Harris 2025 Review: Everything You Need to Know

Summary

This harris review gives a complete analysis of Harris as a possible financial services provider. Our assessment shows major limits in available information. Based on the limited data we can access through official channels, Harris seems to operate in multiple business sectors including government reviews, infrastructure assessments, and literary publications. It lacks clear identification as a traditional forex broker. The entity's background covers various commercial activities. Specific forex trading services, regulatory compliance, and trading conditions remain largely hidden. This harris review stays neutral due to insufficient concrete information about trading platforms, account types, or customer support structures.

The primary user base appears to be individuals seeking government policy analysis, infrastructure reviews, or literary content rather than forex trading services. Without transparent regulatory information, trading conditions, or verified customer testimonials, potential users should exercise considerable caution when considering Harris for financial trading purposes.

Important Notice

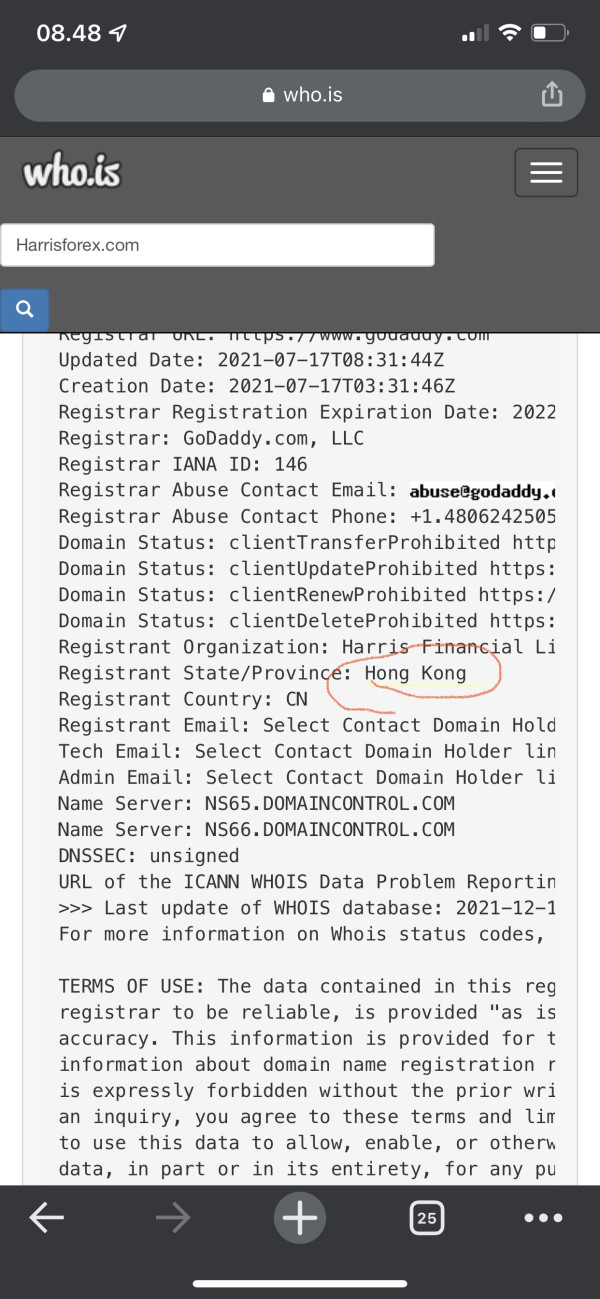

This evaluation acknowledges significant limits in available information about Harris as a financial services provider. Harris entities identified through research include government review bodies, infrastructure assessment organizations, and publishing ventures. Specific forex brokerage operations lack clear documentation. The absence of detailed regulatory information suggests potential compliance variations across different jurisdictions. This makes it difficult to assess the entity's legitimacy as a trading platform.

This harris review methodology relies on publicly available information, which proves insufficient for comprehensive broker evaluation. Readers should note that standard broker assessment criteria cannot be fully applied due to information gaps regarding trading conditions, platform specifications, and regulatory oversight. Any investment decisions should involve additional independent research and verification of regulatory status before proceeding.

Rating Framework

Broker Overview

Harris presents a complex entity structure that spans multiple business sectors. Its role as a forex broker remains unclear. The organization appears to be associated with various government reviews, infrastructure assessments, and policy evaluations rather than traditional financial trading services. According to available information, Harris entities have been involved in custody death reviews, airport demand management schemes, and literary publications. This suggests a diverse operational portfolio that extends beyond financial markets.

