Defi Investment 2025 Review: Everything You Need to Know

Executive Summary

This Defi Investment review shows a complete analysis of a decentralized finance platform. The platform acts as a bridge between traditional finance and innovative digital asset exposure. It offers institutional-grade exposure to digital assets through various DeFi applications including decentralized exchanges, lending protocols, and investment asset management tools. With a minimum capital requirement of $10,000, Defi Investment targets high-net-worth individuals and institutional investors. These investors seek sophisticated DeFi investment strategies.

The platform's core offering centers around providing traditional investors with trusted and secure access to digital assets. Users don't need separate brokerage or banking relationships. However, our analysis reveals significant information gaps regarding regulatory oversight, company background, and user feedback data. While the platform demonstrates technical capabilities in DeFi space operations, problems exist. The absence of transparent regulatory information and limited public user testimonials present notable considerations for potential investors.

Important Notice

This review is based on publicly available information and market data analysis. No direct user feedback or customer testimonials were available for inclusion in this assessment. Potential investors should conduct independent due diligence given the limited regulatory transparency currently available. The evaluation presented reflects information available as of 2025. It may not capture all regional variations or recent platform updates.

Rating Framework

Broker Overview

Defi Investment operates as a decentralized finance platform. The platform focuses on bridging traditional finance with innovative digital asset exposure. The platform's business model centers on providing institutional-grade access to digital assets through multiple DeFi protocols and applications. According to available information, the platform emphasizes serving traditional investors who seek exposure to cryptocurrencies and digital assets through trusted and secure channels. This eliminates the need for separate brokerage or banking arrangements.

The platform's core infrastructure revolves around decentralized exchanges that enable permissionless trading, derivatives platforms, and comprehensive lending protocols. The company positions itself within the broader DeFi ecosystem that supports trading, lending, and investment of crypto assets. It uses stablecoins to facilitate fund transfers. However, specific details regarding the company's founding date, headquarters location, and detailed corporate structure remain unclear from available public information.

This Defi Investment review notes that while the platform demonstrates technical sophistication in DeFi operations, the limited transparency regarding corporate governance and regulatory compliance presents considerations for potential users. The platform appears designed for sophisticated investors familiar with decentralized finance mechanisms. It doesn't target retail traders seeking traditional brokerage services.

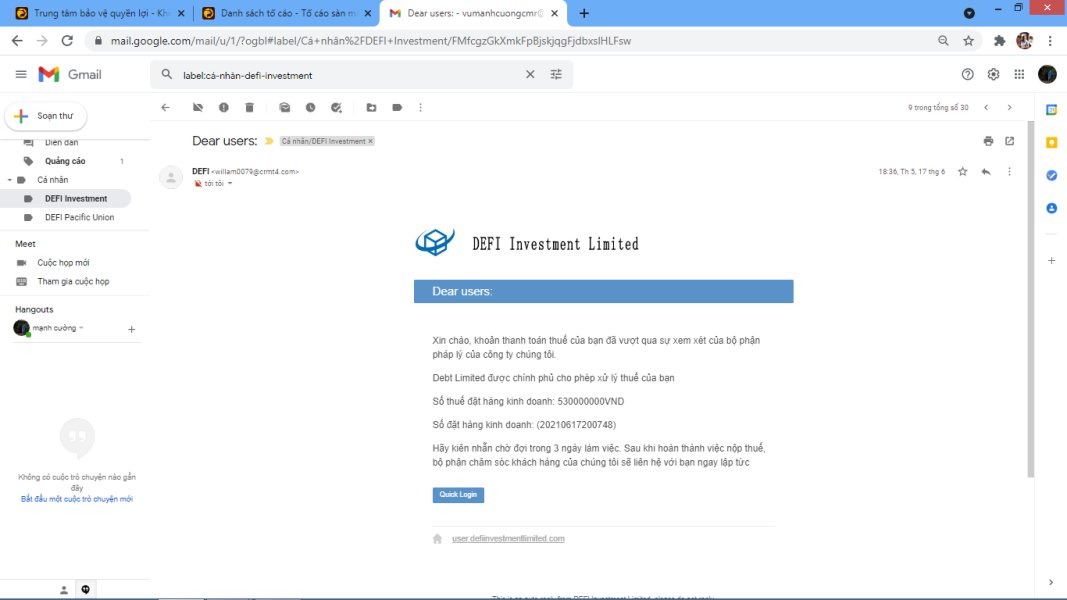

Regulatory Status: Available information does not specify particular regulatory jurisdictions or oversight authorities governing Defi Investment's operations. This represents a significant information gap for potential investors seeking regulatory assurance.

