AZEE 2025 Review: Everything You Need to Know

Executive Summary

AZEE Securities stands out as one of Pakistan's leading retail stock brokers. The company earns an impressive user rating of 4.69 out of 5 stars based on 88 reviews. Established in 2003 and headquartered in Karachi, this azee review reveals a broker that has built its reputation on providing comprehensive financial services to retail investors seeking exposure to multiple asset classes.

The company's standout features include its exceptional 24/7 customer support service. Users consistently praise this service as a "game changer" in the industry. AZEE Securities offers a diverse range of trading opportunities, including equities, derivatives, IPO participation, commodities, indices, portfolio management, and forex trading. As a Corporate Member of Pakistan Stock Exchange Limited, the firm provides what it describes as a "360-degree solution" for equity investments in Pakistan's competitive financial market.

This broker primarily targets retail investors who desire access to multi-asset trading capabilities within the Pakistani market. The company's extensive experience spans over two decades. This experience has positioned it as one of the largest equity broking houses in Pakistan, serving clients with comprehensive financial solutions tailored to the local market dynamics.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Readers should note that specific regulatory details and compliance information were not extensively detailed in available materials. As with any financial service provider, potential clients are advised to conduct their own due diligence and verify regulatory status before engaging in any trading activities. The information presented reflects the broker's services as of 2025 and may be subject to change.

Rating Framework

Broker Overview

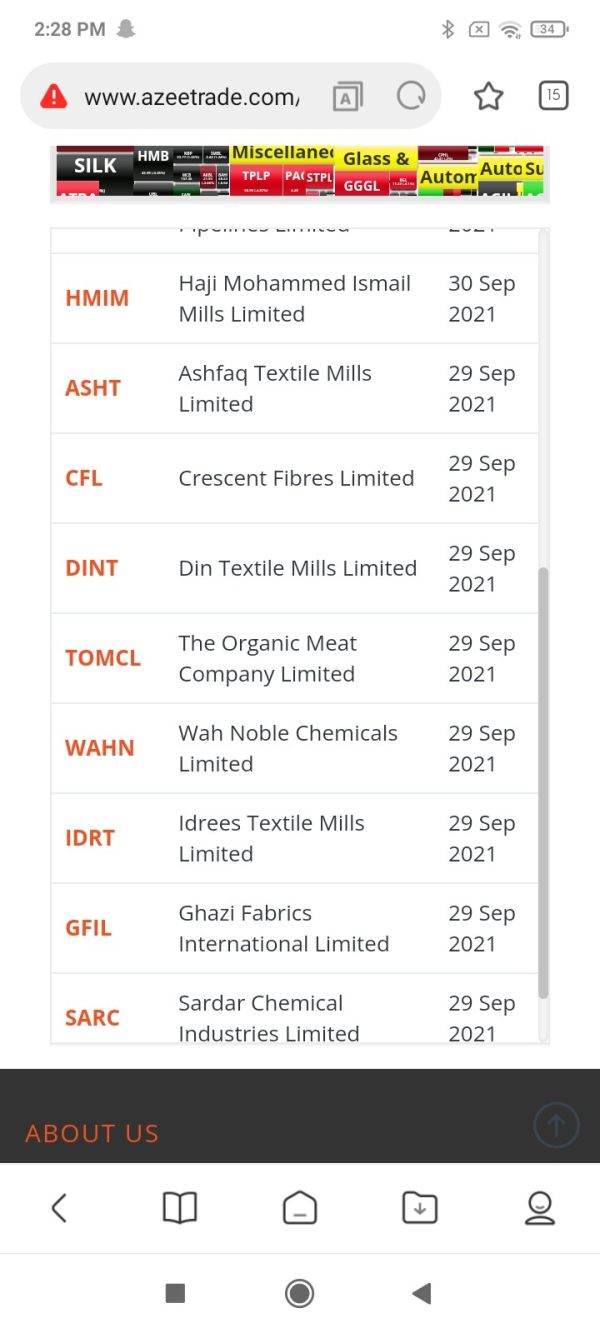

AZEE Securities began operations in 2003. The company established itself as a prominent player in Pakistan's financial services sector over the following years. Based in Karachi, Sindh, the company operates as a Corporate Member of Pakistan Stock Exchange Limited, which provides it with the necessary credentials to offer comprehensive equity broking services. The firm has grown significantly over its 22-year history. It now employs between 51-200 staff members and maintains a substantial social media following of 1,952 followers, indicating strong market presence and client engagement.

The company positions itself as a retail financial services provider specializing in stock brokerage services that span multiple financial sectors. AZEE Securities has built its business model around providing accessible investment solutions for individual investors seeking to participate in Pakistan's capital markets. This azee review indicates that the firm has successfully carved out a niche in serving retail clients who require professional guidance and comprehensive trading services.

