Is Harris safe?

Pros

Cons

Is Harris Safe or a Scam?

Introduction

Harris, a forex broker claiming to operate from Ohio, positions itself as a provider of diverse trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the forex market is rife with scams, making it crucial for traders to conduct thorough evaluations before engaging with any broker. The potential for financial loss is significant, especially with unregulated entities. This article will investigate the legitimacy of Harris, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our analysis is based on a review of multiple online sources and expert opinions regarding the broker's operations.

Regulation and Legitimacy

The regulatory status of a forex broker is a primary indicator of its legitimacy. Harris claims to be based in the United States but operates without any recognized regulatory oversight. This raises significant concerns about the safety of funds and the broker's adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation implies that there are no safeguards in place to protect traders' funds. Furthermore, the absence of a license from established regulatory bodies such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA) is alarming. Unregulated brokers often lack transparency and can engage in practices that are detrimental to traders, such as manipulating prices or refusing withdrawal requests. Therefore, it is evident that Harris is not safe for traders looking to invest their money.

Company Background Investigation

Harris's company history reveals a lack of substantial information regarding its operations and ownership structure. There is no clear evidence of a robust corporate background, which is essential for establishing trust with potential clients. Additionally, the management team behind Harris appears to be virtually anonymous, further complicating any attempts to assess their qualifications and experience in the financial industry.

The absence of detailed information about the company's leadership raises red flags about its transparency. A legitimate broker typically provides information about its executives and their professional backgrounds, which can help build trust with clients. Unfortunately, Harris lacks this transparency, making it difficult to ascertain whether the broker operates with integrity or if it is a front for fraudulent activities.

Trading Conditions Analysis

Harris claims to offer competitive trading conditions, but the specifics of its fee structure are unclear and potentially problematic. Transparency in trading costs is essential for traders to make informed decisions.

| Fee Type | Harris | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Many unregulated brokers often employ hidden fees or unfavorable trading conditions that can erode profits. Moreover, the lack of a defined commission structure suggests that traders may face unexpected costs, which can significantly impact their overall trading experience. Therefore, the ambiguity surrounding Harris's trading conditions further supports the notion that it may not be a safe option for traders.

Client Fund Security

When considering a forex broker, the security of client funds is paramount. Harris does not provide adequate information regarding its fund safety measures, such as whether it employs segregated accounts or offers negative balance protection.

In the absence of regulatory oversight, there are no guarantees that client funds are secure. Unregulated brokers are not obligated to adhere to strict financial standards, which means they can easily misappropriate funds. The lack of transparency regarding Harris's fund safety measures raises considerable concerns about the potential for financial loss. This lack of clarity regarding fund security further emphasizes that Harris is not safe for potential investors.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, reviews and testimonials regarding Harris are predominantly negative.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

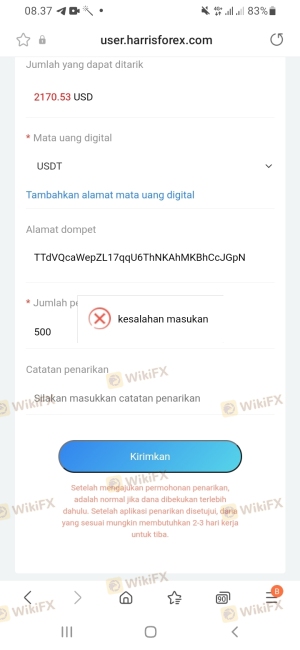

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

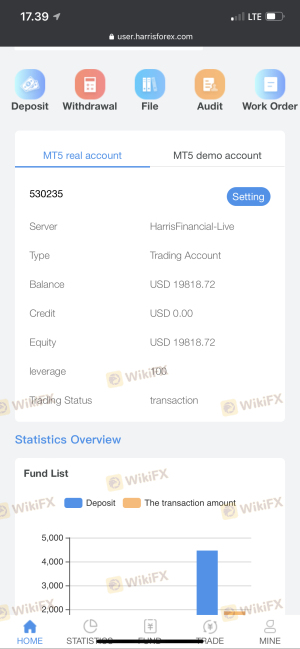

Common complaints include difficulties with withdrawals, lack of responsiveness from customer support, and accusations of misleading information. These issues indicate a concerning pattern of customer dissatisfaction. For instance, some users have reported that their withdrawal requests were delayed or denied without clear explanations. Such practices are often indicative of a scam. Given this context, it is evident that Harris has significant customer service issues, which further raises doubts about its legitimacy.

Platform and Execution

The trading platform offered by a broker is crucial for a seamless trading experience. Harris claims to provide access to popular trading platforms, but the performance and reliability of these platforms remain unverified.

Users have reported issues with order execution, including slippage and rejected orders. Such problems can significantly affect trading outcomes, especially in a volatile market. If a broker manipulates execution quality or engages in practices that disadvantage traders, it can be a sign of fraudulent activity. Therefore, the potential for platform manipulation at Harris is a significant concern for traders.

Risk Assessment

Using an unregulated broker like Harris presents a variety of risks that traders must consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Financial Risk | High | Potential loss of funds due to lack of regulation. |

| Operational Risk | Medium | Issues with platform reliability and execution. |

| Customer Service Risk | High | Poor support and unresolved complaints. |

Given these risks, it is essential for traders to exercise caution. Engaging with an unregulated broker increases the likelihood of experiencing financial loss and operational difficulties. To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Harris is not safe for traders. The lack of regulatory oversight, transparency in trading conditions, and negative customer experiences all point toward the broker being a potential scam. For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities. Trusted brokers typically offer transparent trading conditions, robust customer support, and enhanced security for client funds. By choosing a regulated broker, traders can significantly reduce their risk of falling victim to scams and ensure a safer trading environment.

Is Harris a scam, or is it legit?

The latest exposure and evaluation content of Harris brokers.

Harris Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Harris latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.