Deposit and Withdrawal Methods: Specific deposit and withdrawal mechanisms are not detailed in available documentation. Given the DeFi nature of the platform, digital asset transfers likely constitute primary funding methods.

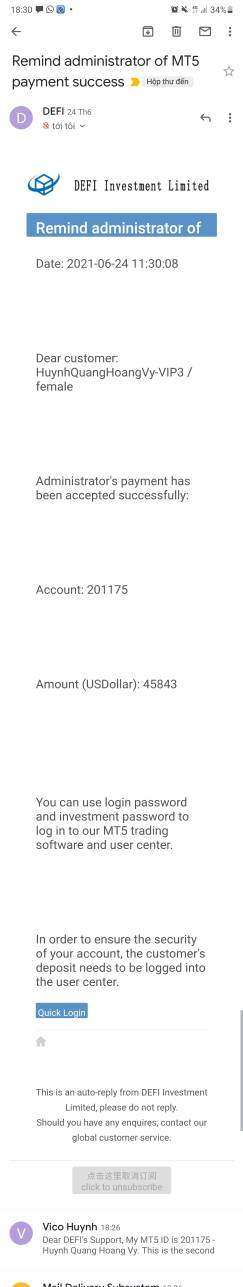

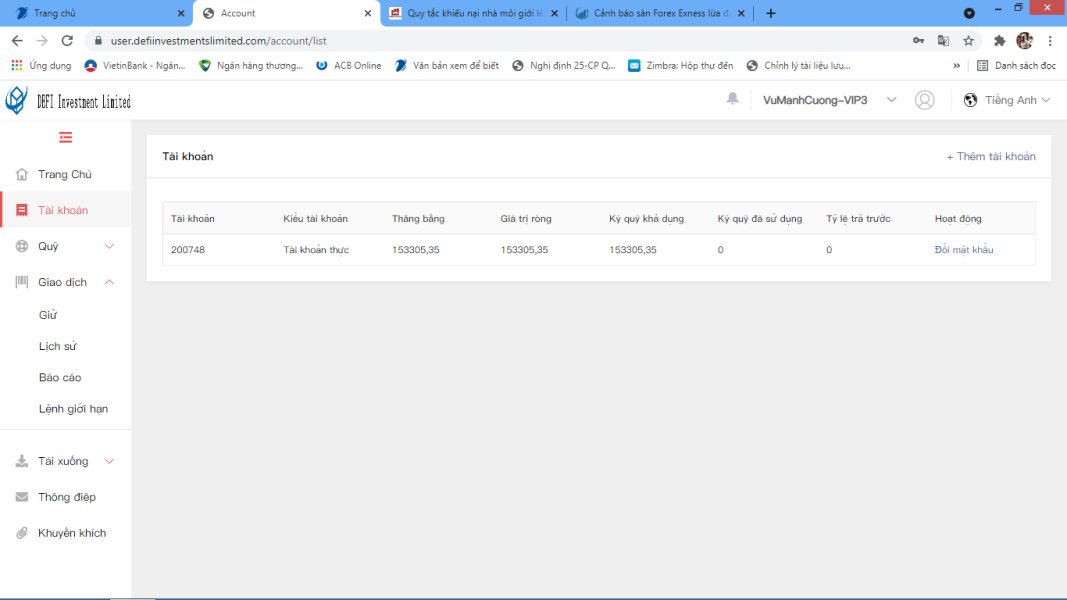

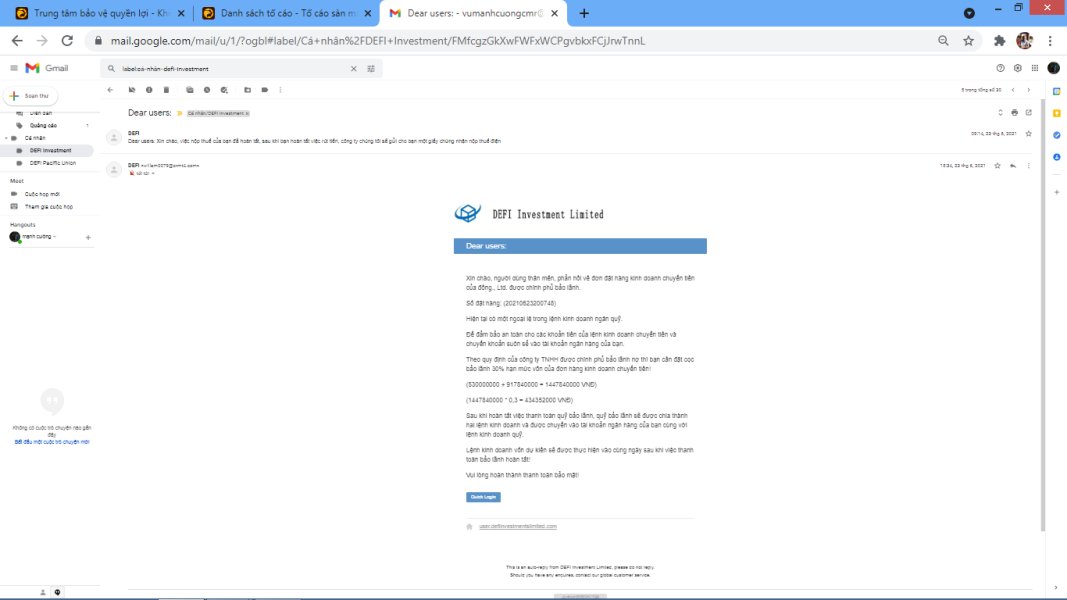

Minimum Deposit Requirements: The platform suggests a minimum capital requirement of $10,000 for new members. This allows them to effectively utilize their DeFi investment strategies and achieve optimal returns from available protocols.

Bonuses and Promotions: Current promotional offerings or bonus structures are not specified in available platform information.

Tradable Assets: The platform provides access to various digital assets through decentralized protocols. Specific asset listings and supported cryptocurrencies are not enumerated in available documentation.

Cost Structure: Detailed information regarding spreads, commissions, or protocol fees is not available in current documentation. DeFi platforms typically involve network gas fees and protocol-specific charges.

Leverage Options: Specific leverage ratios or margin trading capabilities are not detailed in available information. DeFi protocols often provide various leveraged investment opportunities.

Platform Selection: The primary trading environment utilizes decentralized exchange infrastructure enabling permissionless trading across multiple protocols and asset pairs.

Geographic Restrictions: Specific regional limitations or restricted territories are not outlined in available platform documentation.

Customer Support Languages: Available customer service languages and support options are not specified in current information sources.

This Defi Investment review emphasizes that many operational details require clarification directly from the platform provider. Limited public documentation creates this need.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

