Regarding the legitimacy of ABANS GLOBAL forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is ABANS GLOBAL safe?

Pros

Cons

Is ABANS GLOBAL markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ABans Global Limited

Effective Date:

2013-04-02Email Address of Licensed Institution:

admin@abansglobal.co.uk, compliance@abansglobal.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

http://www.abansglobal.co.uk/index.htmlExpiration Time:

--Address of Licensed Institution:

Third Floor 19 Gerrard Street London W1D 6JG UNITED KINGDOMPhone Number of Licensed Institution:

+442038685803Licensed Institution Certified Documents:

Is AGL a Scam?

Introduction

AGL is a forex broker that has positioned itself in the competitive landscape of the foreign exchange market, offering various trading services to clients globally. As the forex market is known for its high volatility and potential risks, it is crucial for traders to evaluate brokers meticulously before committing their funds. With numerous options available, the integrity and reliability of a broker can significantly impact a trader's experience and financial safety. This article aims to investigate the legitimacy of AGL by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The assessment is based on a thorough examination of various online sources and user feedback.

Regulation and Legitimacy

The regulatory environment in which a forex broker operates is vital for ensuring the safety of traders' funds and the overall legitimacy of the broker. AGL's regulatory status has raised concerns, as it lacks proper oversight from recognized financial authorities. Below is a summary of the key regulatory information concerning AGL:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation implies that AGL is not subject to the stringent standards and practices enforced by reputable regulatory bodies. This lack of oversight can expose traders to significant risks, including potential fraud and mismanagement of funds. Furthermore, the absence of a regulatory license raises red flags about the broker's legitimacy, as regulated entities are required to maintain transparency and adhere to strict financial practices. Historical compliance data is also lacking, which further complicates the assessment of AGL's trustworthiness.

Company Background Investigation

AGL's company history and ownership structure play a crucial role in understanding its credibility. Established relatively recently, AGL has not built a significant track record in the forex industry. Information regarding its founding year, ownership, and management team is sparse, leading to questions about its operational transparency.

The management teams professional background is essential for assessing the broker's reliability. However, details about key personnel and their qualifications remain elusive. This lack of information can be concerning for potential investors, as a well-experienced management team often indicates a broker's commitment to ethical practices and customer service.

Moreover, the company's transparency regarding its operations and financial disclosures is crucial. AGL's failure to provide clear and accessible information about its business practices and financial health may deter potential clients. Transparency is a hallmark of reputable brokers, and AGL's shortcomings in this area are notable.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding its trading conditions, including fees, spreads, and commissions. AGL's overall fee structure appears to be competitive; however, there are indications of potentially unusual or problematic fee policies that traders should be aware of.

| Fee Type | AGL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | $0 - $10 per lot |

| Overnight Interest Range | High | Low |

The spreads offered by AGL can vary significantly, which may impact traders' profitability, especially for those engaging in high-frequency trading. Additionally, the absence of a clear commission structure raises concerns about hidden fees that could erode traders' profits. It is vital for traders to clarify these costs upfront to avoid unexpected financial burdens.

Customer Funds Security

The security of customer funds is paramount in the forex trading environment. AGL's measures for safeguarding client funds require careful examination. The broker's policies regarding fund segregation, investor protection, and negative balance protection are critical indicators of its commitment to client security.

AGL has not provided clear information about its fund segregation practices, which are essential for protecting client assets in the event of insolvency. Furthermore, the absence of investor protection schemes raises concerns, as traders may not have recourse in case of disputes or financial mismanagement. Historical issues related to fund security or disputes have not been documented, but the lack of transparency in this area is alarming.

