INPC 2025 Review: Everything You Need to Know

Executive Summary

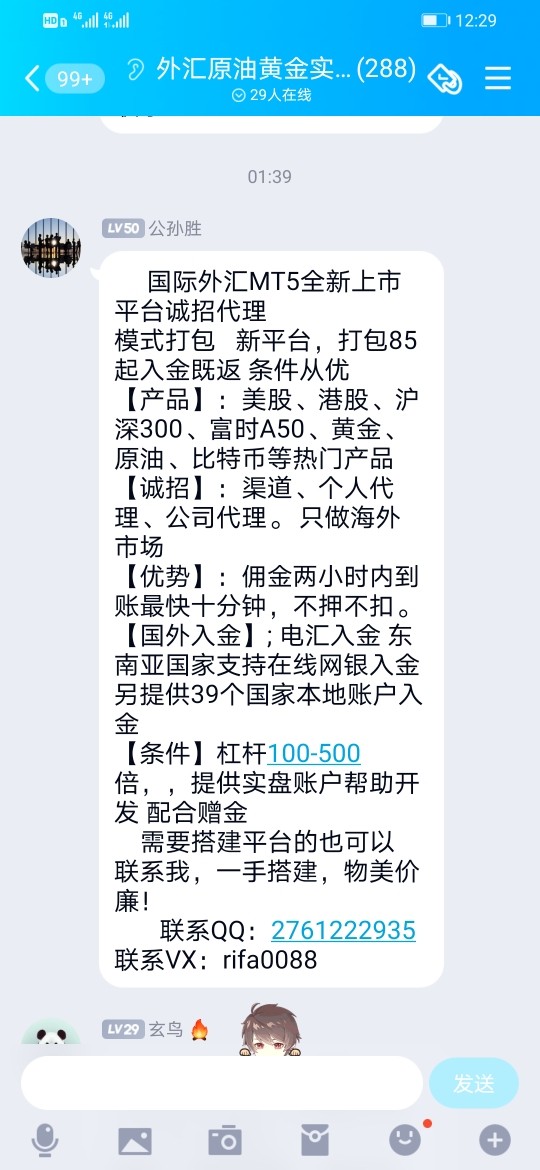

This comprehensive Inpc review looks at a forex broker that has created mixed reactions in the trading community. Based on user feedback and platform analysis, INPC shows itself as a forex trading platform that uses the MetaTrader5 trading environment, though the broker's overall rating stays neutral because of conflicting user experiences. Some traders report positive trading conditions while others have raised serious concerns about the platform's legitimacy.

The broker mainly targets forex traders who want access to professional trading tools and resources. INPC's main feature appears to be its connection with the widely-recognized MetaTrader5 platform, which gives traders advanced charting capabilities and automated trading options, but the platform faces significant credibility challenges. User reports question its authenticity and regulatory standing.

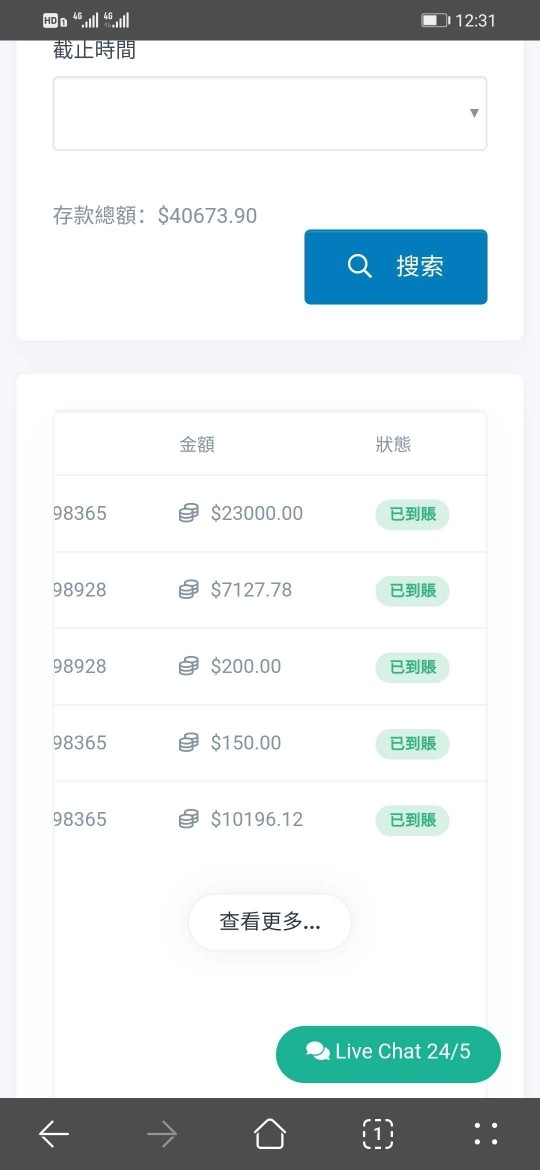

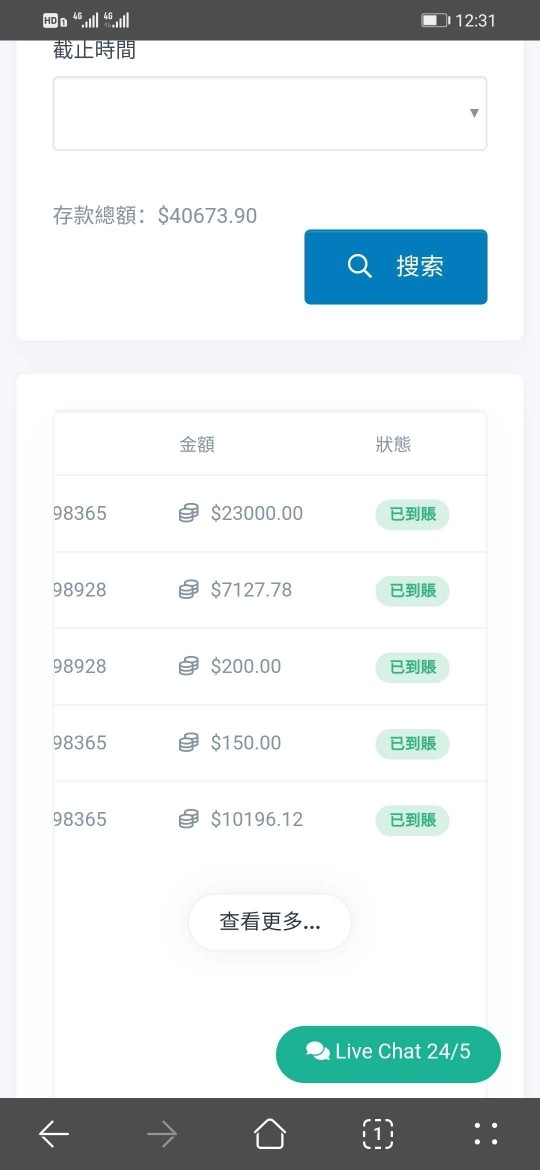

User feedback shows a polarized experience, with some traders liking the trading tools available, while others have expressed concerns about the platform's operations. The presence of negative exposure reports and allegations of fraudulent activity significantly impact the broker's trustworthiness rating, so potential traders should exercise considerable caution when considering this platform. This is particularly important given the lack of clear regulatory oversight information in publicly available sources.

