Forex Club Review 1

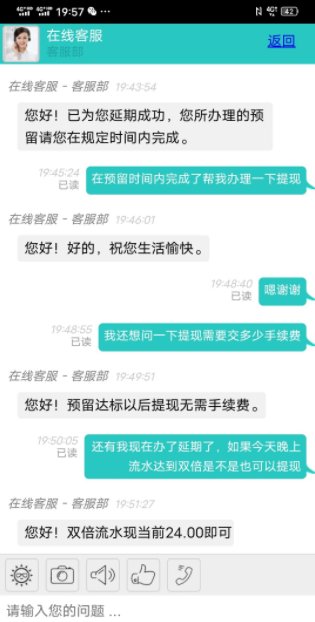

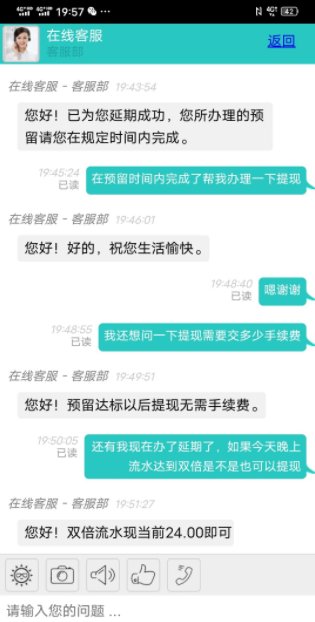

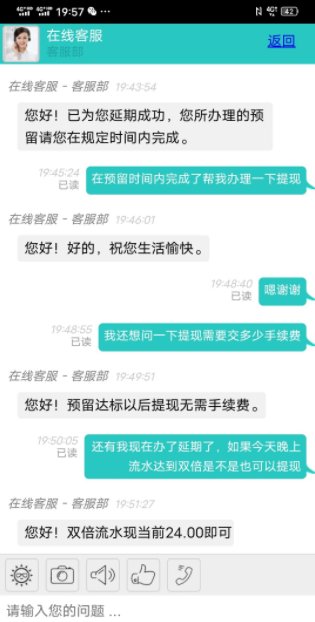

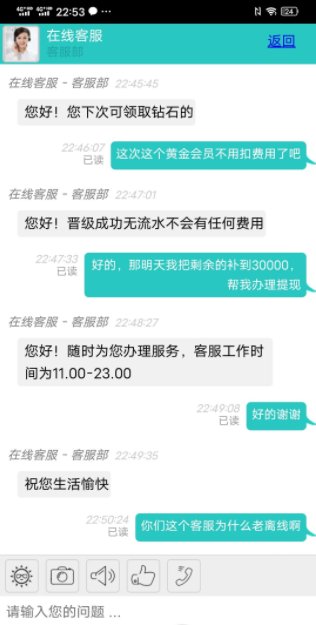

I deposited more than 160,000 but was unable to withdraw.

Forex Club Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I deposited more than 160,000 but was unable to withdraw.

This comprehensive Forex Club review evaluates a broker that has been serving the global forex and CFD trading community since 1997. The company operates under the Libertex brand with headquarters in New York. Forex Club presents itself as a fair forex broker that maintains stable trading platforms under normal market conditions, according to user feedback and industry reports. The broker demonstrates reliable performance in most operational aspects. However, some areas require attention.

The broker's standout features include support for Islamic accounts and multilingual customer service spanning 11 languages. This makes it accessible to a diverse international clientele. User ratings average 7.65 out of 10, indicating generally positive sentiment among active traders, though user feedback reveals mixed experiences, particularly regarding withdrawal processes. Some traders report delays that contrast with the broker's claims of timely fund processing.

Forex Club caters primarily to forex and CFD traders seeking a regulated environment with multiple platform options. The broker's regulatory framework includes oversight from CFTC, NFA, and FFMS, though its compliance history includes notable incidents that potential clients should consider carefully. While the trading platform operates stably under normal market conditions and customer service receives positive marks for accessibility, withdrawal-related concerns and transparency issues in account conditions represent areas where the broker could improve its service delivery significantly.

