Merry Capital 2025 Review: Everything You Need to Know

Summary

This Merry Capital review shows major concerns about this trading platform. Traders should think carefully before investing here. The company started in 2022 in Sydney, Australia, and offers access to over 90 trading instruments across multiple asset classes including forex, precious metals, energy, indices, stocks, and cryptocurrencies. It attracts attention with high leverage up to 1:500, which might appeal to traders seeking amplified market exposure.

However, our research finds serious red flags that overshadow these benefits. Most importantly, Merry Capital operates without authorization from any recognized financial regulatory authority, which raises basic questions about trader protection and fund security. The Australian Securities and Investments Commission (ASIC) has issued specific warnings about this company. WikiFX assigns it a concerning rating of just 1 out of 10 points. Multiple user complaints have emerged regarding fund theft and poor customer service responses, painting a troubling picture of how the company operates.

This broker mainly targets traders with higher risk tolerance. Even experienced investors should be extremely careful. While the platform's extensive instrument selection and high leverage ratios might seem attractive, the absence of regulatory oversight and documented user complaints suggest significant operational and security risks that could result in substantial financial losses.

Important Notice

This evaluation is based on publicly available information, user feedback, and regulatory warnings as of January 2025. Readers should note that our assessment relies primarily on official regulatory communications, third-party rating platforms, and documented user experiences due to limited transparent information from the broker itself.

Given the absence of comprehensive regulatory oversight and the presence of multiple warning signals from financial authorities, prospective clients should conduct thorough independent research. They should also consider consulting with licensed financial advisors before making any investment decisions. The information presented reflects the current available data and may not capture all aspects of the broker's operations or recent developments.

Our Rating Framework

Broker Overview

Merry Capital emerged in the financial trading landscape in 2022. The company positioned itself as a Sydney-based financial services provider targeting the global retail trading market. Merry Capital presents a comprehensive trading ecosystem designed to serve individual investors seeking exposure to diverse financial markets. Operating from Australia, the company has structured its business model around providing access to multiple asset classes through a single trading platform, attempting to capture market share in the competitive online brokerage sector.

The company's business approach centers on offering high-leverage trading opportunities across traditional and contemporary financial instruments. Their service portfolio encompasses foreign exchange markets, precious metals trading, energy commodities, global stock indices, individual equity securities, and the increasingly popular cryptocurrency markets. This broad spectrum approach aims to attract traders with varying interests and risk profiles. It targets everyone from conservative investors seeking stable forex pairs to more aggressive traders pursuing volatile cryptocurrency opportunities.

However, this Merry Capital review must emphasize a critical operational aspect: the company operates without authorization from any recognized financial regulatory authority. Unlike established brokers who maintain licenses from respected regulators such as the Financial Conduct Authority (FCA), Securities and Exchange Commission (SEC), or Cyprus Securities and Exchange Commission (CySEC), Merry Capital lacks such credentialing. This regulatory gap represents a fundamental concern for potential clients, as it means traders have limited recourse options and reduced protection for their invested capital should disputes or operational issues arise.

Regulatory Status: Merry Capital operates in a regulatory vacuum. The company has failed to secure authorization from any major financial oversight body. Most concerning, the Australian Securities and Investments Commission (ASIC) has issued explicit warnings regarding this entity, signaling potential risks to Australian and international traders. This regulatory absence means clients lack access to compensation schemes and dispute resolution mechanisms typically available through licensed brokers.

Available Trading Assets: The platform offers access to over 90 trading instruments spanning six major categories. Forex traders can access major, minor, and exotic currency pairs, while commodity enthusiasts can trade precious metals like gold and silver alongside energy products. The inclusion of global stock indices provides exposure to major economies, complemented by individual stock trading opportunities. Cryptocurrency trading rounds out the offering, though specific digital assets available remain unclear from available information.

Leverage Conditions: Merry Capital advertises maximum leverage ratios of up to 1:500. This is significantly higher than many regulated brokers who must comply with leverage restrictions. While this high leverage can amplify potential profits, it equally magnifies potential losses, making it particularly risky for inexperienced traders. The absence of regulatory oversight means there are no protective leverage caps typically imposed by financial authorities.

Cost Structure: Specific information regarding spreads, commissions, and fee structures remains undisclosed in available materials. This represents a significant transparency gap. The lack of clear pricing information makes it impossible for potential clients to accurately assess trading costs or compare the broker's competitiveness against established alternatives.