Important Notice

This review is based on publicly available information, user feedback, and platform analysis available at the time of writing. The evaluation method incorporates user testimonials, platform features assessment, and market reputation analysis to provide a comprehensive overview of INPC's services, though traders should conduct their own due diligence and consider consulting with financial advisors before making any investment decisions.

Information presented in this review may vary across different jurisdictions, and specific terms and conditions may differ based on geographical location and regulatory requirements.

Rating Framework

Broker Overview

INPC operates as a forex trading platform that claims to provide services to international traders. While specific establishment details are not clearly documented in available sources, the broker positions itself as a UK-based entity focusing on foreign exchange trading services, and the company's business model centers around providing access to forex markets through advanced trading technology and platform integration.

The broker's primary operational framework revolves around offering forex trading opportunities to retail and potentially institutional clients. According to available information, INPC emphasizes its technological capabilities and trading environment as key differentiators in the competitive forex brokerage landscape, though this Inpc review notes that regulatory information remains unclear.

INPC uses the MetaTrader5 trading platform as its primary trading interface, providing users with access to advanced charting tools, technical analysis capabilities, and automated trading features. The platform supports forex trading, though specific details about additional asset classes such as CFDs, commodities, or indices are not clearly specified in available documentation, which represents a significant concern for potential traders seeking transparent and regulated trading environments.

Regulatory Status: Available sources do not provide clear information about INPC's regulatory oversight or licensing details, which represents a significant transparency concern for potential traders.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in accessible sources.

Minimum Deposit Requirements: The minimum deposit amount required to open a trading account with INPC is not specified in available documentation.

Promotional Offers: Details about welcome bonuses, promotional campaigns, or loyalty programs are not mentioned in current source materials.

Tradeable Assets: The platform primarily focuses on forex trading, though comprehensive information about specific currency pairs, exotic currencies, or additional financial instruments is not thoroughly documented.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources, making it difficult to assess the platform's competitiveness.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in accessible documentation.

Platform Options: INPC uses MetaTrader5 as its primary trading platform, providing users with professional-grade trading tools and analytical capabilities.

Geographic Restrictions: Information about restricted territories or regional limitations is not clearly outlined in available sources.

Customer Support Languages: Available customer service languages and support channels are not specified in current documentation. This Inpc review emphasizes the importance of clear communication channels for effective trader support.

Account Conditions Analysis

The evaluation of INPC's account conditions faces significant limitations due to insufficient publicly available information. Standard account features such as account types, minimum balance requirements, and specific account benefits are not clearly documented in accessible sources, which raises concerns about the platform's commitment to providing clear terms and conditions to potential clients.

Account opening procedures and verification requirements remain unclear, making it difficult for prospective traders to understand the onboarding process. The absence of detailed account information also prevents meaningful comparison with industry standards and competitor offerings, so traders cannot adequately assess whether INPC's account structures align with their trading needs and risk management requirements.

Without access to comprehensive account documentation, this information gap significantly impacts the platform's credibility and professional appearance in the competitive forex brokerage market. The lack of clear account condition details in this Inpc review highlights the need for improved transparency from the broker regarding basic service parameters that traders require for informed decision-making.

INPC's integration with MetaTrader5 represents its strongest feature in terms of trading tools and resources. The MetaTrader5 platform provides users with comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors, and this professional-grade platform supports advanced order types, multiple timeframe analysis, and extensive customization options.

The platform offers access to various technical indicators, drawing tools, and analytical features that cater to both novice and experienced traders. MetaTrader5's mobile compatibility ensures that traders can monitor and execute trades across multiple devices, providing flexibility in trading management, though information about additional educational resources, market research, trading signals, or proprietary analytical tools is not available in current source materials.

The absence of comprehensive educational content or market analysis resources may limit the platform's appeal to traders seeking ongoing learning opportunities and market insights. While MetaTrader5 provides robust trading functionality, the lack of detailed information about supplementary tools and resources prevents a complete assessment of INPC's overall value proposition in terms of trader support and development capabilities.

Customer Service and Support Analysis

Customer service information for INPC is notably absent from available sources, creating significant concerns about support accessibility and quality. Essential details such as available contact methods, support hours, response times, and service languages are not documented in accessible materials, which raises questions about the broker's commitment to client service and problem resolution.

Professional forex brokers typically provide multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ sections. Without clear customer service information, traders cannot assess the platform's ability to address account issues, technical problems, or trading-related inquiries effectively, and this absence of support details significantly impacts trader confidence and suggests potential operational limitations.

The unavailability of customer service information in publicly accessible sources represents a major transparency deficiency that affects the platform's professional credibility and user trust ratings.

