Is DAS Capital safe?

Pros

Cons

Is Das Capital Safe or a Scam?

Introduction

Das Capital, officially known as Das Capitals Limited, is a forex broker that has been operating for approximately 2 to 5 years. Registered in Saint Vincent and the Grenadines, a known offshore jurisdiction, it positions itself as a provider of forex trading education and signal services. As the forex market continues to grow, traders must exercise caution when selecting brokers, given the prevalence of scams and unethical practices in the industry. This article aims to objectively analyze the safety and legitimacy of Das Capital by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety for traders. Das Capital operates under a non-regulated status, meaning it does not adhere to the regulations set by recognized financial authorities. This lack of oversight raises significant concerns regarding the broker's practices and the level of protection afforded to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Not Regulated |

The absence of a valid regulatory license is a red flag for potential investors. Regulatory bodies typically enforce standards of fairness, transparency, and accountability, which are vital for maintaining market integrity. Without such oversight, traders may find themselves vulnerable to fraudulent activities, including difficulties in fund withdrawals and unexpected fees. The lack of historical compliance with industry standards further compounds these concerns.

Company Background Investigation

Das Capital's history is relatively brief, having been established in the last few years. The company claims to have a management team with extensive experience in finance, although specific details about the individuals behind Das Capital remain unclear. This opacity raises questions about the company's credibility and commitment to transparency.

The ownership structure is not well-documented, making it challenging to assess the accountability of its management. Furthermore, the company's official website is currently unavailable, limiting access to critical information about its operations, terms, and conditions. This lack of transparency is concerning, particularly for a financial institution that handles clients' funds.

Trading Conditions Analysis

Understanding the trading conditions offered by Das Capital is essential to evaluate its safety. The broker's fee structure appears to be complex, with reports indicating potential hidden fees that could significantly impact traders' profits.

| Fee Type | Das Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commissions raises concerns about the broker's transparency. Traders have reported being subjected to unusual fees, including charges that seem disproportionate to standard industry practices. Such practices not only affect profitability but also indicate a lack of ethical standards in the broker's operations.

Customer Fund Safety

The safety of customer funds is a critical aspect of any forex broker. Das Capital's approach to fund security is questionable, given its non-regulated status. There are no clear indications of whether customer funds are kept in segregated accounts or if there are any investor protection measures in place.

Reports from users suggest that there have been significant issues with fund withdrawals, with claims that the withdrawal process is intentionally complicated. This raises alarms about the broker's reliability and the security of traders' investments. Historical issues regarding fund safety and disputes further contribute to the perception that Das Capital may not be a safe option for traders.

Customer Experience and Complaints

Customer feedback and experiences provide valuable insights into the operations of a broker. Das Capital has garnered mixed reviews, with many users expressing frustration over withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Poor |

| Customer Support | High | Poor |

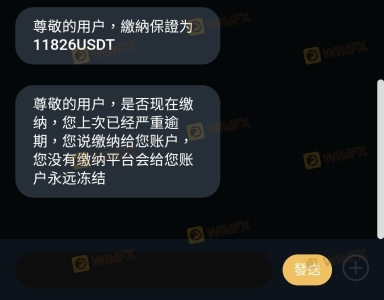

Common complaints include being charged excessive fees and encountering delays in processing withdrawals. The companys response to these issues has been criticized as inadequate, further diminishing its reputation in the trading community. For instance, some users have reported being asked to pay additional fees before their withdrawal requests were processed, which is a concerning practice for any financial institution.

Platform and Execution

The performance of the trading platform is another critical factor in assessing a broker's reliability. While Das Capital claims to offer a robust trading environment, the lack of a functional website raises questions about the platform's accessibility and reliability.

Order execution quality is paramount in forex trading, and any signs of slippage or order rejections can significantly impact traders' experiences. Although specific data on execution quality for Das Capital is scarce, the absence of user-friendly platform features and reports of execution issues suggest that traders may face challenges when trading with this broker.

Risk Assessment

Using Das Capital involves several risks that potential investors should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases vulnerability. |

| Fund Safety Risk | High | Reports of withdrawal issues and lack of fund protection. |

| Transparency Risk | High | Unavailable website and unclear fee structures. |

To mitigate these risks, traders are advised to conduct thorough due diligence, seek alternative brokers with robust regulatory frameworks, and avoid investing significant amounts until they can verify the broker's credibility and operational integrity.

Conclusion and Recommendations

In conclusion, the evidence suggests that Das Capital raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and numerous customer complaints indicate that traders should approach this broker with caution.

For those considering forex trading, it may be wise to explore other options that are regulated and have a proven track record of reliability and customer satisfaction. Brokers such as IG, OANDA, and Forex.com are often recommended for their regulatory compliance and positive user experiences.

Overall, potential investors should prioritize safety and conduct thorough research before engaging with any forex broker, especially one like Das Capital that lacks regulatory oversight and has a mixed reputation in the trading community.

Is DAS Capital a scam, or is it legit?

The latest exposure and evaluation content of DAS Capital brokers.

DAS Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DAS Capital latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.