including Cyprus, Vanuatu, Germany, Spain, and Sweden. Each area has different regulatory rules and requirements. This presence in many places means that services, features, and protections may be very different depending on where you live and which UFX entity you work with. Traders should carefully check which regulatory entity controls their account and understand what investor protections are available to them.

This evaluation uses comprehensive analysis of user feedback, regulatory information, and public company data. The assessment shows current market conditions and user experiences as of 2025. Individual trading experiences may be different based on account type, location, and trading strategy.

Rating Framework

Broker Overview

UFX entered the financial markets in 2007 with big goals of serving international traders. The company has built its reputation by providing comprehensive trading services across multiple asset classes, though its journey has had both successes and major challenges. Over its time in business, UFX has managed to get more than 20 global awards. This suggests recognition within certain industry circles for various parts of its service delivery.

The broker operates on a traditional forex and CFD trading model. It offers clients access to leveraged trading across various financial instruments. UFX's business approach focuses on providing technology solutions, including their special MassInsights technology that is designed to help with trading decisions. The company targets investors interested in forex and CFD trading. It positions itself as a complete solution for traders seeking exposure to international financial markets, cryptocurrencies, and exchange-traded funds.

UFX's asset portfolio includes foreign exchange pairs, contracts for difference, ETFs, and cryptocurrencies including Bitcoin. This provides traders with diversified investment opportunities. The broker maintains regulatory presence through multiple authorities including the Cyprus Securities and Exchange Commission, Vanuatu Financial Services Commission, Germany's Federal Financial Supervisory Authority, Spain's National Securities Market Commission, and Sweden's Finansinspektionen. This ufx review shows that while regulatory compliance appears strong, operational execution has faced major challenges that have hurt user satisfaction levels.

Regulatory Coverage: UFX maintains licenses across multiple areas, regulated by CySEC in Cyprus, VFSC in Vanuatu, BaFin in Germany, CNMV in Spain, and Finansinspektionen in Sweden. This provides different regulatory protections depending on client location.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current documentation. This requires direct broker contact for comprehensive payment option details.

Minimum Deposit Requirements: Current minimum deposit amounts are not specified in available materials. This indicates potential variation across account types and regulatory areas.

Bonus and Promotions: Details about current promotional offers and bonus structures are not provided in accessible documentation. This suggests limited or region-specific promotional activities.

Tradeable Assets: UFX offers trading access to forex pairs, contracts for difference across various underlying assets, exchange-traded funds, and cryptocurrency instruments including Bitcoin. This provides diversified market exposure opportunities.

Cost Structure: Specific information about spreads, commission structures, and additional trading costs is not detailed in current source materials. This requires direct inquiry for comprehensive fee schedules.

Leverage Ratios: Current leverage offerings are not specified. These likely vary based on asset class, account type, and applicable regulatory restrictions in different areas.

Platform Options: Detailed platform specifications and available trading software options are not comprehensively outlined in accessible documentation. This indicates need for direct broker consultation.

Geographic Restrictions: Specific country restrictions and availability limitations are not detailed in current materials. Multi-jurisdictional operations suggest broad but potentially limited global access.

This ufx review reveals significant information gaps that potential clients should address through direct broker communication before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of UFX's account conditions presents major challenges due to limited publicly available information about specific account structures and requirements. Available documentation does not provide comprehensive details about different account tiers, their respective features, or the criteria for accessing various account levels. This lack of transparency about account conditions represents a concerning aspect for potential traders who need clear information about what to expect from their trading relationship.

Without specific details about minimum deposit requirements, account maintenance fees, or special account features such as Islamic accounts for Shariah-compliant trading, prospective clients face uncertainty about the basic terms of engagement. The absence of clear account condition information in readily accessible materials suggests either limited marketing transparency or potentially complex account structures that require direct consultation to understand fully. The lack of detailed account opening process information further complicates the assessment, as traders cannot easily determine verification requirements, documentation needs, or expected timeframes for account activation.

This ufx review indicates that while UFX operates under multiple regulatory frameworks, the specific account conditions and client onboarding processes remain unclear from publicly available sources. This requires direct broker engagement for clarification.

UFX's trading tools and resources present a mixed picture, with the broker highlighting their proprietary MassInsights technology as a key differentiator in their service offering. However, comprehensive details about the full range of available trading tools, analytical resources, and educational materials are not extensively documented in accessible sources. This limitation makes it challenging to assess the true value and effectiveness of the broker's technological offerings.