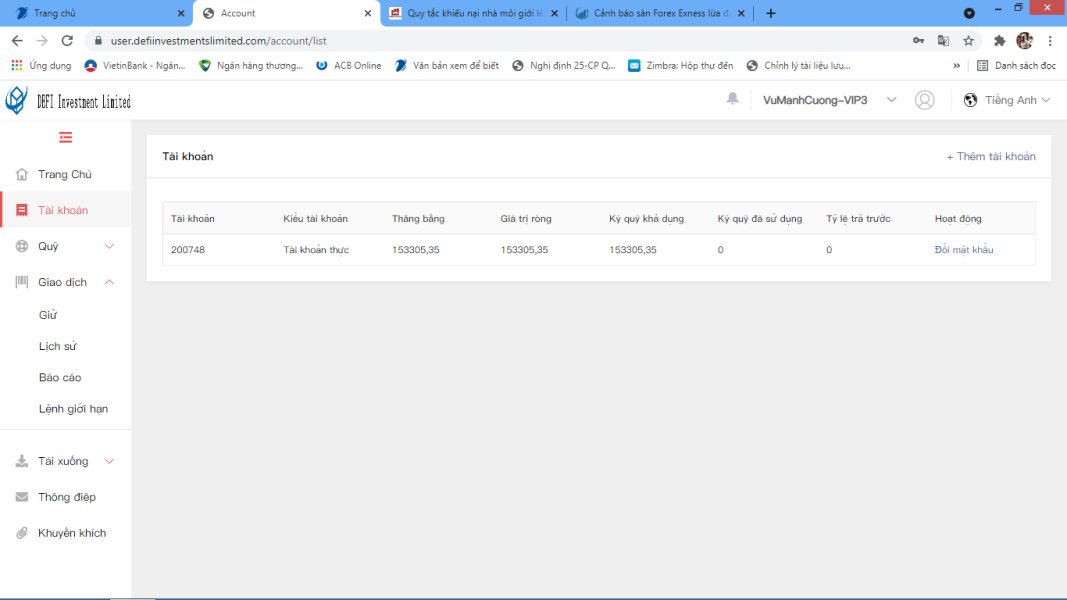

The account structure at Defi Investment reflects its positioning toward sophisticated investors with substantial capital allocation capabilities. The platform's $10,000 minimum capital requirement significantly exceeds typical retail brokerage standards. This indicates a focus on high-net-worth individuals and institutional participants. This threshold aligns with the platform's strategy of providing institutional-grade exposure to digital assets rather than accommodating smaller retail investors.

However, specific account types, tier structures, or differentiated service levels are not clearly outlined in available documentation. The absence of detailed account opening procedures, verification requirements, or graduated service offerings limits transparency for potential users. Traditional account features such as demo accounts, Islamic-compliant options, or educational account types are not mentioned in current information sources.

The platform's emphasis on DeFi investment strategies suggests that account holders gain access to sophisticated protocol interactions and yield-generating opportunities. Yet without clear documentation of account benefits, fee structures, or service differentiators across potential account tiers, prospective users face uncertainty. They cannot determine specific entitlements and obligations.

This Defi Investment review notes that while the high minimum capital requirement may ensure serious participant engagement, the lack of transparent account condition documentation represents a significant information gap. Potential investors seeking comprehensive service understanding face this challenge.

Defi Investment demonstrates strong technical capabilities through its comprehensive DeFi protocol integration. The platform provides access to decentralized exchanges enabling permissionless trading across multiple asset pairs and protocols. Additionally, users can engage with lending platforms and derivatives protocols. This creates diverse investment and yield-generation opportunities within the decentralized finance ecosystem.

The platform's infrastructure appears designed to support sophisticated DeFi strategies including liquidity provision, yield farming, and protocol governance participation. The integration of stablecoins for fund transfers and the emphasis on institutional-grade digital asset exposure suggest robust technical architecture. This architecture supports complex financial operations.

However, specific details regarding research tools, market analysis resources, or educational materials are not available in current documentation. Traditional brokerage features such as charting tools, technical analysis indicators, or automated trading support remain unclear. The absence of information regarding mobile applications, API access, or third-party platform integrations limits comprehensive tool assessment.

While the DeFi protocol access represents significant technical sophistication, the lack of traditional trading tools and research resources may limit appeal for users accustomed to comprehensive brokerage platforms. The platform appears optimized for users already familiar with DeFi protocols. It doesn't target those requiring extensive educational or analytical support.

Customer Service and Support Analysis (5/10)

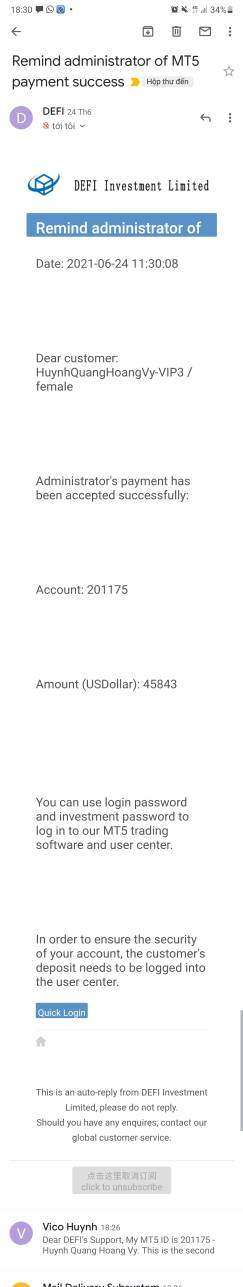

Customer service information represents a significant gap in available Defi Investment documentation. Specific support channels, response times, or service availability hours are not outlined in current platform materials. This absence of transparent customer service information creates uncertainty for potential users regarding assistance availability and problem resolution capabilities.

Traditional customer support features such as live chat, telephone support, email ticketing systems, or comprehensive FAQ sections are not documented in available information sources. The lack of specified support languages or regional service availability further limits transparency regarding customer assistance capabilities.

Given the technical complexity of DeFi protocols and the platform's focus on sophisticated investment strategies, robust customer support becomes particularly important for user success and problem resolution. However, without clear documentation of support structures, response time commitments, or escalation procedures, potential users cannot assess service quality expectations.

