Flying Hummingbird 2025 Review: Everything You Need to Know

Executive Summary

This Flying Hummingbird review shows serious concerns about this forex broker. Potential traders must think carefully before choosing this company. Our research and user feedback analysis reveals that Flying Hummingbird uses questionable practices that worry the trading community. The broker connects to EffortWe Global in various scam allegations, as shown in Forex Peace Army forums and other trading communities.

Potential traders who want security, transparency, and regulatory compliance make up the primary user base for this evaluation. Flying Hummingbird fails to meet these basic requirements unfortunately. User testimonials and forum discussions always highlight concerns about the broker's legitimacy, operational transparency, and overall trustworthiness. The lack of clear regulatory information and the connection with reported scam activities make this broker wrong for serious traders who want a reliable trading environment.

Important Notice

Regional Entity Differences: Flying Hummingbird lacks clear regulatory information, which means legal protections and operational standards may change a lot across different areas. Traders should know that this lack of regulatory oversight creates big risks no matter where they live.

Review Methodology: This complete Flying Hummingbird review uses thorough analysis of user feedback, forum discussions, and available public information. The limited official information about this broker means this assessment relies heavily on user experiences and community reports to give an accurate evaluation.

Rating Framework

Broker Overview

Flying Hummingbird works in the forex trading space, though specific details about when it started and its corporate background stay unclear from available sources. The broker's lack of transparent company information raises immediate concerns for potential clients who want reliable trading services. Various forum discussions and user reports show that the broker connects to questionable business practices that have drawn strong criticism from the trading community.

The broker's business model and operational structure lack the transparency that legitimate forex brokers typically show. Traders face big uncertainty when considering Flying Hummingbird as their broker choice without clear information about company registration, regulatory compliance, or operational history. This opacity in basic business information represents a major red flag for potential clients.

Specific information about Flying Hummingbird's technical infrastructure stays largely undisclosed regarding trading platforms and asset offerings. The absence of detailed platform specifications, available trading instruments, and technological capabilities makes concerns about the broker's legitimacy even worse. Most reputable brokers give complete information about their trading platforms, supported assets, and regulatory compliance, which makes Flying Hummingbird's lack of such transparency particularly worrying.

Regulatory Status: Available information does not give clear details about Flying Hummingbird's regulatory compliance or oversight by recognized financial authorities.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures is not detailed in available sources.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not clearly specified in accessible documentation.

Promotional Offers: Details about bonus structures or promotional campaigns are not provided in available materials.

Trading Assets: Information about available trading instruments and asset classes remains unspecified.

Cost Structure: Specific details about spreads, commissions, and other trading costs are not clearly outlined.

Leverage Options: Maximum leverage ratios and margin requirements are not detailed in available sources.

Platform Selection: Specific trading platform options and their features are not completely documented.

Geographic Restrictions: Information about regional limitations or restricted areas is not clearly specified.

Customer Support Languages: Available language options for customer service are not detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Flying Hummingbird's account conditions get a poor rating because of the complete lack of transparency about account types, features, and requirements. The absence of clear information about minimum deposits, account tiers, or special account features makes it impossible for potential traders to make informed decisions about their account selection.

The broker fails to give essential details about account opening procedures, verification requirements, or account management features. This lack of transparency stands in stark contrast to industry standards, where reputable brokers typically offer complete account information including Islamic accounts, demo accounts, and various account tiers tailored to different trader needs.

User feedback suggests significant dissatisfaction with account-related services, though specific details about account conditions remain largely undocumented. The absence of clear terms and conditions, account specifications, or customer protection measures makes confidence in the broker's account offerings even worse.

Traders cannot properly assess whether Flying Hummingbird's account conditions meet their trading requirements or financial objectives without transparent information about account features, costs, or benefits.

The evaluation of Flying Hummingbird's trading tools and resources shows significant problems in available information and user satisfaction. The broker fails to give clear details about trading platforms, analytical tools, or educational resources that are typically essential for successful forex trading.

Research and analysis capabilities appear to be poorly documented, with no clear information about market research, technical analysis tools, or fundamental analysis resources. Professional traders typically need access to complete market data, charting tools, and analytical resources, none of which are clearly outlined in available information about Flying Hummingbird.

Educational resources, which are crucial for both new and experienced traders, are not detailed in accessible documentation. The absence of trading guides, webinars, tutorials, or market analysis makes the broker less appealing to traders who want complete support for their trading activities.

