Is atatong safe?

Business

License

Is Atatong Safe or a Scam?

Introduction

Atatong Financial Services Group Limited, commonly referred to as Atatong, positions itself as a global player in the foreign exchange market, offering a diverse range of trading instruments, including currencies, cryptocurrencies, stocks, indices, and metals. As the forex market continues to grow, the importance of choosing a reliable broker cannot be overstated. Traders need to be vigilant in evaluating the legitimacy and safety of forex brokers, as the market is rife with scams and unregulated entities. This article aims to investigate the safety of Atatong by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory landscape is a critical factor in assessing the safety of any forex broker. Atatong claims to operate under a regulatory framework; however, its status has been flagged as a "suspicious clone" by various financial watchdogs. This raises significant concerns regarding its legitimacy and operational practices. Below is a table summarizing the core regulatory information for Atatong:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unknown | United States | Suspicious Clone |

The lack of a verifiable license and the label of a "suspicious clone" indicate that Atatong may not meet the regulatory standards necessary to ensure client protection. This absence of oversight is particularly alarming, as it can lead to potential fraud and malpractice. Traders should be cautious when dealing with brokers that do not have a solid regulatory foundation, as this often correlates with high risks and low accountability.

Company Background Investigation

Atatong was established in 2010, and although it claims to have garnered recognition for its trading services, the details surrounding its ownership and management team remain vague. The company's operational history, including its growth trajectory and any significant milestones, is not readily available. This lack of transparency can be a red flag for potential clients.

Furthermore, the management team's qualifications and experience are crucial in determining the broker's reliability. Without accessible information about the leadership, traders may find it challenging to trust the company's operations. Transparency in a broker's structure and its management is paramount for building confidence among clients.

Trading Conditions Analysis

Understanding the trading conditions offered by Atatong is essential for evaluating its overall appeal. While the broker claims to provide competitive spreads and a variety of account types, the specifics regarding fees and trading costs are not clearly outlined. Below is a comparative table of core trading costs:

| Fee Type | Atatong | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 0.1 - 1.5 pips |

| Commission Model | Unspecified | Varies by broker |

| Overnight Interest Range | Unspecified | 0.5% - 2% |

The absence of clear information regarding spreads, commissions, and overnight interest rates raises concerns about potential hidden fees. Unusual or unclear fee structures can lead to unexpected costs for traders, which may ultimately affect their profitability. Therefore, it is crucial for traders to fully understand the fee landscape before committing to a broker.

Customer Fund Safety

The safety of customer funds is a paramount concern when choosing a forex broker. Atatong claims to implement various safety measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Traders should be particularly wary if a broker lacks a robust framework for fund protection. The absence of a well-defined policy for negative balance protection and investment safeguards can lead to significant losses, especially in volatile market conditions. Historical issues related to fund safety at Atatong, if any, should also be thoroughly investigated to gauge the broker's reliability.

Customer Experience and Complaints

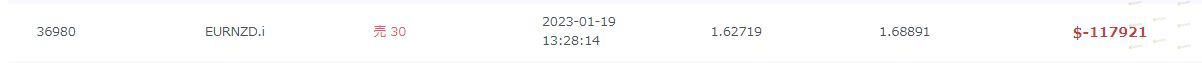

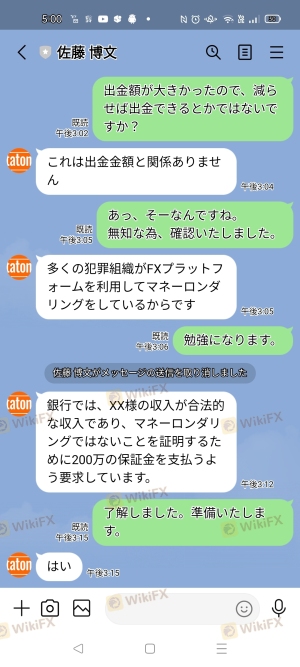

Customer feedback plays a crucial role in understanding the real-world experience of traders with Atatong. An analysis of online reviews reveals a mixed bag of experiences, with some users reporting satisfactory trading experiences, while others have raised serious concerns about withdrawal issues and customer service.

The table below summarizes the main types of complaints against Atatong and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inconsistent |

| Account Management | Low | Acceptable |

Common complaints include difficulties in withdrawing funds and poor customer support. These issues are significant red flags that indicate potential underlying problems within the broker's operations. Traders should exercise caution and consider these complaints seriously when evaluating whether Atatong is safe.

Platform and Execution

The performance of the trading platform is a critical factor in the overall trading experience. Atatong claims to offer a robust trading platform with advanced features; however, user experiences suggest varying levels of satisfaction regarding platform stability and order execution quality.

Issues such as slippage and order rejection have been reported, which can severely impact trading outcomes. Traders should be cautious of any signs of platform manipulation, as these can indicate deeper systemic issues within the broker.

Risk Assessment

Using Atatong as a trading platform entails inherent risks. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of credible regulation |

| Fund Security | High | Insufficient protection measures |

| Customer Service | Medium | Mixed feedback on support quality |

| Trading Conditions | Medium | Unclear fee structures and policies |

Traders should consider implementing risk mitigation strategies, such as starting with a small investment or utilizing demo accounts to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Atatong raises multiple red flags regarding its safety and legitimacy. The lack of credible regulation, mixed customer feedback, and unclear trading conditions indicate that traders should approach this broker with caution.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by top-tier authorities, such as the FCA or ASIC, which provide a more secure trading environment. Overall, while Atatong may offer various trading instruments, the potential risks associated with its operations may outweigh the benefits. Therefore, it is crucial for traders to perform thorough due diligence before engaging with Atatong or similar brokers in the forex market.

Is atatong a scam, or is it legit?

The latest exposure and evaluation content of atatong brokers.

atatong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

atatong latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.