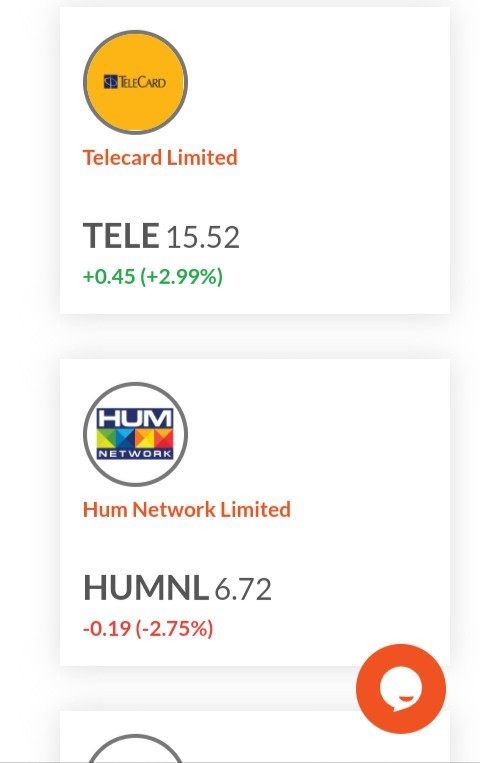

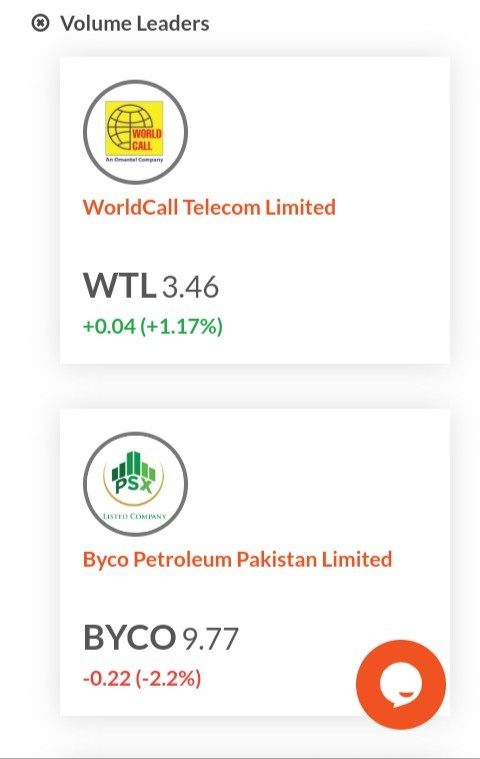

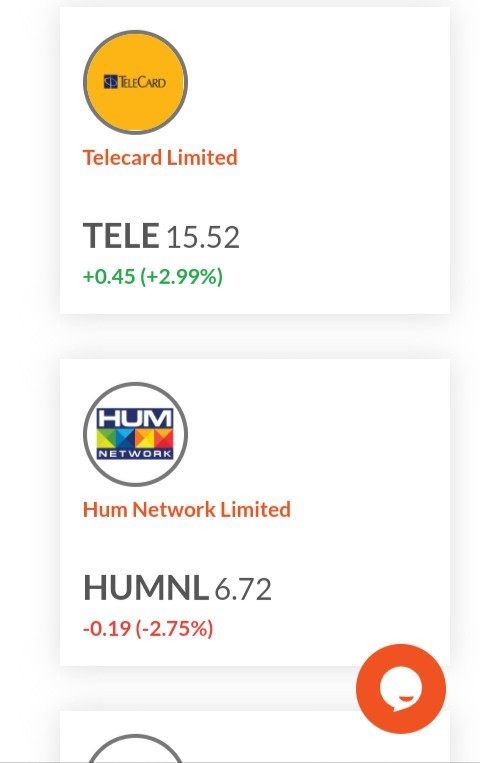

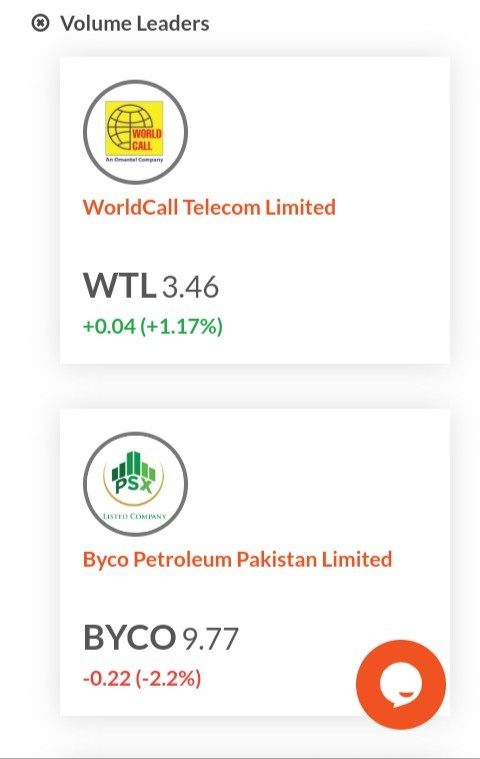

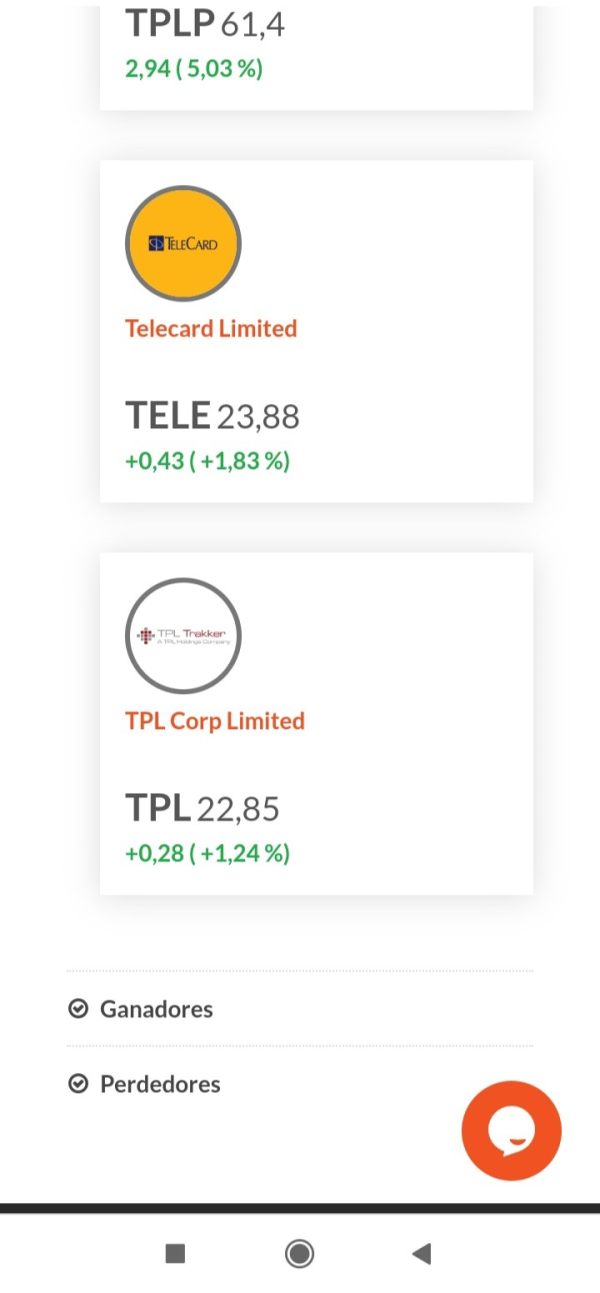

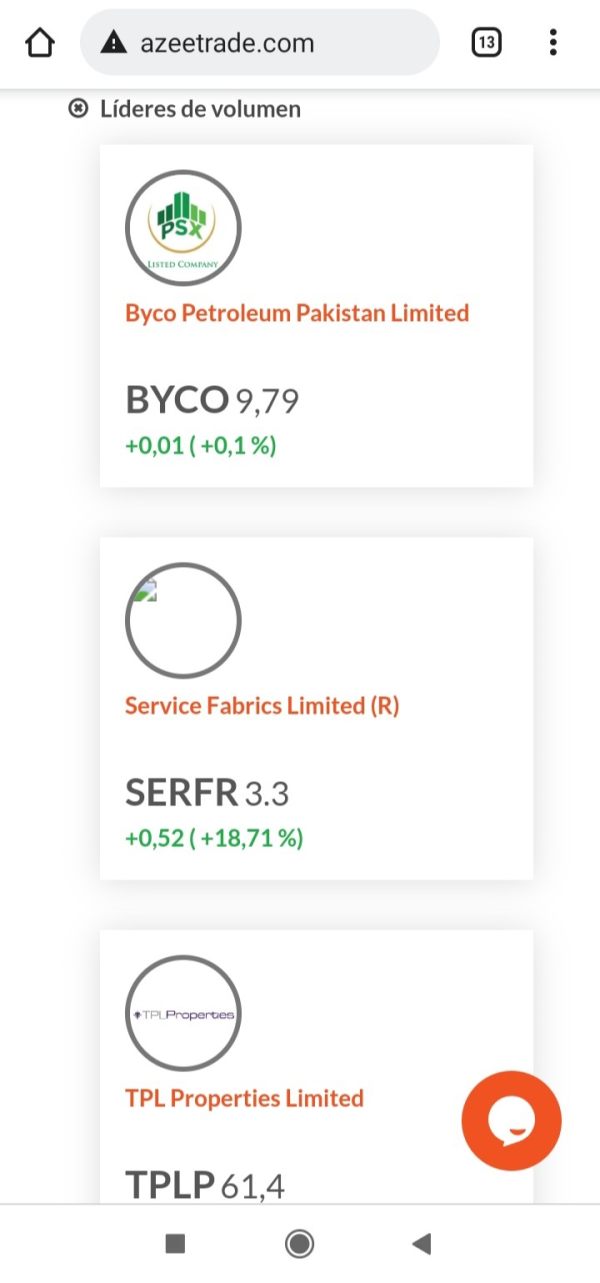

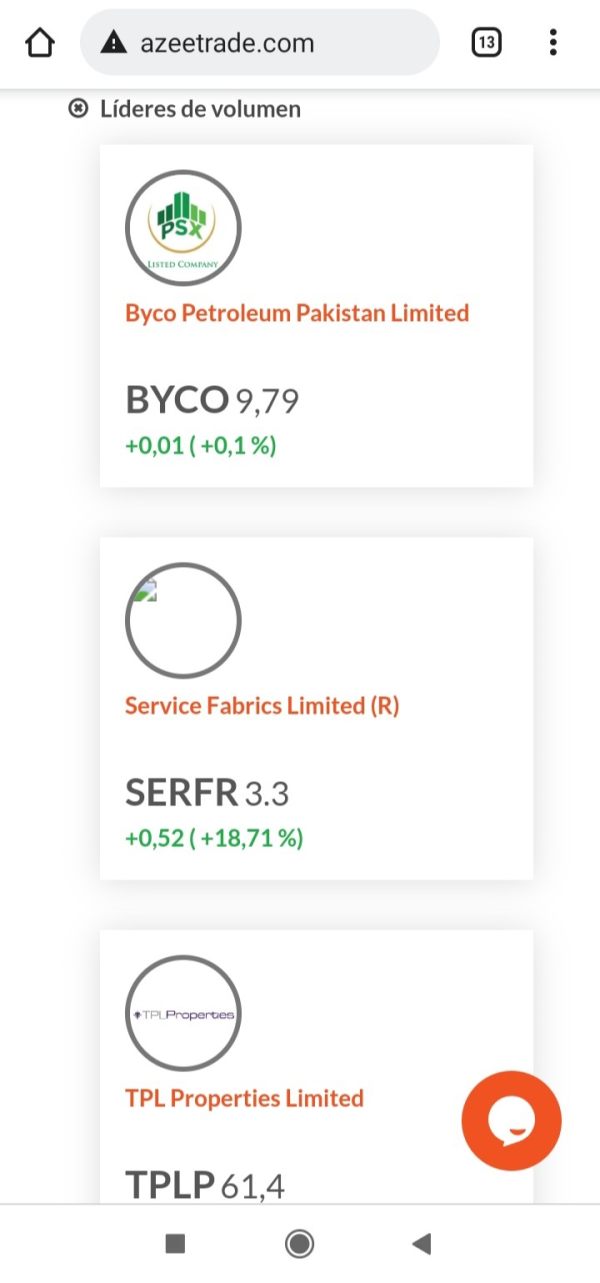

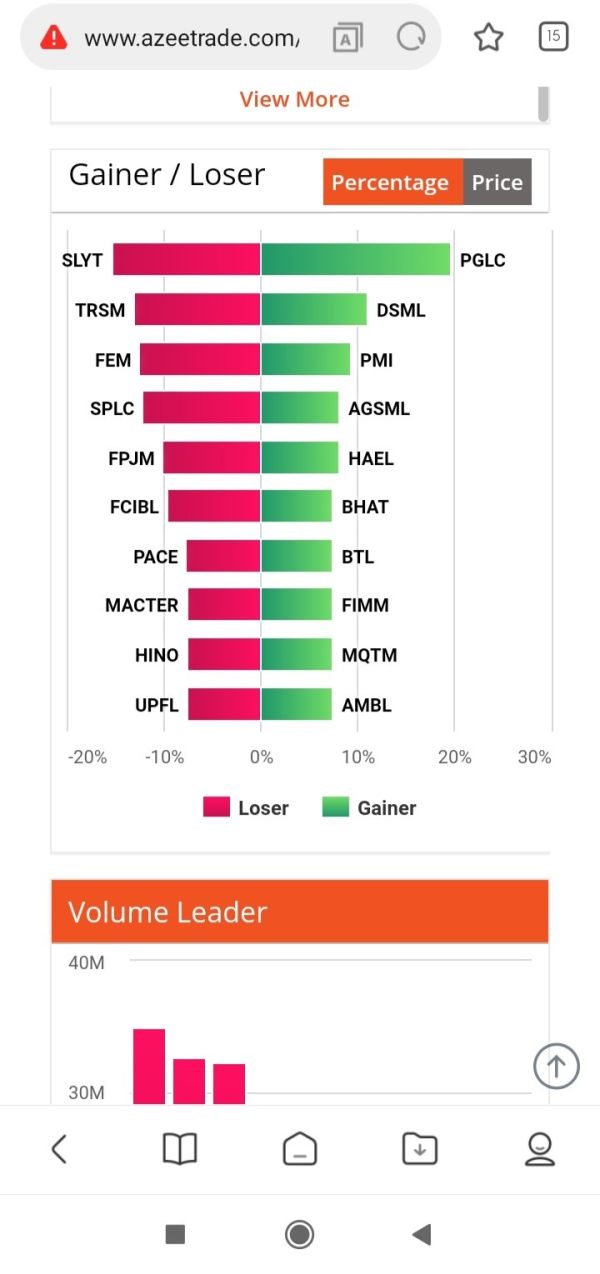

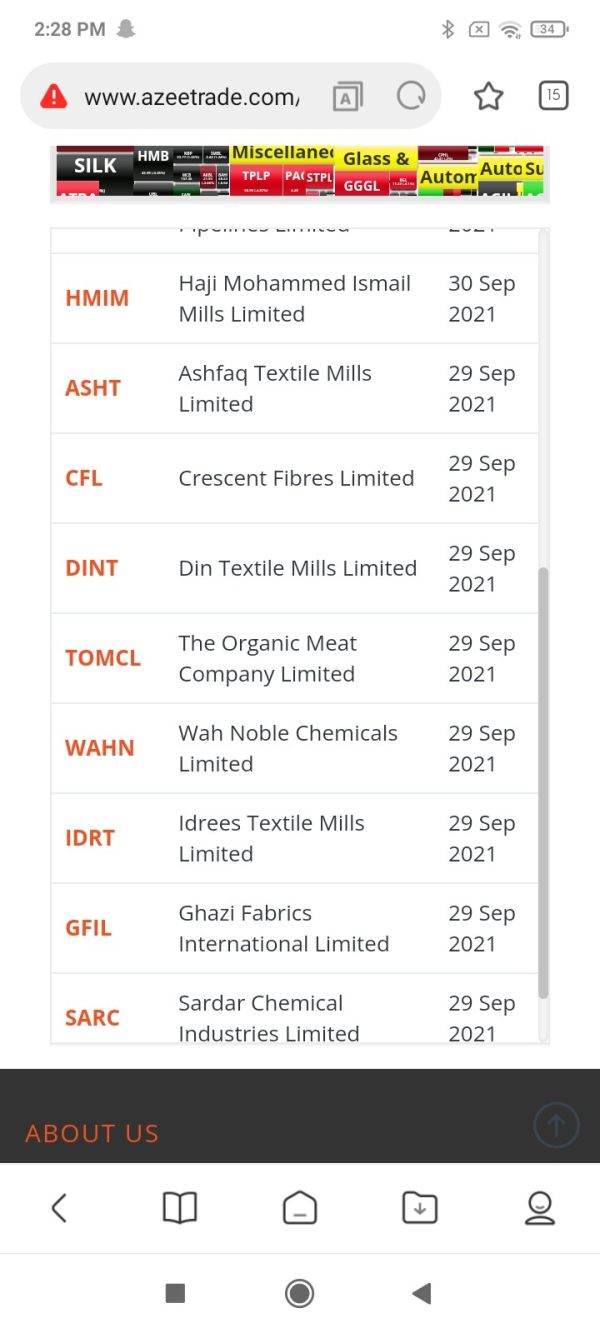

AZEE Securities provides an online trading platform for trading