Automated trading support and algorithmic trading capabilities are not specified, leaving traders uncertain about the broker's technical capabilities and platform sophistication.

Customer Service and Support Analysis (Score: 3/10)

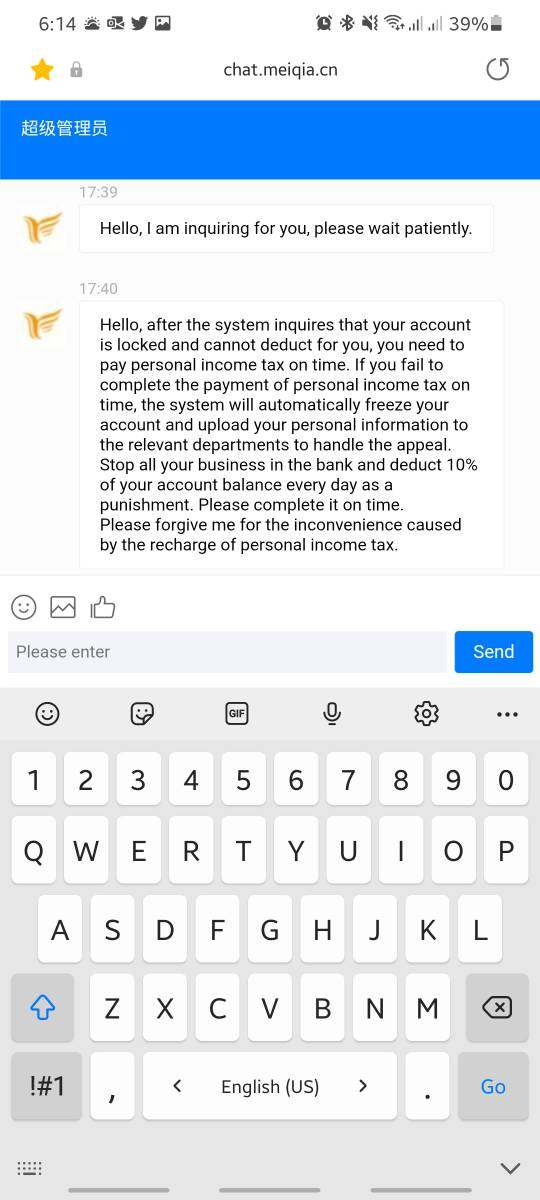

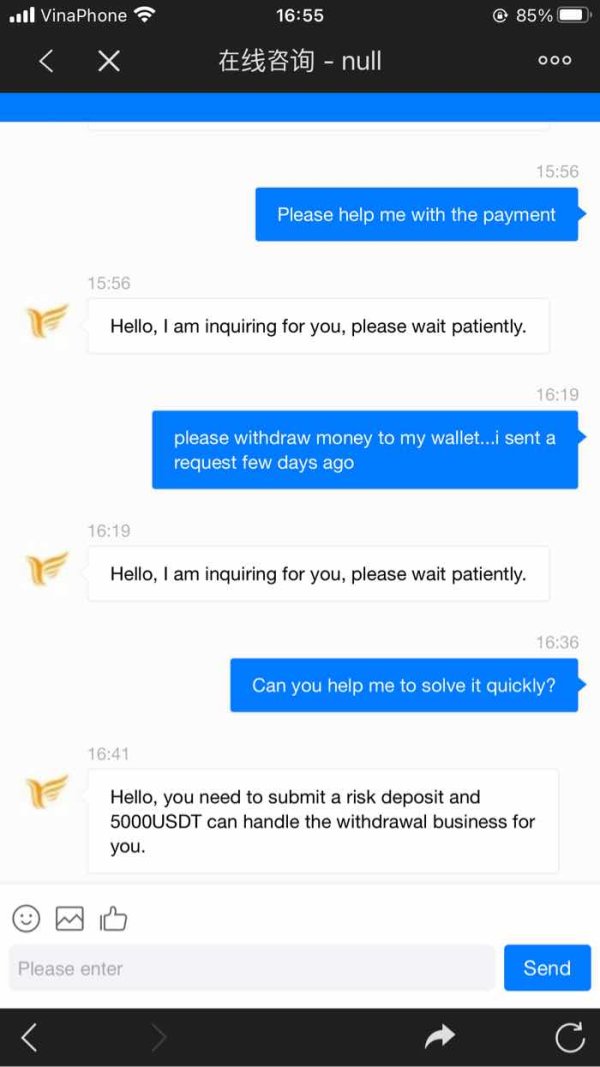

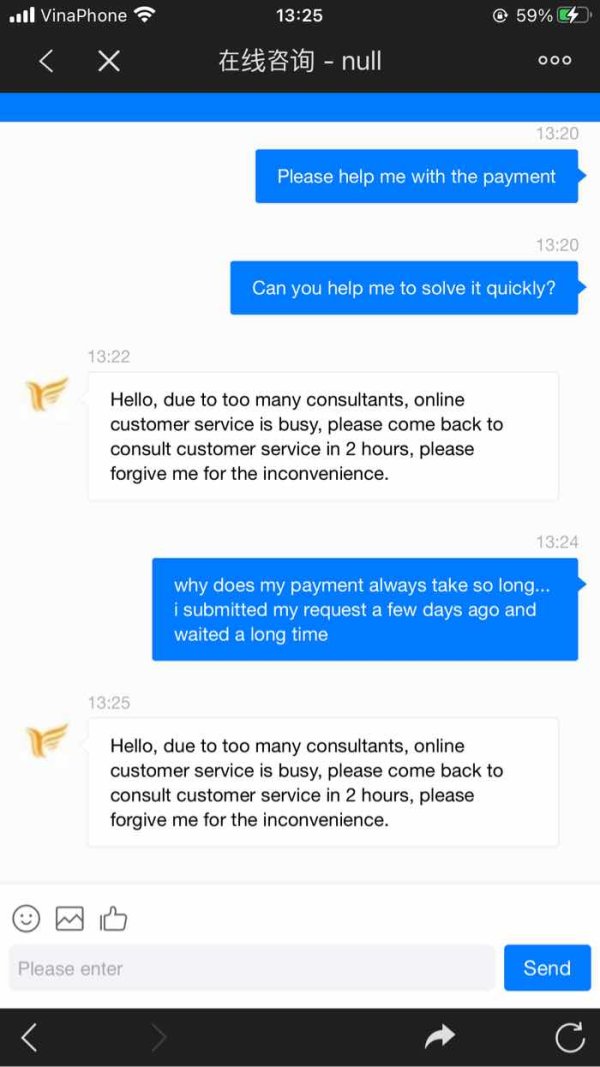

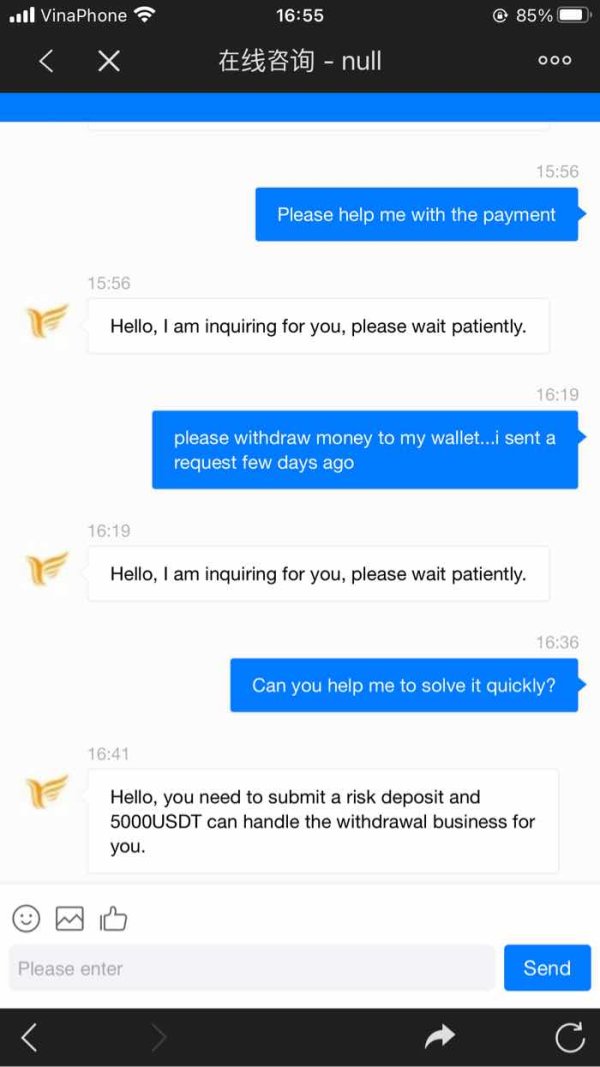

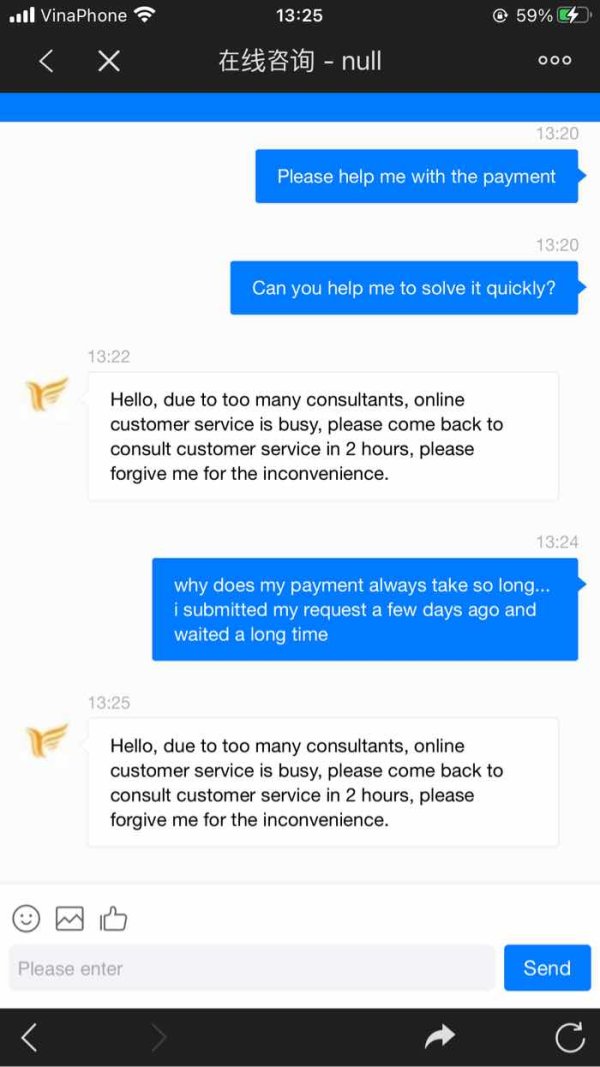

Customer service quality represents a critical concern for Flying Hummingbird, with user feedback showing significant problems in support services. Available information suggests that customer service channels, response times, and service quality fall well below industry standards.

User reports from various forums show dissatisfaction with customer support responsiveness and problem resolution capabilities. The lack of clear information about available support channels, operating hours, or multilingual support options makes these concerns even worse.

Response times for customer inquiries appear to be problematic based on user feedback, though specific service level agreements or guaranteed response times are not documented. This uncertainty about support availability creates additional risks for traders who may need urgent help with their accounts or trading activities.

The absence of complete customer service information, combined with negative user feedback, suggests that Flying Hummingbird's support infrastructure may be inadequate for meeting trader needs effectively.

Trading Experience Analysis (Score: 2/10)

The trading experience offered by Flying Hummingbird gets a poor rating because of numerous concerns raised by users and the lack of transparent information about trading conditions. Platform stability, execution quality, and overall trading environment appear to be significant problem areas based on available feedback.

Order execution quality has been questioned by users, though specific performance metrics or execution statistics are not provided by the broker. The absence of detailed information about execution speeds, slippage rates, or order fulfillment procedures raises concerns about trading conditions.

Platform functionality and reliability are not properly documented, making it difficult for traders to assess whether the broker's technical infrastructure can support their trading strategies effectively. User feedback suggests potential issues with platform performance and reliability.

Mobile trading capabilities and cross-platform compatibility are not clearly specified, limiting traders' ability to manage their positions effectively across different devices and environments. This Flying Hummingbird review highlights the significant gaps in trading experience documentation and user satisfaction.

