Is RELY safe?

Business

License

Is Rely Safe or Scam?

Introduction

Rely, a forex broker established in 2019, has quickly positioned itself within the online trading market, particularly catering to traders interested in the forex and CFD markets. However, as with any financial service, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with potential risks, including scams and unregulated brokers that may not provide adequate protection for investors. This article aims to investigate whether Rely is a safe trading platform or if it raises red flags that warrant concern. Our investigation is based on a comprehensive review of online sources, user feedback, and regulatory information, providing a structured assessment framework to determine the trustworthiness of Rely.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its safety. Rely has been noted for operating without adequate regulatory oversight, which significantly raises concerns about its legitimacy. The absence of regulation can expose traders to higher risks, as unregulated brokers are not held accountable to any governing body, potentially leading to issues such as fund mismanagement or withdrawal difficulties.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that Rely does not adhere to any established standards designed to protect investors. Regulatory agencies typically enforce rules that require brokers to maintain certain levels of transparency, fund segregation, and operational integrity. Without such oversight, traders may find it challenging to seek recourse in the event of a dispute. Furthermore, the absence of a regulatory history raises questions about Rely's operational practices and compliance with industry standards.

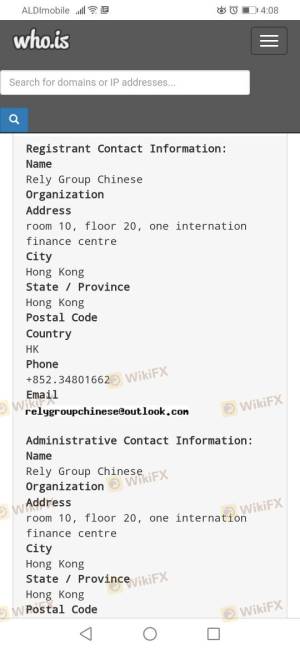

Company Background Investigation

Rely was founded in 2019, and its relatively short history raises questions about its long-term stability and reliability. The company claims to offer a range of trading services, yet detailed information about its ownership structure and management team is scarce. This lack of transparency can be concerning for potential investors who rely on the credibility of a brokers leadership.

The management team's background is essential in evaluating a broker's trustworthiness. A team with extensive experience and a solid reputation in the financial sector can often indicate a more reliable trading environment. However, the limited information available about Rely's management leaves potential clients with unanswered questions regarding their expertise and intentions. Moreover, the absence of clear information about the company's operational practices or any history of compliance with financial regulations further complicates the assessment of whether Rely is safe.

Trading Conditions Analysis

The trading conditions offered by Rely also warrant scrutiny. A broker's fee structure can significantly impact a trader's profitability, and any unusual or opaque fees can be a red flag. Rely's trading conditions have been criticized, particularly regarding its overall cost structure, which appears to lack clarity.

| Fee Type | Rely | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information about spreads, commissions, and other trading costs makes it difficult for traders to accurately assess the potential profitability of trading with Rely. High costs or hidden fees can quickly erode profits, making it essential for traders to understand the complete cost of trading before committing their funds. Furthermore, any reports of unexpected fees or charges could indicate a lack of transparency, which is another point of concern regarding whether Rely is safe.

Client Fund Safety

The safety of client funds is a paramount consideration when evaluating any broker. Rely's practices regarding fund security are crucial in determining if it is a safe trading platform. The absence of regulatory oversight raises questions about whether Rely employs adequate measures to protect client funds.

Traders should look for brokers that utilize fund segregation, ensuring that client funds are kept separate from the broker's operational funds. Additionally, the presence of investor protection schemes, such as negative balance protection, is vital for safeguarding against potential losses beyond the initial investment.

Historically, Rely has faced complaints from users regarding fund withdrawal issues, raising alarms about its financial practices. Such complaints can indicate a lack of reliability in terms of fund management, which is a significant concern for traders considering whether Rely is safe.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a broker. Rely has received numerous complaints regarding its services, particularly concerning withdrawal difficulties and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

The high severity of complaints related to fund withdrawals is particularly alarming, as it directly impacts traders' ability to access their money. Furthermore, the company's inadequate response to these complaints raises concerns about its commitment to customer service and satisfaction. Users have reported difficulties in receiving timely support, which can exacerbate frustrations when issues arise.

Platform and Execution

The trading platform's performance is another critical factor in determining whether Rely is safe. A reliable trading platform should offer stability, ease of use, and efficient order execution. However, reports indicate that Rely's platform may not meet these expectations, with users experiencing issues related to execution quality, slippage, and order rejections.

Traders must be cautious of any signs of platform manipulation or inefficiencies, as these can significantly affect trading outcomes. A platform that consistently fails to execute trades as intended can lead to substantial financial losses, making it essential for traders to thoroughly evaluate Rely's platform before engaging in trading activities.

Risk Assessment

Using Rely as a trading platform comes with inherent risks due to its unregulated status and the complaints it has garnered.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Complaints about withdrawal issues |

| Operational Risk | Medium | Potential issues with platform stability |

To mitigate these risks, traders should consider diversifying their trading activities and not committing significant funds to a broker without a solid regulatory framework. Additionally, conducting regular reviews of broker performance and customer feedback can help identify any emerging issues.

Conclusion and Recommendations

In summary, Rely raises several red flags that suggest it may not be a safe trading platform. The absence of regulatory oversight, coupled with numerous user complaints and a lack of transparency regarding its operations and management, creates a concerning picture.

Traders should exercise caution and consider alternative brokers that offer robust regulatory protections, transparent fee structures, and a proven track record of customer satisfaction. Reliable options include brokers regulated by top-tier financial authorities, which can provide a more secure trading environment. Ultimately, ensuring the safety of your investments should be the top priority when choosing a forex broker.

Is RELY a scam, or is it legit?

The latest exposure and evaluation content of RELY brokers.

RELY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RELY latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.