The mention of MassInsights technology suggests UFX has invested in developing proprietary analytical capabilities. Specific functionality, user interface details, and practical applications of this technology remain unclear though. Without detailed information about research resources, market analysis tools, or educational content availability, potential clients cannot adequately assess whether UFX's tool suite meets their trading requirements. The absence of detailed information about automated trading support, third-party tool integration, or advanced charting capabilities further limits the assessment of UFX's technological infrastructure.

User feedback about tool effectiveness and reliability is not comprehensively available. This makes it difficult to determine real-world performance and user satisfaction with the provided resources.

Customer Service and Support Analysis

Customer service evaluation for UFX faces significant limitations due to the lack of detailed information about support channels, availability, and service quality metrics. Available documentation does not provide comprehensive details about customer service hours, supported languages, or the various contact methods available to clients seeking assistance. This absence of clear customer support information raises concerns about the broker's commitment to client service transparency.

Without specific information about response times, service quality standards, or escalation procedures, potential clients cannot adequately assess the level of support they might expect when facing trading issues or account-related questions. The lack of detailed customer service specifications becomes particularly concerning given the poor user ratings that UFX has received. This suggests potential service delivery challenges.

The absence of information about dedicated account management, technical support capabilities, or problem resolution processes further complicates the customer service assessment. Given the multi-jurisdictional nature of UFX's operations, the variation in customer service quality and availability across different regions remains unclear. This potentially creates inconsistent client experiences depending on regulatory jurisdiction and local service provisions.

