Regarding the legitimacy of Trust forex brokers, it provides FSPR and WikiBit, .

Is Trust safe?

Pros

Cons

Is Trust markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

SPEEDTRADER INTERNATIONAL LIMITED

Effective Date:

2016-03-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

3/112 Gowing Drive Meadowbank Auckland 1072Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Trust Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, Trust has positioned itself as a broker that offers various trading opportunities to traders worldwide. However, the rapid growth of the forex market, which boasts an average daily trading volume exceeding $5 trillion, also attracts a multitude of unscrupulous entities. This necessitates a careful evaluation of any forex broker before traders commit their funds. Is Trust safe? This question is pivotal for potential investors, as the stakes are high. In this article, we will conduct a thorough investigation into Trusts regulatory status, company background, trading conditions, customer experience, and more, to determine whether it is a legitimate broker or a potential scam.

Our investigation is grounded in a comprehensive evaluation framework that encompasses regulatory compliance, company history, trading conditions, and user feedback. By synthesizing data from reputable sources and user testimonials, we aim to provide a well-rounded view of the broker's credibility.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring investor protection and maintaining market integrity. Trust claims to adhere to regulatory standards; however, it is essential to analyze its regulatory status in detail. Below is a summary of Trust's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Unregulated |

As indicated in the table, Trust does not appear to be regulated by any recognized financial authority. This lack of oversight raises significant concerns about the broker's legitimacy. Regulatory bodies, such as the SEC (Securities and Exchange Commission) in the United States, FCA (Financial Conduct Authority) in the UK, and ASIC (Australian Securities and Investments Commission) in Australia, enforce stringent guidelines to protect traders. Without such regulation, is Trust safe? The absence of regulatory oversight means that there are no guarantees regarding fair trading practices, transparent pricing, or the security of client funds.

Moreover, the quality of regulation is paramount. Brokers regulated by top-tier authorities are subject to rigorous compliance standards, which include regular audits and the establishment of investor compensation schemes. In contrast, unregulated brokers often lack such safeguards, making them more susceptible to engaging in unethical practices. Therefore, prospective traders should exercise extreme caution when considering Trust as a trading partner.

Company Background Investigation

Understanding the background of a broker is vital for assessing its credibility. Trust was established with the intention of providing traders with access to the forex market, but detailed information regarding its history, ownership structure, and management team is scarce. This lack of transparency is a red flag for potential investors.

The management teams experience and qualifications are critical factors that contribute to a broker's reliability. Unfortunately, there is little publicly available information regarding the backgrounds of the individuals running Trust. This absence of information can lead to concerns regarding the broker's operational practices and overall legitimacy. A reputable broker typically provides clear details about its leaders and their professional histories, which helps build trust with clients.

Furthermore, the level of transparency in a broker's operations is crucial. Information about trading conditions, fees, and corporate governance should be readily accessible to clients. Trust's limited disclosures may indicate a lack of accountability, which further complicates the question of whether is Trust safe? Without comprehensive information, traders are left to navigate the risks associated with an obscure broker.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are of paramount importance. Trust claims to provide competitive trading conditions, but an in-depth analysis is necessary to understand the true cost of trading with them.

Fee Structure Overview

Trust's overall fee structure appears to be less favorable compared to industry standards. Below is a comparison of key trading costs:

| Fee Type | Trust | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Low |

The spreads offered by Trust on major currency pairs are variable, which can lead to unexpected costs during trading. Additionally, the lack of a transparent commission model raises concerns about hidden fees that could erode profitability. Traders should be cautious of any broker that does not clearly outline its fee structures, as this can lead to significant financial losses.

Moreover, the overnight interest rates charged by Trust appear to be higher than the industry average. This could significantly impact traders who hold positions overnight, further complicating the evaluation of whether is Trust safe? Traders must be vigilant about the costs associated with their trading activities, as excessive fees can quickly accumulate and diminish returns.

Customer Funds Security

The safety of customer funds is a primary concern for any trader. Trust's measures regarding fund security are critical in determining its reliability as a broker.

