Regarding the legitimacy of United Trust Bank forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is United Trust Bank safe?

Pros

Cons

Is United Trust Bank markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

United Trust Bank Limited

Effective Date:

2001-12-01Email Address of Licensed Institution:

hello@utbank.co.uk, mheaphy@utbank.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.utbank.co.ukExpiration Time:

--Address of Licensed Institution:

United Trust Bank Citypoint 1 Ropemaker Street London City Of London EC2Y 9AW UNITED KINGDOMPhone Number of Licensed Institution:

+4402071905555Licensed Institution Certified Documents:

Is United Trust Bank Safe or a Scam?

Introduction

United Trust Bank is a UK-based financial institution that has positioned itself within the forex and CFD trading markets. Established in 2001, the bank aims to provide a range of financial products and services, catering primarily to individual and institutional investors. However, as the forex market is rife with potential pitfalls, traders must exercise caution when selecting a broker. Evaluating the credibility of a trading platform is crucial to safeguarding ones investments. This article aims to provide a comprehensive assessment of United Trust Bank, examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. The analysis is based on a thorough review of online resources, including user reviews and regulatory information.

Regulation and Legitimacy

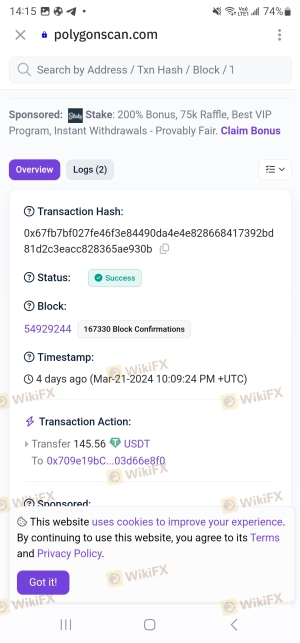

Understanding the regulatory framework governing a broker is essential for evaluating its safety and legitimacy. United Trust Bank is regulated by the Financial Conduct Authority (FCA) in the UK, which is considered one of the most stringent regulatory bodies globally. Regulation by the FCA ensures that brokers adhere to strict guidelines designed to protect clients and maintain market integrity. Below is a summary of the regulatory information for United Trust Bank:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 204463 | United Kingdom | Verified |

The quality of regulation is vital because it dictates how brokers manage client funds, conduct business, and respond to disputes. The FCA imposes high standards on its regulated entities, including requirements for capital adequacy and transparency. United Trust Bank has not faced significant regulatory actions or complaints, indicating a relatively clean compliance history. This regulatory framework enhances the bank's credibility and suggests that it is safe for trading, although potential investors should remain vigilant.

Company Background Investigation

United Trust Bank has a history that dates back to its establishment in 2001, evolving from a niche lender into a more diversified financial institution. The ownership structure is straightforward, with the bank being a limited company based in London. The management team comprises seasoned professionals with extensive experience in finance and banking, which adds to the bank's credibility.

Transparency is a critical aspect of any financial institution, and United Trust Bank appears to maintain a reasonable level of information disclosure. Its website provides essential details about its services, regulatory status, and contact information, which is a positive indicator for potential clients. However, some user reviews have pointed out that while the bank is generally trustworthy, there are areas where more information could be beneficial, particularly regarding specific trading conditions and fees.

Trading Conditions Analysis

The trading environment at United Trust Bank is characterized by its fee structure, which is essential for traders to understand. The bank offers competitive spreads and a straightforward fee model, but potential traders should be aware of any unusual fees that could impact their profitability. Below is a comparative analysis of core trading costs:

| Fee Type | United Trust Bank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

While the spreads offered by United Trust Bank are slightly higher than the industry average, the absence of commissions can make it an attractive option for some traders. However, the overnight interest rates may be a concern for those who hold positions for extended periods. It is essential for traders to be aware of these costs to avoid unexpected losses.

Customer Fund Security

When assessing whether United Trust Bank is safe, the security of client funds is paramount. The bank employs various measures to ensure the safety of customer deposits. Client funds are held in segregated accounts, which means that they are kept separate from the bank's operational funds, providing an additional layer of protection. Furthermore, the FCA mandates that clients' funds are protected up to a certain limit, ensuring that even in the unlikely event of insolvency, clients can recover their investments.

Despite these safety measures, there have been isolated reports of issues related to fund withdrawals, which could raise concerns among potential clients. However, such incidents appear to be exceptions rather than the norm. Overall, the bank's commitment to fund security suggests that it is safe for trading, but clients should remain informed and vigilant.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of any trading platform. Reviews of United Trust Bank indicate a mixed bag of experiences among users. While many clients report satisfactory service and prompt responses from customer support, others have raised concerns regarding withdrawal processes and communication during disputes. Below is a summary of the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Lack of Communication | High | Needs improvement |

| Fee Transparency Issues | Moderate | Addressing concerns |

A couple of notable cases highlight these issues. One user reported difficulties in withdrawing funds, which took longer than expected, while another mentioned inadequate communication from customer service regarding fee structures. These complaints underscore the importance of maintaining open lines of communication and transparency with clients. While such issues may not indicate that United Trust Bank is a scam, they highlight areas that require attention.

Platform and Execution

The trading platform offered by United Trust Bank is user-friendly, with features designed to facilitate efficient trading. Users have generally reported positive experiences regarding platform stability and performance. However, concerns have been raised about order execution quality, particularly regarding instances of slippage and order rejections. Traders should be aware of these potential issues, as they can significantly impact trading outcomes.

Risk Assessment

Using United Trust Bank does come with certain risks, which traders must consider. A risk assessment can help clarify these concerns:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by FCA |

| Withdrawal Issues | Medium | Some reports of delays |

| Fee Transparency | Medium | Not all fees clearly disclosed |

To mitigate these risks, traders should conduct thorough research, maintain communication with customer service, and ensure they fully understand the fee structure before engaging in trading activities.

Conclusion and Recommendations

In conclusion, United Trust Bank appears to be a legitimate broker with a robust regulatory framework, which suggests that it is generally safe for trading. While there are some concerns related to customer experiences, particularly regarding withdrawals and communication, these issues do not necessarily indicate that the bank is a scam. Potential traders should remain cautious and conduct their due diligence before committing funds.

For traders looking for alternatives, it may be beneficial to consider brokers with a more established reputation for customer service and transparency. Overall, while United Trust Bank is safe, potential clients should remain informed and vigilant to ensure a positive trading experience.

Is United Trust Bank a scam, or is it legit?

The latest exposure and evaluation content of United Trust Bank brokers.

United Trust Bank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

United Trust Bank latest industry rating score is 6.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.