DAS Capital Review 1

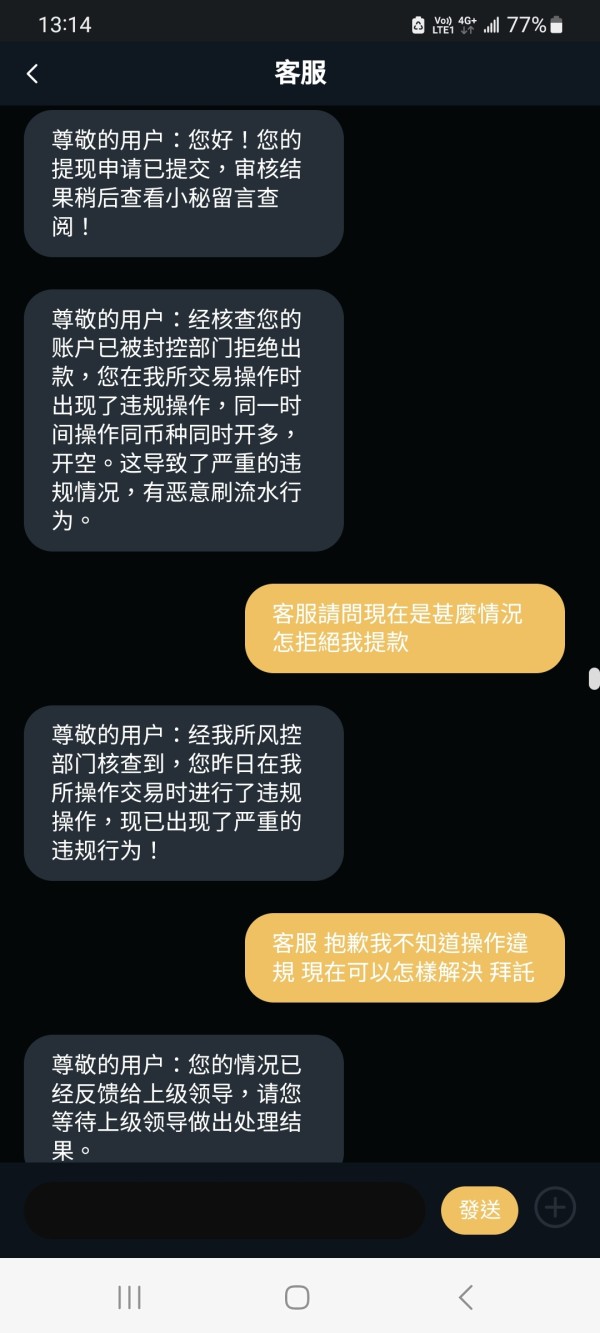

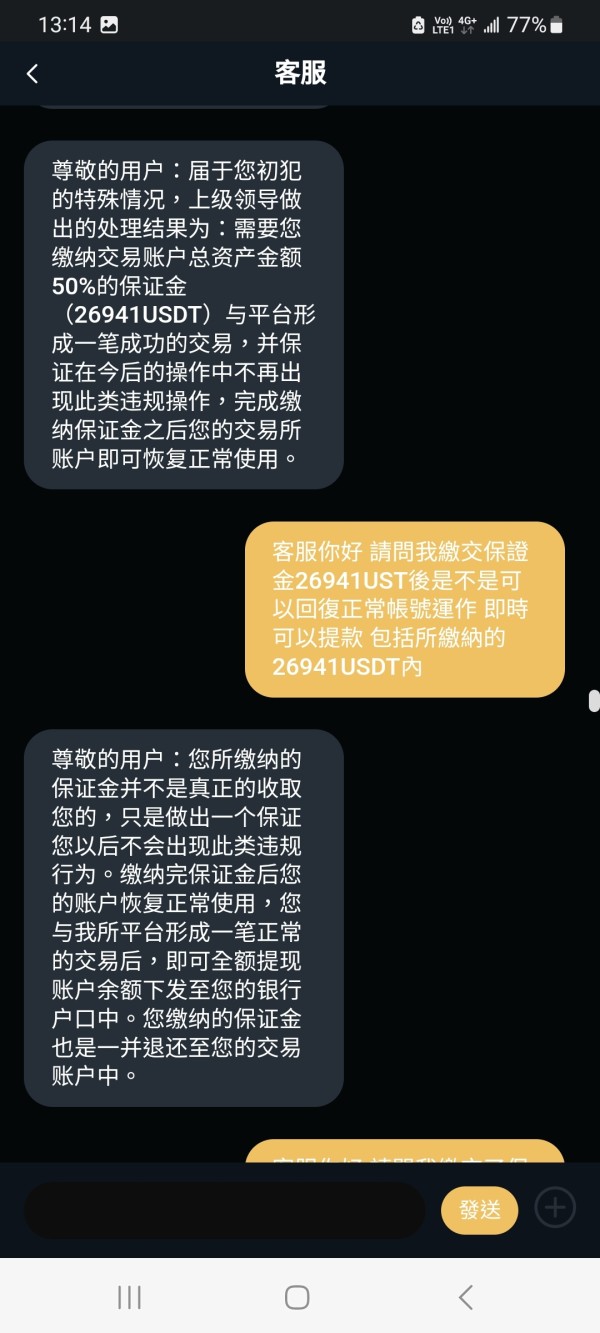

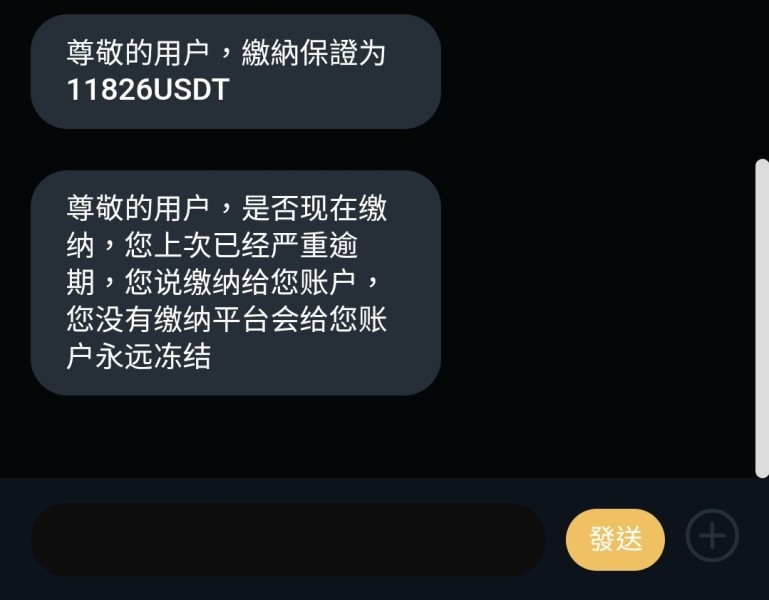

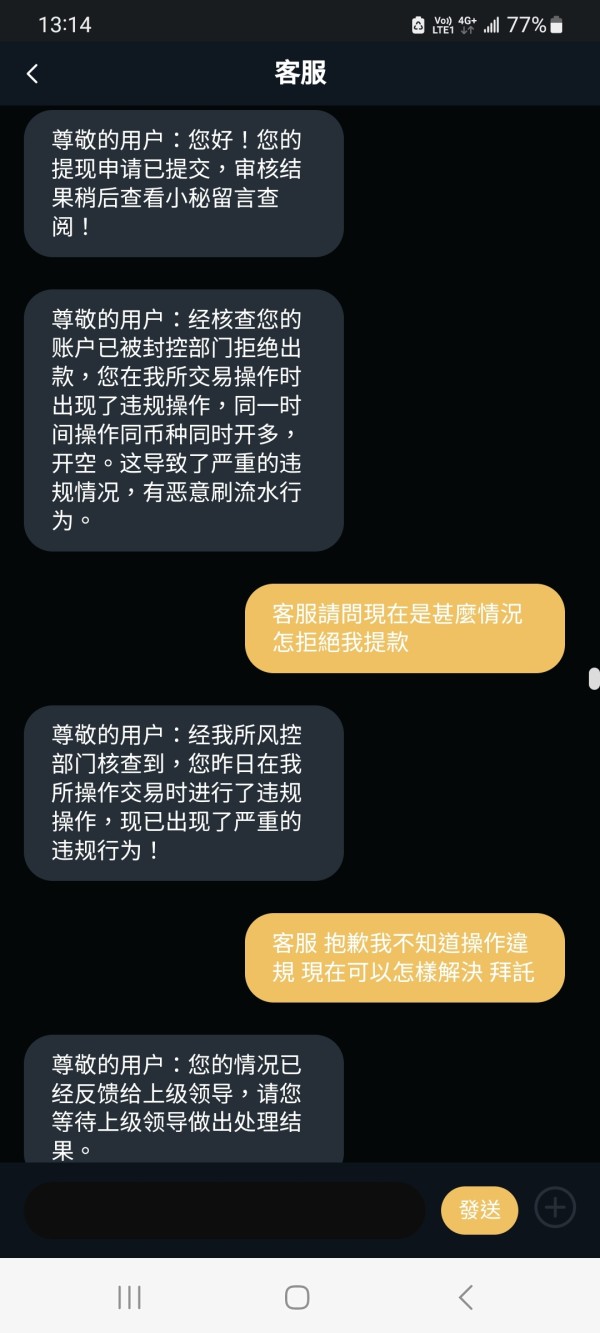

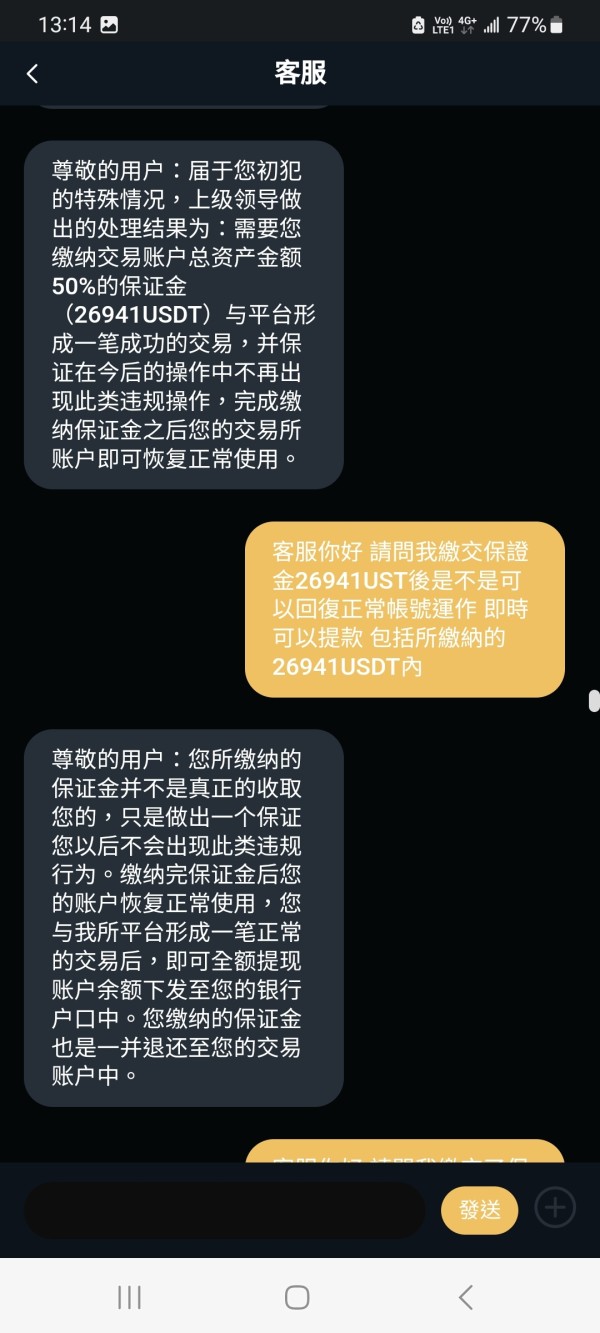

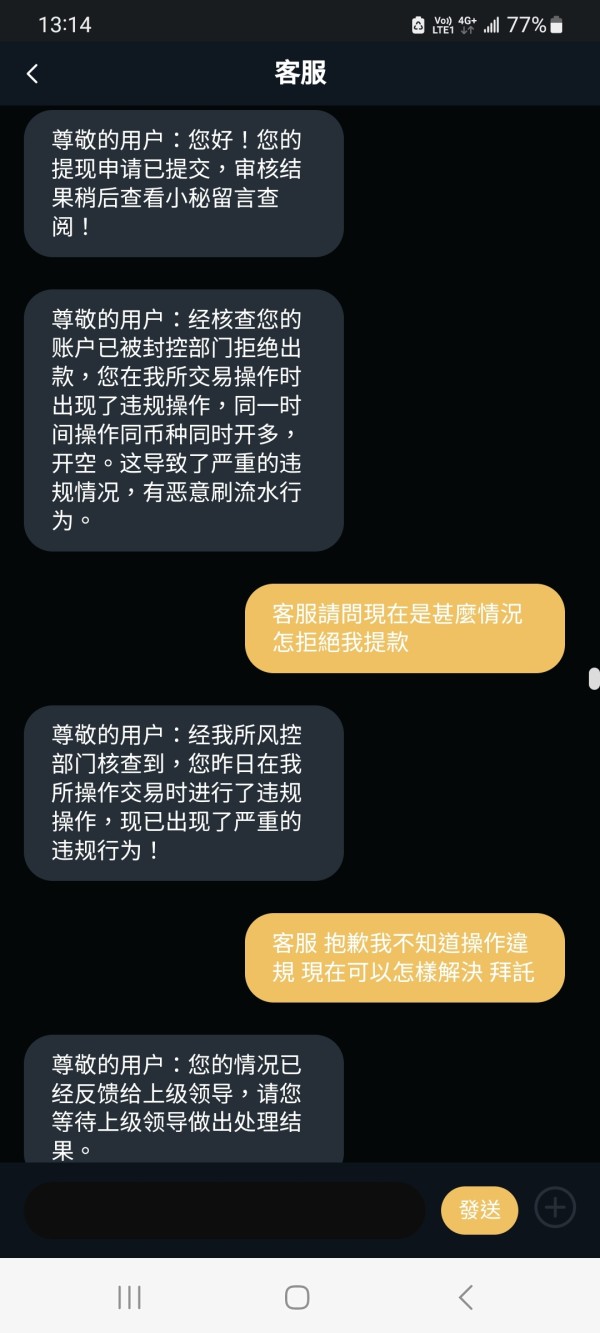

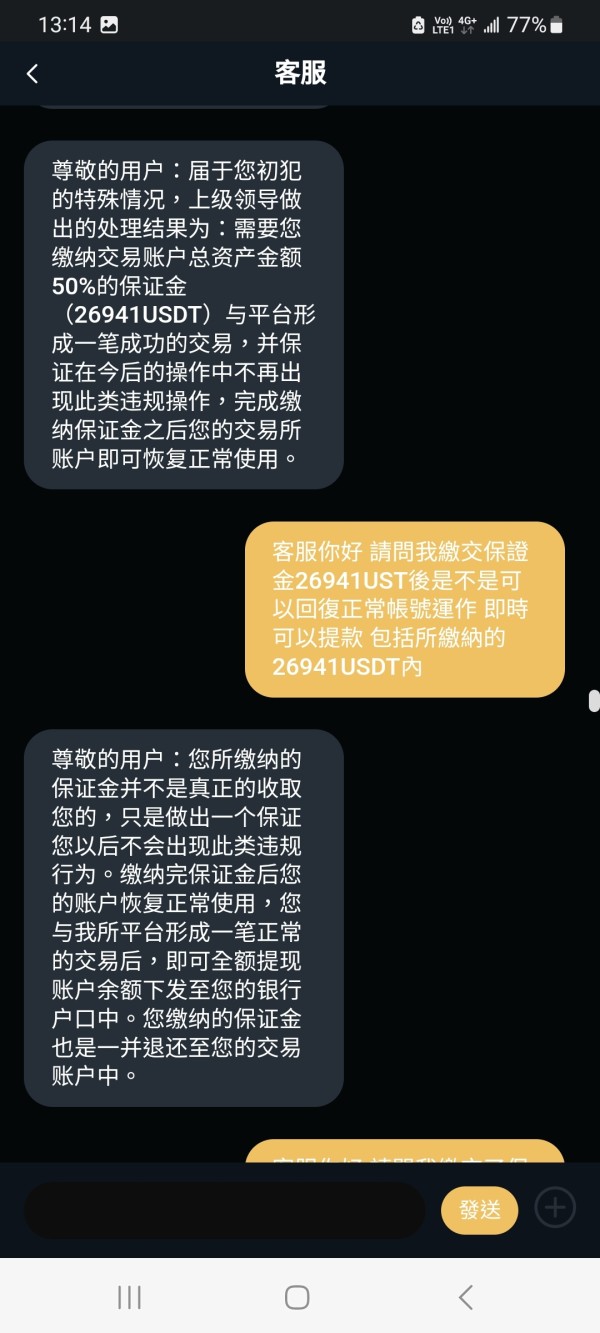

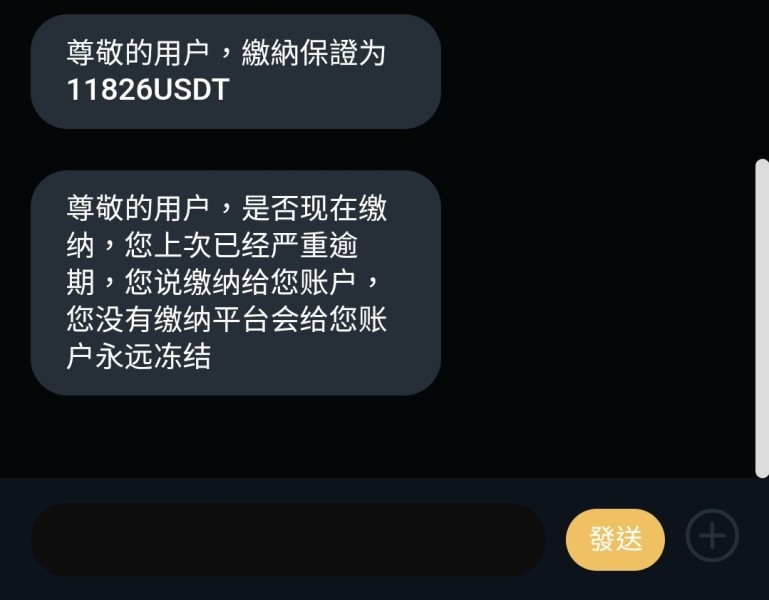

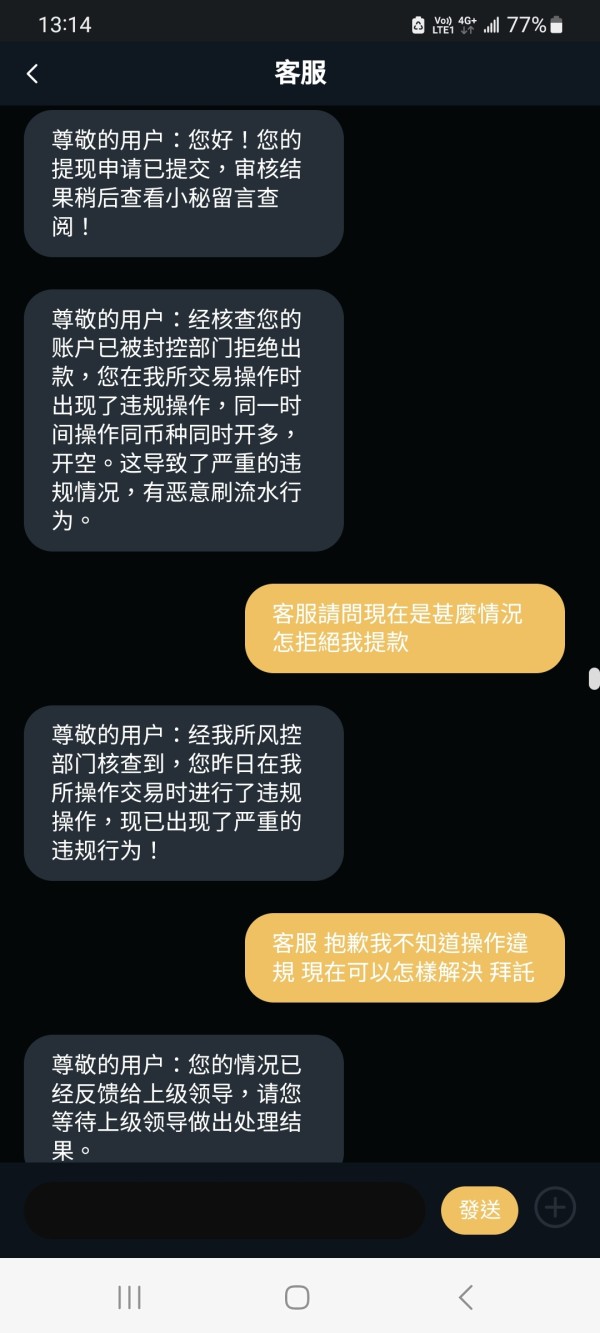

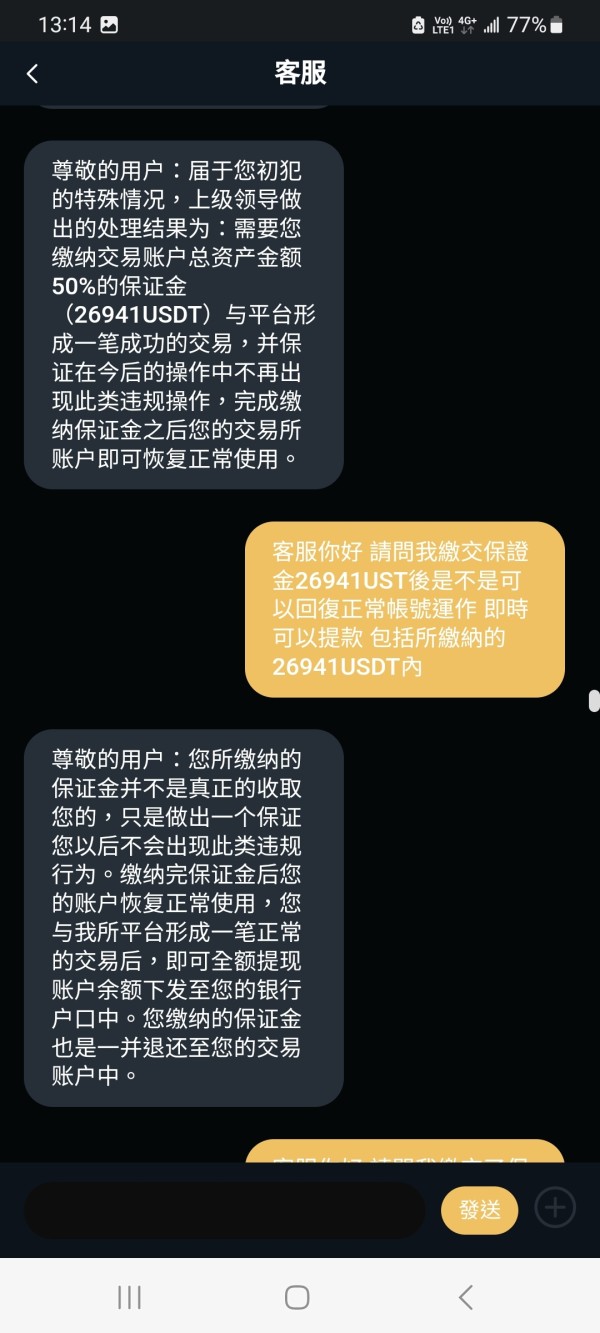

Withdrawal is not possible!!! I paid taxes first, then I was asked to pay 50% of the total profit margin for violations of the rules. This is a scam broker!!!

DAS Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Withdrawal is not possible!!! I paid taxes first, then I was asked to pay 50% of the total profit margin for violations of the rules. This is a scam broker!!!

