PrimeFin is administered by Caps Solutions Ltd, a company incorporated in Labuan, Malaysia. Founded in 2020, the brokerage quickly gained traction with its user-friendly trading platform and low-cost structure. While its regulatory association with the LFSA provides some credibility, it does not meet the stringent standards required by tier-one regulators like the FCA or ASIC.

PrimeFin features a multitude of business activities centered around trading Contracts for Difference (CFDs) on various asset classes. The broker emphasizes ease of trading via its web trader, mobile app, and MT4 platform, aiming to cater to traders seeking diverse investment opportunities. That said, heavy reliance on the LFSA prompts important questions regarding client safety and investor protection.

PrimeFin holds a license from the LFSA, which lacks the credibility of major financial regulators like the FCA or ASIC. This raises questions about the oversight standard and could pose risks to clients.

- Visit the LFSA Website: Search for registered entities.

- Consult NFA Basics Database: Check for complaints filed against PrimeFin.

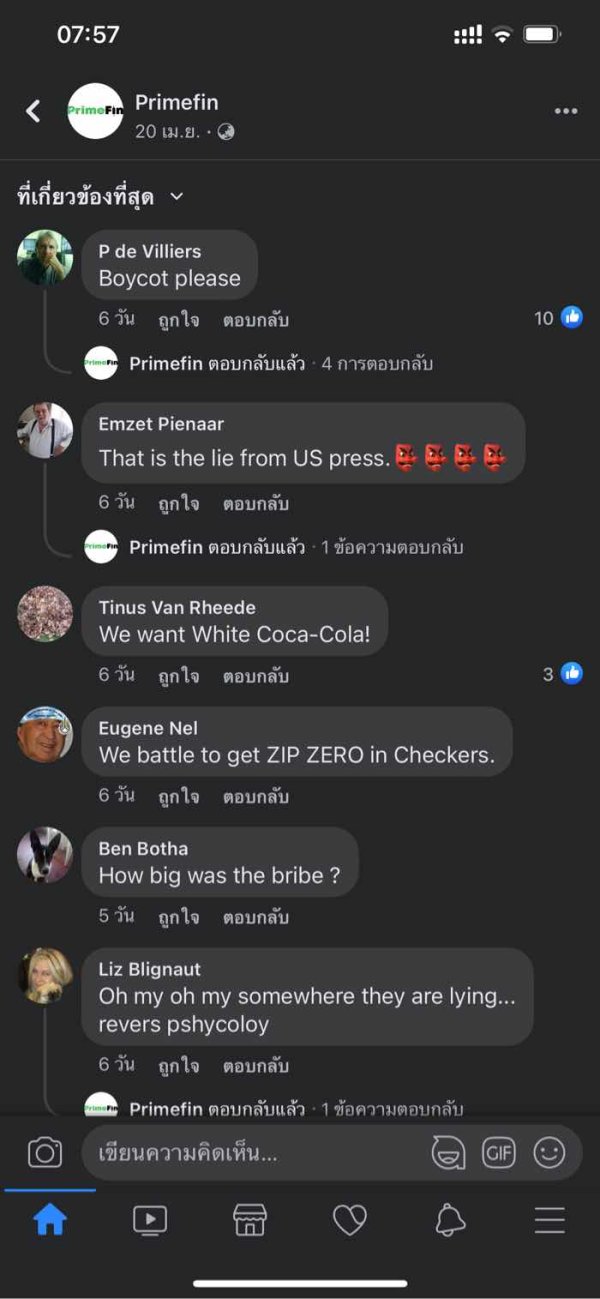

- Review Feedback on Platforms: Platforms like Trustpilot can offer insights into user experiences.