The lack of specific establishment dates for trading operations, combined with unclear corporate structure, makes it challenging to assess the organization's experience in forex brokerage services. The trading platform specifications, asset categories, and regulatory oversight remain largely undisclosed in available documentation. Unlike established forex brokers that typically provide comprehensive information about their trading platforms, account types, and regulatory compliance, Harris lacks transparency in these critical areas.

This harris review cannot identify specific MetaTrader integration, proprietary platform development, or mobile trading applications that would typically characterize professional forex brokerage services. The absence of clear regulatory authority oversight, combined with limited information about asset classes and trading instruments, raises questions about the entity's positioning within the competitive forex market landscape.

Regulatory Jurisdictions: Available documentation does not specify particular regulatory jurisdictions or oversight authorities governing Harris's financial services operations. This creates uncertainty about compliance standards and investor protection measures.

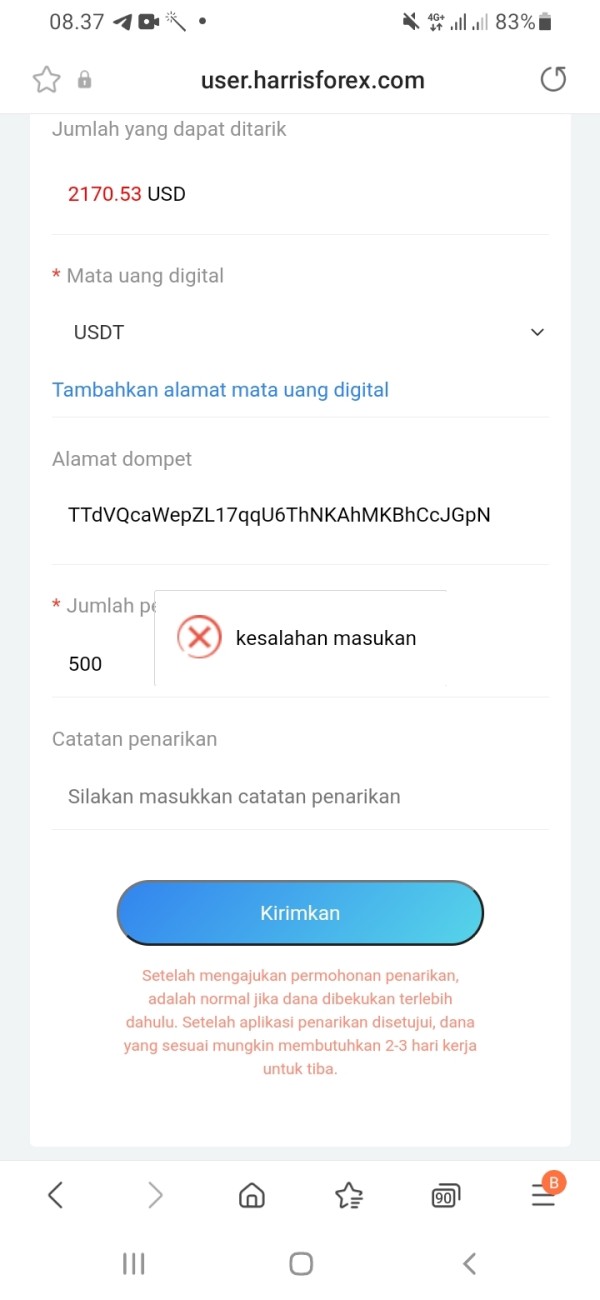

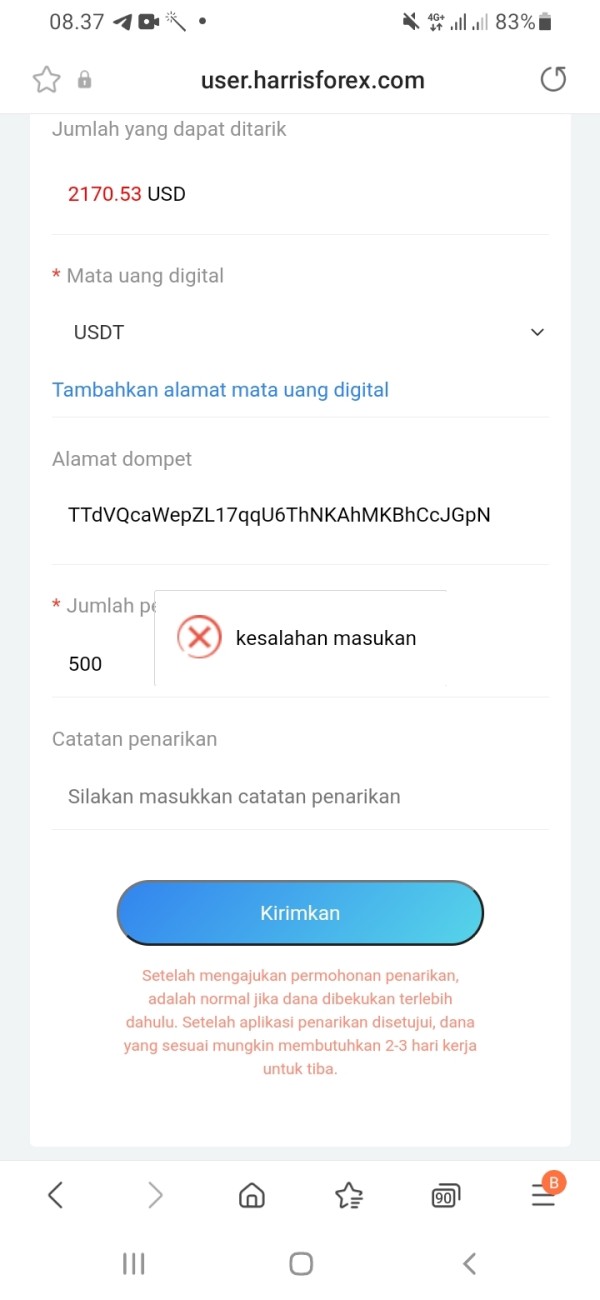

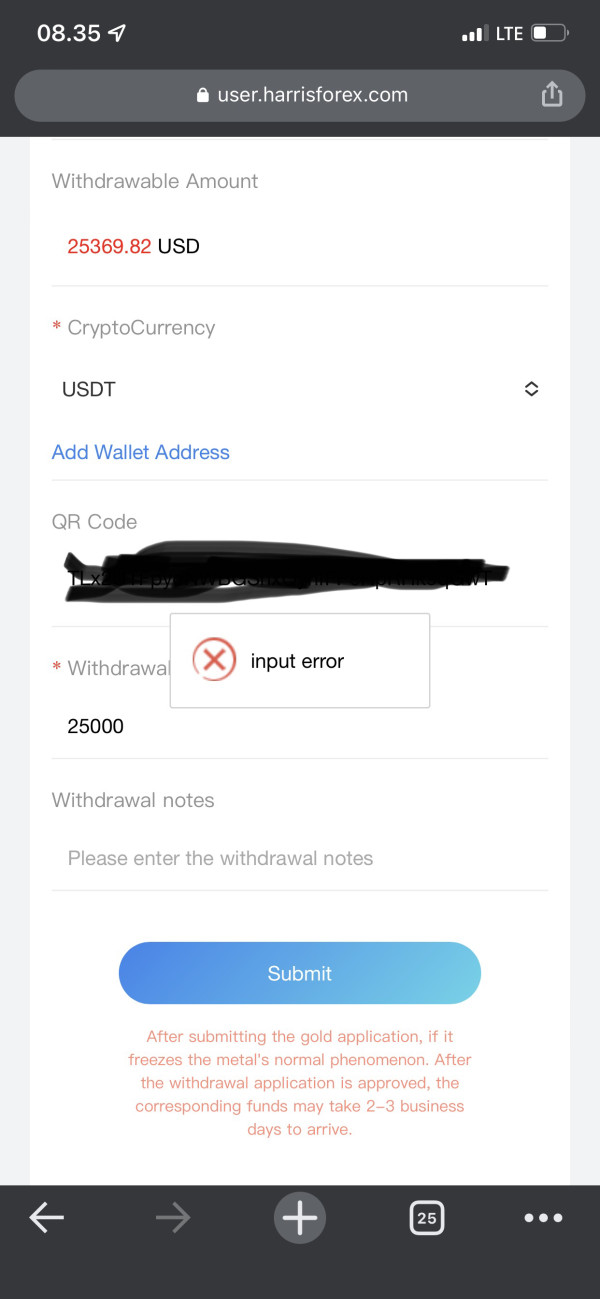

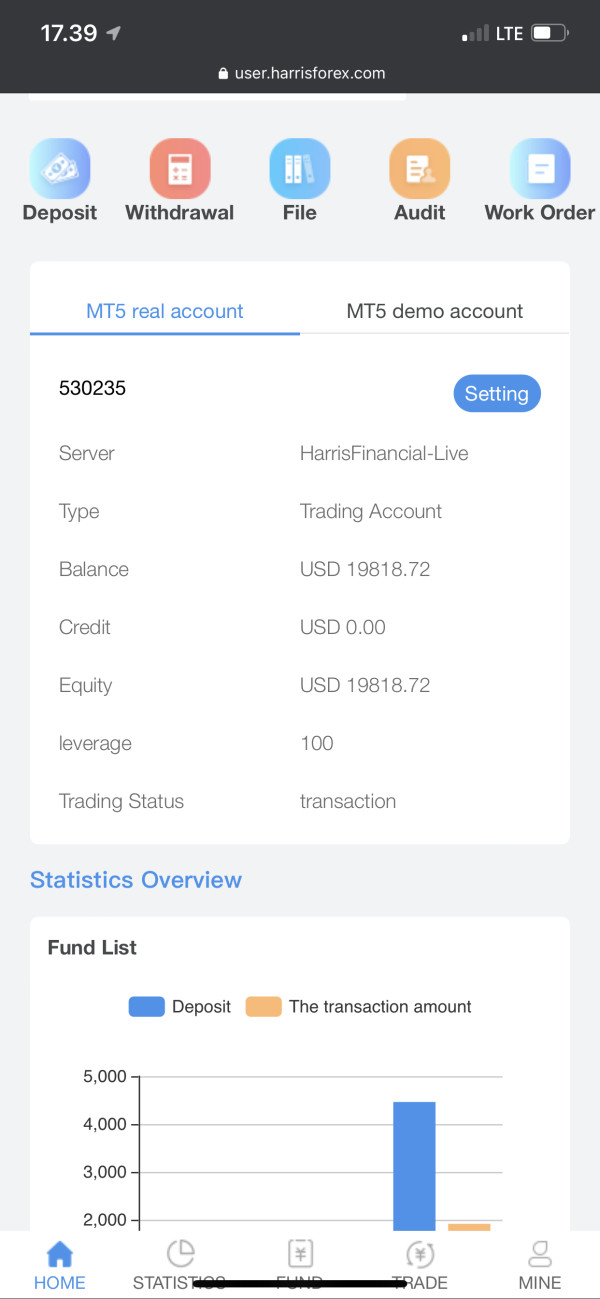

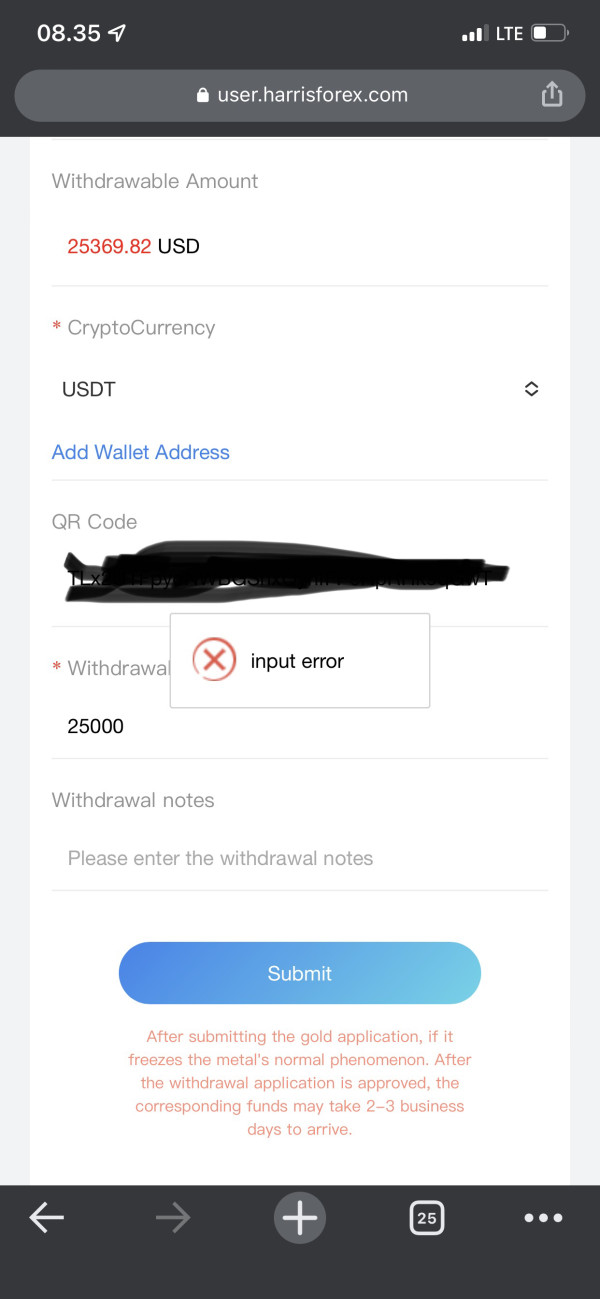

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees for deposits and withdrawals is not disclosed in accessible materials.