Trading Experience Analysis

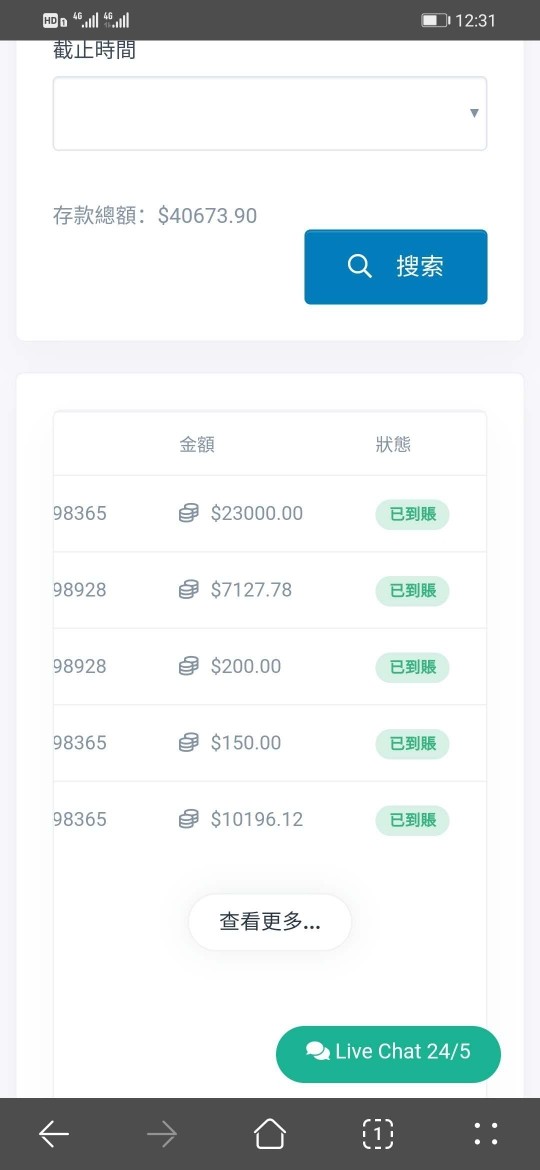

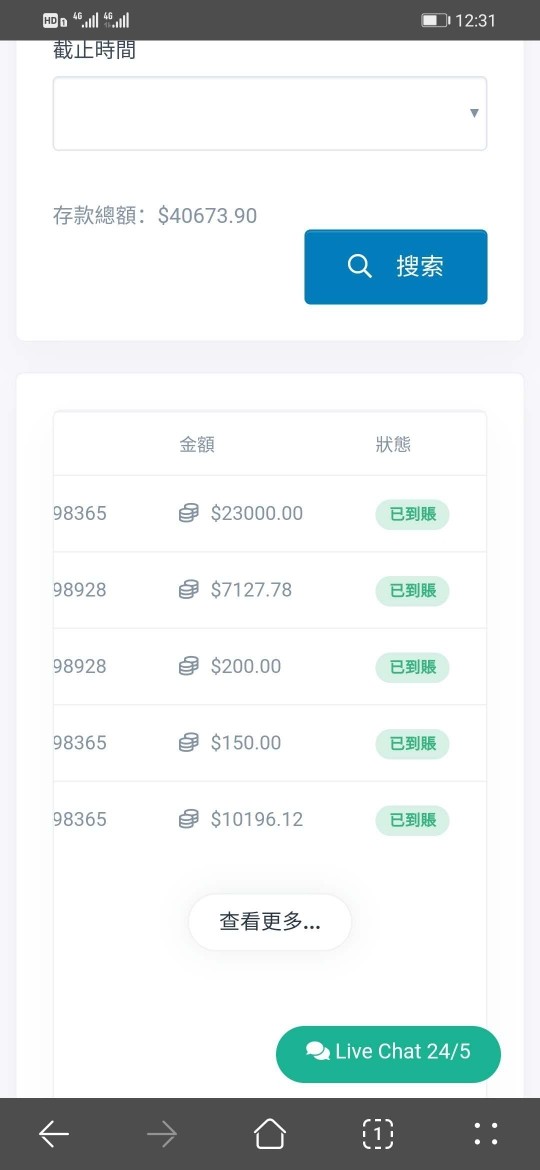

User feedback regarding INPC's trading experience presents a mixed picture with both positive and negative testimonials. Some traders have reported satisfactory trading conditions and platform functionality, while others have expressed significant concerns about the platform's operations and legitimacy, though the MetaTrader5 integration provides a familiar and professional trading environment for users experienced with this platform.

The system's stability, execution speed, and order processing capabilities generally align with industry standards when functioning properly. However, conflicting user reports suggest inconsistent service quality and potential operational issues that may affect trading performance, and some users have questioned the platform's legitimacy, which significantly impacts overall trading confidence and user satisfaction.

The presence of both positive feedback and serious concerns creates uncertainty about the platform's reliability and consistency in delivering quality trading experiences. This Inpc review emphasizes the importance of considering these mixed experiences when evaluating the platform's suitability for individual trading needs.

