Is Atallia safe?

Pros

Cons

Is Atallia Safe or Scam?

Introduction

Atallia is an online forex broker that positions itself within the competitive landscape of the forex market, offering a variety of trading instruments including forex pairs, indices, cryptocurrencies, and commodities. As the forex market continues to grow, the importance of choosing a reliable broker cannot be overstated. Traders must exercise caution and thoroughly evaluate brokers to avoid potential scams and ensure their investments are secure. This article investigates the safety and legitimacy of Atallia by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

When assessing the safety of any forex broker, regulatory oversight is a crucial factor. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Atallia currently operates without any valid regulatory licenses, which raises significant concerns about its legitimacy.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Atallia is not subject to the scrutiny and accountability that regulated brokers must adhere to. This lack of oversight can lead to potential risks for traders, including the possibility of fraudulent activities. Historical compliance records indicate that unregulated brokers often have a higher incidence of customer complaints and disputes, further emphasizing the need for caution when considering Atallia as a trading partner.

Company Background Investigation

Atallia Traders Limited, the parent company of Atallia, claims to operate from the United Kingdom. However, the lack of a clear history or substantial information about the company's founding and ownership structure raises red flags. The absence of transparency regarding the management team and their professional backgrounds further complicates the assessment of Atallias credibility.

In the forex industry, a reputable broker typically provides detailed information about its leadership, including their qualifications and experience. This transparency builds trust with potential clients. However, Atallia fails to meet these expectations, leaving potential traders in the dark about who is managing their investments.

Trading Conditions Analysis

Atallia offers various trading conditions, but the lack of transparency regarding fees and costs is concerning. The overall fee structure is crucial for traders, as hidden costs can significantly impact profitability.

| Fee Type | Atallia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0-2.0 pips |

| Commission Model | Unknown | $5-$10 per lot |

| Overnight Interest Range | Unknown | Varies by broker |

The absence of clear information about spreads and commissions suggests that traders may face unexpected charges. Furthermore, the lack of a transparent overnight interest policy could lead to additional costs that are not disclosed upfront. This ambiguity creates uncertainty and may deter potential customers from engaging with Atallia.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Atallia's lack of regulatory oversight raises concerns about its fund security measures. A reputable broker typically implements strict policies for fund segregation, investor protection, and negative balance protection.

Without these safeguards, traders risk losing their investments, especially in volatile market conditions. Additionally, any historical issues regarding fund safety or disputes have not been adequately addressed by Atallia, which could signal deeper systemic problems within the company.

Customer Experience and Complaints

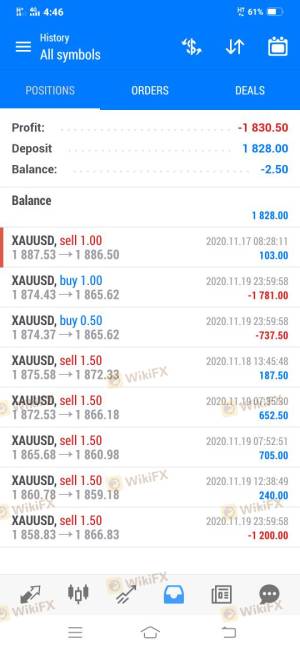

Analyzing customer feedback is essential in understanding the overall experience with a broker. Atallia has received numerous complaints regarding its services, particularly concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds and a lack of communication from customer service representatives. These issues reflect poorly on Atallias commitment to customer satisfaction and raise questions about its operational integrity. For potential traders, these complaints should serve as a warning sign when considering whether Atallia is safe.

Platform and Trade Execution

The trading platform offered by Atallia is another critical aspect to evaluate. A reliable platform should be stable, user-friendly, and capable of executing trades efficiently. However, reports of execution delays, slippage, and rejected orders have been noted by users.

These issues can significantly affect trading performance, especially for those employing high-frequency trading strategies. If traders experience frequent slippage or rejected orders, it can lead to substantial financial losses. Therefore, the overall performance of Atallia's trading platform raises concerns about its reliability and effectiveness.

Risk Assessment

Using Atallia as a forex broker presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Fund Safety Risk | High | Lack of investor protection measures. |

| Trading Conditions Risk | Medium | Ambiguous fees and execution issues. |

To mitigate these risks, traders should conduct thorough research and consider starting with a small investment to test the platform's reliability. Additionally, seeking out alternative, regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Atallia poses significant risks to potential traders. The lack of regulation, transparency issues, and numerous customer complaints indicate that Atallia may not be a safe choice for forex trading.

For traders seeking a reliable broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as [insert reputable brokers here] offer safer trading environments with robust regulatory oversight and transparent practices. Ultimately, due diligence is essential in ensuring the security of your investments in the forex market.

In summary, is Atallia safe? The answer leans towards caution, and potential traders should be wary of engaging with this broker.

Is Atallia a scam, or is it legit?

The latest exposure and evaluation content of Atallia brokers.

Atallia Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atallia latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.