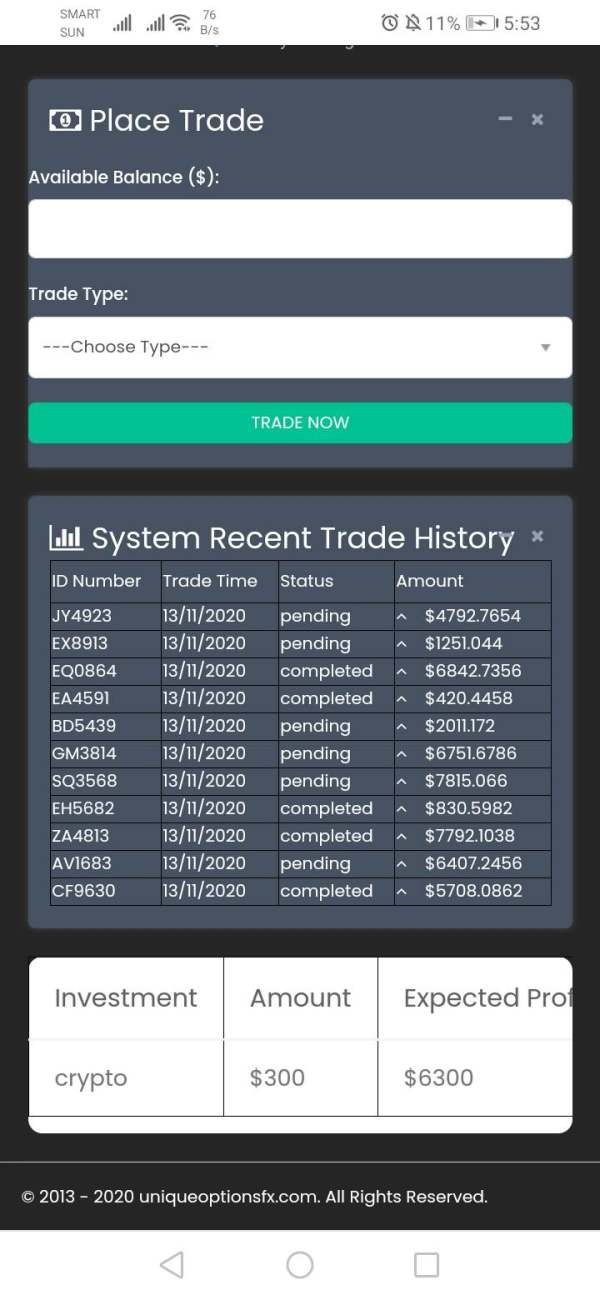

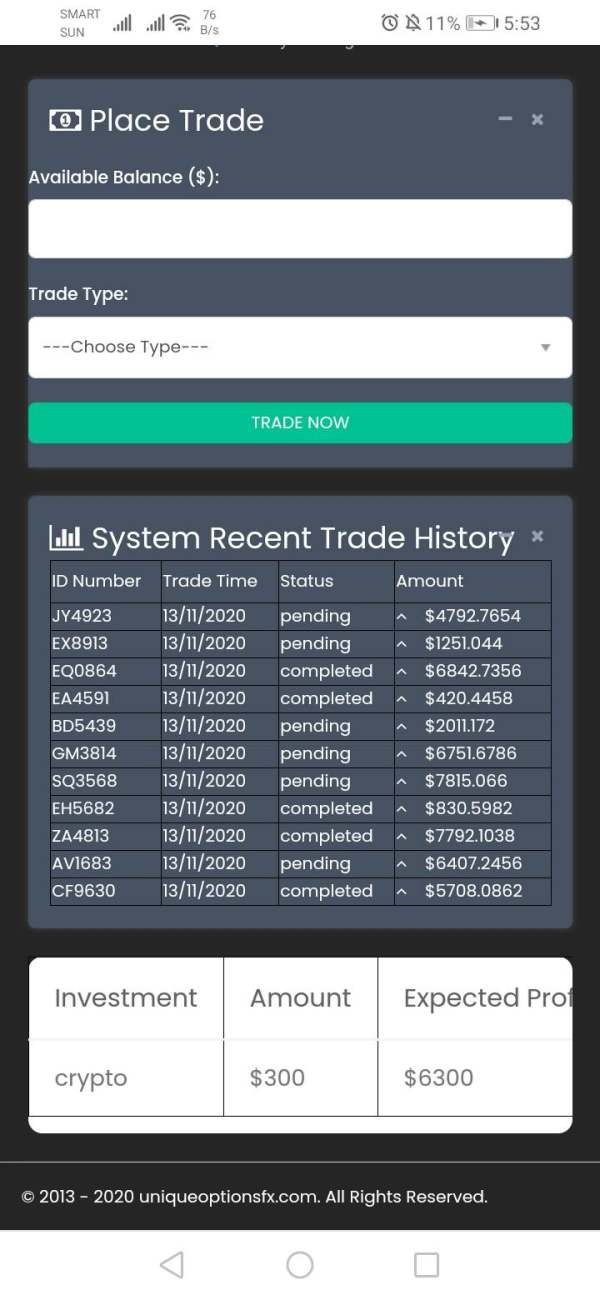

Trading Experience Analysis

The trading experience evaluation for UFX reveals concerning gaps in available information about platform performance, execution quality, and overall user satisfaction. While the broker promotes technological innovations like MassInsights, specific details about platform stability, order execution speeds, and trading environment quality are not comprehensively documented. This lack of detailed performance information makes it challenging to assess the actual trading conditions clients might experience.

Available user feedback indicates significant dissatisfaction, with UFX receiving poor ratings that suggest substantial issues with the overall trading experience. However, specific details about platform functionality, mobile trading capabilities, or trading environment stability are not thoroughly documented. This limits the ability to identify particular areas of concern or strength within the trading infrastructure.

The absence of detailed information about order execution quality, slippage rates, or platform reliability during high-volatility periods further complicates the trading experience assessment. Without comprehensive performance metrics or detailed user experience reports, potential clients cannot adequately evaluate whether UFX's trading environment meets professional trading standards. This ufx review suggests that while technological capabilities are promoted, actual trading experience quality remains questionable based on available user feedback.

Trust and Security Analysis

UFX demonstrates strong regulatory compliance through its licensing with multiple respected financial authorities including CySEC, VFSC, BaFin, CNMV, and Finansinspektionen. This multi-jurisdictional regulatory presence provides significant credibility and suggests adherence to various international financial standards and client protection requirements. The broker's ability to maintain licenses across different regulatory environments indicates compliance with diverse operational and financial standards.

The company's recognition through more than 20 global awards suggests some level of industry acknowledgment. The specific nature and recency of these awards are not detailed though. UFX's established operational history since 2007 provides additional credibility, demonstrating longevity in a competitive and regulated industry where compliance failures typically result in operational difficulties or closure.

However, the regulatory oversight quality varies significantly between jurisdictions, with some authorities providing stronger investor protections than others. While the regulatory presence appears comprehensive, the specific client fund protection measures, segregation policies, and compensation schemes applicable to different jurisdictions are not detailed in available materials. The disconnect between strong regulatory standing and poor user feedback raises questions about operational execution despite regulatory compliance.

