Regarding the legitimacy of BizzTrade LTD forex brokers, it provides CYSEC and WikiBit, .

Is BizzTrade LTD safe?

Business

License

Is BizzTrade LTD markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Royal Financial Trading (Cy) Ltd

Effective Date:

2016-08-10Email Address of Licensed Institution:

Compliance@oneroyal.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.oneroyal.euExpiration Time:

--Address of Licensed Institution:

152 Fragklinou Rousvelt, 3045 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 080 880Licensed Institution Certified Documents:

Is BizzTrade a Scam?

Introduction

BizzTrade, a forex trading platform, has emerged as a focal point of discussion in the trading community, particularly concerning its legitimacy and safety. As a company that claims to offer various trading opportunities, including forex and CFDs, it is essential for potential traders to carefully evaluate the trustworthiness of BizzTrade before committing their funds. In the highly competitive and often risky world of forex trading, conducting thorough research on brokers is crucial to avoid potential scams and financial losses. This article aims to provide an objective assessment of BizzTrade by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical aspect of any trading platform, as it ensures adherence to specific standards and provides a layer of protection for traders. BizzTrade claims to operate under the jurisdiction of Saint Vincent and the Grenadines, a location known for its lenient regulatory framework. However, the absence of a robust regulatory body raises significant concerns about the safety of funds and the legitimacy of the trading operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and Grenadines | Unregulated |

The lack of regulation means that BizzTrade does not have to meet the stringent requirements imposed by reputable financial authorities, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This situation is troubling, as unregulated brokers often operate without transparency and can engage in practices that may be detrimental to traders. Furthermore, historical compliance issues related to BizzTrade's operations, including its previous incarnation as Bizz Trek, suggest a pattern of evasiveness and potential misconduct.

Company Background Investigation

BizzTrade was established in 2019, initially under the name Bizz Trek, before rebranding to its current name. The company is owned by the Gohar brothers, Rizwan and Rehan, along with their partner Gurpreet Dhaliwal. The transition from Bizz Trek to BizzTrade raises questions about the company's stability and intentions, particularly when considering the timing of the rebranding following reported financial difficulties.

The management team behind BizzTrade lacks the necessary credentials and experience typically associated with reputable trading firms. This deficiency in leadership further exacerbates concerns regarding the company's transparency and willingness to provide clear and accessible information to potential clients. The absence of detailed information about the company's operations, ownership structure, and management background is indicative of a lack of accountability, which is a red flag for prospective investors.

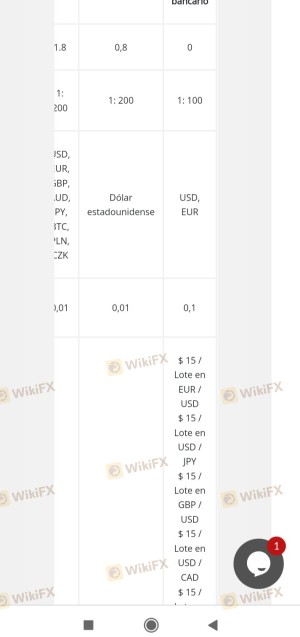

Trading Conditions Analysis

BizzTrade's trading conditions are another crucial area of concern. The platform claims to offer various account types and trading instruments, but the details surrounding fees and costs are often vague. Potential traders need to be aware of any unusual or hidden fees that could impact their trading experience.

| Fee Type | BizzTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1-2 pips |

| Commission Structure | Not specified | $5-10 per trade |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves facing unexpected costs that could erode their profits. Furthermore, the absence of a demo account for practice trading suggests that BizzTrade may not be committed to providing a user-friendly experience for new traders.

Client Fund Security

The safety of client funds is paramount when choosing a broker. BizzTrade's approach to fund security raises alarm bells, as it operates without the safeguards typically offered by regulated brokers. The company does not provide clear information regarding the segregation of client funds, investor protection schemes, or negative balance protection policies.