Trust and Safety Analysis (Score: 1/10)

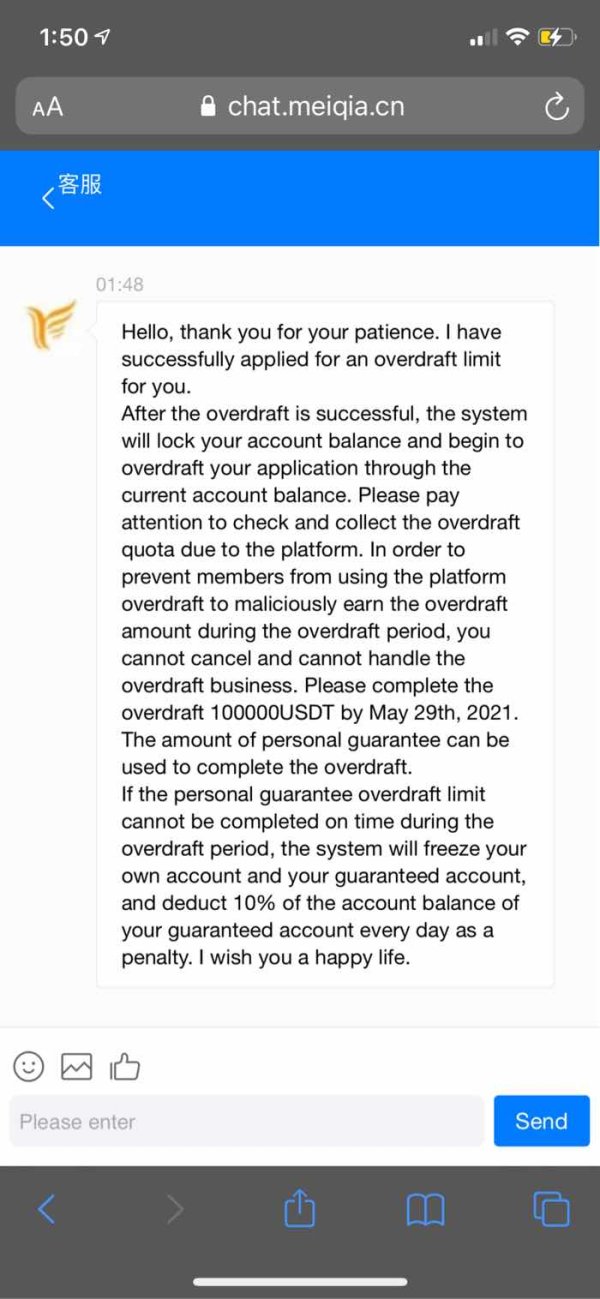

Trust and safety represent the most critical concerns with Flying Hummingbird, earning the lowest possible rating because of serious questions about the broker's legitimacy and safety. The connection with EffortWe Global in various scam allegations, as documented in Forex Peace Army discussions, raises immediate red flags about the broker's trustworthiness.

Regulatory oversight appears to be absent or poorly documented, leaving traders without the protection typically provided by recognized financial regulatory authorities. The lack of clear regulatory compliance information means that standard investor protections may not be available to Flying Hummingbird clients.

Fund security measures and client money protection protocols are not clearly outlined, creating significant risks for trader deposits and account balances. Reputable brokers typically give detailed information about segregated accounts, deposit insurance, and fund protection measures.

The broker's reputation within the trading community appears to be significantly compromised based on user reports and forum discussions, with multiple references to potential fraudulent activities and questionable business practices.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Flying Hummingbird appears to be extremely low based on available feedback and community discussions. Users consistently express concerns about safety, legitimacy, and service quality, showing basic problems with the broker's operations.

Interface design and platform usability are not properly documented, though user feedback suggests significant problems in user experience design and functionality. The absence of clear information about platform features and capabilities makes user satisfaction even worse.

Account registration and verification processes are not transparently outlined, creating uncertainty and potential frustration for new users attempting to open accounts. User feedback shows problems with onboarding procedures and account management processes.

Common user complaints center around safety concerns, lack of transparency, and questionable business practices. The prevalence of negative feedback and the absence of positive user testimonials suggest systematic problems with the broker's service delivery and customer satisfaction.

Conclusion

This complete Flying Hummingbird review shows significant concerns that make this broker unsuitable for serious forex traders. The connection with scam allegations, lack of regulatory transparency, and consistently negative user feedback create an unacceptable risk profile for potential clients.

The broker is not recommended for any category of traders, particularly those who prioritize safety, regulatory compliance, and transparent business practices. The absence of clear information about basic aspects of the brokerage operation, combined with serious questions about legitimacy, makes Flying Hummingbird a poor choice for forex trading.

Traders who want reliable forex brokerage services should consider well-regulated, transparent brokers with strong reputations and positive user feedback. The risks connected with Flying Hummingbird far outweigh any potential benefits, making it advisable to explore alternative brokerage options that offer better security, transparency, and regulatory protection.