infrastructure. The company does not specify whether it uses popular platforms like MT4 or MT5 in available materials. The company offers access to a broad spectrum of asset classes including stocks, derivatives, IPO participation opportunities, commodity trading, index trading, portfolio management services, and foreign exchange. Available materials do not extensively cover specific regulatory oversight details. However, the firm's membership with Pakistan Stock Exchange Limited provides a foundational level of market authorization.

Regulatory Jurisdiction: Available information does not specify particular regulatory bodies overseeing AZEE Securities beyond its Corporate Membership with Pakistan Stock Exchange Limited. Potential clients should verify current regulatory status directly with the company.

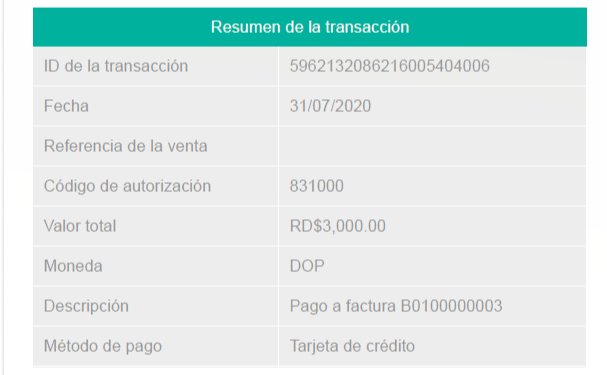

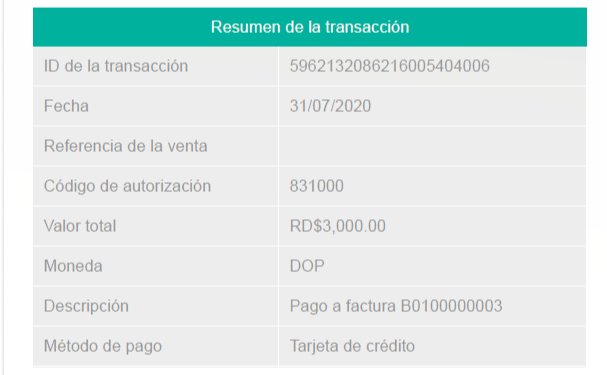

Deposit and Withdrawal Methods: Available source materials do not detail specific information regarding funding methods, processing times, and associated fees.

Minimum Deposit Requirements: The reviewed information does not specify exact minimum deposit amounts for different account types.

Bonus and Promotional Offers: Available materials do not cover details about current promotional campaigns, welcome bonuses, or ongoing client incentives.