The absence of user testimonials or service quality feedback in available documentation prevents assessment of actual customer service performance. This information gap represents a notable consideration for potential users. It particularly affects those new to DeFi protocols who may require substantial guidance and support during platform adoption and strategy implementation.

Trading Experience Analysis (6/10)

The trading experience at Defi Investment centers on decentralized exchange functionality enabling permissionless trading across various digital asset pairs. The platform's infrastructure supports interaction with multiple DeFi protocols. This provides users access to diverse trading opportunities within the decentralized finance ecosystem. This technical approach offers sophisticated users significant flexibility and protocol access.

However, specific information regarding platform stability, execution speed, or order processing capabilities is not available in current documentation. Traditional trading experience metrics such as slippage rates, execution quality statistics, or platform uptime data are not provided. The absence of mobile platform information or cross-device compatibility details limits comprehensive experience assessment.

The platform's focus on DeFi protocols suggests that users engage with smart contract-based trading rather than traditional order book systems. While this approach offers unique advantages such as permissionless access and protocol composability, it may present complexity challenges. Users accustomed to traditional trading interfaces may face difficulties.

Without user feedback or performance benchmarking data, this Defi Investment review cannot definitively assess trading experience quality. The technical sophistication of DeFi protocol integration suggests capable infrastructure. Yet the absence of transparency regarding execution quality and platform performance represents notable information limitations for potential users seeking comprehensive trading experience evaluation.

Trust and Security Analysis (4/10)