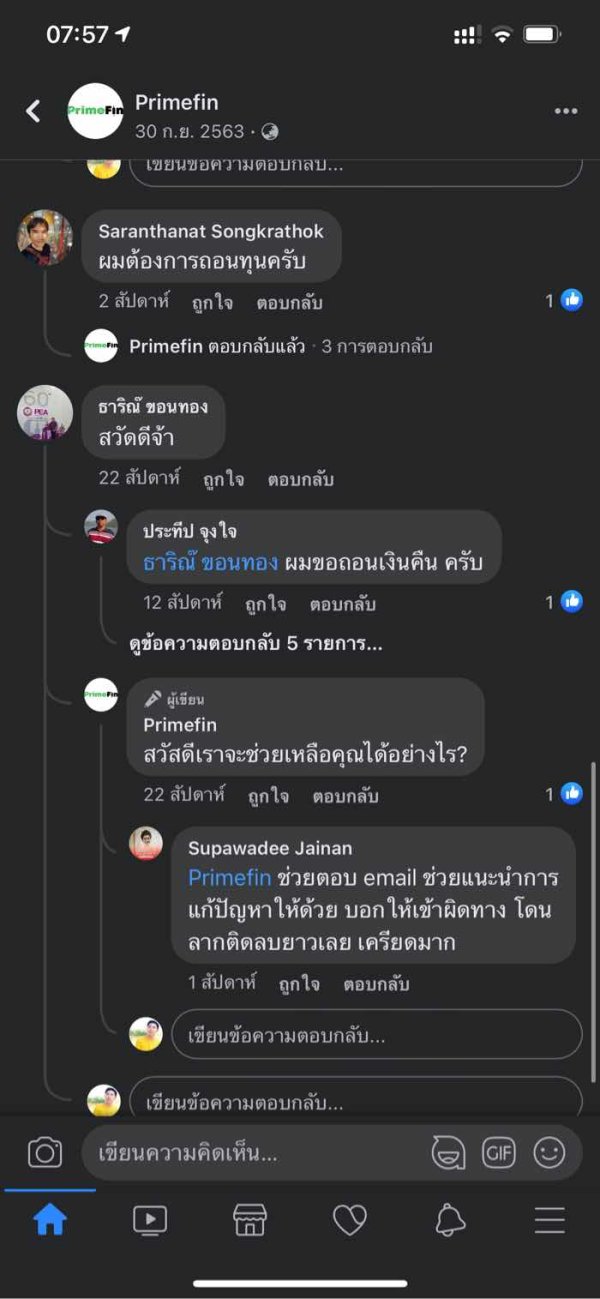

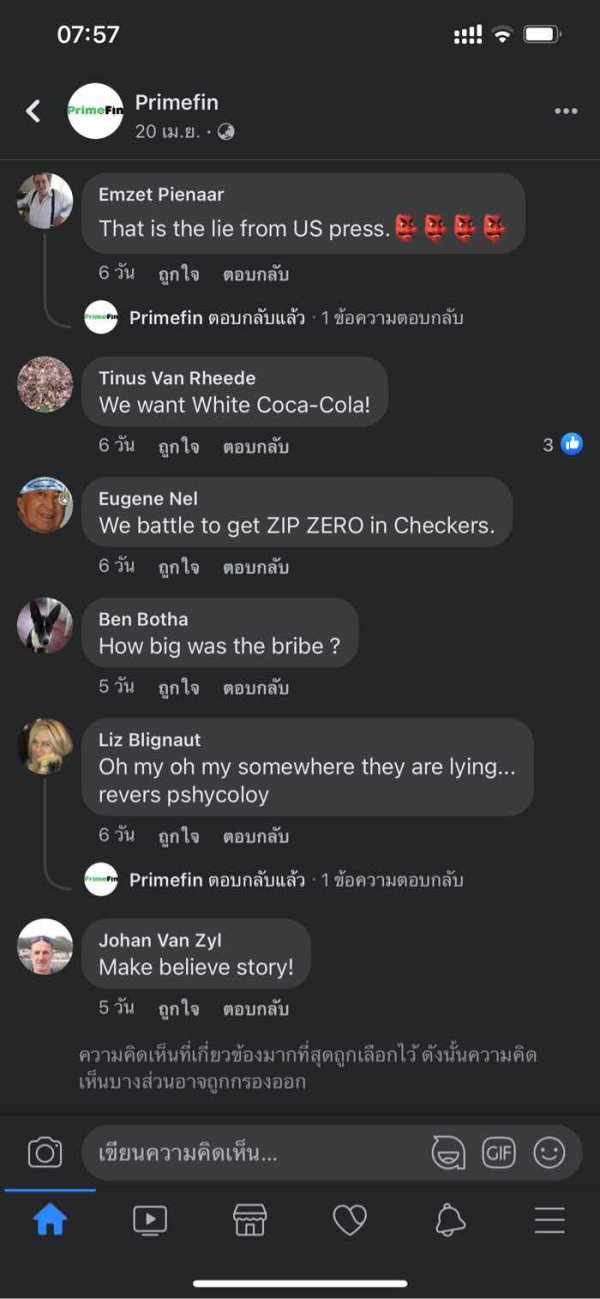

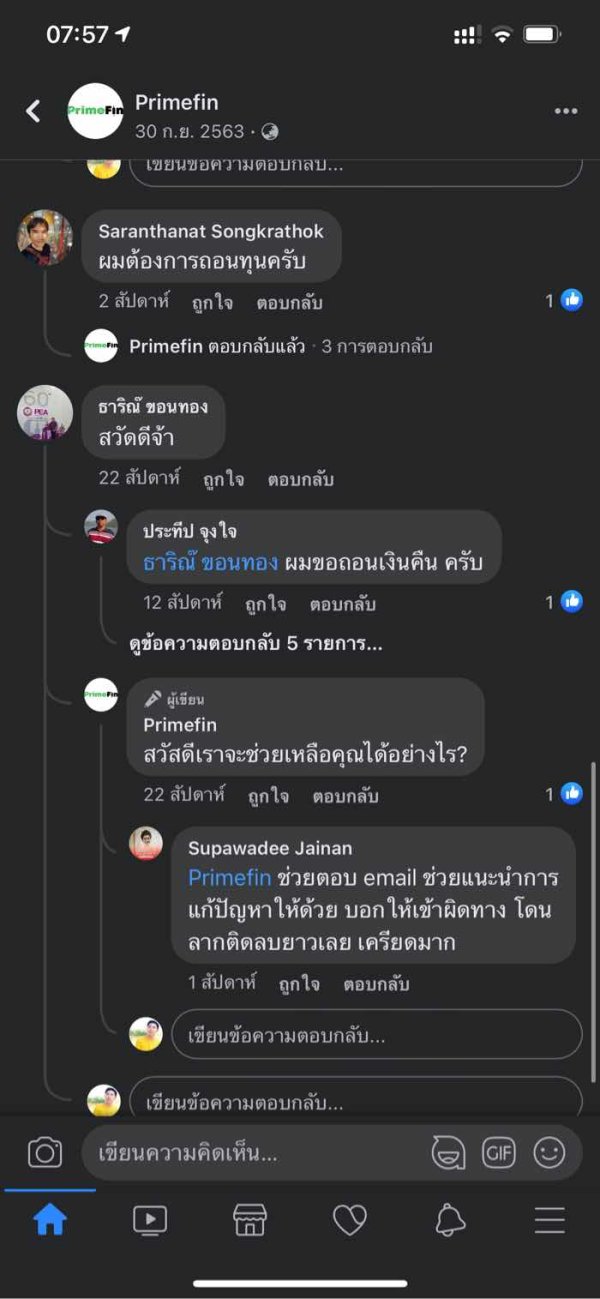

"I faced numerous issues requesting my withdrawal. It's almost impossible to retrieve funds." — Anonymous user feedback.

Industry Reputation and Summary

While various reviews circulating on the web indicate a fair market presence, reports of withdrawal complications overshadow much of the positive sentiment. Consequently, traders should approach with heightened caution.

2. Trading Costs Analysis

Advantages in Commissions

PrimeFin boasts a commission-free trading model coupled with competitive spreads, often beginning at 0.03 pips. Such an appealing structure is designed to attract active traders who frequently open and close positions.

The "Traps" of Non-Trading Fees

Hidden costs can arise, particularly withdrawal fees that some users allege can be as high as $30 per transaction. This fee induces a bottleneck, often leading to frustration amongst traders attempting to access their earnings.