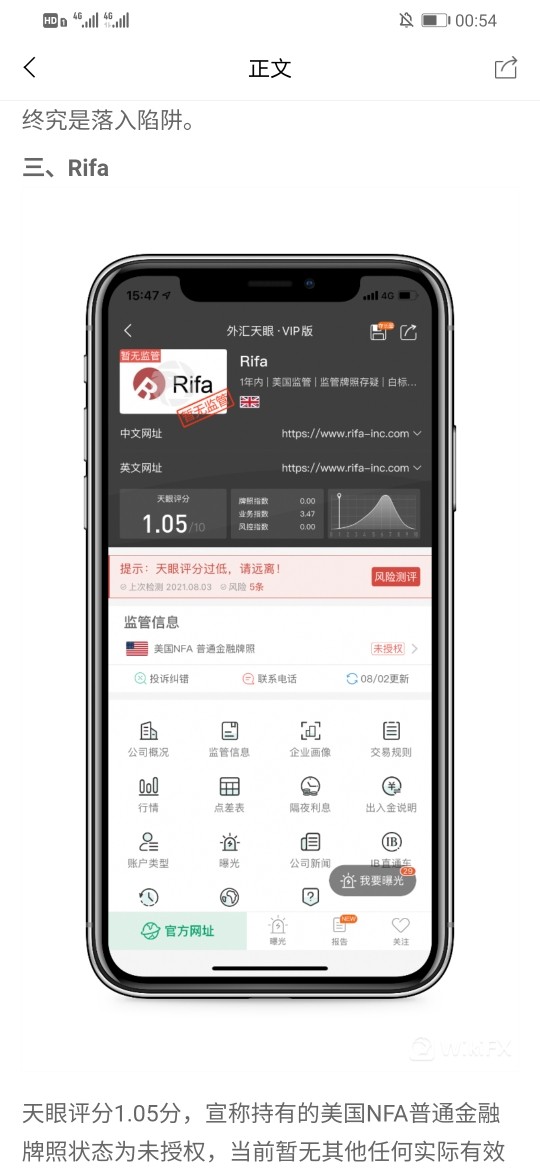

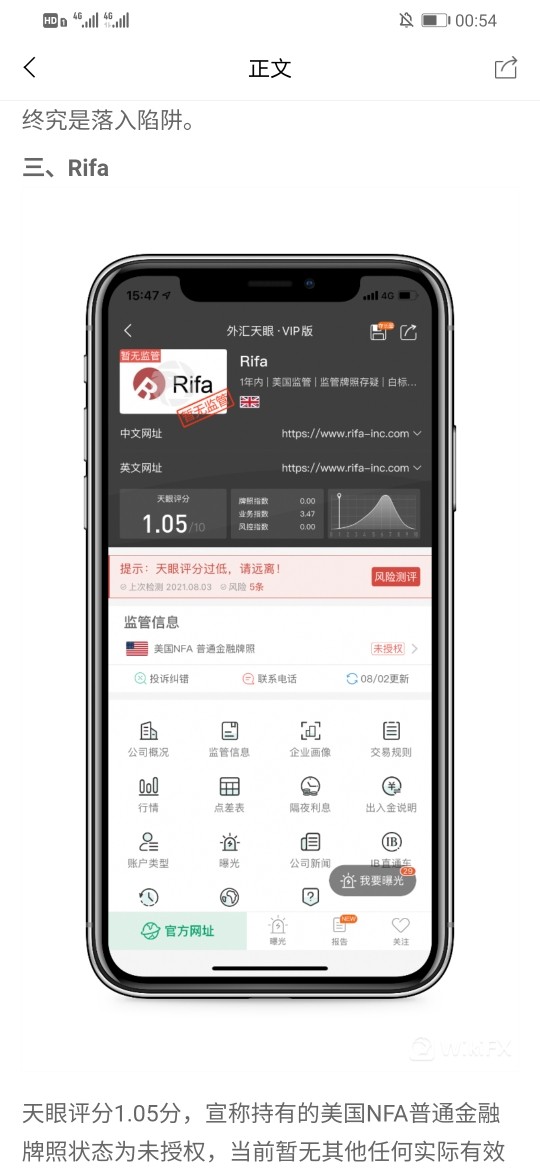

Trust and Safety Analysis

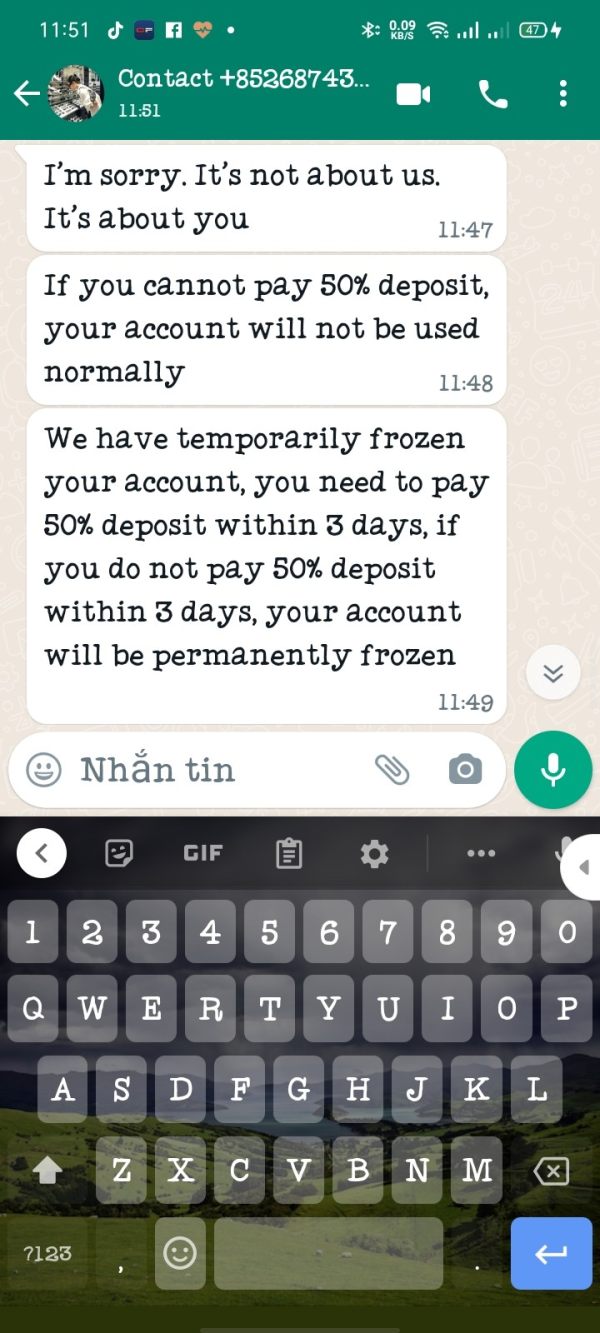

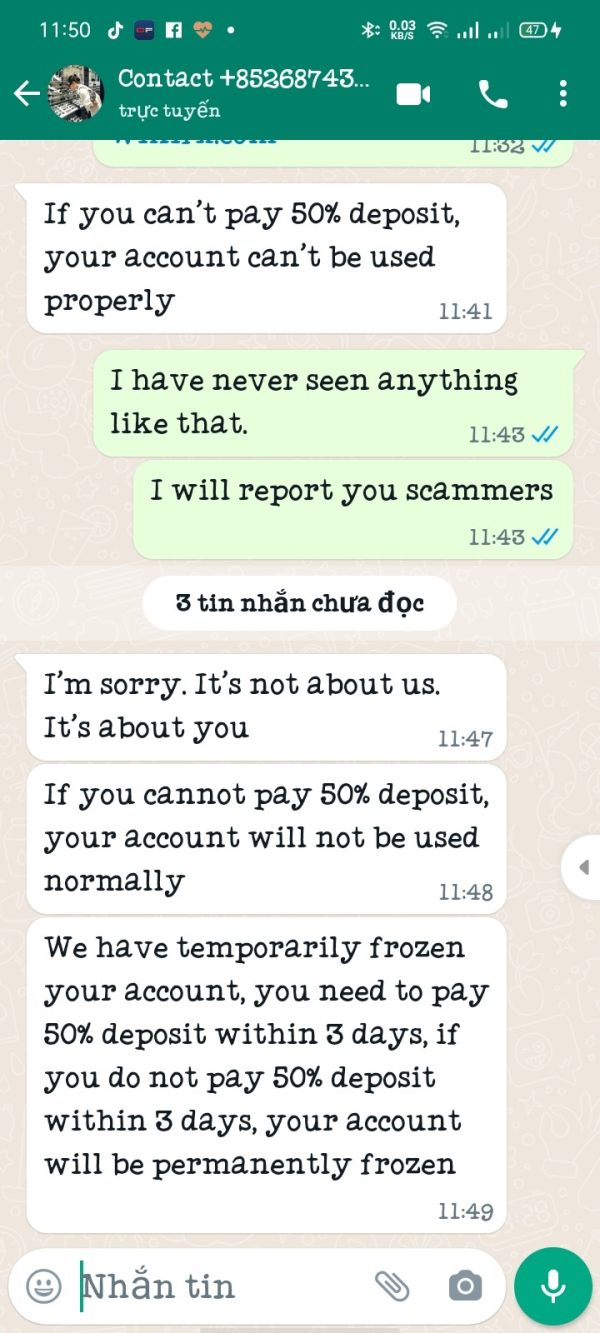

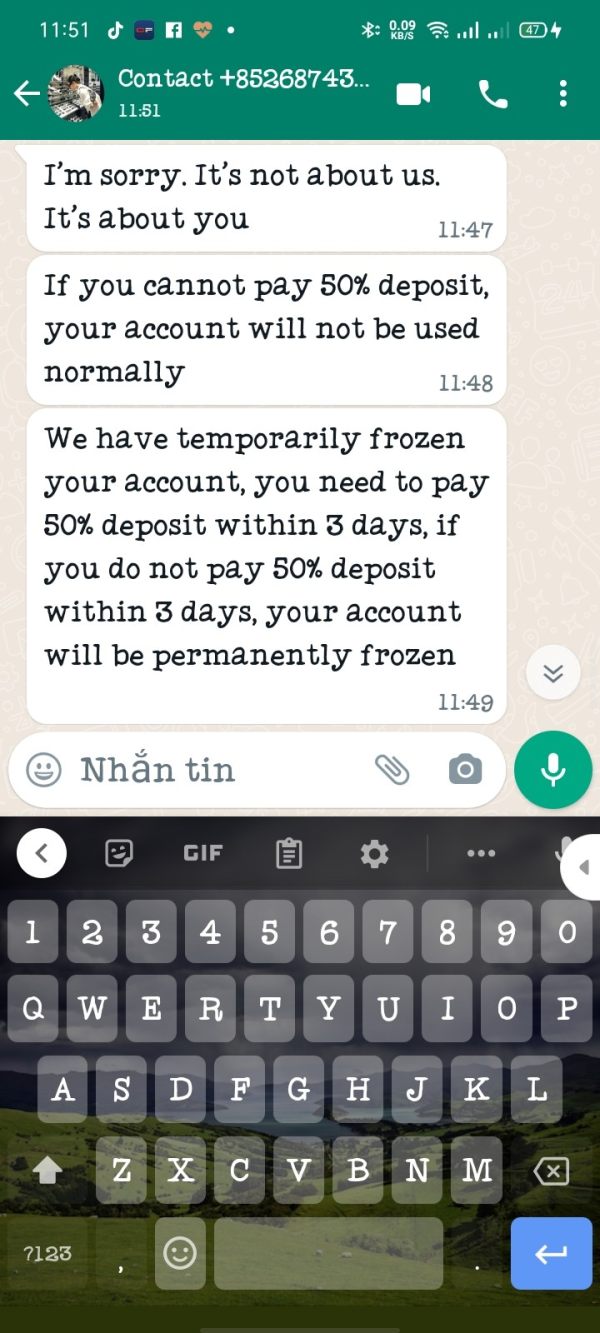

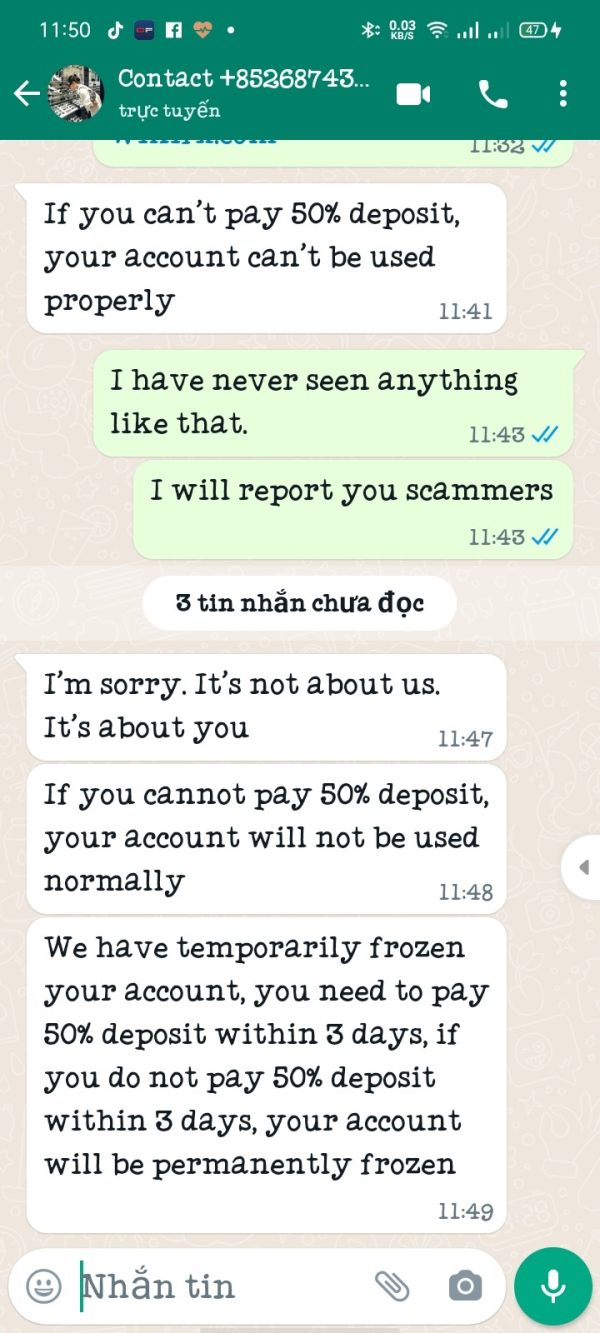

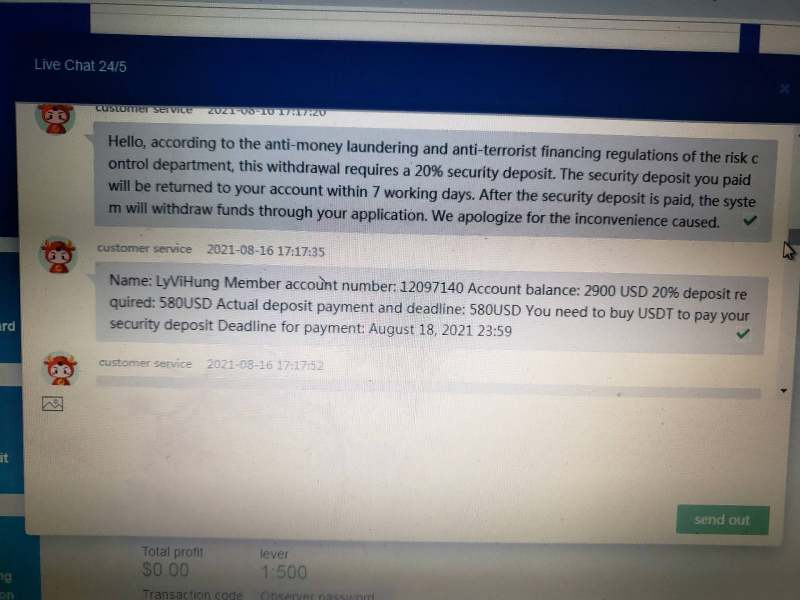

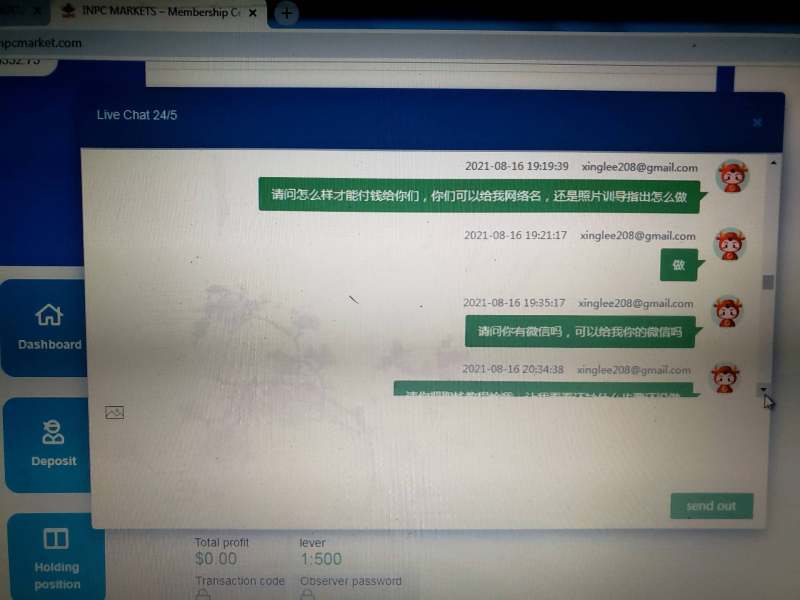

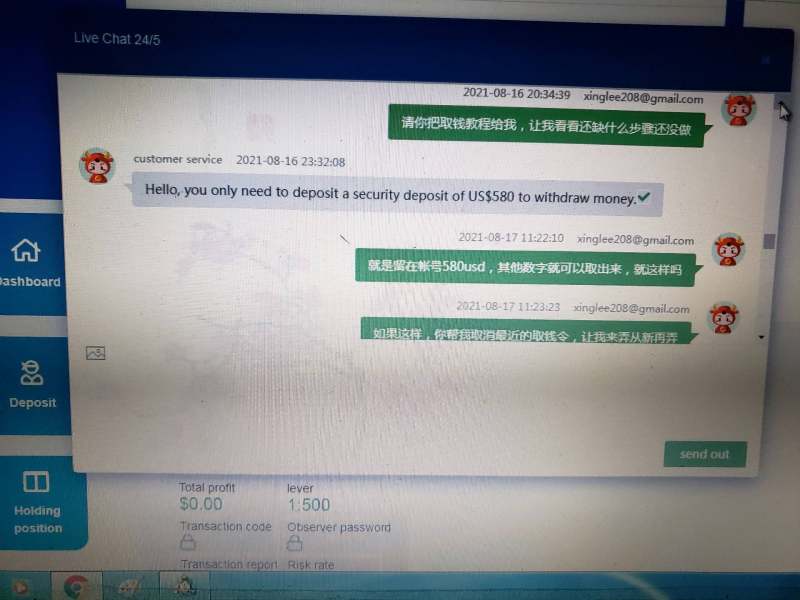

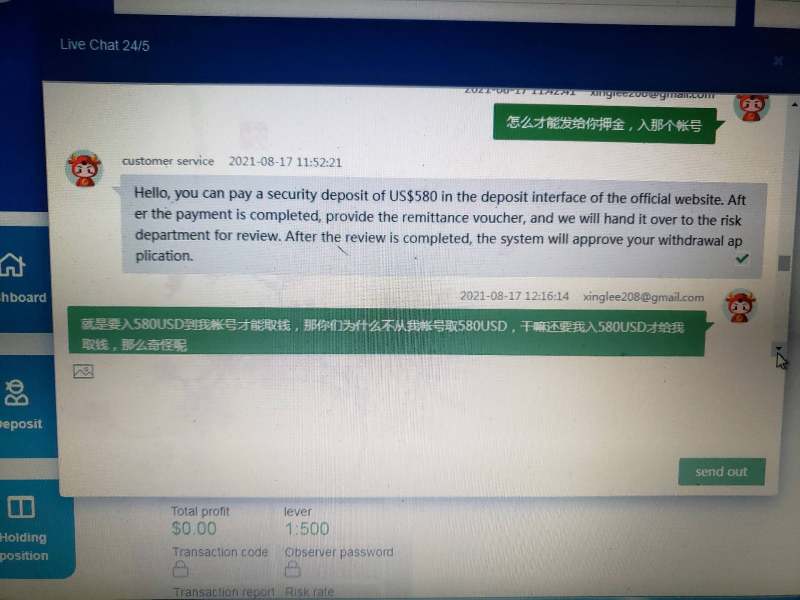

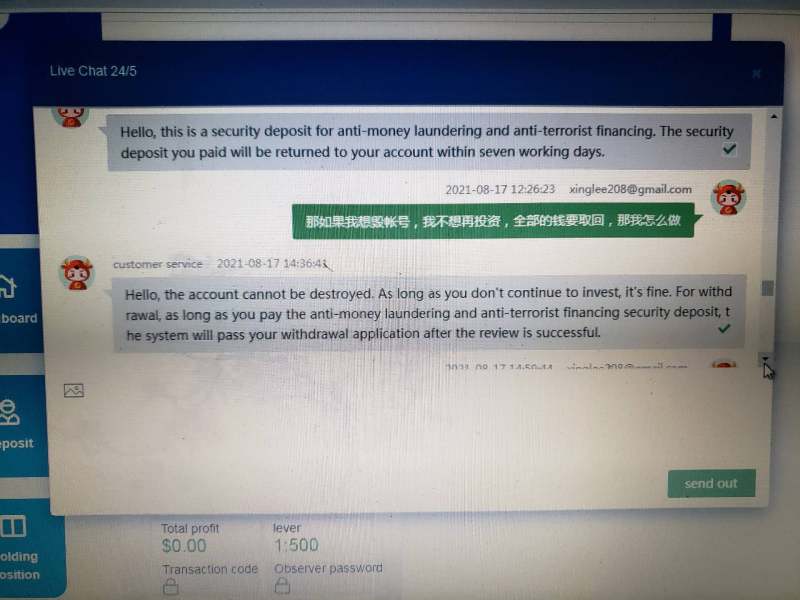

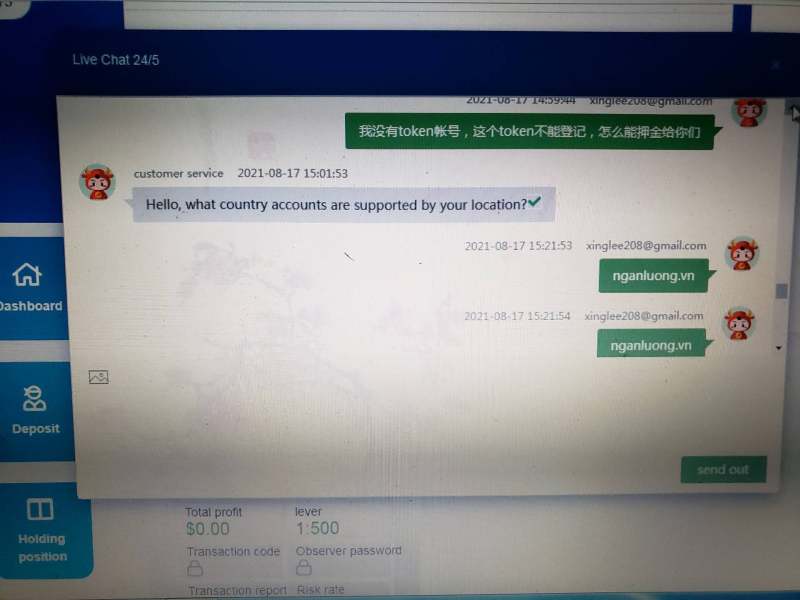

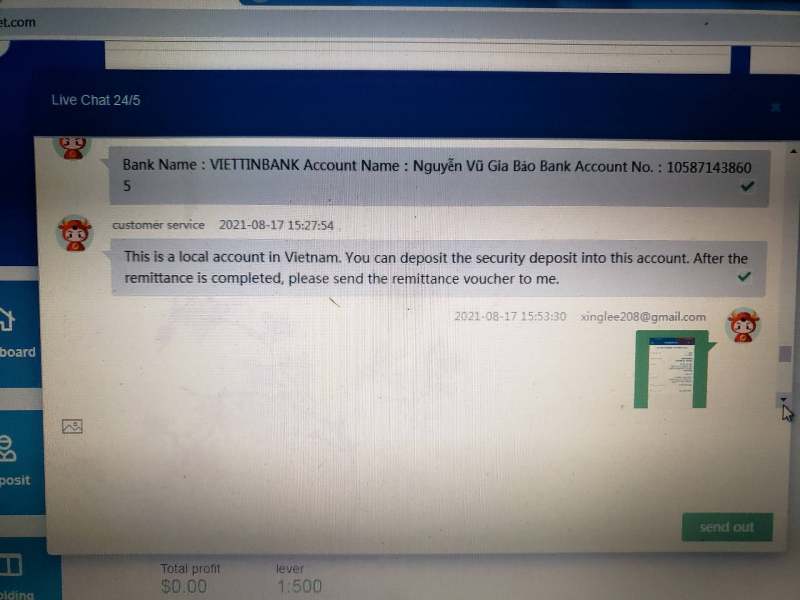

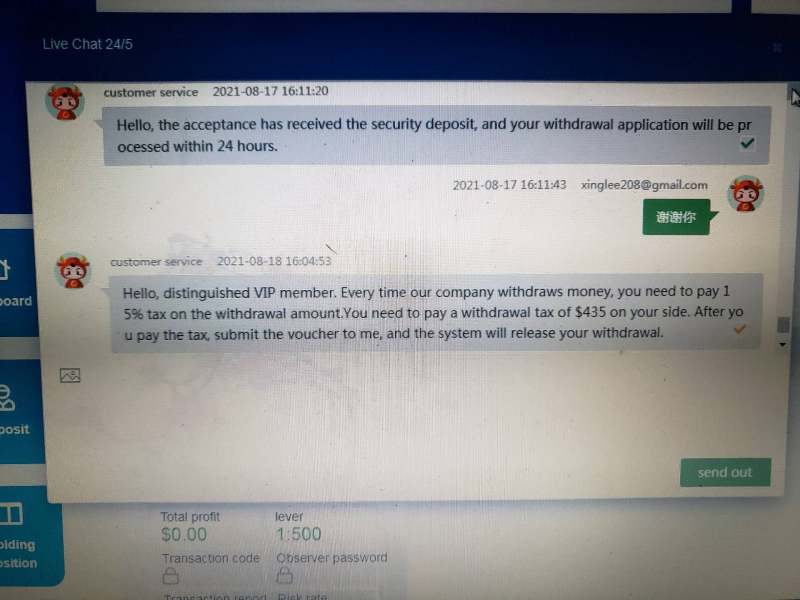

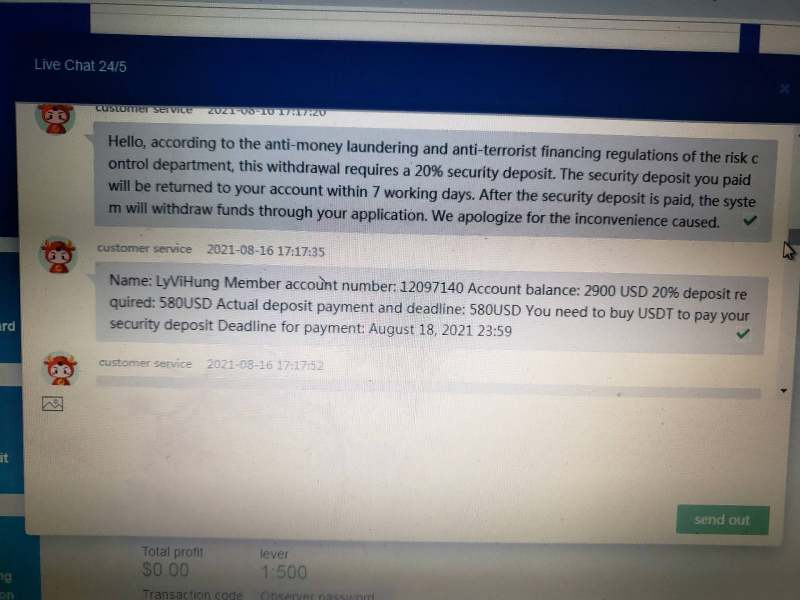

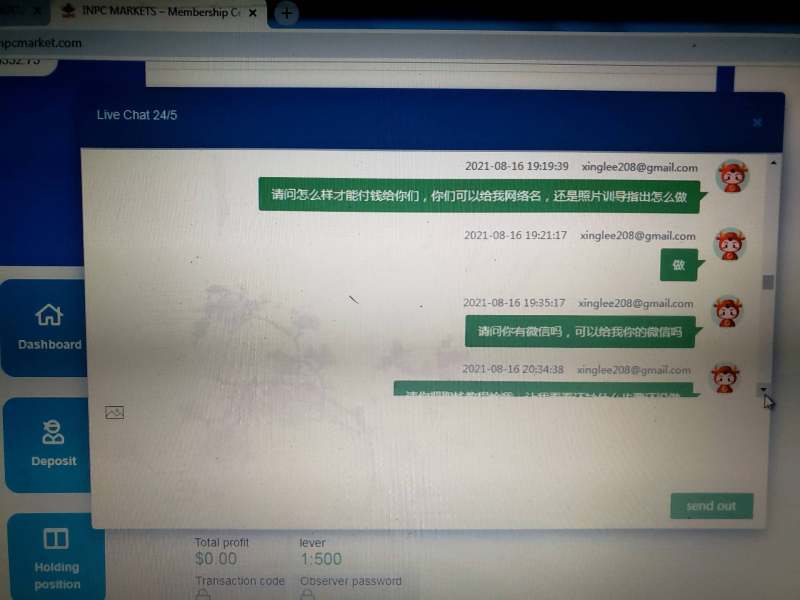

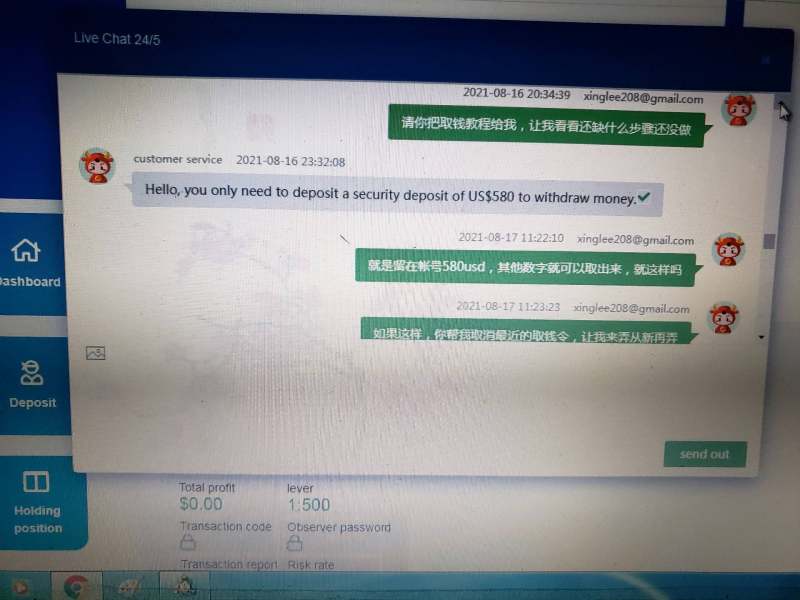