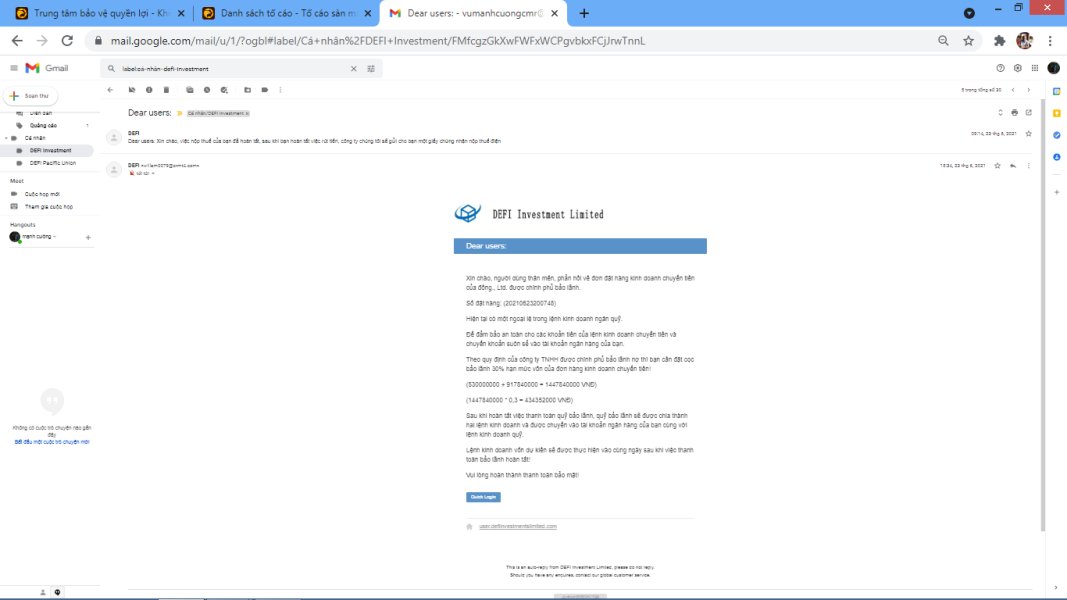

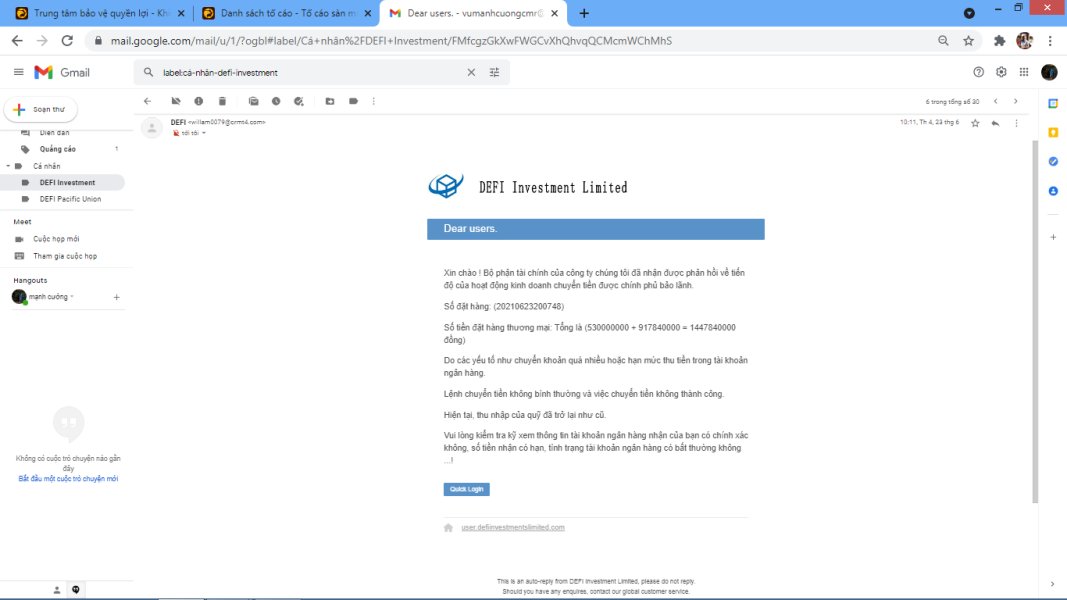

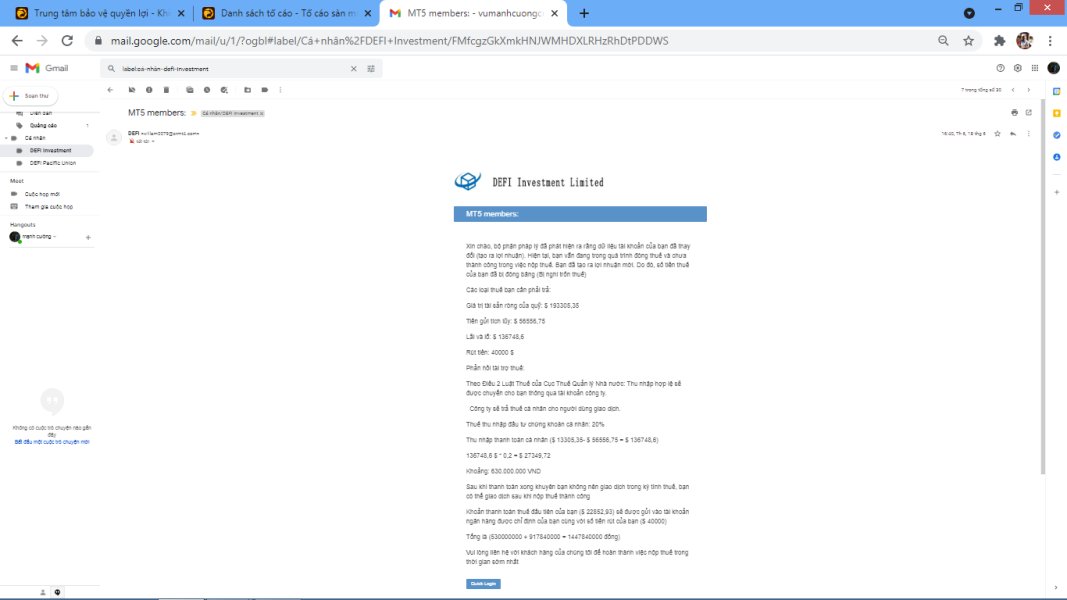

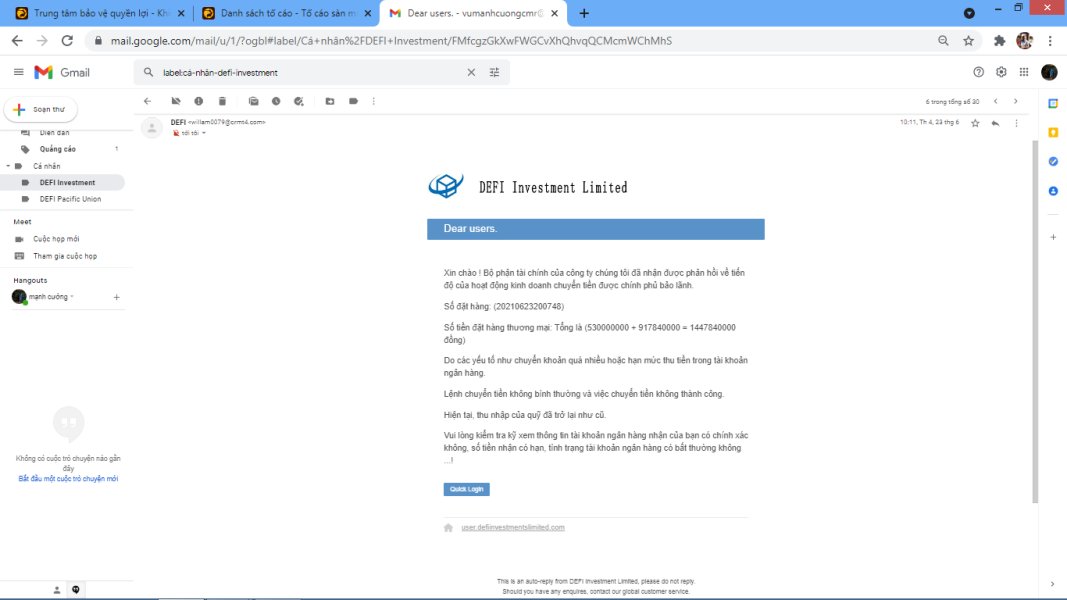

Trust and security represent significant concerns in this Defi Investment assessment due to limited regulatory transparency and corporate disclosure. Available information does not specify regulatory oversight authorities, compliance frameworks, or jurisdictional governance structures. This regulatory uncertainty creates substantial trust considerations for potential investors seeking institutional-grade security assurance.

The absence of detailed corporate information including founding dates, leadership teams, or operational transparency limits due diligence capabilities. Traditional security measures such as segregated client funds, insurance coverage, or third-party audits are not documented in available platform materials. This information gap prevents comprehensive security assessment and risk evaluation.

While DeFi protocols often provide built-in security features through smart contract architecture and blockchain immutability, platform-specific security measures remain unclear. The lack of information regarding private key management, custody solutions, or security incident response procedures creates additional uncertainty. Potential users managing substantial capital allocations face this challenge.

