Regarding the legitimacy of IFC Markets forex brokers, it provides FSCA, FSC and WikiBit, (also has a graphic survey regarding security).

Is IFC Markets safe?

Software Index

Risk Control

Is IFC Markets markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

IFC MARKETS SA (PTY) LTD

Effective Date: Change Record

2021-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

NORWICH PLACE WEST2ND FLOORCNR 5TH AND NORWICH2031Phone Number of Licensed Institution:

082 3029618Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IFCMARKETS. CORP.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is IFC Markets A Scam?

Introduction

IFC Markets is an international online broker that has been operating in the forex and CFD markets since 2006. Headquartered in the British Virgin Islands, with additional offices in Cyprus and Malaysia, IFC Markets positions itself as a provider of diverse trading instruments, including over 650 assets across forex, commodities, indices, and cryptocurrencies. Given the complexity and risks associated with forex trading, it is crucial for traders to carefully evaluate the credibility and reliability of their chosen brokers. This article aims to provide an objective analysis of IFC Markets, utilizing a variety of sources and methodologies to assess its legitimacy, regulatory status, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and reliability. IFC Markets claims to be regulated by several authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) of the British Virgin Islands. However, the quality of regulation varies significantly between these jurisdictions.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 147/11 | Cyprus | Active |

| FSC | SIBA/L/14/1073 | British Virgin Islands | Active |

| LFSA | MB/20/0049 | Labuan, Malaysia | Active |

While CySEC is considered a reputable regulator within the European Union, the FSC and LFSA are often viewed as less stringent due to their offshore nature. This can raise concerns about investor protection and compliance with international standards. Historically, IFC Markets has faced scrutiny regarding its regulatory adherence, particularly with complaints from various jurisdictions, including warnings issued by Canadian regulators.

Company Background Investigation

Founded in 2006, IFC Markets has established itself as a key player in the forex trading landscape. The company operates under the IFCM Group, which encompasses several subsidiaries across different regions. The ownership structure is relatively transparent, with clear delineation of its various entities.

The management team consists of professionals with backgrounds in finance and technology, contributing to the broker's innovative approach to trading. However, the company's transparency regarding its management and operational practices has been questioned, particularly in light of the mixed reviews from clients regarding their experiences with the broker.

Trading Conditions Analysis

IFC Markets offers a competitive trading environment with a low minimum deposit requirement of just $1 for beginner accounts. However, traders should be aware of the potential hidden costs associated with trading on this platform.

Trading Cost Comparison Table

| Cost Type | IFC Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 - 1.8 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs ranges from 0.4 to 1.8 pips, which is competitive compared to the industry average. However, the absence of a clear commission structure could lead to confusion for traders regarding their total trading costs. Additionally, the broker charges fees for certain deposit methods, which may not be typical among its competitors.

Customer Funds Security

The safety of customer funds is paramount when considering a broker. IFC Markets claims to utilize segregated accounts to protect client funds, which is a standard practice among regulated brokers. Furthermore, they offer negative balance protection, ensuring that clients cannot lose more than their deposited funds.

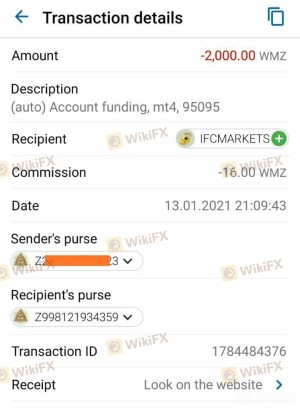

However, concerns have been raised regarding the broker's historical handling of funds, with reports of withdrawal issues and account closures. These incidents may indicate potential risks that traders should be aware of before engaging with IFC Markets.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of IFC Markets reveal a mixed bag of experiences, with some traders praising the platform's features and customer support, while others report significant issues.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Closures | High | Unresolved |

| Trading Platform Stability | Medium | Average |

Common complaints include difficulties with fund withdrawals and account closures, often without clear explanations. In some cases, customers reported that their accounts were blocked after depositing funds, leading to frustration and distrust.

Platform and Trade Execution

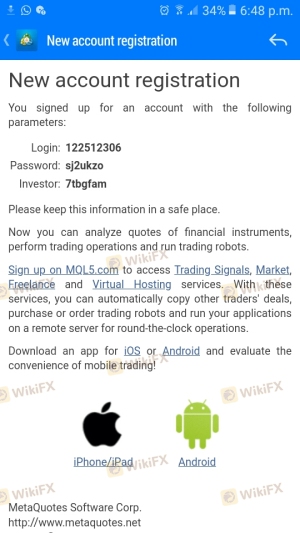

The performance of a trading platform is crucial for a positive trading experience. IFC Markets offers several platforms, including MetaTrader 4 and their proprietary Net Tradex. While these platforms are generally well-received, users have reported issues with execution quality, including slippage and order rejections.

The absence of clear evidence of platform manipulation is a positive sign, but the reported execution issues may deter some traders from fully trusting the broker's capabilities.

Risk Assessment

Engaging with IFC Markets carries inherent risks that should be carefully considered.

Risk Assessment Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack investor protection. |

| Financial Risk | Medium | High leverage can amplify losses. |

| Operational Risk | Medium | Reports of withdrawal issues and account closures. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and consider starting with a smaller investment.

Conclusion and Recommendations

In conclusion, while IFC Markets presents itself as a legitimate broker with a range of trading options, there are significant concerns regarding its regulatory status, customer complaints, and historical handling of funds. The mixed reviews and reports of withdrawal issues suggest that potential clients should exercise caution.

For traders seeking a more secure trading environment, it may be advisable to consider brokers with stronger regulatory oversight, such as those regulated by the FCA or ASIC. Overall, while IFC Markets may offer attractive trading conditions, the risks associated with this broker warrant careful consideration before proceeding.

Is IFC Markets a scam, or is it legit?

The latest exposure and evaluation content of IFC Markets brokers.

IFC Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFC Markets latest industry rating score is 2.96, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.96 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.