INPC faces significant trust and safety concerns due to the absence of clear regulatory information and conflicting user feedback. The lack of transparent regulatory oversight represents a major red flag for traders seeking secure and compliant trading environments, while user reports include allegations of fraudulent activity and platform legitimacy concerns, which severely impact the broker's trustworthiness rating.

The presence of negative exposure reports and scam allegations creates substantial doubt about the platform's operational integrity. Without clear regulatory licensing information, traders cannot verify the platform's compliance with financial services regulations or assess available investor protection measures, and this regulatory ambiguity significantly increases potential risks for traders considering the platform.

The combination of unclear regulatory status and negative user allegations creates a high-risk environment that experienced traders typically avoid. Professional forex traders generally prioritize regulated brokers with transparent operational frameworks and clear dispute resolution mechanisms.

User Experience Analysis

User experience feedback for INPC reveals significant polarization between satisfied users and those reporting negative experiences. The overall user satisfaction appears inconsistent, with experiences varying dramatically between different traders and time periods, though positive user feedback typically focuses on the MetaTrader5 platform's functionality and trading tools availability.

Users familiar with MT5 generally appreciate the platform's comprehensive features and analytical capabilities when accessible. However, negative feedback includes serious allegations about platform legitimacy and operational concerns, and some users have characterized the platform as fraudulent, which represents extreme dissatisfaction and raises substantial credibility concerns.

The registration and verification processes are not clearly documented, making it difficult to assess user onboarding experiences. Similarly, fund management procedures and withdrawal experiences lack detailed user feedback in available sources, while the significant variation in user experiences suggests inconsistent service delivery and potential operational issues that affect user satisfaction.

Traders considering INPC should carefully evaluate these mixed experiences against their risk tolerance and trading requirements.

Conclusion

This comprehensive Inpc review reveals a forex broker with significant transparency and credibility challenges. While the platform offers MetaTrader5 integration as a positive feature, the absence of clear regulatory information and presence of negative user allegations create substantial concerns for potential traders, though INPC may appeal to experienced forex traders familiar with MetaTrader5 who prioritize platform functionality over regulatory transparency.

However, the mixed user feedback and legitimacy concerns make this platform unsuitable for risk-averse traders or those seeking regulated trading environments. The primary advantages include access to professional trading tools through MT5, while significant disadvantages encompass unclear regulatory status and user allegations of fraudulent activity, so potential traders should exercise extreme caution and conduct thorough due diligence before considering this platform for forex trading activities.