The platform's emphasis on institutional-grade services suggests sophisticated security infrastructure. Yet without transparent documentation or third-party verification, trust assessment remains challenging. Potential users must weigh the technical capabilities of DeFi protocols against the limited transparency regarding platform-specific security measures and regulatory compliance frameworks.

User Experience Analysis (5/10)

User experience assessment proves challenging due to the absence of available user testimonials, satisfaction surveys, or public feedback in current documentation. The platform's focus on sophisticated DeFi strategies suggests a user base familiar with decentralized finance protocols. Yet specific interface design, usability features, or user journey optimization details are not available for evaluation.

The $10,000 minimum capital requirement indicates targeting of experienced investors rather than retail users seeking simplified interfaces. However, without specific information regarding platform navigation, onboarding processes, or user interface design, comprehensive experience assessment remains limited. Traditional usability features such as intuitive navigation, responsive design, or accessibility accommodations are not documented.

The technical complexity of DeFi protocol interactions typically requires substantial user education and interface optimization to ensure positive experiences. Yet available information does not address user support resources, educational materials, or interface design principles. These elements facilitate successful platform adoption and strategy implementation.

Without user feedback data or experience testimonials, this analysis cannot provide definitive user experience ratings. The platform's institutional focus suggests sophisticated user requirements. Yet the absence of transparent user experience documentation represents a notable limitation for potential users seeking comprehensive platform assessment before capital commitment.

Conclusion

This Defi Investment review reveals a platform with sophisticated DeFi protocol capabilities targeting high-net-worth investors and institutional participants. While the platform demonstrates technical competence in decentralized finance operations and provides access to diverse DeFi protocols, significant information gaps regarding regulatory oversight, customer service, and user experience create notable evaluation limitations.

The platform best serves sophisticated investors already familiar with DeFi protocols and comfortable with limited regulatory transparency. The $10,000 minimum capital requirement and institutional-grade positioning make it unsuitable for retail investors. These investors typically seek traditional brokerage services or regulatory assurance.

Primary advantages include comprehensive DeFi protocol access and institutional-focused service positioning, while key limitations involve regulatory uncertainty, limited customer service transparency, and absence of user feedback data. Potential users should conduct thorough independent due diligence given the significant information gaps identified in this assessment.