Platform and Technology: Available sources do not provide detailed information about the trading platform(s) offered by Merry Capital. This includes whether they utilize popular platforms like MetaTrader 4/5 or proprietary solutions. The information gap extends to mobile trading capabilities, platform stability, and execution speeds.

This Merry Capital review highlights significant information deficiencies that potential clients should consider concerning when evaluating this broker against more transparent alternatives in the market.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Merry Capital's account conditions present several transparency challenges. These contribute to our modest 4/10 rating in this category. The broker fails to provide clear information about account types, minimum deposit requirements, or specific trading conditions that potential clients need to make informed decisions. This lack of transparency stands in stark contrast to reputable brokers who typically offer detailed breakdowns of their account structures, including standard, premium, and VIP tiers with clearly defined benefits and requirements.

The absence of publicly available information regarding minimum deposit thresholds raises immediate concerns about accessibility and target market positioning. Established brokers typically offer accounts ranging from $10 to $500 minimum deposits, allowing traders to start with amounts matching their risk tolerance and experience level. Without this fundamental information, potential Merry Capital clients cannot properly assess whether the broker aligns with their financial capacity or trading objectives.

Furthermore, the lack of details about special account features such as Islamic accounts, demo accounts, or educational accounts suggests either limited service offerings or poor communication of available services. User complaints documented across various platforms indicate problems with account security and fund accessibility, with some traders reporting difficulties withdrawing their invested capital. These concerning reports, combined with the general lack of transparent account information, significantly impact our assessment of Merry Capital's account conditions.

The Merry Capital review findings suggest that prospective clients should demand comprehensive account information before proceeding. The current transparency level falls well below industry standards established by regulated competitors.

Despite regulatory concerns, Merry Capital earns a relatively strong 7/10 rating for tools and resources. This is primarily due to its extensive selection of over 90 trading instruments across six major asset categories. The comprehensive offering provides traders with significant diversification opportunities, spanning traditional forex markets, precious metals, energy commodities, global indices, individual stocks, and contemporary cryptocurrency markets. Such breadth of available instruments matches or exceeds many established brokers, particularly in the cryptocurrency space where traditional brokers often lag.

The forex selection appears to cover major pairs like EUR/USD, GBP/USD, and USD/JPY, alongside minor and exotic pairs that appeal to more sophisticated traders seeking unique opportunities. Precious metals trading likely includes gold, silver, and possibly platinum and palladium, providing traditional safe-haven investment options. Energy trading opportunities probably encompass crude oil, natural gas, and related commodities that respond to global economic and geopolitical developments.

However, this positive assessment must be tempered by the lack of detailed information about research and analysis resources, educational materials, or trading tools beyond basic instrument access. Reputable brokers typically provide market analysis, economic calendars, trading signals, and educational webinars to support client success. The absence of information about such resources in available materials suggests either limited offerings or inadequate communication of available services.

Additionally, without specific details about automated trading support, API access, or advanced charting tools, traders cannot fully assess whether Merry Capital's platform meets their technical analysis and strategy implementation needs. While the instrument variety is impressive, the overall tools and resources package remains incompletely defined.

Customer Service and Support Analysis (3/10)