Tradeable Assets: AZEE Securities offers a comprehensive range of investment products. These include equities, derivatives, IPO participation, commodities trading, index trading, portfolio management services, and foreign exchange trading, providing clients with diversified investment opportunities.

Cost Structure: Source materials reviewed for this azee review do not detail specific information about spreads, commissions, overnight fees, and other trading costs.

Leverage Ratios: Available materials do not specify maximum leverage ratios offered for different asset classes or account types.

Platform Options: The company provides online trading platforms. Available materials do not comprehensively cover specific platform software details, mobile application features, or web-based trading capabilities.

Geographic Restrictions: Available materials do not specify information about regional trading restrictions or prohibited jurisdictions.

Customer Service Languages: 24/7 support is confirmed. However, reviewed sources do not detail specific language support options.

Detailed Rating Analysis

Account Conditions Analysis

Publicly available materials largely leave the specific details regarding AZEE Securities' account structure undocumented. This azee review cannot provide comprehensive insights into the variety of account types offered, their respective features, or the differentiation between various client categories. Without access to detailed account specifications, it's challenging to assess whether the broker offers tiered account structures common in the industry. These structures typically include basic, premium, or VIP account classifications.

Available sources lack minimum deposit information, which prevents evaluation of the broker's accessibility to different investor segments. Many brokers structure their minimum deposits to accommodate various client demographics, from entry-level retail investors to high-net-worth individuals. Similarly, the reviewed materials do not detail account opening procedures, required documentation, and verification timelines.

Available information does not mention special account features, such as Islamic trading accounts that comply with Sharia law principles. Given Pakistan's predominantly Muslim population, such offerings would be particularly relevant for local clients. The lack of detailed account condition information represents a significant gap in this evaluation. These factors typically play crucial roles in client decision-making processes.

