Is Forex Club safe?

Business

License

Is Forex Club Safe or a Scam?

Introduction

Forex Club is a well-known player in the forex and CFD trading market, established in 1997 and headquartered in Saint Vincent and the Grenadines. It offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies, through multiple platforms like MetaTrader 4, MetaTrader 5, and its proprietary Libertex platform. Given the competitive nature of the forex market, traders must exercise caution when selecting a broker, as the potential for scams and fraudulent activities is significant. This article aims to provide an objective analysis of Forex Club, evaluating its safety and legitimacy based on regulatory compliance, company background, trading conditions, customer experiences, and security measures.

To gather insights, this evaluation utilizes a comprehensive approach that includes reviewing regulatory information, examining customer feedback, and analyzing the overall trading environment provided by Forex Club. Through this multifaceted assessment, we aim to answer the pressing question: Is Forex Club safe or a scam?

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its safety and legitimacy. Forex Club is regulated by the Cyprus Securities and Exchange Commission (CySEC) and holds a license from the National Bank of the Republic of Belarus (NBRB). Regulation by reputable authorities ensures that brokers adhere to strict operational standards, providing a level of investor protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 164/12 | Cyprus | Active |

| NBRB | 192580558 | Belarus | Active |

While Forex Club is regulated, it is important to note that some critics argue that its offshore registration in Saint Vincent and the Grenadines may raise concerns about the quality of regulation. The lack of oversight from top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, can lead to potential risks for traders. Additionally, Forex Club has faced regulatory challenges in the past, including a revoked license in Russia in 2018, which adds to the scrutiny surrounding its operations.

Company Background Investigation

Forex Club has a long history in the financial industry, having been established in 1997. Over the years, it has expanded its operations internationally, gaining a substantial client base across various regions. However, the company has experienced significant challenges, particularly related to regulatory compliance. The management team consists of experienced professionals, but the lack of transparency regarding ownership structures and decision-making processes can be concerning for potential clients.

The company has made efforts to improve its transparency and information disclosure, but some users still report difficulties in accessing comprehensive information about its operations. The overall impression of Forex Club's transparency is mixed, with some users expressing satisfaction with the available resources, while others highlight gaps in information that could aid traders in making informed decisions.

Trading Conditions Analysis

Forex Club offers a variety of trading conditions that cater to different trader needs. The broker has a low minimum deposit requirement of $10, making it accessible for beginners. However, the overall fee structure can be complex, with varying spreads and commissions depending on the trading platform used.

| Fee Type | Forex Club | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1-2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 2.5% | 0.5% - 3% |

Forex Club's commission structure can be seen as competitive, but certain fees may not be clearly communicated, leading to confusion among traders. The potential for hidden fees, particularly related to withdrawals and inactivity, is a concern that traders should be aware of before opening an account with Forex Club.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. Forex Club implements several measures to protect client funds, including segregated accounts to ensure that client deposits are kept separate from the company's operational funds. Additionally, the broker offers negative balance protection, which prevents traders from losing more than their account balance, a crucial feature in the volatile forex market.

Despite these security measures, some users have reported concerns regarding the withdrawal process, citing delays and complications in accessing their funds. While Forex Club claims to have robust security protocols, the historical context of regulatory issues raises questions about the reliability of its fund protection policies.

Customer Experience and Complaints

Customer feedback is an essential component of assessing the reliability of any broker. Reviews of Forex Club reveal a mixed bag of experiences, with some clients praising the platform's user-friendly interface and range of trading tools, while others express frustration over customer service and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Mixed Responses |

| High Fees | Medium | Limited Clarity |

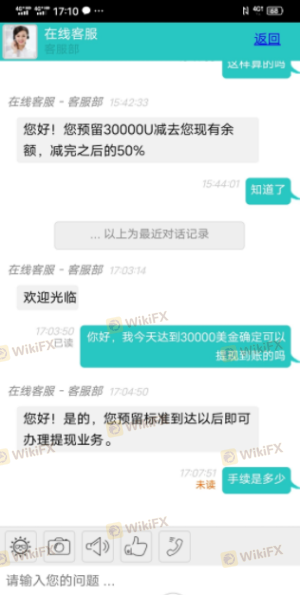

Common complaints include slow response times from customer support and difficulties in withdrawing funds. For example, some traders have reported that their withdrawal requests were delayed or required additional documentation, leading to frustration and mistrust. Such issues can significantly impact the overall trading experience and may deter potential clients from choosing Forex Club as their broker.

Platform and Trade Execution

The performance of a trading platform is crucial for any trader. Forex Club offers multiple platforms, including the popular MetaTrader 4 and 5, as well as its proprietary Libertex platform. While many users find the interfaces intuitive and easy to navigate, there are concerns regarding execution quality, particularly during volatile market conditions.

Users have reported instances of slippage and re-quotes when executing trades, which can lead to unexpected losses. These issues raise questions about the reliability of Forex Club's trade execution and whether the broker engages in any form of market manipulation.

Risk Assessment

The overall risk of trading with Forex Club can be summarized through a risk scorecard, which highlights key areas of concern that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation raises concerns. |

| Fund Security | Medium | Segregated accounts, but past issues. |

| Customer Service Quality | Medium | Mixed reviews on support responsiveness. |

| Execution Quality | High | Reports of slippage and re-quotes. |

To mitigate these risks, traders should conduct thorough research before committing funds, consider using demo accounts to familiarize themselves with the platform, and maintain a cautious approach when trading with leverage.

Conclusion and Recommendations

In conclusion, while Forex Club has established itself as a long-standing broker in the forex market, several factors raise concerns about its safety and reliability. The lack of top-tier regulatory oversight, combined with historical compliance issues and mixed customer feedback, suggests that traders should exercise caution when considering Forex Club as their broker.

For those who prioritize regulatory safety and a transparent trading environment, it may be advisable to explore alternative brokers with stronger regulatory frameworks and better customer service reputations. Overall, is Forex Club safe? The answer is nuanced; while it offers several attractive features, potential clients should weigh the risks and consider their trading needs carefully before proceeding.

Is Forex Club a scam, or is it legit?

The latest exposure and evaluation content of Forex Club brokers.

Forex Club Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex Club latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.