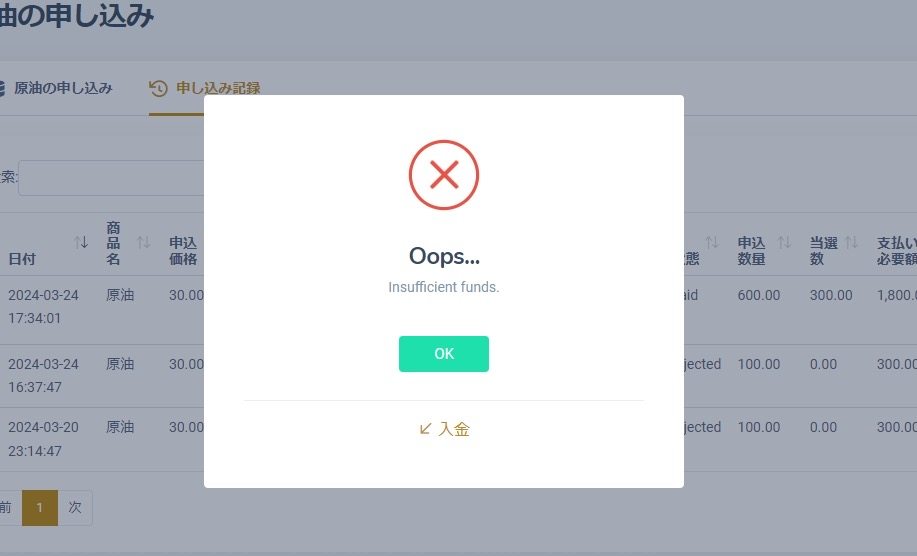

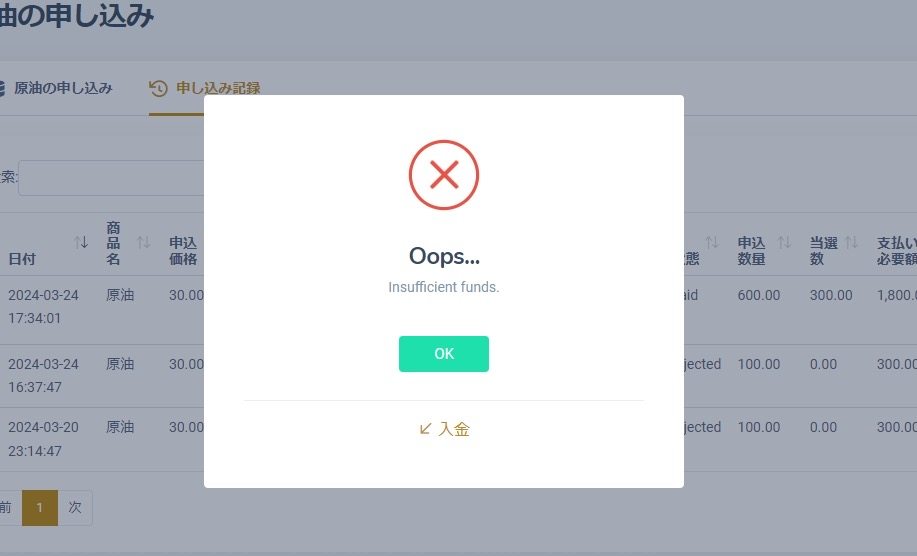

Customer service represents one of Merry Capital's most concerning weaknesses. It earns only 3/10 in our assessment. Multiple user complaints document serious issues with support responsiveness and problem resolution, particularly regarding fund security and withdrawal processes. These complaints paint a troubling picture of a support system that fails to adequately address client concerns or provide timely assistance when needed most.

According to available user feedback, traders have experienced significant delays in receiving responses to support inquiries. Some report complete lack of communication from customer service representatives. This communication breakdown becomes particularly problematic when clients encounter account access issues or have concerns about fund safety. The absence of clear information about available support channels – whether phone, email, live chat, or social media – further compounds these accessibility problems.

Most concerning are documented cases where traders report fund theft or unauthorized account access, with subsequent support interactions failing to provide adequate resolution or explanation. These serious allegations suggest either inadequate security measures or insufficient support team training to handle complex security incidents. The lack of transparent escalation procedures or management contact information leaves affected clients with limited recourse options.

The support quality concerns extend to basic service elements. There is no clear information available about support hours, multilingual capabilities, or response time commitments. Established brokers typically provide 24/5 or 24/7 support with guaranteed response times and multiple language options. Merry Capital's apparent deficiencies in these fundamental service areas contribute significantly to the overall trust and reliability concerns identified in this evaluation.

Trading Experience Analysis (5/10)

The trading experience evaluation yields a middle-ground 5/10 rating. This is primarily due to insufficient reliable information about platform performance, execution quality, and user interface design. While Merry Capital offers access to diverse markets with high leverage ratios, the actual trading experience remains largely undocumented in available user feedback and official communications, making comprehensive assessment challenging.

Available information suggests the platform supports various asset classes with leverage up to 1:500, potentially providing traders with significant market exposure opportunities. However, critical performance metrics such as execution speeds, slippage rates, and platform uptime remain undisclosed. These technical specifications directly impact trading success, particularly for scalpers and high-frequency traders who depend on rapid order execution and minimal price deviation.

The absence of detailed platform information extends to user interface design, charting capabilities, and order management tools. Modern traders expect sophisticated charting packages with multiple timeframes, technical indicators, and drawing tools. Without clear documentation of these features, potential clients cannot assess whether Merry Capital's platform meets their analytical and execution requirements.

Mobile trading capabilities represent another information gap. Contemporary traders increasingly rely on smartphone and tablet access for market monitoring and trade management. The lack of specific mobile app information or mobile web platform details suggests either limited mobile offerings or inadequate marketing communication of available features.