User Experience Analysis

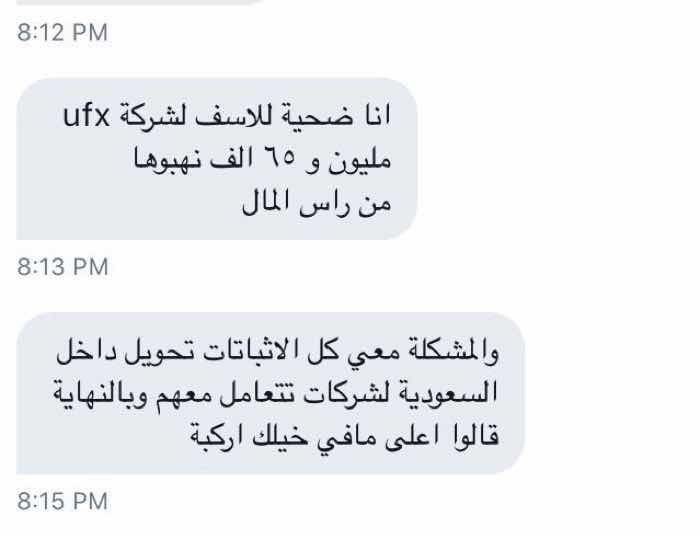

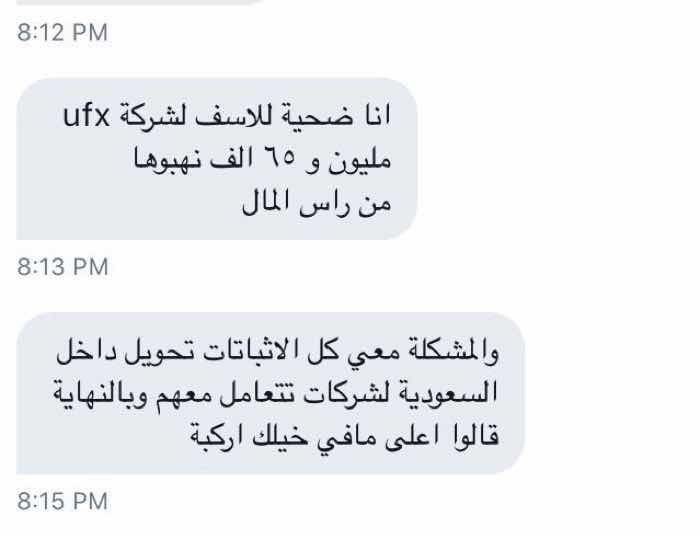

User experience evaluation for UFX reveals significant concerns, with the broker receiving a disappointing 1-star rating that clearly indicates widespread user dissatisfaction. This poor rating suggests fundamental issues with the broker's service delivery, platform functionality, or client relationship management that have created negative experiences for a substantial portion of users. The consistently negative feedback pattern indicates systemic rather than isolated service problems.

The contrast between UFX's marketed technological capabilities and actual user satisfaction levels suggests a significant gap between promotional claims and operational reality. While the broker promotes advanced features like MassInsights technology and highlights industry awards, user experiences appear to fall substantially short of expectations. This creates a credibility gap that potential clients should carefully consider.

Without detailed information about specific user interface design, account management processes, or platform usability features, the assessment relies heavily on overall satisfaction metrics which paint a concerning picture. The poor user experience ratings, combined with limited transparency about service improvements or client feedback response initiatives, suggest that UFX currently struggles to meet basic client satisfaction standards expected in the competitive forex and CFD trading market.

Conclusion

This comprehensive ufx review reveals a broker with significant regulatory credentials and technological aspirations that unfortunately fails to deliver satisfactory user experiences. While UFX maintains proper licensing across multiple respected jurisdictions and has received industry recognition through various awards, the stark reality of poor user feedback and 1-star ratings cannot be overlooked. The broker's current standing suggests substantial operational challenges that overshadow its regulatory compliance and marketed technological innovations.

UFX may theoretically suit investors seeking forex and CFD trading opportunities across diverse asset classes including cryptocurrencies and ETFs. However, the significant gap between regulatory standing and user satisfaction, combined with limited transparency about key operational details, makes UFX difficult to recommend for new traders. The broker's main advantages include strong regulatory oversight and claimed technological innovations, while its primary disadvantages center on poor user experiences and limited operational transparency that have resulted in widespread client dissatisfaction.