Regarding the legitimacy of EBC forex brokers, it provides ASIC, FCA, FSCA, CIMA and WikiBit, (also has a graphic survey regarding security).

Is EBC safe?

Pros

Cons

Is EBC markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

EBC FINANCIAL GROUP (AUSTRALIA) PTY LTD

Effective Date: Change Record

2018-01-24Email Address of Licensed Institution:

compliance@ebc.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'GROSVENOR PLACE TOWER S3403 L34' 225 GEORGE ST THE ROCKS NSW 2000Phone Number of Licensed Institution:

0282110506Licensed Institution Certified Documents:

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

EBC Financial Group (UK) Ltd

Effective Date:

2021-02-08Email Address of Licensed Institution:

david.barrett@ebcfin.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.ebcfin.co.ukExpiration Time:

--Address of Licensed Institution:

Level 30 The Leadenhall Building 122 Leadenhall Street London EC3V 4AB UNITED KINGDOMPhone Number of Licensed Institution:

+442077863550Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

EBC FINANCIAL GROUP SA (PTY) LTD

Effective Date:

2021-07-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1 HOOD AVENUE ROSEBANK JOHANNESBURG GAUTENG 2196Phone Number of Licensed Institution:

0823729628Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EBC Financial Group (Cayman) Limited

Effective Date:

2024-03-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is EBC A Scam?

Introduction

EBC Financial Group, established in 2020, positions itself as a global player in the forex market, offering a range of trading instruments including forex, commodities, shares, and indices. As the financial landscape becomes increasingly complex, traders must exercise caution when selecting a broker. The potential for fraud and mismanagement in the forex industry necessitates a thorough evaluation of any broker's credibility and operational integrity. This article aims to provide a comprehensive analysis of EBC, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a review of multiple credible sources, including regulatory filings, customer feedback, and industry analyses, allowing us to present a balanced view of EBC's operations.

Regulation and Legitimacy

Understanding a broker's regulatory status is critical for assessing its legitimacy. EBC Financial Group is regulated by several reputable authorities, which adds a layer of security for traders. Below is a summary of EBC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 927552 | United Kingdom | Verified |

| ASIC | 500991 | Australia | Verified |

| CIMA | 2038223 | Cayman Islands | Exceeded |

EBC is primarily regulated by the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). Both of these regulators are known for their stringent oversight and consumer protection measures, which are crucial for maintaining market integrity. However, the Cayman Islands Monetary Authority (CIMA) has labeled EBC's license as "exceeded," indicating that the broker may be operating beyond its regulatory scope in that jurisdiction. This aspect raises questions about the broker's compliance and operational boundaries.

The quality of regulation is paramount in ensuring that a broker adheres to best practices in financial management. The FCA, for instance, enforces strict requirements related to capital adequacy and client fund protection, while ASIC similarly prioritizes consumer interests. Despite these robust regulatory frameworks, potential clients should remain vigilant and consider the implications of EBC's less stringent oversight in the Cayman Islands.

Company Background Investigation

EBC Financial Group was founded in 2020, with its headquarters located in London, UK. The company operates under a corporate structure that includes entities in Australia and the Cayman Islands, allowing it to cater to a diverse clientele. The ownership structure of EBC is relatively opaque, which is not uncommon in the forex industry, particularly for newer firms. The company's management team comprises professionals with varying degrees of experience in finance and trading, although specific details about their backgrounds are not extensively disclosed.

Transparency in company operations is essential for building trust with clients. EBC's website provides some information about its services and regulatory status, but lacks comprehensive details about its management team and operational history. This limited disclosure can be a red flag for potential clients who prioritize transparency and accountability in their trading partners.

In summary, while EBC Financial Group appears to be a legitimate broker with regulatory backing, the lack of detailed information regarding its ownership and management may deter some traders who seek a higher level of transparency.

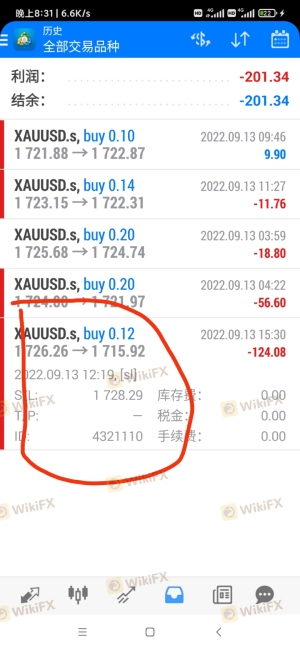

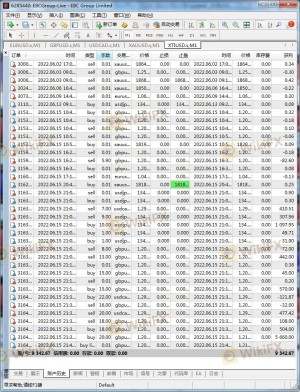

Trading Conditions Analysis

EBC Financial Group offers a competitive trading environment, but understanding its fee structure is crucial for traders. The broker provides two main account types: the standard account and the professional account. The overall cost structure includes spreads, commissions, and overnight interest rates, which can significantly impact trading profitability.

| Fee Type | EBC Financial Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | $6 per lot (Professional) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The standard account offers spreads starting from 0.6 pips with no commission per lot, making it an attractive option for beginners. In contrast, the professional account features tighter spreads from 0.0 pips but incurs a commission of $6 per lot. While these conditions are competitive, traders should be aware of any unusual fees that may arise, particularly concerning overnight financing costs.

Additionally, some user reviews have indicated concerns about hidden fees and unexpected costs, which could diminish overall trading profitability. Therefore, it is advisable for traders to thoroughly review the terms and conditions associated with their chosen account type before committing capital.

