Is FORTFS safe?

Pros

Cons

Is FortFS A Scam?

Introduction

FortFS, also known as Fort Financial Services Ltd, is a forex and CFD broker that has been in operation since 2010. Based in Saint Vincent and the Grenadines, it positions itself as a platform catering to both novice and experienced traders by offering a variety of trading instruments and account types. However, the legitimacy and safety of FortFS have come under scrutiny, prompting traders to exercise caution when choosing a broker. In the volatile world of forex trading, where financial loss can occur rapidly, it is crucial for traders to thoroughly evaluate the credibility and reliability of their chosen brokerage. This article aims to provide an objective analysis of FortFS, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our assessment is based on a comprehensive review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory framework of a brokerage is a significant factor in determining its safety and legitimacy. FortFS claims to be registered under the International Financial Services Commission (IFSC) of Belize. However, it is important to note that the IFSC is often regarded as a weaker regulatory authority compared to tier-1 regulators like the FCA or ASIC. This raises questions about the level of investor protection provided by FortFS.

Here is a summary of the regulatory information for FortFS:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | IFSC/60/256/TS/14 | Belize | Active |

While FortFS holds a license from the IFSC, it is essential to understand that this does not equate to the same level of oversight as more reputable regulators. The lack of stringent regulatory compliance can expose traders to higher risks, as there are fewer safeguards in place to protect their funds. Additionally, there have been reports indicating that FortFS has faced scrutiny from various regulatory bodies, including warnings from the CNMV and FSMA regarding its operations. This history of regulatory concerns suggests that potential clients should approach FortFS with caution and consider the risks involved.

Company Background Investigation

Fort Financial Services Ltd was established in 2010, claiming to provide innovative financial services to traders worldwide. The company operates from Saint Vincent and the Grenadines, a popular offshore jurisdiction for many brokers due to its lenient regulatory environment. The ownership structure and management team of FortFS are not extensively documented, which raises transparency concerns.

The lack of detailed information about the company's leadership and their professional backgrounds can be a red flag for potential clients. A reputable broker typically provides clear information about its management team, including their qualifications and experience in the finance industry. FortFS's opacity in this regard makes it difficult for traders to assess the broker's credibility and reliability.

Moreover, the company's commitment to transparency and information disclosure is crucial in building trust with clients. In the case of FortFS, the absence of comprehensive information about its operations and management may lead to skepticism among potential traders. Thus, it is essential to weigh these factors when considering whether to engage with FortFS.

Trading Conditions Analysis

When evaluating the trading conditions offered by a broker, it is vital to consider the overall cost structure, including spreads, commissions, and any unusual fees. FortFS offers a variety of account types, each with different trading conditions. The minimum deposit to open an account is notably low at $5, which may attract novice traders. However, the trading costs associated with these accounts can vary significantly.

Here is a comparison of the core trading costs at FortFS:

| Cost Type | FortFS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 0.1 pips |

| Commission Model | $10 on CFDs | $5 on average |

| Overnight Interest Range | Variable | Variable |

While FortFS advertises competitive spreads starting from 0.3 pips, some traders have reported wider spreads during volatile market conditions, raising concerns about transparency. Additionally, the commission structure appears complex, with potential hidden fees that could impact overall trading costs. Traders should be aware that the low initial deposit may not reflect the true cost of trading, especially if they are subject to various fees that are not clearly disclosed.

Client Funds Security

The security of client funds is paramount when assessing any broker. FortFS claims to implement several measures to protect client funds, including segregated accounts. However, the absence of a robust regulatory framework raises questions about the effectiveness of these measures. Without strong regulatory oversight, there is less assurance that client funds are adequately protected.

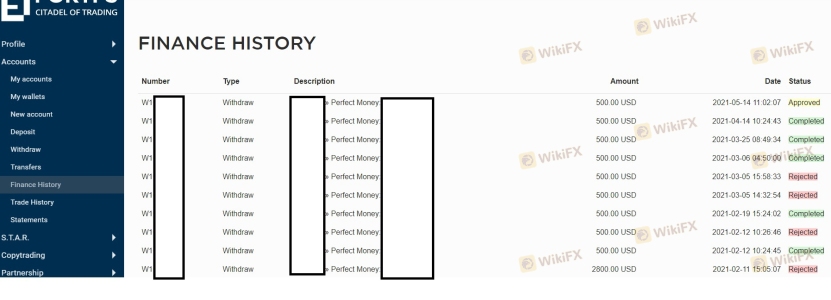

The broker's policies on negative balance protection and investor compensation schemes are also critical factors to consider. While FortFS does offer some level of fund segregation, the lack of independent regulation means that traders may not have recourse in the event of financial mishaps. Historical complaints regarding the withdrawal of funds and the handling of client accounts further exacerbate concerns about the safety of funds held with FortFS.

Customer Experience and Complaints

Customer feedback is an invaluable resource when evaluating a broker's reliability. Reviews of FortFS reveal a mixed bag of experiences. While some traders report satisfactory service, others have raised serious complaints regarding withdrawal issues and lack of support.

Here is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Spread Manipulation | Medium | Inconsistent |

| Customer Support Accessibility | High | Slow response |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and distrust in the broker. This pattern of complaints suggests a concerning trend that potential clients should consider before engaging with FortFS.

Platform and Trade Execution

The trading platform provided by a broker can significantly impact the overall trading experience. FortFS offers several platforms, including MetaTrader 4, MetaTrader 5, NinjaTrader, and CQG. While these platforms are popular among traders, the execution quality and reliability of the systems are paramount.

Traders have reported mixed experiences with order execution on FortFS, with some noting instances of slippage and rejected orders. Such issues can be detrimental, especially in fast-moving markets, and may indicate potential manipulation or inefficiencies within the trading infrastructure.

Risk Assessment

Using FortFS carries inherent risks, particularly due to its regulatory status and historical complaints. Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of stringent oversight |

| Fund Security Risk | Medium | Segregated accounts, but limited protection |

| Customer Service Risk | High | Frequent complaints about support |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts initially, and be cautious about the broker's promotional offers, which may come with strings attached.

Conclusion and Recommendations

In summary, the evidence suggests that FortFS presents several red flags that may categorize it as a risky choice for traders. While it offers a variety of trading instruments and platforms, the lack of robust regulatory oversight, mixed customer feedback, and concerns regarding fund security raise significant doubts about its reliability.

For traders seeking a secure and trustworthy trading environment, it may be prudent to consider alternative brokers that are regulated by reputable authorities. Brokers like eToro, AvaTrade, and IG offer stronger regulatory frameworks and more transparent trading conditions. Ultimately, the decision to engage with FortFS should be made with caution, keeping in mind the potential risks involved.

In conclusion, while FortFS may appeal to some traders due to its low minimum deposit and promotional offers, the overall assessment indicates that it is essential to prioritize safety and regulatory compliance in the forex trading landscape.

Is FORTFS a scam, or is it legit?

The latest exposure and evaluation content of FORTFS brokers.

FORTFS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FORTFS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.