Minimum Deposit Requirements: No clear minimum deposit thresholds are established in available documentation. This makes it impossible to assess accessibility for different trader categories.

Bonus and Promotional Offers: Current promotional campaigns, welcome bonuses, or loyalty programs are not detailed in accessible information sources.

Tradeable Assets: The range of available trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, remains unspecified in available materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in accessible documentation. This prevents accurate cost comparison analysis.

Leverage Ratios: Maximum leverage offerings and margin requirements are not clearly stated in available information sources.

Platform Options: Specific trading platform availability, including desktop, web-based, and mobile applications, lacks detailed documentation in accessible materials.

Geographic Restrictions: Information about restricted countries or regional limitations is not clearly outlined in available sources.

Customer Support Languages: Available language options for customer service communication are not specified in accessible documentation.

This harris review acknowledges that the absence of standard broker information significantly limits the ability to provide comprehensive evaluation across these essential categories.

Account Conditions Analysis

The assessment of Harris's account conditions proves challenging due to insufficient publicly available information about account structures and requirements. Traditional forex brokers typically offer multiple account tiers designed for different trading experience levels. These range from basic accounts suitable for beginners to premium accounts featuring enhanced benefits for high-volume traders. However, Harris lacks clear documentation regarding account type variations. This makes it impossible to evaluate whether the organization provides standard, premium, or VIP account options that would typically characterize professional brokerage services.

Minimum deposit requirements, which serve as crucial accessibility indicators for potential traders, remain undisclosed in available materials. Established brokers usually provide transparent information about initial funding requirements. These range from micro accounts with minimal deposits to institutional accounts requiring substantial capital commitments. The absence of such information in this harris review reflects the organization's lack of transparency regarding entry barriers and target market positioning.

Additionally, account opening procedures, verification requirements, and documentation standards are not clearly outlined. This creates uncertainty about onboarding processes and compliance protocols. Special account features that modern traders expect, including Islamic accounts compliant with Sharia law, demo accounts for practice trading, and managed account options, are not addressed in accessible documentation.

The lack of information about account-specific benefits, trading condition variations, or premium service offerings suggests either limited service scope or inadequate communication of available features. Without user testimonials or comparative analysis possibilities, this evaluation cannot provide definitive guidance about Harris's account condition competitiveness within the broader forex market landscape.

The evaluation of Harris's trading tools and analytical resources faces significant limitations due to insufficient information about platform capabilities and research offerings. Professional forex brokers typically provide comprehensive analytical suites including real-time charting software, technical indicators, economic calendars, and market research reports. These support informed trading decisions. However, Harris's tool inventory remains largely undocumented. This prevents assessment of whether the organization offers industry-standard analytical capabilities that experienced traders require for effective market analysis.

Research and educational resources, which serve as critical differentiators among competitive brokers, lack clear documentation in available materials. Established brokers usually provide daily market analysis, weekly outlooks, educational webinars, and trading guides to support client development and market understanding. The absence of information about Harris's educational commitment or research team expertise creates uncertainty about the organization's ability to support trader development through knowledge transfer and analytical insight provision.

