Is AZEE Securities Private Limited safe?

Pros

Cons

Is Azee Safe or Scam?

Introduction

Azee is a retail brokerage firm based in Pakistan, primarily operating in the forex and CFD markets. Established in 2003, Azee Securities aims to provide traders with access to a variety of financial instruments, including equities, commodities, and derivatives. However, as the forex market continues to grow, so does the number of fraudulent brokers, making it essential for traders to thoroughly evaluate the brokers they choose to work with. This article aims to investigate whether Azee is a safe trading option or a potential scam. Our evaluation will focus on regulatory compliance, company background, trading conditions, customer fund security, customer experience, platform performance, and overall risk assessment.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and legitimacy of a forex broker. A regulated broker is typically subject to stringent oversight, which can protect traders from fraud and malpractice. In the case of Azee, the broker claims to be licensed by the Securities and Exchange Commission of Pakistan (SECP) under the Securities Act of 2015 and the Futures Market Act of 2006. However, several reviews indicate that Azee operates without proper regulation, raising concerns about its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| SECP | N/A | Pakistan | Unverified |

The lack of verified regulatory oversight and the absence of a solid reputation in the trading community suggest that Azee may not be a reliable broker. Moreover, industry experts have indicated that unregulated brokers pose a higher risk for traders, as they may not adhere to industry standards or protect client funds adequately. Therefore, when considering whether Azee is safe, it is crucial to recognize this regulatory gap.

Company Background Investigation

Azee Securities was founded in 2003 and has positioned itself as a prominent player in Pakistan's retail financial services sector. The company claims to have a diversified portfolio, providing services such as equities trading, IPOs, and mutual funds. Despite its long-standing presence, Azee's transparency regarding its ownership structure and management team is limited.

The management team consists of individuals with varying degrees of experience in finance and trading; however, specific details about their qualifications and past achievements are not readily available. This lack of information raises questions about the company's commitment to transparency and accountability.

Furthermore, the company's operational history has not been without controversy. It has faced scrutiny for its regulatory compliance and has been linked to other entities that have had issues with fraud. This history casts a shadow over Azee's credibility and raises concerns about whether Azee is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital for assessing its overall reliability. Azee offers a range of trading services, but the fee structure appears to be somewhat opaque. Traders have reported various fees, including spreads and commissions, but specific details are often unclear.

| Fee Type | Azee | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 0.5% - 2% |

The absence of transparent information regarding fees raises red flags. Traders may encounter hidden costs that could significantly impact their profitability. Furthermore, the lack of clarity surrounding commissions and spreads makes it challenging for traders to accurately assess whether they are getting a competitive deal. This uncertainty about trading conditions is a significant factor in determining whether Azee is safe for traders.

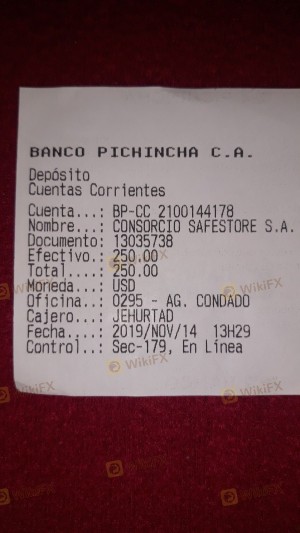

Customer Fund Security

The security of customer funds is paramount when choosing a forex broker. Azee claims to implement several measures to safeguard client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's unregulated status.

Traders should be aware that in an unregulated environment, there is no guarantee that their funds will be protected in the event of insolvency or fraud. Historical cases involving unregulated brokers have shown that clients often struggle to recover their investments.

Additionally, Azee has not publicly addressed any past incidents of fund security breaches or complaints related to fund management. This lack of transparency raises concerns about the broker's commitment to protecting client assets. Therefore, traders must seriously consider whether Azee is safe in terms of fund security.

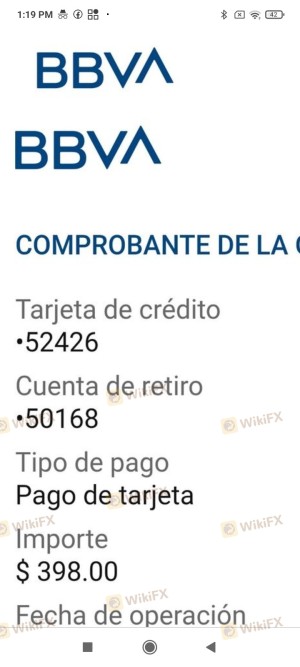

Customer Experience and Complaints

Customer feedback is crucial in assessing the reliability of a brokerage firm. Reviews of Azee's services reveal a mixed bag of experiences. While some users report satisfactory trading conditions and customer service, others have voiced significant complaints, particularly regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Lack of Transparency | High | Minimal feedback |

Common complaints include difficulties in withdrawing funds, with several users reporting long delays and unresponsive customer service. Such issues are indicative of a potentially problematic broker and raise questions about whether Azee is safe for traders who require reliable access to their funds.

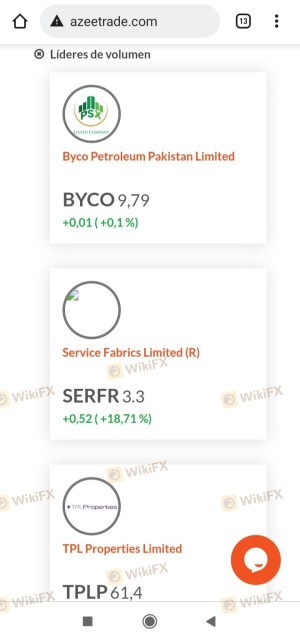

Platform and Trade Execution

Azee provides its clients with a proprietary trading platform designed to facilitate online trading. However, reviews of the platform's performance indicate that it may not be as user-friendly or reliable as competitors. Users have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

In a volatile market, the ability to execute trades quickly and efficiently is critical. Azee's platform has faced criticism for lagging during high-traffic periods, leading to missed trading opportunities. Such performance issues could be detrimental to traders, particularly those employing high-frequency trading strategies. Therefore, the execution quality raises concerns about whether Azee is safe for serious traders.

Risk Assessment

Using Azee as a forex broker comes with several risks that potential traders should consider. The lack of regulation, unclear trading conditions, and mixed customer feedback contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No verified regulatory oversight |

| Financial Risk | Medium | Unclear fee structure and potential hidden costs |

| Operational Risk | High | Platform performance issues and execution delays |

To mitigate these risks, traders should conduct thorough due diligence before committing funds to Azee. Opening a mini account to test the platform and trading conditions may provide valuable insights into its reliability.

Conclusion and Recommendations

In conclusion, while Azee Securities has established itself as a player in the forex market, significant concerns about its regulatory status, trading conditions, and customer experiences raise doubts about its safety. The lack of verified regulation and transparency, combined with user complaints about fund withdrawals and platform performance, suggest that traders should exercise caution.

If you are considering trading with Azee, it is essential to weigh these risks carefully. For those who prioritize safety and regulation, it may be advisable to explore alternative brokers with a solid regulatory framework and positive user reviews. Ultimately, the question of whether Azee is safe remains open, and potential traders should proceed with caution.

Is AZEE Securities Private Limited a scam, or is it legit?

The latest exposure and evaluation content of AZEE Securities Private Limited brokers.

AZEE Securities Private Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AZEE Securities Private Limited latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.