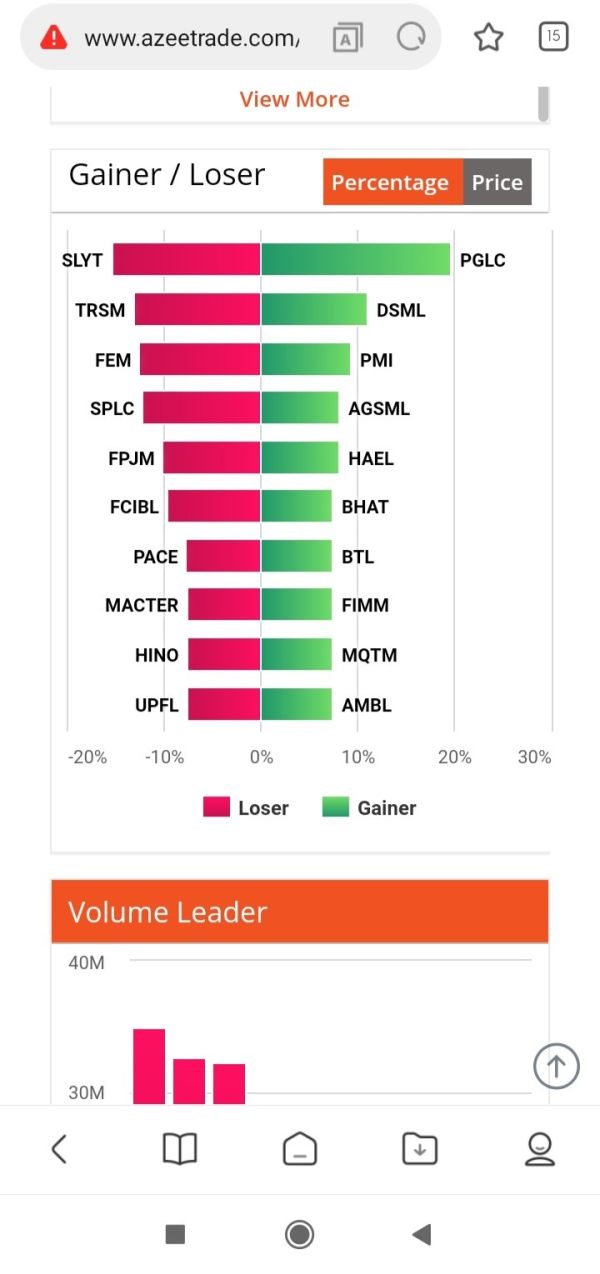

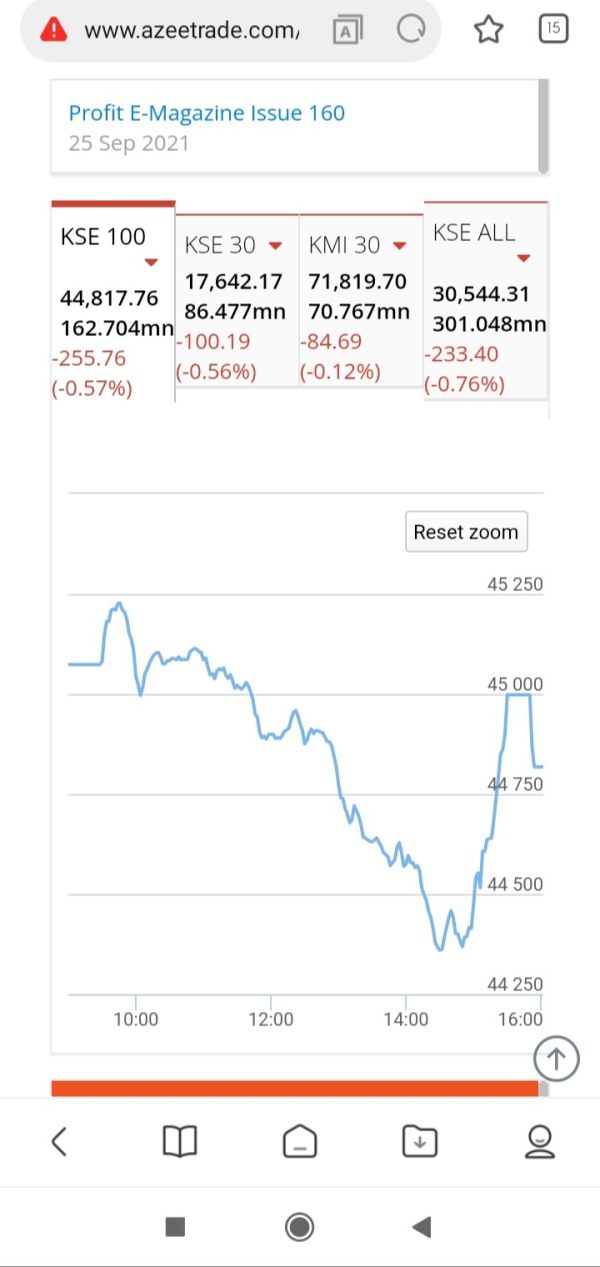

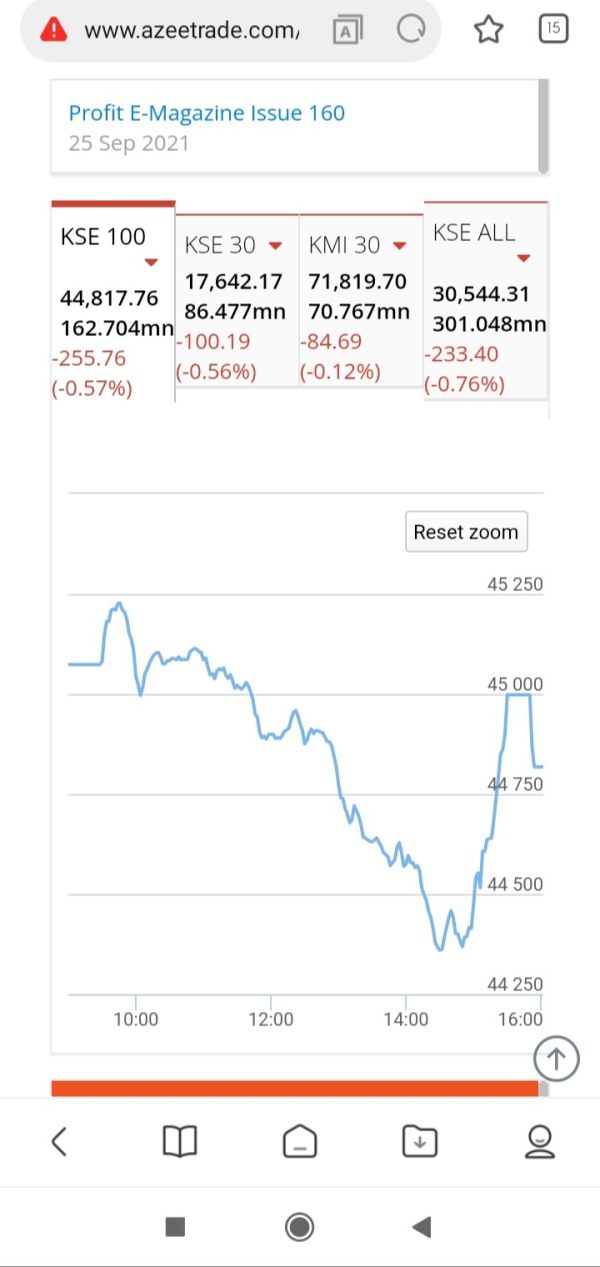

AZEE Securities demonstrates a solid commitment to providing essential trading tools and resources to its client base. The company offers an online trading platform that serves as the primary interface for client trading activities. Available materials do not detail specific technical specifications and advanced features. The platform appears designed to accommodate the diverse asset classes the broker supports, including equities, derivatives, and forex trading.

Market analysis and research capabilities represent another strength in the firm's service offering. The company provides market updates and research materials, which are essential resources for informed investment decision-making. However, the reviewed information does not specifically detail the depth, frequency, and analytical quality of these research materials.

Available materials do not extensively cover educational resources, which are increasingly important for retail investor development. Many modern brokers provide comprehensive educational programs, webinars, and learning materials to help clients improve their trading skills and market understanding. The absence of detailed information about educational offerings prevents a complete assessment of this important service dimension.

