Is DEFI Investment safe?

Pros

Cons

Is Defi Investment A Scam?

Introduction

Defi Investment is a forex brokerage that has garnered attention in the trading community for its promises of high returns and advanced trading tools. Operating primarily in the decentralized finance (DeFi) sector, it positions itself as a modern alternative to traditional financial institutions. However, the rapid growth of the DeFi space has also led to an increase in fraudulent activities, making it crucial for traders to evaluate the legitimacy of brokers like Defi Investment. In this article, we will explore the safety and legitimacy of Defi Investment by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk factors. Our evaluation will rely on data sourced from reputable financial analysis websites, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is one of the most critical factors in determining its safety. A well-regulated broker is typically subject to stringent oversight, which can significantly reduce the risk of fraud and mismanagement. In the case of Defi Investment, the broker claims to operate under the auspices of the National Futures Association (NFA). However, several reports indicate that this regulatory claim may be misleading, as it lacks the necessary authorization from recognized regulatory bodies.

Heres a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

The absence of a valid regulatory license raises significant concerns about the broker's credibility. Regulatory authorities play a pivotal role in ensuring that brokers adhere to strict standards, including financial transparency, client fund protection, and ethical trading practices. In this case, the lack of oversight from a reputable regulator suggests that Defi Investment may not be a safe option for traders looking to invest their money. Furthermore, historical compliance issues, if any, could further jeopardize the safety of client funds.

Company Background Investigation

Understanding the history and ownership structure of a brokerage can provide valuable insights into its reliability. Defi Investment, registered in the United Kingdom, has been operational for approximately 2 to 5 years. However, details about its ownership and management team remain sparse, leading to questions about its legitimacy. Transparency is a key indicator of a trustworthy broker, and the lack of information about its founders and executive team raises red flags.

The management team‘s expertise is crucial for the broker’s operational integrity. Unfortunately, the absence of publicly available information about their professional backgrounds makes it difficult to assess whether they possess the necessary qualifications and experience to manage a financial services firm. A transparent organization typically provides detailed information about its leadership, including their qualifications, past experiences, and roles within the company. In this case, the opacity surrounding Defi Investment's management team further complicates the assessment of its credibility.

Trading Conditions Analysis

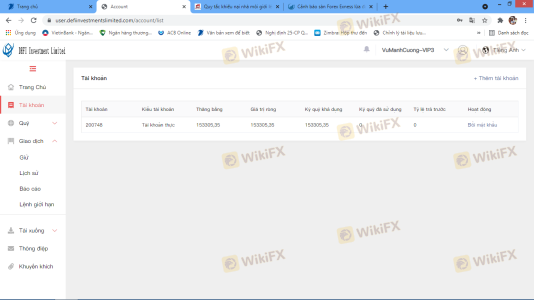

When evaluating a brokerage, it is essential to scrutinize its trading conditions, including fees, spreads, and commissions. Defi Investment offers various account types, each with different fee structures. However, reports suggest that the overall cost of trading with this broker may be higher than industry averages, which could impact profitability for traders.

Heres a comparison of key trading costs:

| Fee Type | Defi Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 pips |

| Commission Model | $7 per trade | $5 per trade |

| Overnight Interest Range | Variable | Variable |

The spreads offered by Defi Investment are slightly above the industry average, which may deter cost-sensitive traders. Additionally, the commission structure appears to be less competitive compared to other brokers. High trading costs can eat into profits, making it essential for traders to consider whether the potential returns justify the expenses involved in trading with Defi Investment.

Customer Funds Security

The safety of customer funds is paramount in the trading environment. Defi Investment claims to implement various safety measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

Segregation of funds is a fundamental practice that ensures client funds are held separately from the broker's operational funds, providing a layer of protection in case of insolvency. Negative balance protection is another essential feature that prevents traders from losing more than their initial investment. However, without a robust regulatory framework, the enforcement of these policies may be unreliable.

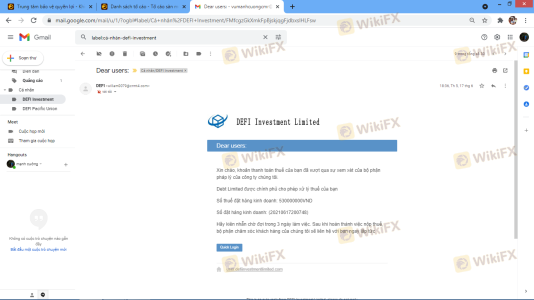

Furthermore, historical issues surrounding fund security or any controversies related to client withdrawals raise additional concerns. If traders face difficulties accessing their funds, it could indicate deeper operational problems within the brokerage.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the real-world experiences of traders using a brokerage. Reviews of Defi Investment reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving inadequate customer support.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Unresponsive |

| Platform Stability | High | Frequent Downtime |

Several users have reported that their withdrawal requests were delayed or denied, leading to frustration and distrust. Additionally, the companys response to complaints appears to be lacking, with many users citing slow or unhelpful customer service. These issues can significantly impact a trader's experience and may contribute to an overall perception of Defi Investment as an unreliable broker.

Platform and Execution

The performance and reliability of a trading platform are essential for successful trading. Defi Investment claims to offer a user-friendly interface and access to popular trading tools. However, reports suggest that users have experienced issues with platform stability, including frequent downtimes and slow execution speeds.

The quality of order execution is another critical factor. Traders rely on timely execution to capitalize on market opportunities, and any delays can result in missed profits. If there are indications of slippage or high rejection rates, it could further diminish the broker's credibility.

Risk Assessment

Engaging with Defi Investment carries inherent risks, particularly due to its regulatory status and customer feedback.

Heres a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unauthorized by reputable regulators |

| Customer Fund Security | High | Lack of transparency and historical issues |

| Trading Costs | Medium | Higher than industry average |

| Customer Support | High | Inadequate response to complaints |

Given these factors, potential traders should approach Defi Investment with caution. Conducting thorough research and considering alternative options may be prudent to mitigate risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Defi Investment may not be a safe option for traders. The lack of regulatory oversight, combined with customer complaints regarding fund withdrawals and inadequate support, raises significant concerns about the broker's credibility. Therefore, it is advisable for traders to exercise caution and consider alternative brokers with robust regulatory frameworks and positive user experiences.

For those seeking reliable trading options, we recommend exploring brokers that are regulated by top-tier authorities such as the FCA, ASIC, or NFA. These brokers typically offer better safety measures, competitive trading conditions, and more responsive customer support, ensuring a more secure trading environment.

In summary, while Defi Investment presents itself as a modern trading platform, the risks associated with its operations suggest that it may be safer to look elsewhere for forex trading needs.

Is DEFI Investment a scam, or is it legit?

The latest exposure and evaluation content of DEFI Investment brokers.

DEFI Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DEFI Investment latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.