This review acknowledges that Forex Club operates across different regulatory jurisdictions. Performance may vary significantly between regions, particularly regarding compliance standards and fund security measures. Regulatory oversight differs between jurisdictions, with varying levels of consumer protection and operational requirements that may affect the trading experience substantially.

The evaluation presented here is based on comprehensive analysis of user feedback, official broker information, and market research from multiple sources. Traders should verify current regulatory status and terms of service in their specific jurisdiction before making any trading decisions, as regulatory requirements and operational practices may differ from those described in this assessment significantly.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited transparency in account specifications and fee structures |

| Tools and Resources | 6/10 | Basic trading infrastructure with insufficient detail on advanced features |

| Customer Service | 7/10 | Multi-channel support with 11-language capability, positive user feedback |

| Trading Experience | 8/10 | Platform stability confirmed by users under normal market conditions |

| Trust and Safety | 6/10 | Regulated status offset by historical compliance issues and withdrawal concerns |

| User Experience | 7/10 | User rating of 7.65/10 indicates satisfactory overall experience |

Forex Club established its presence in the global trading marketplace in 1997. The company has built nearly three decades of operational experience in the forex and CFD sectors. The company operates under the Libertex brand, maintaining its primary headquarters in New York, United States, while serving an international client base through its comprehensive trading platform infrastructure extensively. As a global forex and CFD broker, Forex Club has positioned itself to serve traders across multiple jurisdictions, focusing on providing accessible trading solutions for both individual and institutional clients worldwide.

The broker's business model centers on providing comprehensive forex and CFD trading services through stable, reliable trading platforms. These platforms are designed to handle various market conditions effectively. According to available reports, Forex Club maintains its commitment to serving the global market while adapting to regional regulatory requirements and client preferences across different jurisdictions. The company's operational approach emphasizes platform stability and customer service accessibility, as evidenced by user feedback indicating consistent performance under normal trading conditions.

Forex Club operates primarily through established trading platforms that support forex and CFD trading across multiple asset classes. The broker maintains regulatory compliance through oversight from major regulatory bodies including the CFTC, NFA, and FFMS, ensuring adherence to industry standards across its operational jurisdictions comprehensively. This Forex Club review finds that while the broker provides fundamental trading services effectively, specific technical specifications and advanced features require further clarification for potential clients seeking detailed platform information.

Regulatory Jurisdictions: Forex Club operates under supervision from multiple regulatory authorities including the Commodity Futures Trading Commission, National Futures Association, and Federal Financial Markets Service. This provides regulatory oversight across different operational regions.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available sources, requiring direct verification with the broker for current payment processing options and associated terms comprehensively.

Minimum Deposit Requirements: Detailed minimum deposit requirements for different account types were not specified in available documentation. This necessitates direct inquiry with customer service for current account opening requirements.

Promotional Offerings: Current bonus structures and promotional campaigns were not detailed in available materials, though traders should verify any promotional terms directly with the broker before account opening to ensure accuracy.

Available Trading Assets: The broker specializes in forex and CFD trading, providing access to currency pairs and contracts for difference across various underlying assets. However, specific asset counts and categories require direct verification.

Cost Structure: Detailed information regarding spreads, commissions, and fee structures was not comprehensively available in reviewed sources. This makes direct broker consultation necessary for accurate cost assessment.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in available documentation, requiring verification with customer service for current leverage policies across different account types thoroughly.

Platform Selection: Forex Club provides stable and reliable trading platforms according to user feedback. However, specific platform types and technical specifications require direct verification with the broker.

Geographic Restrictions: Specific regional availability and restrictions were not detailed in available sources. This necessitates direct inquiry regarding service availability in specific jurisdictions.

Customer Service Languages: The broker's website and customer support services are available in 11 different languages, facilitating communication for international clients across multiple regions effectively.

This Forex Club review notes that while basic operational information is available, many specific details require direct verification with the broker for the most current and accurate information.

Forex Club's account structure presents both opportunities and limitations for potential traders seeking comprehensive trading solutions. While the broker offers Islamic account options, addressing the needs of traders requiring Sharia-compliant trading conditions, detailed information about account types, their specific features, and associated benefits remains limited in publicly available documentation significantly. This lack of transparency in account specifications may concern traders who prefer to thoroughly evaluate terms before committing to a broker.