"I was shocked to see a $30 fee deducted from my account. They didnt warn me in advance." — User complaint.

Cost Structure Summary

For active traders, PrimeFin's low-cost structure poses an attractive entry point. However, the possibility of hidden fees introduces a level of risk that should be considered.

PrimeFin offers two main trading platforms: their proprietary web trader and MetaTrader 4 (MT4). While MT4 is industry-leading, the absence of MetaTrader 5 (MT5) might deter some traders who rely on its advanced features.

The web trader showcases basic charting tools and some analytical features; however, MT4 remains the favored option among users for its comprehensive analytical capabilities.

Feedback indicates a mix of experiences; while many users appreciate the accessibility of the web trader, others have encountered usability challenges.

4. User Experience Analysis

Registration and Account Setup

The registration process is straightforward, culminating in account activation usually within an hour post-verification. Feedback regarding the user journey from account creation to trading is generally positive.

Trading Experience

Traders generally note that execution speed is satisfactory with most trades being executed swiftly. However, reviews highlight potential lagging issues within the web platform.

Overall User Sentiment

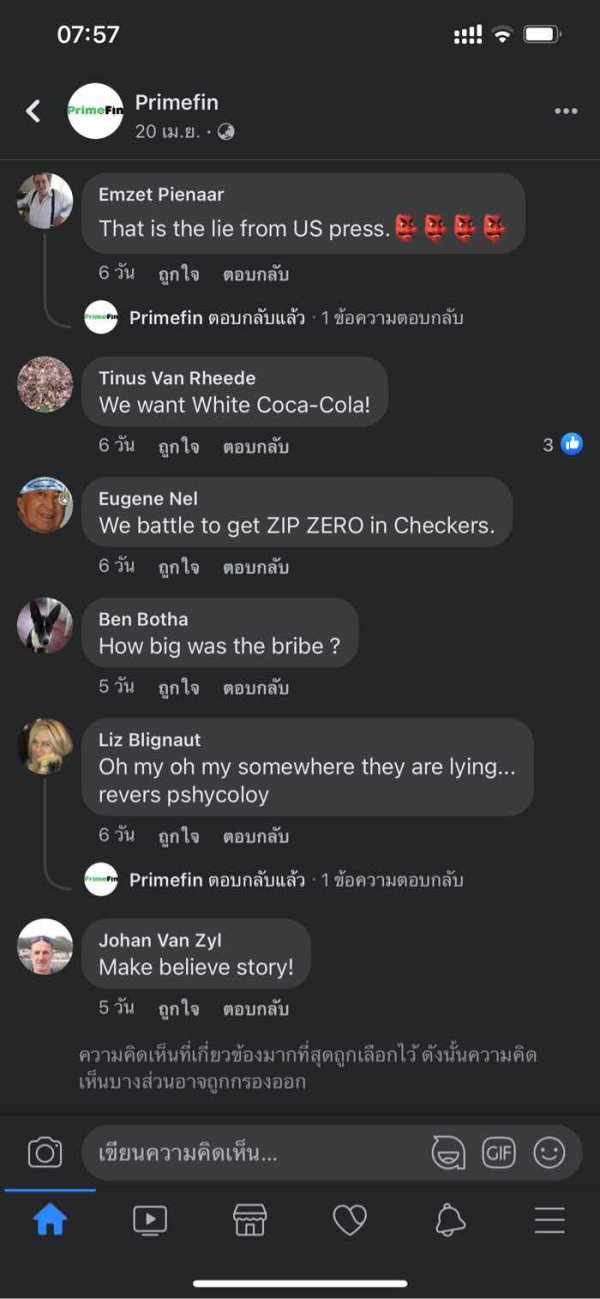

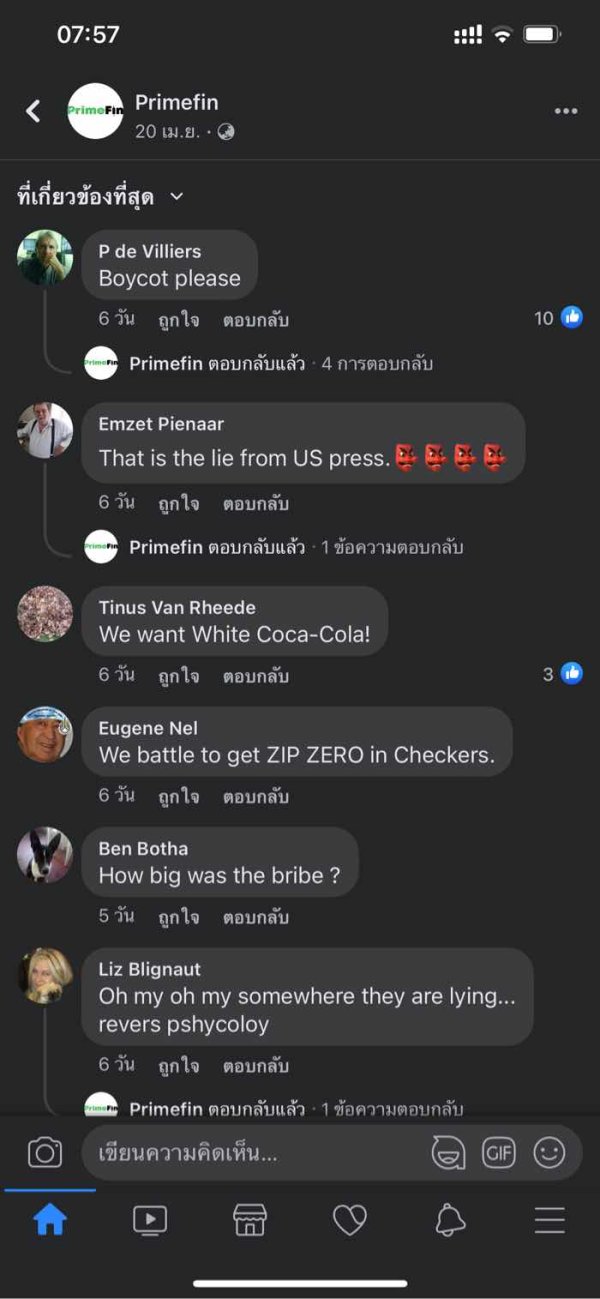

Mixed reviews characterize the platform's usability. While some users are satisfied, recurring comments regarding account management and withdrawal issues warrant attention.

5. Customer Support Analysis

Support Availability

PrimeFin offers customer support five days a week via live chat, telephone, and email. However, availability on weekends can be a crucial drawback for traders who operate outside standard hours.