Customer Funds Security

The security of customer funds is a primary concern for any trader, and EBC Financial Group has implemented several measures to ensure the safety of client assets. The broker maintains segregated accounts, meaning that client funds are kept separate from the company's operational funds. This practice is crucial in protecting traders in the event of financial difficulties faced by the broker.

EBC also provides deposit protection under the FCA regulations, which can cover up to £85,000 per client in the UK. However, such protections are not available under the CIMA regulations in the Cayman Islands, which could expose clients to higher risks if they are trading under that jurisdiction. Additionally, EBC does not offer negative balance protection, which means clients could potentially lose more than their initial investment during volatile market conditions.

Historically, EBC has not reported any significant issues related to fund security, but the absence of negative balance protection and the regulatory status in the Cayman Islands warrant caution. Traders are encouraged to assess their risk tolerance and consider the implications of these factors before engaging with EBC.

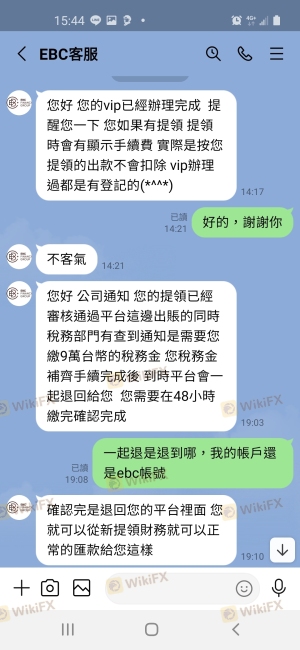

Customer Experience and Complaints

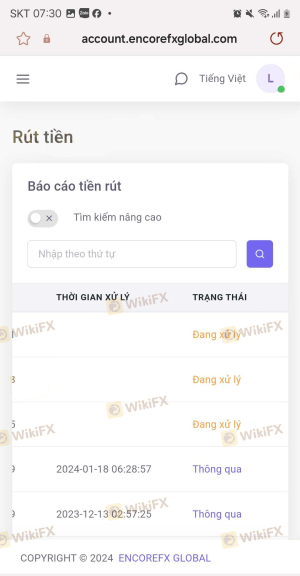

Customer feedback is a vital component in evaluating the reliability of a broker. EBC Financial Group has received a mix of positive and negative reviews from its users. Many clients praise the broker for its competitive trading conditions and responsive customer service. However, there are also reports of issues regarding withdrawal delays and difficulties in accessing customer support during peak times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Delayed response |

| Lack of Communication | Medium | Inconsistent |

| Account Management Issues | High | Unresolved |

Typical complaints include withdrawal issues where clients report being unable to access their funds promptly. Some users have claimed that the broker imposed unexpected conditions on withdrawals, which could be perceived as a tactic to retain client funds. The company's response to these complaints has been criticized for being slow and sometimes inadequate, which can further exacerbate customer dissatisfaction.

For instance, one user reported experiencing significant delays in processing their withdrawal request, leading to frustration and a loss of trust in the broker. Such experiences highlight the importance of evaluating a broker's customer service quality and responsiveness, especially when it comes to critical operations like fund withdrawals.

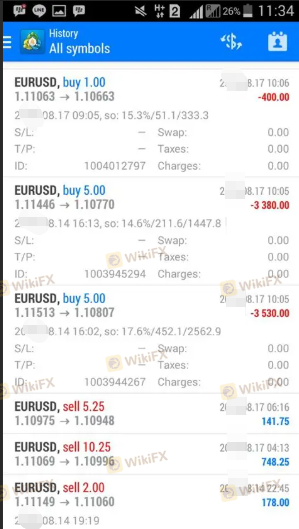

Platform and Trade Execution

The trading platform is a crucial aspect of the trading experience, and EBC offers the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their robust features, including advanced charting tools and automated trading capabilities. However, user experiences regarding platform performance have varied.

Traders have reported that order execution speeds are generally fast, averaging around 20 milliseconds. However, there are instances of slippage and requotes, which can be frustrating for active traders. The broker's ability to maintain stable platform performance during high volatility periods is essential for ensuring a seamless trading experience.

In terms of platform manipulation, there have been no significant allegations against EBC, but traders should remain vigilant and monitor their trading activity for any unusual patterns that may indicate issues with order execution.

Risk Assessment

Engaging with EBC Financial Group involves various risks that traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed regulatory oversight; CIMA license concerns. |

| Fund Security | High | Absence of negative balance protection; limited insurance under CIMA. |

| Customer Service Quality | Medium | Reports of withdrawal issues and inconsistent communication. |

| Trading Conditions | Medium | Competitive but potential hidden fees; variable spreads. |

To mitigate these risks, traders should conduct thorough research, maintain a clear understanding of the broker's policies, and implement sound risk management strategies. It is also advisable to start with a demo account to familiarize oneself with the platform and trading conditions before committing significant capital.

Conclusion and Recommendations

In conclusion, EBC Financial Group presents a complex picture. While it is regulated by reputable authorities like the FCA and ASIC, the concerns related to its CIMA license, lack of negative balance protection, and mixed customer feedback warrant caution. Traders should be particularly mindful of the potential risks associated with fund security and customer service responsiveness.

For traders considering EBC, it is recommended to start with a small investment and utilize the demo account to gauge the broker's performance and service quality. If you prioritize strong regulatory oversight and robust customer support, you may also want to explore alternatives such as brokers regulated solely by top-tier authorities without the complexities associated with offshore licenses. Ultimately, due diligence and careful consideration of individual trading needs will be crucial in making an informed decision.

Is EBC a scam, or is it legit?

The latest exposure and evaluation content of EBC brokers.

EBC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EBC latest industry rating score is 6.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.