The minimum deposit requirements across different account tiers were not clearly specified in available sources. This makes it difficult for potential clients to plan their initial investment appropriately. Additionally, the account opening process details, verification requirements, and timeline for account activation require direct consultation with customer service for accurate assessment comprehensively.

User feedback indicates that while basic account functionality operates as expected, some traders have experienced challenges with withdrawal processes that suggest potential limitations in account management efficiency. The availability of Islamic accounts represents a positive feature for Muslim traders, demonstrating the broker's commitment to accommodating diverse client requirements effectively. However, the overall account conditions evaluation suffers from insufficient transparency regarding fee structures, account maintenance requirements, and specific terms governing different account types.

This Forex Club review emphasizes that potential clients should prioritize direct communication with broker representatives to clarify account conditions. Publicly available information does not provide sufficient detail for informed decision-making regarding account selection and management expectations.

The trading tools and resources offered by Forex Club present a mixed picture. Basic functionality is confirmed through user feedback but limited detailed information is available regarding advanced features and educational resources. While users report stable platform performance under normal market conditions, specific details about analytical tools, charting capabilities, and automated trading support require direct verification with the broker for comprehensive assessment.

Research and analysis resources, which are crucial for informed trading decisions, were not detailed in available documentation. This information gap makes it challenging to evaluate whether the broker provides adequate market analysis, economic calendars, news feeds, or proprietary research that many traders consider essential for their trading strategies effectively. The absence of detailed information about educational resources also limits the assessment of whether Forex Club adequately supports trader development through tutorials, webinars, or educational content.

Automated trading support capabilities, including expert advisor compatibility and algorithmic trading features, were not specifically addressed in available sources. For traders who rely on automated strategies or require advanced technical analysis tools, this lack of detailed information represents a significant limitation in evaluating the broker's suitability for their trading approach comprehensively.

The overall tools and resources evaluation indicates that while basic trading functionality appears adequate based on user feedback, the broker would benefit from providing more comprehensive information about available features, educational support, and advanced trading tools. This would enable potential clients to make fully informed decisions about platform capabilities.

Customer service represents one of Forex Club's stronger operational areas. Multiple communication channels are available to support client inquiries and issues. The broker provides customer support through telephone, email, and online chat systems, ensuring that traders have various options for contacting support staff based on their preferences and urgency of their needs effectively. This multi-channel approach demonstrates a commitment to accessibility that many users find beneficial.

The broker's multilingual support capability, spanning 11 languages, significantly enhances its appeal to international traders who prefer to communicate in their native languages. This language diversity indicates substantial investment in customer service infrastructure and cultural sensitivity, making the platform more accessible to traders from different geographic regions and linguistic backgrounds comprehensively.

User feedback generally indicates positive experiences with customer service quality, suggesting that support staff are knowledgeable and helpful in addressing trader concerns. However, specific information about response times, support hours, and escalation procedures for complex issues was not detailed in available sources, limiting the comprehensive assessment of service efficiency and availability significantly.

While the customer service infrastructure appears robust, some user feedback mentions delays in withdrawal processing. This may indicate coordination challenges between customer service and operational departments. The overall customer service evaluation shows promise, but the broker could enhance transparency by providing clearer information about service level commitments and response time expectations for different types of inquiries.

The trading experience with Forex Club demonstrates solid performance in platform stability and reliability. User feedback confirms consistent operation under normal market conditions. This stability represents a crucial foundation for effective trading, as platform downtime or technical issues can significantly impact trading outcomes and user satisfaction comprehensively. The positive feedback regarding platform performance suggests that the broker has invested appropriately in technical infrastructure to support client trading activities.

User reports indicate that the trading environment generally meets expectations for order execution and platform responsiveness. However, specific data regarding execution speeds, slippage rates, and platform latency were not detailed in available sources. This information would be valuable for traders who prioritize execution quality and need to understand how the platform performs during various market conditions, particularly during high volatility periods significantly.

Mobile trading capabilities and platform functionality across different devices were not specifically addressed in available documentation. This represents a gap in understanding the complete trading experience. As mobile trading becomes increasingly important for many traders, information about app functionality, feature parity between desktop and mobile platforms, and mobile-specific tools would enhance the evaluation of overall trading experience comprehensively.