Automated trading support, including Expert Advisor compatibility, algorithmic trading platforms, and copy trading services, represents another area where Harris lacks clear documentation. Modern traders increasingly rely on automated solutions for strategy implementation and portfolio management. This makes platform automation capabilities essential evaluation criteria. This harris review cannot assess whether Harris supports popular automated trading solutions or provides proprietary automation tools that would enhance trading efficiency.

The lack of information about third-party integration capabilities, API access, or custom indicator support further limits the ability to evaluate Harris's technological sophistication and trader support infrastructure.

Customer Service and Support Analysis

Customer service evaluation proves particularly challenging given the limited information available about Harris's support infrastructure and client communication channels. Professional forex brokers typically maintain multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. These address client inquiries promptly and effectively. However, Harris lacks clear documentation regarding available support channels. This makes it impossible to assess communication accessibility or response time commitments that would indicate service quality standards.

Response time expectations and service level agreements, which serve as important indicators of broker reliability and client prioritization, are not specified in accessible materials. Established brokers usually provide clear response time commitments for different inquiry types. These range from immediate live chat responses to structured email reply timeframes. The absence of such information in this evaluation reflects uncertainty about Harris's customer service standards and operational efficiency in addressing client concerns or technical issues that may arise during trading activities.

Multilingual support capabilities and service hour coverage represent additional areas where Harris lacks transparent information. Global forex brokers typically provide support in multiple languages to serve international client bases. Many offer 24/5 or 24/7 assistance to accommodate different time zones and trading schedules. Without specific information about language options, support team expertise, or operational hours, potential clients cannot assess whether Harris's customer service infrastructure would adequately support their communication needs and trading schedule requirements.

Trading Experience Analysis

The assessment of Harris's trading experience faces substantial limitations due to insufficient information about platform performance, execution quality, and technological infrastructure. Professional forex brokers typically provide detailed specifications about order execution speeds, platform uptime statistics, and server reliability. These demonstrate their commitment to optimal trading conditions. However, Harris lacks documentation regarding these critical performance metrics. This makes it impossible to evaluate whether the organization maintains the technological standards that serious traders require for effective market participation.

Platform stability and execution quality represent fundamental aspects of trading experience that remain undocumented in available materials. Traders depend on reliable platform performance, especially during high-volatility periods when rapid order execution becomes crucial for strategy implementation and risk management. The absence of information about Harris's technological infrastructure, server locations, or execution speed statistics prevents assessment of whether the organization can provide the stable trading environment that professional traders demand.

Mobile trading capabilities and cross-device synchronization, which have become essential features for modern traders who require market access flexibility, are not addressed in accessible documentation. Contemporary brokers typically offer sophisticated mobile applications with full trading functionality, real-time notifications, and seamless account management capabilities. This harris review cannot evaluate Harris's mobile trading solutions or assess whether the organization provides the technological flexibility that today's traders expect for managing positions and monitoring markets across multiple devices and locations.