This Das Capital review looks at a financial company that has caught attention in investment circles. Specific details about how the company works are hard to find in public records. Das Capital seems to work in investment and financial services based on what we know. The company has offices in Singapore and Vienna and started around 2012. Traders and investors should be careful because we can't find complete information about rules and operations in standard financial databases.

The company works in a way that might include venture capital activities. Whether they offer retail trading services needs more explanation. People looking for forex and CFD trading should know that detailed information about trading rules, oversight, and client protection is not clearly written in available sources. This review tries to give a fair assessment based on current information. We also point out areas where more openness would help potential clients.

Entity Differentiation: You need to know that there may be differences between "DasCapital" and "Das Kapital" companies operating in different places. These differences could mean different rules, trading conditions, and client protection depending on the specific company and where it's registered.

Review Methodology: This evaluation uses publicly available information and has not involved direct testing of services or on-site checks. Potential clients should strongly consider doing independent research and checking current regulatory status before working with any financial services provider.

| Evaluation Criteria | Rating | Basis for Assessment |

|---|---|---|

| Account Conditions | N/A | Specific account information not detailed in available sources |

| Tools and Resources | N/A | Trading tools and educational resources not documented |

| Customer Service | N/A | Support structure and availability not clearly specified |

| Trading Experience | N/A | Platform performance and execution quality not verifiable |

| Trust Factor | N/A | Regulatory information and safety measures not comprehensively available |

