Is INPC safe?

Business

License

Is INPC Safe or Scam?

Introduction

INPC, also known as International Pacific Capital, positions itself as a forex broker catering to a global clientele. The firm claims to provide a range of trading services, including access to various financial instruments and advanced trading platforms. However, the forex market is notorious for its risks, and traders must exercise caution when selecting brokers. The potential for scams and fraudulent activities is significant, making it essential for investors to conduct thorough evaluations of any brokerage before committing their funds.

This article investigates whether INPC is a safe trading option or a potential scam. Our assessment is based on a comprehensive analysis of regulatory status, company background, trading conditions, customer experiences, and risk factors. We will present structured information alongside narrative insights to provide a clear picture of INPC's credibility.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is crucial for ensuring the safety of traders' funds and the integrity of trading practices. INPC claims to be regulated; however, investigations reveal a lack of credible regulatory oversight. Below is a summary of the broker's regulatory status:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

INPC operates without any valid regulatory license, which is a significant red flag. The absence of oversight means that traders have little to no recourse in case of disputes or issues with the broker. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) enforce strict guidelines to protect traders, and INPC's lack of affiliation with such authorities raises concerns about its legitimacy.

The quality of regulation is paramount in the forex industry, as it directly influences the operational standards of brokers. A regulated broker must adhere to stringent compliance measures, including fund segregation, transparency, and accountability. INPC's failure to provide any proof of regulatory compliance suggests a high risk for potential investors. Therefore, the question remains: Is INPC safe? The evidence points towards a negative response.

Company Background Investigation

A thorough investigation into INPC's company background reveals a lack of transparency regarding its history, ownership structure, and management team. The absence of publicly available information about the company's founders or executives is alarming. Reliable brokers typically provide detailed information about their leadership, including professional backgrounds and relevant experience in the financial industry.

INPC's website claims to offer services to retail and institutional clients across various regions, including Europe and Asia. However, the lack of verifiable information about its operational history and corporate governance raises significant doubts about its credibility. The company appears to have minimal transparency, which is a crucial factor for traders seeking to understand who is managing their investments.

Moreover, the anonymity surrounding INPC's operations can be alarming. The inability to identify key personnel or locate a physical office is a common tactic employed by fraudulent brokers to evade accountability. This lack of transparency further solidifies the notion that INPC may not be safe for traders.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is understanding its trading conditions, including fees and spreads. INPC advertises various trading features, but a closer examination reveals potential inconsistencies.

| Fee Type | INPC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by INPC appear to be higher than the industry average, which could eat into traders' profits. Additionally, the lack of transparency regarding commissions and overnight interest rates raises concerns about hidden fees. Traders must be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that may significantly impact overall profitability.

Furthermore, the trading conditions presented by INPC may not align with standard practices in the industry. Legitimate brokers typically provide detailed information about their trading costs and conditions, allowing traders to make informed decisions. The absence of such information from INPC's offerings suggests that trading with this broker may not be safe, as traders may encounter unexpected expenses and unfavorable trading conditions.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. INPC's approach to fund security is questionable, as the broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

In the forex industry, reputable brokers typically segregate client funds from their operational funds, ensuring that traders' money is protected even in the event of the broker's insolvency. However, INPC lacks any evidence of such practices, which poses a significant risk to traders. The absence of investor compensation schemes further exacerbates this concern, as traders have no safety net in case of broker failure.

Additionally, the lack of historical information related to any past issues or disputes involving INPC raises further questions about its reliability. Traders must prioritize brokers that demonstrate a commitment to fund safety and transparency. Given the current information, it is evident that INPC does not provide a safe environment for trading.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Analyzing user reviews and complaints about INPC reveals a pattern of dissatisfaction and concerns regarding the broker's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Average |

| High Fees | High | Poor |

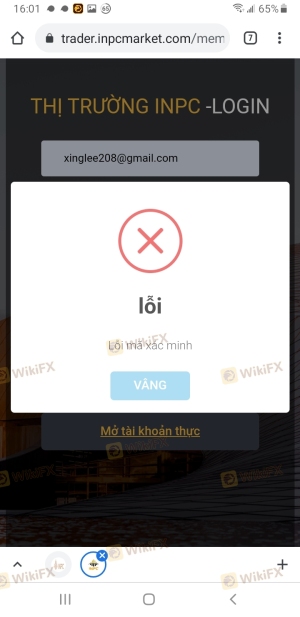

Common complaints from users include difficulties withdrawing funds, inadequate customer support, and unexpected fees. The severity of these complaints suggests that traders often face significant challenges when dealing with INPC.

For instance, some users have reported delays in processing withdrawal requests, leading to frustration and distrust towards the broker. Additionally, the quality of customer support appears to be lacking, with many users citing unresponsive or unhelpful interactions. These patterns of complaints raise serious concerns about the broker's operational integrity and responsiveness.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. INPC claims to offer access to the popular MetaTrader 5 platform, which is generally well-regarded in the industry. However, user experiences indicate potential issues related to platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. A broker's ability to execute orders promptly and accurately is essential for maintaining a competitive edge in the forex market. Any indication of platform manipulation or execution issues could further compromise traders' trust in INPC.

In conclusion, while INPC markets itself as a reputable broker with a well-known trading platform, the lack of positive user experiences and potential execution problems raises questions about its overall reliability.

Risk Assessment

Engaging with INPC presents several risks that traders must consider. Below is a summary of the key risk categories associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Issues with order execution |

The high regulatory risk stems from INPC's lack of licensing, which leaves traders vulnerable to potential fraud or malpractice. Additionally, the absence of fund safety measures compounds this risk, as traders have no assurance that their money is secure.

To mitigate these risks, traders should conduct thorough due diligence before engaging with any broker and consider alternatives with robust regulatory frameworks and proven track records.

Conclusion and Recommendations

In summary, the investigation into INPC reveals several red flags that suggest it may not be a safe trading option. The lack of regulatory oversight, transparency issues, and negative customer experiences collectively point towards a high-risk environment for traders.

For those considering forex trading, it is advisable to steer clear of INPC and explore alternatives that are regulated by reputable authorities, provide clear trading conditions, and demonstrate a commitment to customer satisfaction. Brokers such as FP Markets or HFM, which are well-regarded in the industry, may offer safer and more reliable trading environments.

Ultimately, the question remains: Is INPC safe? Given the evidence presented, it is prudent for traders to exercise caution and seek out more trustworthy options in the forex market.

Is INPC a scam, or is it legit?

The latest exposure and evaluation content of INPC brokers.

INPC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INPC latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.