Trust and Reliability Analysis

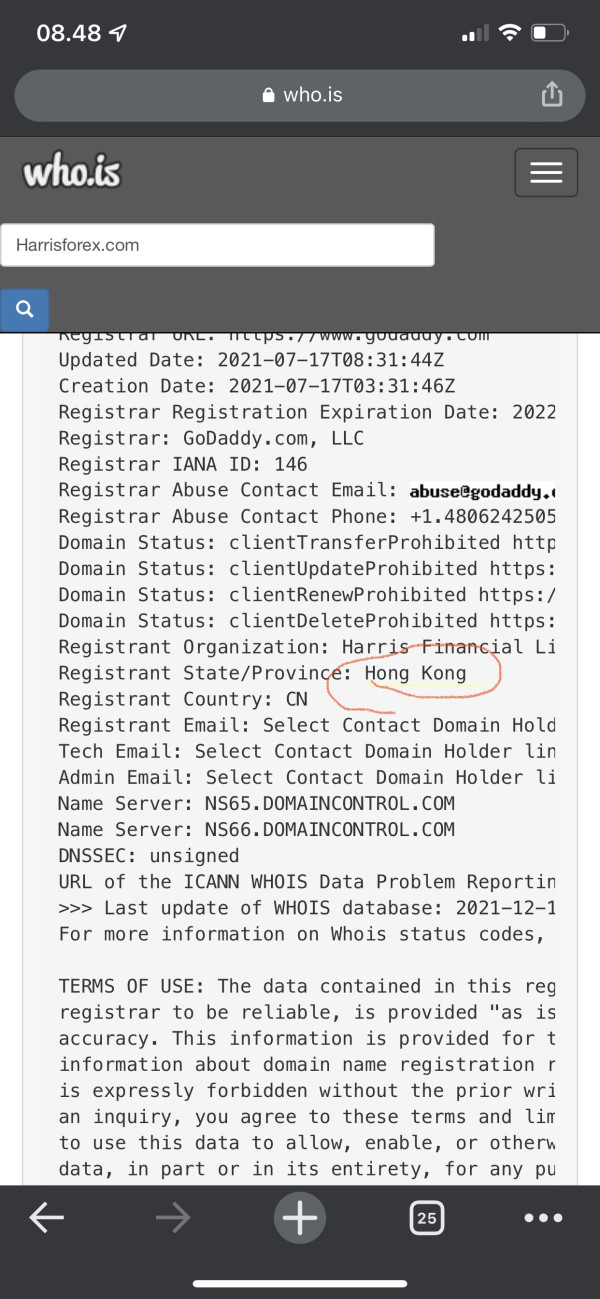

The evaluation of Harris's trustworthiness encounters significant challenges due to limited information about regulatory oversight, compliance standards, and operational transparency. Reputable forex brokers typically maintain clear regulatory relationships with established financial authorities. They provide clients with specific license numbers, regulatory body affiliations, and compliance documentation that demonstrates adherence to industry standards. However, Harris lacks transparent regulatory information. This creates uncertainty about the oversight mechanisms that would typically protect client interests and ensure operational integrity.

Fund security measures and client protection protocols, which serve as fundamental trust indicators in forex brokerage, remain undocumented in available materials. Established brokers usually provide detailed information about segregated account structures, deposit insurance coverage, and financial audit procedures that protect client funds from operational risks. The absence of such information raises questions about Harris's commitment to client fund protection and operational transparency standards that professional traders expect from legitimate brokerage services.

Industry reputation and third-party validations, including awards, certifications, and independent assessments, are not clearly documented in accessible sources. Reputable brokers typically maintain positive relationships with industry organizations, participate in regulatory compliance programs, and receive recognition for service excellence or operational standards. Without evidence of industry standing, regulatory compliance history, or third-party endorsements, this evaluation cannot provide confidence about Harris's position within the competitive forex market or its commitment to maintaining professional standards that would justify client trust and investment.

User Experience Analysis

User experience assessment proves challenging given the limited feedback and interface information available about Harris's platform design and usability standards. Professional forex brokers typically prioritize intuitive interface design, streamlined navigation, and user-friendly features. These accommodate traders with varying experience levels and technical expertise. However, Harris lacks documented user interface specifications or design philosophy information. This prevents assessment of whether the organization prioritizes user experience optimization in platform development and service delivery.

Registration and account verification processes, which significantly impact initial user experience and onboarding satisfaction, are not clearly outlined in available documentation. Modern brokers usually provide transparent information about account opening procedures, required documentation, and verification timeframes. This sets appropriate client expectations and ensures smooth onboarding experiences. The absence of such procedural clarity creates uncertainty about Harris's approach to client acquisition and whether the organization has developed efficient processes that minimize barriers to account establishment.

Overall user satisfaction metrics and feedback compilation remain unavailable through accessible sources. This limits the ability to assess real-world client experiences with Harris's services. Established brokers typically maintain review systems, satisfaction surveys, and feedback mechanisms that provide insights into service quality and areas requiring improvement. This harris review cannot reference specific user testimonials, satisfaction ratings, or common experience patterns that would typically inform potential clients about service quality expectations and operational reliability standards.

Conclusion

This comprehensive harris review reveals significant limitations in assessing Harris as a forex brokerage option due to insufficient publicly available information about essential trading services and operational standards. The organization's apparent involvement in various sectors including government reviews and infrastructure assessments suggests a diverse business portfolio. It lacks clear positioning within the competitive forex market. The absence of transparent regulatory information, trading condition specifications, and customer service details creates substantial uncertainty about Harris's suitability for serious forex trading activities.

Potential users seeking reliable forex brokerage services should prioritize providers with established regulatory oversight, transparent operational standards, and comprehensive service documentation that Harris currently lacks in accessible materials.