Regarding the legitimacy of Agm Forex forex brokers, it provides CYSEC and WikiBit, .

Is Agm Forex safe?

Business

License

Is Agm Forex markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Maxigrid Limited

Effective Date:

2011-05-31Email Address of Licensed Institution:

infobox@maxigrid.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.agmmarkets.com, www.dualix.com, www.maxigrid.comExpiration Time:

--Address of Licensed Institution:

214 Arch. Makarios III Avenue, Office 301, ‘IDEAL BUILDING’ Agias Zonis, 3030 Limassol, Cyprus, 214 Arch. Makariou III, Ideal Building, Office 301, Ayia Zoni, 3030, Limassol, Cyprus.Phone Number of Licensed Institution:

+357 25 262 922Licensed Institution Certified Documents:

Is AGM Forex Safe or a Scam?

Introduction

AGM Forex, a relatively new player in the forex market, was established in 2020 and is based in Cyprus. It positions itself as a broker offering a variety of trading options, including forex and metals, with a focus on providing a user-friendly trading experience. However, the increasing number of unregulated brokers in the market raises concerns for traders looking to invest their hard-earned money. It's crucial for traders to evaluate the legitimacy and safety of their chosen brokers, as the forex market can be rife with scams and fraudulent activities. This article aims to assess whether AGM Forex is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

AGM Forex claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a significant factor in determining its legitimacy. Regulation by a reputable authority like CySEC is crucial as it imposes strict standards on brokers, ensuring they operate transparently and protect client funds. However, the regulatory landscape is complex, and not all licenses offer the same level of protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 145/11 | Cyprus | Active (but under scrutiny) |

Despite being regulated, AGM Forex has been flagged as a suspicious clone by various review platforms, raising red flags about its operational integrity. The broker's regulatory license has faced scrutiny, and the CySEC has previously revoked licenses for similar firms due to non-compliance with industry standards. This history raises questions about the reliability of AGM Forex and whether it truly adheres to the regulatory requirements necessary for safeguarding client investments. Thus, while AGM Forex claims to be regulated, potential investors should approach with caution and consider the implications of its regulatory history.

Company Background Investigation

AGM Forex is operated by Maxigrid Limited, a company registered in Cyprus. Established in 2020, AGM Forex is relatively new compared to many of its competitors. The ownership structure and management team are crucial indicators of a broker's reliability. However, detailed information about the management team is scarce, which can be a cause for concern.

The lack of transparency regarding the company's ownership and management raises questions about accountability and trustworthiness. A reputable broker typically provides clear information about its team and their qualifications. Furthermore, AGM Forex's website does not prominently feature any information regarding its operational history or the qualifications of its staff. This opacity can make it challenging for potential clients to assess the broker's credibility and the expertise of its management team.

Trading Conditions Analysis

AGM Forex offers various account types, including mini, standard, and ECN accounts, with varying minimum deposit requirements and leverage options. However, the overall cost structure and fees associated with trading on this platform are critical factors for traders to consider.

| Fee Type | AGM Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2 pips | From 1.5 pips |

| Commission Model | Varies by account type | Typically fixed or lower |

| Overnight Interest Range | Not disclosed | Generally disclosed |

AGM Forex's spreads start at 2 pips, which is higher than the industry average for major currency pairs. Additionally, the lack of clarity regarding commissions and overnight interest can create confusion for traders. Transparent fee structures are essential for traders to make informed decisions, and any ambiguity can be perceived as a potential risk. Therefore, the higher-than-average spreads and unclear fee policies raise concerns about the overall trading conditions at AGM Forex.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. AGM Forex claims to implement various measures to protect client funds, including segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds. This practice is a standard requirement for regulated brokers and is designed to protect clients in the event of the broker's insolvency.

However, there are concerns regarding the actual implementation of these safety measures. The broker's history of regulatory scrutiny and the lack of transparency regarding its financial practices raise questions about the effectiveness of its fund protection measures. Additionally, there have been no reported incidents of client fund mismanagement, but the absence of negative disclosures does not necessarily guarantee safety. Traders must remain vigilant and consider the potential risks associated with their investments.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of AGM Forex reveal a mixed bag of experiences, with some users reporting positive interactions, while others express frustration over withdrawal issues and lack of customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Management Issues | Medium | Limited support availability |

| High Spreads Complaints | Low | General dissatisfaction |

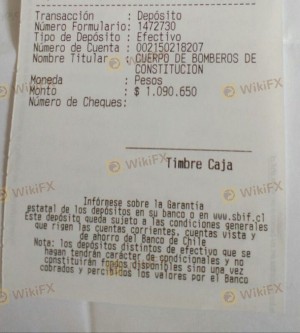

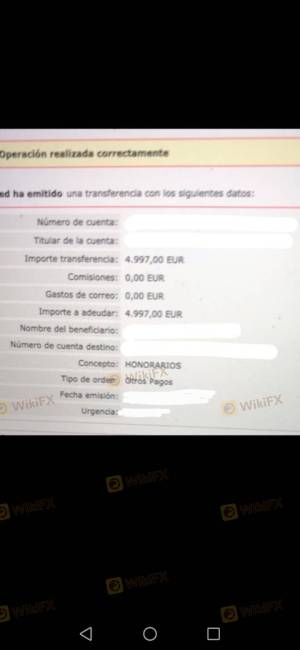

One notable case involved a trader who reported a delay in withdrawing funds, claiming that the company provided vague explanations and failed to resolve the issue promptly. Such complaints, particularly regarding withdrawal processes, are common indicators of potential scams, as they can point to a broker's unwillingness to return client funds. While AGM Forex has not faced widespread allegations of fraud, the recurring themes in customer complaints warrant caution.

Platform and Trade Execution

The trading platform offered by AGM Forex is the widely-used MetaTrader 4 (MT4), known for its reliability and user-friendly interface. However, the quality of trade execution is equally important. Users have reported mixed experiences with order execution, with some highlighting issues such as slippage and re-quotes, which can significantly impact trading performance.

The broker's ability to provide a stable and efficient trading environment is crucial for traders, especially those employing strategies that require precise execution. Any signs of manipulation or consistent execution issues can indicate deeper operational problems. Therefore, while AGM Forex utilizes a reputable platform, the execution quality remains a concern for potential users.

Risk Assessment

Investing with AGM Forex carries inherent risks, and potential traders should be aware of these before committing their funds.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Regulatory scrutiny and potential clone concerns |

| Fund Safety Risk | Medium | Segregated accounts, but transparency issues exist |

| Execution Risk | Medium | Reports of slippage and re-quotes |

Given these risks, it is advisable for traders to conduct thorough due diligence before engaging with AGM Forex. Strategies such as starting with a small investment, utilizing risk management tools, and keeping abreast of regulatory developments can help mitigate potential downsides.

Conclusion and Recommendations

In conclusion, while AGM Forex presents itself as a regulated broker with various trading options, significant concerns regarding its regulatory history, transparency, and customer experiences suggest that traders should exercise caution. The higher-than-average spreads, mixed reviews regarding customer support, and potential issues with fund withdrawals raise red flags about the broker's overall reliability.

For traders seeking safer alternatives, it is advisable to consider well-established brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Ultimately, the decision to engage with AGM Forex should be made with careful consideration of the associated risks and a thorough understanding of the broker's operational practices.

Is Agm Forex a scam, or is it legit?

The latest exposure and evaluation content of Agm Forex brokers.

Agm Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Agm Forex latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.