This Merry Capital review emphasizes that the moderate rating reflects uncertainty rather than confirmed quality. It highlights the need for potential clients to thoroughly test any demo accounts or trial periods before committing significant capital to the platform.

Trust and Reliability Analysis (2/10)

Trust and reliability represent Merry Capital's most significant weakness. The category earns a concerning 2/10 rating that reflects fundamental operational and regulatory deficiencies. The absence of authorization from any recognized financial regulatory authority creates an immediate trust deficit, as clients lack the protective frameworks typically provided by licensed brokers operating under established oversight regimes.

The Australian Securities and Investments Commission (ASIC) has issued specific warnings about Merry Capital. This indicates regulatory concern about the entity's operations and potential risks to investors. Such warnings from major financial authorities carry significant weight and typically result from identified operational irregularities, consumer complaints, or failure to meet regulatory standards. This official regulatory concern substantially undermines confidence in the broker's legitimacy and operational integrity.

WikiFX, a prominent broker verification platform, assigns Merry Capital a rating of just 1 out of 10 points. This reflects severe concerns about the broker's reliability and safety. The exceptionally low rating typically indicates multiple red flags including regulatory issues, user complaints, and operational transparency problems. Such ratings serve as important warning signals for potential clients considering broker selection.

User complaints documented across various platforms report serious issues including alleged fund theft, withdrawal difficulties, and unresponsive customer service. These reports, while requiring independent verification, create a pattern of concern that aligns with the regulatory warnings and low third-party ratings. The combination of unregulated status, official warnings, poor third-party ratings, and user complaints creates a comprehensive trust deficit.

The absence of transparent company information, including detailed management profiles, audited financial statements, or clear operational procedures, further compounds reliability concerns. Established brokers typically provide extensive company information to build client confidence and demonstrate operational transparency.

User Experience Analysis (4/10)

User experience assessment yields a 4/10 rating. This reflects limited positive feedback and concerning reports about overall service quality and platform functionality. Available user testimonials and reviews present a predominantly negative picture, with only isolated positive comments failing to offset broader concerns about service delivery and client satisfaction.

The limited positive feedback available suggests that some users appreciate the extensive instrument selection and high leverage options. This particularly applies to traders seeking exposure to diverse markets through a single platform. However, these positive elements are overshadowed by more frequent complaints about fundamental service issues including account security, fund safety, and support responsiveness.

User interface and platform usability information remains largely unavailable in documented feedback. This prevents comprehensive assessment of navigation ease, feature accessibility, and overall design quality. Modern traders expect intuitive interfaces with customizable layouts, efficient order placement systems, and comprehensive account management tools. The absence of detailed user feedback about these critical elements suggests either limited platform sophistication or insufficient user engagement to generate comprehensive reviews.

Registration and account verification processes lack detailed documentation in available user experiences. This makes it difficult to assess onboarding efficiency and compliance procedures. Established brokers typically streamline these processes while maintaining necessary security and regulatory compliance measures. Without clear user feedback about account opening experiences, potential clients cannot anticipate the time and documentation requirements involved.

The concentration of user complaints around fund security and withdrawal processes represents a critical user experience failure. Regardless of platform sophistication or instrument variety, fundamental concerns about fund safety create an unacceptable user experience that undermines all other service elements. These security concerns, combined with limited positive feedback and insufficient platform documentation, contribute to the below-average user experience rating.

Conclusion

This comprehensive Merry Capital review reveals a broker with significant operational and regulatory concerns. These substantially outweigh any potential benefits. While the platform offers an extensive selection of over 90 trading instruments and high leverage ratios up to 1:500, these features cannot compensate for fundamental deficiencies in regulatory compliance, customer protection, and service reliability.

The absence of authorization from recognized financial authorities, combined with explicit ASIC warnings and a 1/10 WikiFX rating, creates an unacceptable risk profile for most traders. User complaints regarding fund security and withdrawal difficulties further reinforce concerns about operational integrity and client fund protection.

Merry Capital might theoretically appeal to experienced traders with extremely high risk tolerance who prioritize instrument variety and leverage over regulatory protection. However, even sophisticated investors should seriously question whether any potential benefits justify the documented risks and regulatory concerns. The combination of unregulated status, official warnings, poor third-party ratings, and user complaints suggests that safer, regulated alternatives would better serve most traders' interests and capital protection needs.