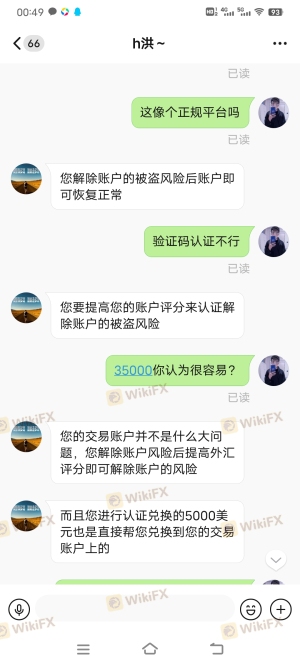

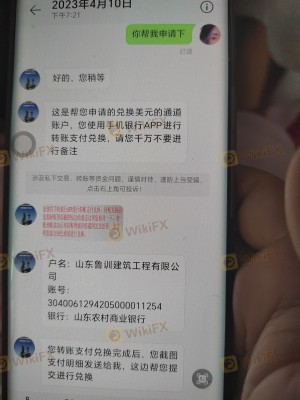

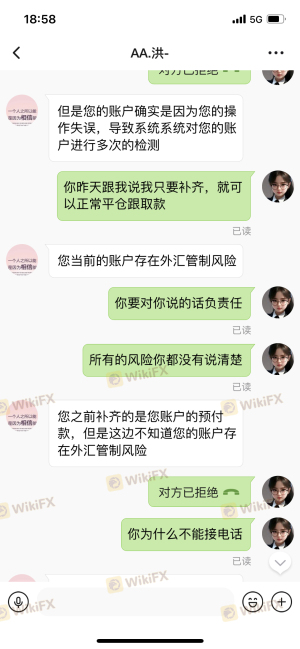

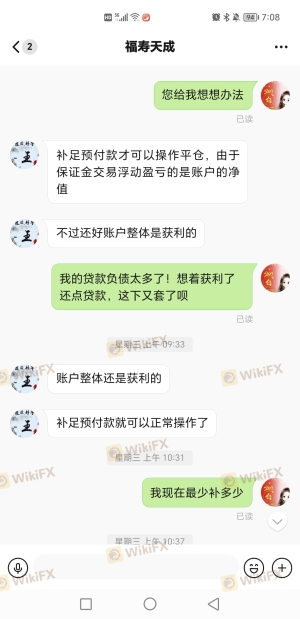

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. AGL has received mixed reviews from users, with several common complaints surfacing regarding its customer service and overall trading experience.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Average |

| Misleading Information | High | Poor |

Many users report difficulties with withdrawals, indicating a potential issue with fund accessibility. Additionally, complaints about unresponsive customer support suggest that AGL may struggle to address client concerns effectively. Case studies highlight instances where traders were unable to retrieve their funds, leading to frustration and distrust.

Platform and Trade Execution

The performance and reliability of a trading platform are critical to a trader's success. AGL's platform has been described as functional but may lack the advanced features offered by industry-leading platforms.

Issues related to order execution, such as slippage and rejected orders, have been reported, which can significantly impact trading outcomes. Traders have expressed concerns about the overall stability of the platform, raising questions about potential market manipulation or technical failures.

Risk Assessment

Using AGL as a forex broker entails several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of transparency and protection |

| Customer Service Risk | Medium | Poor response to client complaints |

To mitigate these risks, traders are advised to conduct thorough research, ensure they understand the fee structures, and consider using regulated brokers with a proven track record of reliability and customer service.

Conclusion and Recommendations

In conclusion, AGL presents several concerning factors that suggest it may not be a trustworthy forex broker. The lack of regulation, transparency, and documented customer experiences raises significant red flags. Traders should exercise caution when considering AGL as their broker and may wish to explore alternatives that offer stronger regulatory oversight and a proven commitment to customer service.

For those seeking reliable forex trading options, brokers with established reputations and regulatory licenses, such as those regulated by the FCA or ASIC, are recommended. These brokers provide a safer trading environment and better protections for traders funds.

Is ABANS GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of ABANS GLOBAL brokers.

ABANS GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ABANS GLOBAL latest industry rating score is 6.97, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.97 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.