User Feedback on Support Quality

Many user experiences reveal that while support can be responsive, follow-ups on technical issues have purportedly suffered delays. Reviews on response efficacy range widely, with some users reporting satisfactory interactions while others lament delays.

Recommendations for Improvement

Expanding support hours to 24/7 could significantly enhance the trading experience, ensuring that users have consistent access to help, especially during critical trading hours.

6. Account Conditions Analysis

Account Types and Features

PrimeFin promotes three primary account types — Silver, Gold, and Platinum. Each tier offers similar base functionalities but diverges in terms of spreads, maximum leverage, and access to premium services.

Deposit and Withdrawal Conditions

The minimum deposit is set at $250 across all account types, which may be seen as steep for a broker under such regulatory scrutiny.

Summary of Account Conditions

While differentiated account offerings allow for adaptability based on trading needs, the solid minimum investment threshold may deter new or cautious traders.

Conclusion

In conclusion, PrimeFin presents a varied landscape of trading opportunities paired with some concerning operational risks. The offer of zero-commission trading, competitive spreads, and a broad asset range are incentivizing; however, regulatory uncertainties and user complaints about withdrawals necessitate a cautious approach.

Prospective investors should thoroughly investigate PrimeFins legitimacy, engage in self-verification of regulatory compliance, consult user testimonials, and conduct extensive research before making any financial commitment. The choice to proceed with this broker involves weighing the attractive trading conditions against the inherent risks linked to its regulatory environment.