Trust does not provide clear information regarding its customer fund protection policies, which raises significant concerns. Effective fund safety measures include segregating client funds from the broker's operational funds, ensuring that client money is protected even in the event of insolvency. Additionally, reputable brokers often participate in investor compensation schemes that provide coverage in case of broker default.

Without such safeguards, traders are left vulnerable to potential financial loss. The absence of transparency surrounding fund security measures further complicates the question of is Trust safe? If customers' funds are not adequately protected, they may face challenges in recovering their investments in the event of a dispute or broker failure.

Customer Experience and Complaints

Customer feedback and experiences provide valuable insights into a broker's reliability. Evaluating the common complaints against Trust is essential to gauge its overall reputation.

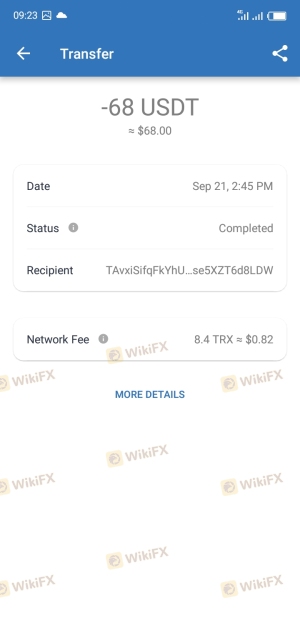

Many users have reported issues related to withdrawal delays and unresponsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | Medium | Average |

| Misleading Information | High | Poor |

A significant number of complaints center around withdrawal delays, which can be a major red flag for potential investors. If a broker struggles to process withdrawals in a timely manner, it raises questions about its financial stability and operational practices. Additionally, the lack of responsiveness from customer service can leave traders feeling unsupported and vulnerable.

In one notable case, a trader reported waiting over three weeks for a withdrawal request to be processed, with minimal communication from Trusts support team. This experience highlights the potential risks associated with trading with an unregulated broker, emphasizing the importance of thorough research before committing funds.

Platform and Execution

The trading platform's performance and execution quality are critical factors that can influence a trader's success. Trust provides access to various trading platforms, but the overall user experience and execution quality require careful evaluation.

Users have reported mixed experiences with Trusts trading platform. While some traders appreciate the user-friendly interface, others have raised concerns about order execution quality, including instances of slippage and rejected orders. These issues can significantly impact trading outcomes, leading to frustration and financial loss.

The potential for platform manipulation is another area of concern. If a broker engages in practices that negatively affect trade execution, it can undermine trust and confidence among traders. Therefore, the question remains: is Trust safe? Traders must remain vigilant and monitor their trading experiences closely to identify any irregularities.

Risk Assessment

Using Trust as a broker presents several risks that traders should consider. A comprehensive risk assessment can help identify potential pitfalls.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Withdrawal Risk | Medium | Delays and issues with fund access reported. |

| Execution Risk | High | Instances of slippage and rejected orders noted. |

As illustrated in the table, the regulatory risk associated with Trust is particularly concerning. The absence of oversight means that traders have limited recourse in the event of disputes or financial issues. Additionally, withdrawal risks can lead to financial strain, while execution risks can directly affect trading performance.

To mitigate these risks, it is advisable for traders to consider diversifying their trading activities and exploring alternative brokers that offer better regulatory protections and customer service.

Conclusion and Recommendations

In conclusion, after a thorough investigation into Trust, it is evident that several red flags warrant caution. The lack of regulatory oversight, limited transparency regarding company operations, and numerous customer complaints raise significant concerns about its legitimacy. Therefore, the question of is Trust safe? leans towards a negative response.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities and have a proven track record of customer service and fund protection. Some recommended alternatives include brokers regulated by the FCA, ASIC, or SEC, which offer robust investor protections and transparent trading conditions.

Ultimately, traders must prioritize their safety and financial well-being by conducting thorough research and due diligence before engaging with any broker, especially one like Trust that lacks the necessary regulatory framework and transparency.

Is Trust a scam, or is it legit?

The latest exposure and evaluation content of Trust brokers.

Trust Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trust latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.