Is Flying Hummingbird safe?

Pros

Cons

Is Flying Hummingbird A Scam?

Introduction

Flying Hummingbird is a relatively new player in the forex market, having established itself in 2020. As a broker, it aims to provide traders with access to a variety of financial instruments, including over 50 currency pairs, commodities, and indices. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy of any broker before depositing their hard-earned money. This article aims to objectively analyze whether Flying Hummingbird is a scam or a legitimate trading platform. Our assessment will be based on a comprehensive review of its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is crucial for ensuring the safety of traders' funds and the integrity of trading practices. A well-regulated broker is subject to strict oversight by financial authorities, which can help protect traders from fraud and malpractice. In the case of Flying Hummingbird, the broker claims to be regulated under the National Futures Association (NFA), but several sources indicate that this claim may not be valid.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0538570 | United States | Unauthorized |

The NFA has flagged Flying Hummingbird as an unauthorized entity, raising significant concerns about its legitimacy. The absence of a credible regulatory authority overseeing its operations means that traders have little to no protection if things go wrong. Furthermore, the lack of transparency regarding its regulatory status makes it difficult to ascertain the broker's compliance history. This lack of oversight is a critical factor for traders considering whether is Flying Hummingbird safe or not.

Company Background Investigation

Flying Hummingbird is registered in China and has been operational for a few years. However, information about its ownership structure and management team is scarce. The absence of publicly available details regarding who runs the company and their qualifications is a significant red flag.

A well-structured company typically discloses information about its founders, management team, and operational history to build trust with potential clients. In contrast, the lack of transparency in Flying Hummingbird's operations raises questions about its credibility. Furthermore, the broker's official website has faced accessibility issues, making it difficult for potential clients to gather essential information. This opacity could indicate that the broker may not have the best interests of its clients at heart, leading to further concerns about whether is Flying Hummingbird safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is vital. Flying Hummingbird claims to offer competitive trading conditions, but several reviews suggest that the actual costs may be higher than advertised.

| Fee Type | Flying Hummingbird | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

The spreads for major currency pairs are reported to be higher than the industry average, which could significantly impact trading profitability. Additionally, the commission structure is ambiguous, leaving traders uncertain about what to expect. Such unclear and potentially unfavorable terms may deter traders from using the platform, further questioning whether is Flying Hummingbird safe for their investments.

Client Funds Safety

The safety of client funds should always be a primary concern for traders. Effective measures should be in place to ensure that client funds are secure and segregated from the broker's operational funds. Unfortunately, there is little information available regarding Flying Hummingbird's policies on fund security, which raises concerns.

A reputable broker typically offers features such as segregated accounts, investor protection schemes, and negative balance protection. However, the lack of transparency in Flying Hummingbird's approach to these critical aspects of fund safety poses a significant risk for potential clients. Historical complaints about difficulties in withdrawing funds also suggest that the broker may not prioritize client security. Therefore, it is essential to consider these factors when evaluating whether is Flying Hummingbird safe for trading.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of a broker. In the case of Flying Hummingbird, numerous complaints have surfaced, indicating significant issues with customer service and fund withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

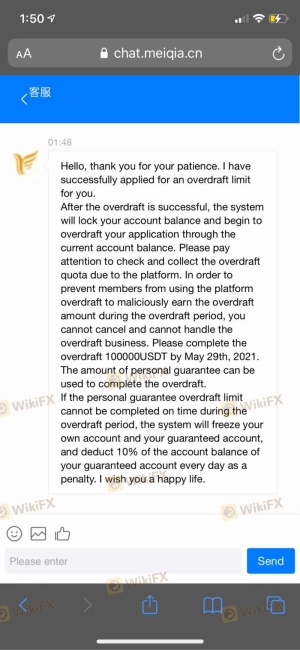

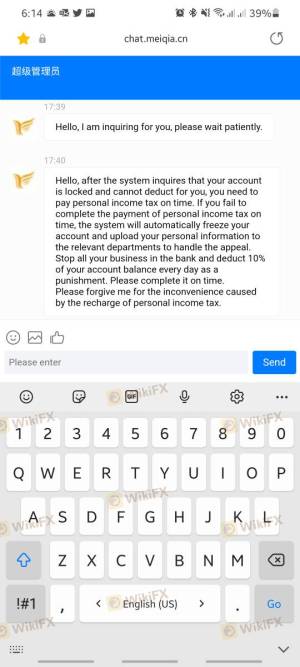

| Misleading Tax Requests | Medium | Poor |

| Platform Closure | High | None |

The most common complaints revolve around withdrawal difficulties, with many users reporting that they were unable to access their funds. Additionally, there are allegations that the broker has engaged in misleading practices, such as requesting taxes on deposits, which raises further concerns about its operational integrity.

Such complaints highlight a pattern of negative experiences among clients, making it imperative for potential traders to carefully consider whether is Flying Hummingbird safe before committing their funds.

Platform and Execution

The trading platform offered by Flying Hummingbird is based on the well-known MetaTrader 5 (MT5) software, which is generally regarded as reliable and user-friendly. However, the actual performance of the platform, including order execution quality and slippage, is critical for traders.

Reports indicate that users have experienced issues with order execution, including delays and slippage, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation would be a significant red flag. The overall user experience on the platform has been mixed, leading to questions about whether is Flying Hummingbird safe for conducting trades.

Risk Assessment

Engaging with an unregulated broker like Flying Hummingbird presents various risks that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No credible oversight |

| Financial Risk | High | Withdrawal issues reported |

| Operational Risk | Medium | Platform stability concerns |

Given the high-risk factors associated with trading with Flying Hummingbird, it is advisable for traders to exercise caution. Potential clients should consider using regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Flying Hummingbird operates in a highly questionable manner. The lack of credible regulation, combined with numerous complaints and issues related to fund security and trading conditions, raises significant concerns about whether is Flying Hummingbird safe for trading.

For traders, especially those new to forex, it is advisable to avoid Flying Hummingbird and consider more reputable and regulated alternatives. Brokers that are well-regulated by recognized financial authorities provide better security for client funds and a more transparent trading environment. Always conduct thorough research and due diligence before deciding on a broker to ensure the safety of your investments.

Is Flying Hummingbird a scam, or is it legit?

The latest exposure and evaluation content of Flying Hummingbird brokers.

Flying Hummingbird Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Flying Hummingbird latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.