The trading environment appears to support basic trading needs effectively based on user feedback. However, more detailed technical specifications and performance metrics would provide better insight into platform capabilities. This Forex Club review notes that while fundamental trading functionality appears adequate, traders seeking advanced features or specific performance guarantees should verify platform capabilities directly with the broker.

Trust and safety considerations for Forex Club present a complex picture that requires careful evaluation by potential clients. The broker maintains regulatory oversight from established authorities including the CFTC, NFA, and FFMS, providing multiple layers of regulatory supervision that enhance credibility significantly. However, the broker's compliance history includes a significant incident in October 2012 when Forex Club was fined $300,000 by the NFA, indicating past regulatory violations that affected its standing with US authorities.

Fund safety measures and client protection protocols were not detailed in available sources. This makes it difficult to assess the specific mechanisms in place to protect client funds and ensure segregation from company operational funds. This information gap represents a significant limitation for traders prioritizing capital protection and seeking transparency about fund security arrangements comprehensively.

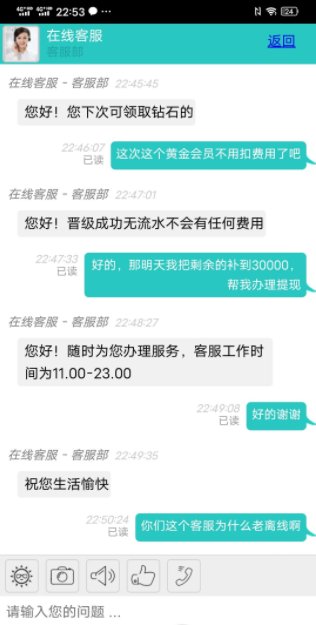

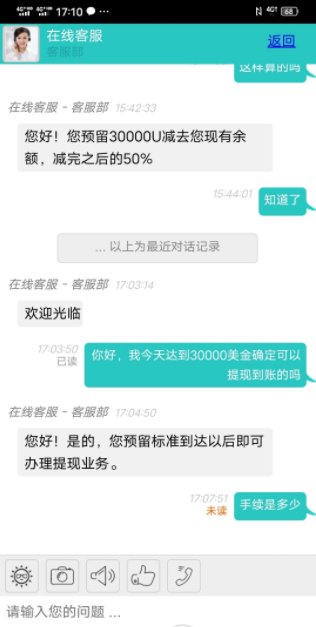

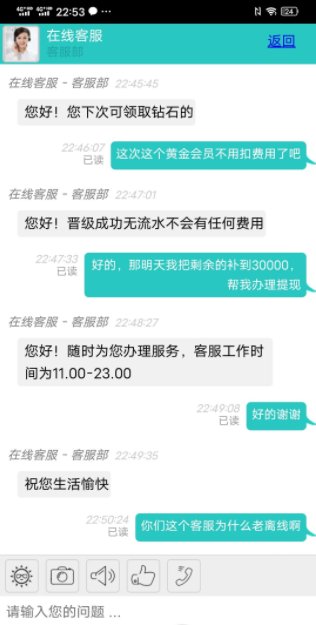

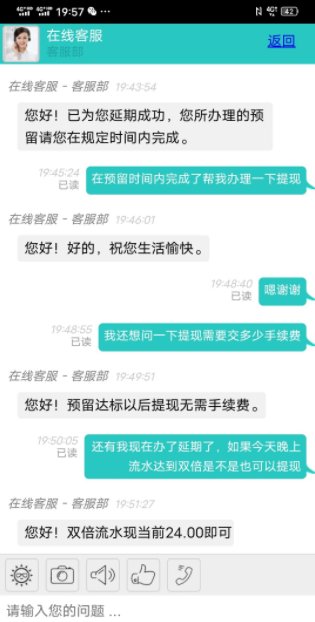

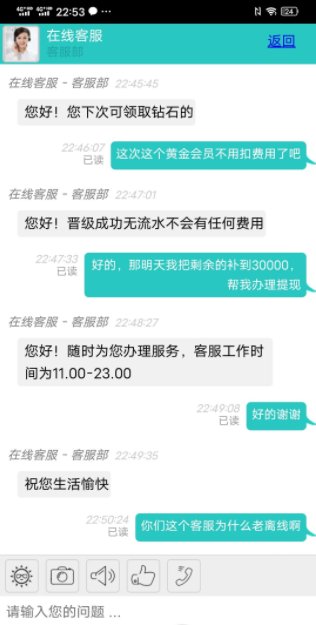

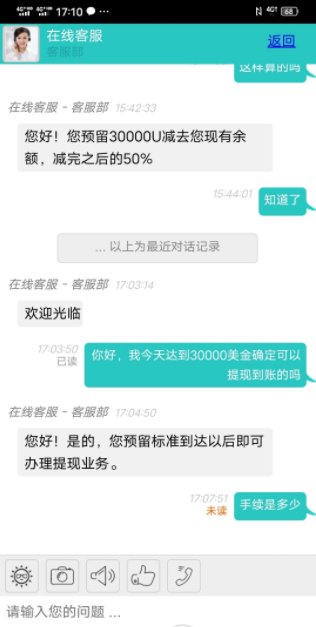

User feedback reveals mixed experiences regarding withdrawal processes, with some traders reporting delays lasting nearly a month. This raises concerns about fund accessibility and operational efficiency. These withdrawal issues contrast with the broker's claims of timely processing and suggest potential systemic challenges that could affect client confidence in fund safety and accessibility significantly.

The regulatory framework provides some assurance. However, the combination of historical compliance issues and current user concerns about withdrawal processing indicates that potential clients should carefully evaluate their risk tolerance and consider the broker's track record when making decisions about fund deposits and trading activities.

User experience with Forex Club reflects a generally positive but imperfect trading relationship. This is evidenced by the overall user rating of 7.65 out of 10. This rating suggests that while most traders find the service acceptable, there are areas where improvements could enhance overall satisfaction significantly. The rating indicates that the broker successfully meets basic expectations for most users while falling short of excellence in some operational areas.