| User Experience | N/A | Client feedback and interface details not accessible |

Das Capital started in the financial world around 2012. The company positioned itself as an investment-focused business with offices in multiple places including Singapore and Vienna. The company's structure suggests it focuses on venture capital activities. However, we don't know much about retail trading services from available records. This Das Capital review must note that while the company has been in financial markets for over ten years, specific details about retail trading offerings are not well documented in standard industry databases.

The business model seems to focus on investment services. Das Kapital is registered as an Austrian investment company while Das Capital has connections to Singapore operations. The difference between these companies and their services needs explanation for potential clients. The fact that they've been operating since 2012 suggests some market presence. Without clear regulatory documentation, checking the full range of services and client protections remains hard for this review.

Regulatory Jurisdiction: Specific regulatory information not detailed in available sources, though entities appear connected to Austrian and Singapore jurisdictions.

Deposit and Withdrawal Methods: Payment processing options and procedures not comprehensively documented in accessible materials.

Minimum Deposit Requirements: Entry-level investment thresholds not specified in available documentation.

Bonuses and Promotions: Marketing incentives and promotional offers not detailed in current information sources.

Tradeable Assets: Available instruments and asset classes not clearly enumerated in accessible documentation.

Cost Structure: Fee schedules, spreads, and commission rates not transparently published in available materials. This represents a significant concern for this Das Capital review.

Leverage Options: Maximum leverage ratios and margin requirements not specified.

Platform Options: Trading software and technology infrastructure not detailed in available sources.

Regional Restrictions: Geographic limitations and accessibility constraints not clearly documented.