Available information does not mention automated trading support and advanced analytical tools, such as algorithmic trading capabilities or sophisticated charting packages. This leaves questions about the platform's technical sophistication for more advanced users.

Customer Service and Support Analysis

Customer service represents one of AZEE Securities' most notable strengths. Users consistently rate the service as "exceptional" and highlight the 24/7 support availability as a significant competitive advantage. This round-the-clock support accessibility addresses a critical need in financial markets, where trading opportunities and urgent issues can arise at any time, regardless of traditional business hours.

Users characterize customer support as a "game changer," which suggests that the quality of service significantly exceeds typical industry standards. This positive feedback indicates that the company has invested substantially in training and staffing its customer service operations to provide meaningful assistance to clients facing various challenges or requiring guidance.

However, available materials do not detail specific information about customer service channels, such as phone support, live chat availability, email response systems, or in-person consultation options. The reviewed information also does not specify response time metrics, which are crucial indicators of service efficiency.

Available materials do not explicitly cover multi-language support capabilities, which are particularly important in Pakistan's diverse linguistic environment. The absence of detailed problem resolution case studies or specific examples of exceptional service delivery limits the ability to provide concrete evidence of the service quality claims.

Trading Experience Analysis

Available materials lack comprehensive coverage of the trading experience dimension, making it challenging to provide a thorough evaluation of platform performance and user satisfaction. azee review materials do not include specific user feedback regarding platform stability, execution speeds, or overall trading environment quality. These are critical factors in determining trading experience quality.

Platform stability and execution reliability are fundamental requirements for any serious trading operation, particularly in fast-moving markets where delays or system failures can result in significant financial losses. Without specific user testimonials or performance data, it's impossible to assess how AZEE Securities' platform performs under various market conditions.

Available information does not detail order execution quality, including fill rates, slippage statistics, and execution speed metrics. These factors are particularly important for active traders who rely on precise execution timing for their trading strategies.

The reviewed materials do not specifically address mobile trading capabilities and user interface design, which have become increasingly important as traders seek flexibility and accessibility. The absence of detailed trading experience feedback represents a significant information gap in evaluating the broker's overall service quality.

Trust and Security Analysis

The trust and security evaluation for AZEE Securities faces significant limitations due to the absence of detailed regulatory information in available materials. The company's Corporate Membership with Pakistan Stock Exchange Limited provides some level of market authorization. However, comprehensive regulatory oversight details are not extensively covered in the azee review source materials.

Available information does not specify fund security measures, such as segregated client accounts, deposit insurance coverage, or third-party fund custody arrangements. These security features are crucial for client confidence and represent standard industry practices for reputable brokers.

Reviewed materials do not detail company transparency regarding financial statements, operational procedures, and business practices. Transparency is a key factor in building client trust and demonstrating corporate responsibility in financial services.

Available sources do not mention industry reputation and recognition, including awards, certifications, or peer acknowledgments. Similarly, information about how the company handles negative events, disputes, or regulatory issues is not covered.

The absence of comprehensive regulatory and security information represents a significant limitation in assessing the broker's trustworthiness and reliability from a client protection perspective.

User Experience Analysis

User satisfaction metrics provide the strongest positive indicator for AZEE Securities. The company achieves an impressive 4.69 out of 5 rating based on 88 user reviews. This high satisfaction score suggests that clients generally have positive experiences with the broker's services and find value in the offerings provided.

The target demographic of retail investors seeking multi-asset trading opportunities appears well-aligned with the company's service structure. The broker's focus on providing comprehensive solutions for equity investments, combined with access to derivatives, commodities, and forex markets, creates a diversified offering that can meet various investor needs and preferences.

However, available materials do not cover specific details about user interface design, platform navigation ease, and overall usability. The reviewed information does not detail registration and account verification processes, which significantly impact initial user experience.

Available sources do not specifically address fund management experiences, including deposit and withdrawal procedures, processing times, and associated user satisfaction levels. Available sources do not identify common user complaints or recurring issues that might affect overall satisfaction. This limits the ability to provide balanced feedback about potential areas for improvement.

Conclusion

AZEE Securities presents itself as a well-established Pakistani broker with over two decades of market experience and strong user satisfaction ratings of 4.69 out of 5. The company's primary strengths lie in its exceptional customer service, comprehensive 24/7 support, and diverse asset class offerings that cater to retail investors seeking multi-asset trading opportunities within the Pakistani market.

The broker appears particularly suitable for retail investors who value responsive customer support and seek access to various investment products. These products include equities, derivatives, commodities, and forex trading. The company's long-standing presence in Pakistan's financial sector and Corporate Membership with Pakistan Stock Exchange Limited suggest operational stability and market credibility.

However, this evaluation reveals significant information gaps regarding regulatory oversight details, specific account conditions, trading costs, and technical platform specifications. Potential clients should conduct additional due diligence to obtain comprehensive information about regulatory compliance, fee structures, and platform capabilities before making investment decisions.