Interface design and platform usability were not specifically detailed in available sources. However, user feedback suggests that basic navigation and functionality meet standard expectations. The absence of detailed information about user interface features, customization options, and platform learning curves limits comprehensive evaluation of how easily new users can adapt to the trading environment effectively.

Registration and account verification processes were not thoroughly documented in available materials. This makes it difficult to assess the efficiency and user-friendliness of the onboarding experience. Smooth account opening procedures significantly impact initial user impressions and overall satisfaction with broker services comprehensively.

The most significant user experience challenge appears to be withdrawal processing, with multiple user reports of delays that extend beyond reasonable timeframes. These issues directly impact user satisfaction and confidence in the broker's operational efficiency. The broker would benefit from addressing these withdrawal concerns to improve overall user experience ratings and client retention significantly. Despite these challenges, the user base appears to find value in the broker's services, as indicated by continued usage and generally positive feedback about core trading functionality.

Forex Club presents itself as a fair and generally reliable forex broker that adequately serves the needs of forex and CFD traders seeking a regulated trading environment. The broker's nearly three decades of operational experience, combined with regulatory oversight from multiple authorities and stable platform performance under normal market conditions, provides a foundation for trustworthy trading relationships comprehensively. The availability of Islamic accounts and multilingual customer support demonstrates commitment to serving diverse international clients.

However, this evaluation reveals several areas where Forex Club could enhance its service delivery and transparency. The most significant concerns involve withdrawal processing delays reported by users and limited transparency regarding account conditions, fee structures, and platform specifications significantly. These issues, combined with the broker's historical regulatory violations, suggest that potential clients should carefully evaluate their priorities and risk tolerance before committing funds.

The broker appears most suitable for traders who prioritize platform stability and basic trading functionality over advanced features or premium service levels. Traders requiring Islamic-compliant accounts or multilingual support may find particular value in Forex Club's offerings effectively. However, those prioritizing rapid fund access, transparent fee structures, or comprehensive trading tools may want to consider alternative brokers that better address these specific requirements. Overall, Forex Club represents a viable option for many traders, provided they understand and accept the limitations identified in this comprehensive assessment.

FX Broker Capital Trading Markets Review