Customer Support Languages: Multilingual support availability not specified in current materials.

Checking account conditions for Das Capital proves hard because there's limited public information about specific account types, minimum deposits, and account features. Standard industry practice would typically include multiple account levels for different client groups, from beginner traders to big clients. This Das Capital review cannot provide clear analysis of account structures because detailed specifications are not documented in accessible sources.

We don't have clear documentation of account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim traders. This means potential clients face uncertainty about what to expect from the sign-up process. The lack of transparent account condition information raises questions about operational transparency that prospective clients should consider carefully. Industry standards typically require clear disclosure of account terms. This appears to be missing in readily available materials.

Trading tools and educational resources are critical parts of any comprehensive trading platform. Specific information about Das Capital's offerings in this area remains undocumented in available sources. Modern forex and investment platforms typically provide market analysis tools, economic calendars, technical indicators, and educational materials to support client decisions.

We don't have detailed information about research capabilities, analytical tools, or educational resources. This makes it hard to assess how well the platform might serve traders seeking comprehensive market insights. Professional trading environments usually include advanced charting capabilities, automated trading support, and regular market commentary. We cannot verify such features based on current available documentation.

Customer support infrastructure and availability are fundamental aspects of any financial services provider. Specific details about Das Capital's support structure are not comprehensively documented. Quality customer service typically includes multiple contact channels, reasonable response times, and knowledgeable support staff capable of addressing both technical and account-related inquiries.

We don't have clear information about support availability, response times, or multilingual capabilities. This presents challenges for potential clients seeking reliable assistance. Industry best practices include 24/5 support during market hours, multiple communication channels including live chat and phone support, and specialized technical support teams. Without documented evidence of such capabilities, assessing customer service quality remains guesswork.

Platform stability, execution speed, and overall trading environment quality are crucial factors in evaluating any trading provider. This Das Capital review cannot provide concrete assessment of these elements because of limited available information about the actual trading infrastructure and technology platform used.

Professional trading environments typically feature low-delay execution, minimal slippage, and robust platform stability during high-volatility periods. Mobile trading capabilities and cross-platform synchronization have become industry standards that traders expect from modern providers. Without access to platform specifications or user experience data, evaluating the actual trading experience remains impossible based on current available information.

Regulatory oversight and client fund protection represent the cornerstone of trust in financial services. The limited availability of comprehensive regulatory information poses significant challenges for assessing the trust factor associated with Das Capital. Established brokers typically maintain clear regulatory documentation, segregated client funds, and transparent operational procedures.

We don't have readily verifiable regulatory information, client protection measures, and operational transparency details. This raises important questions that potential clients should address before considering any engagement. Industry standards include deposit insurance, segregated client accounts, and regular regulatory audits. We cannot verify such protections based on currently available documentation.

Overall user satisfaction and platform usability assessment requires access to client feedback and detailed platform specifications that are not available in current sources. Modern trading platforms prioritize intuitive interface design, streamlined registration processes, and efficient fund management capabilities.

User experience includes everything from initial registration through ongoing platform interaction and fund operations. Without access to client testimonials, platform demonstrations, or detailed interface documentation, providing meaningful analysis of user experience quality remains impossible. The lack of transparent user feedback channels or published client satisfaction metrics further complicates assessment efforts.

This Das Capital review reveals significant limitations in available public information regarding operational details, regulatory oversight, and service specifications. While the entity appears to have maintained market presence since 2012 with connections to multiple jurisdictions, the lack of comprehensive documentation regarding trading conditions, client protections, and platform capabilities presents considerable challenges for potential clients.

Prospective users seeking reliable forex and investment services should prioritize providers with transparent regulatory status, clearly documented trading conditions, and readily accessible client support structures. The absence of detailed information in key areas suggests that interested parties should conduct extensive independent research and verification before considering any financial commitments. Given the limited transparency in available materials, this review cannot recommend Das Capital without significant reservations regarding operational clarity and client protection measures.

FX Broker Capital Trading Markets Review