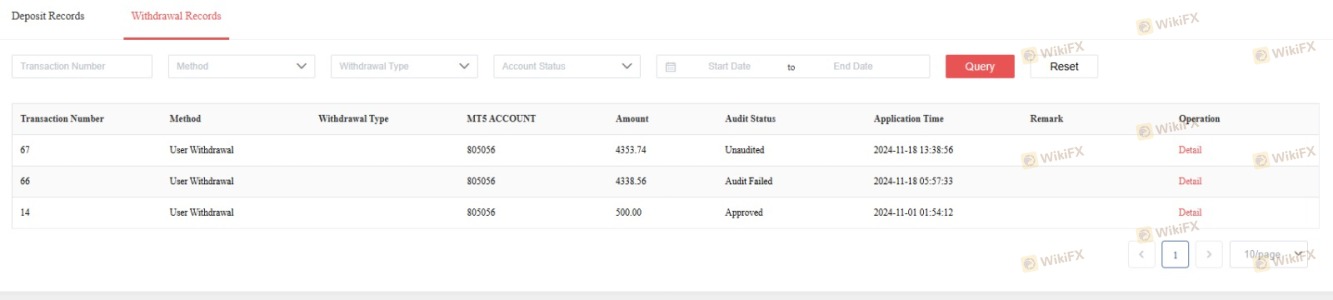

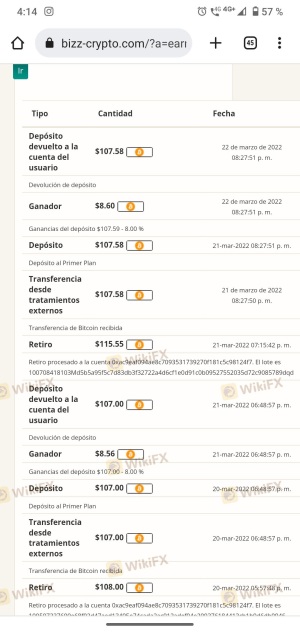

Without these essential protections in place, traders' investments are at significant risk. Historical issues related to fund security, including reports of withdrawal difficulties and unfulfilled requests, highlight the potential dangers of engaging with BizzTrade. Traders should be cautious, as the lack of accountability can lead to severe financial repercussions.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and quality of service. Reviews from BizzTrade clients reveal a troubling pattern of complaints, primarily centered around withdrawal issues, unresponsive customer support, and misleading marketing practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow to respond |

| Misleading Information | High | No clarification |

Typical cases involve clients reporting their inability to withdraw funds after making initial deposits, leading to frustration and financial loss. The lack of effective communication from the company exacerbates these issues, leaving clients feeling abandoned and misled.

Platform and Trade Execution

The trading platform offered by BizzTrade, which claims to utilize MetaTrader 5, has been scrutinized for its performance and reliability. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

The overall user experience on the platform has been described as subpar, with frequent technical difficulties that hinder trading activities. The potential for platform manipulation raises further concerns, as traders may not be able to trust the integrity of the execution process.

Risk Assessment

Using BizzTrade poses several risks that potential traders must consider. The unregulated status of the broker, coupled with its dubious operational history, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from regulatory bodies |

| Fund Security Risk | High | Lack of fund segregation and protection |

| Operational Risk | Medium | History of technical issues and withdrawal problems |

To mitigate these risks, traders are advised to conduct thorough research before investing and to consider utilizing regulated brokers with established reputations for transparency and client protection.

Conclusion and Recommendations

In conclusion, BizzTrade exhibits numerous red flags that suggest it operates as an untrustworthy and potentially fraudulent entity. The lack of regulation, questionable management, opaque trading conditions, and a history of client complaints collectively indicate that this broker may not be a safe option for traders.

For those seeking to enter the forex market, it is advisable to consider reputable alternatives that are regulated by recognized authorities and have a proven track record of client satisfaction. Brokers such as IG, OANDA, and Forex.com offer robust protections and transparent trading conditions, making them safer choices for both novice and experienced traders. Always prioritize safety and due diligence when selecting a trading partner.

Is BizzTrade LTD a scam, or is it legit?

The latest exposure and evaluation content of BizzTrade LTD brokers.

BizzTrade LTD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BizzTrade LTD latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.