Bebor 2025 Review: Everything You Need to Know

Executive Summary

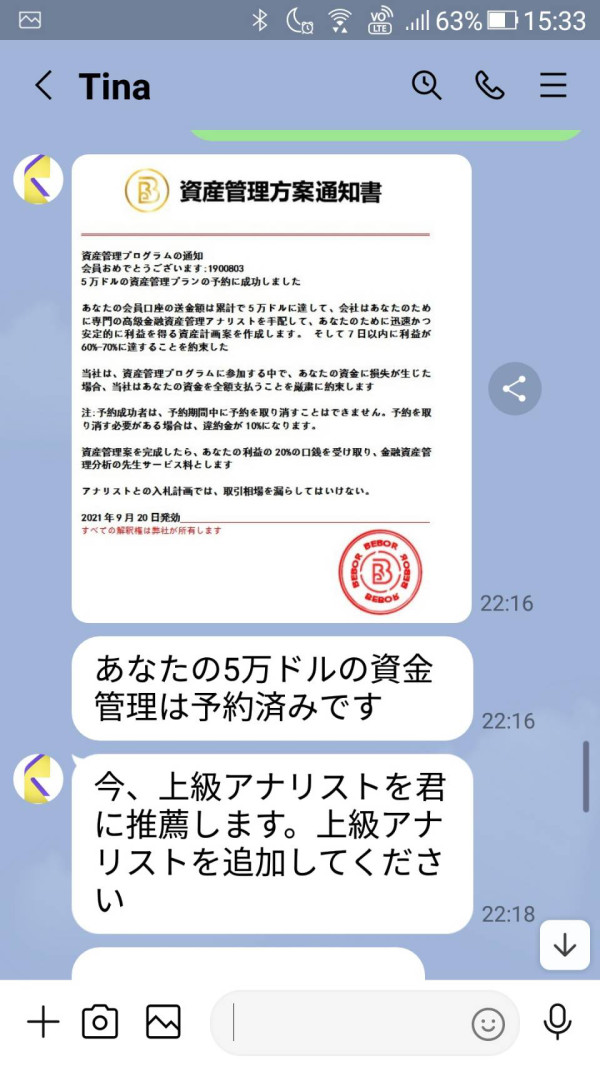

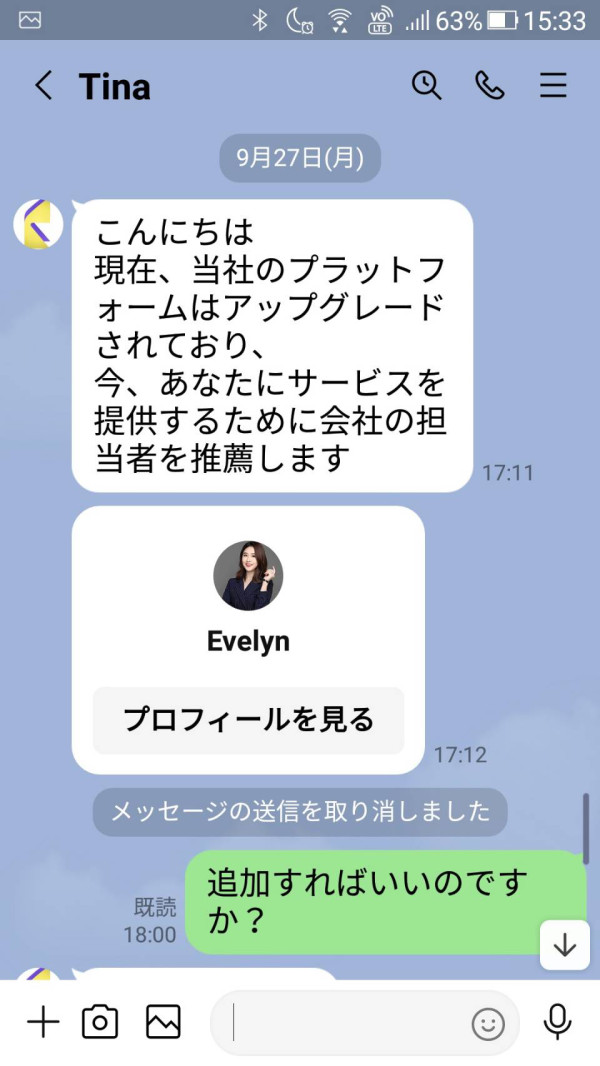

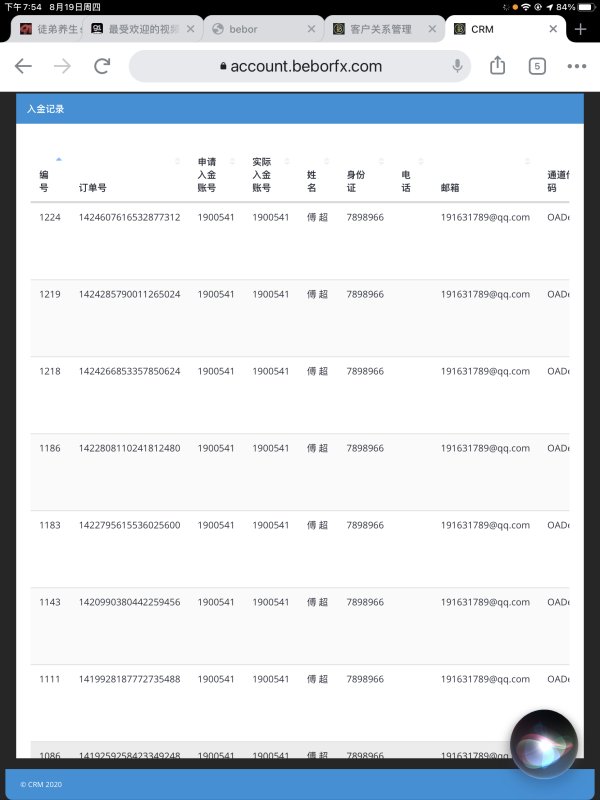

This Bebor review looks at a forex broker that works without proper rules. Bebor Limited says it has its main office in Hong Kong, but it has been found to be an unregulated company with questionable legitimacy. BrokersView reports say the broker might be a scam that traders should avoid.

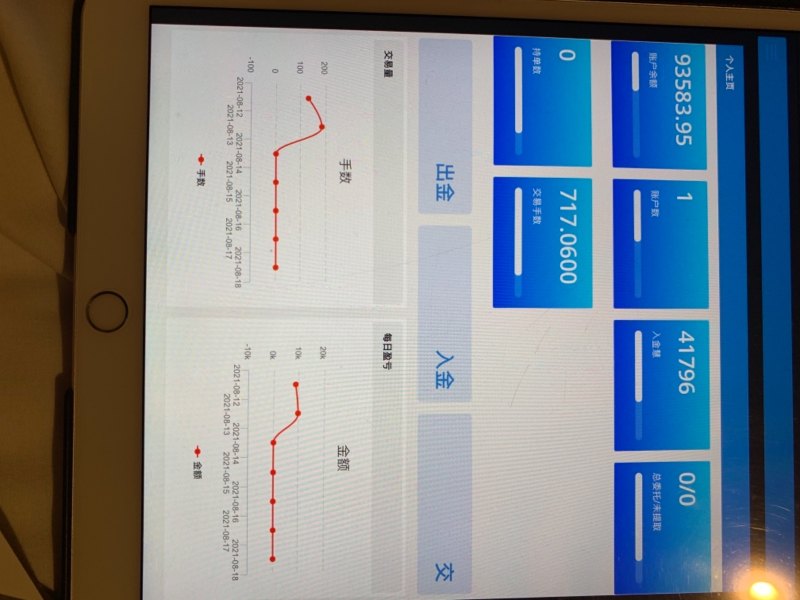

The broker offers multiple account types including Standard, ECN Account, Pro, and Plus accounts with maximum leverage reaching 1:200 as reported by WikiFX. While these account options may look good to forex traders who want different trading conditions, the lack of regulatory protection creates serious concerns about fund safety and operational transparency. Bebor mainly targets forex traders looking for varied account choices and higher leverage options.

However, the absence of regulatory oversight from recognized financial authorities makes this broker unsuitable for serious traders who prioritize capital protection and regulatory compliance. The broker's business model focuses on forex trading, though detailed information about trading platforms, asset varieties, and specific trading conditions remains limited in available public sources.

Important Notice

Bebor Limited claims to operate from Hong Kong but lacks proper regulatory authorization from recognized financial authorities. This Bebor review is based on publicly available information and may not reflect the complete user experience or current operational status.

BrokersView strongly advises traders to avoid unregulated brokers like Bebor Limited due to the inherent risks of fund loss and lack of legal recourse. Traders should exercise extreme caution when considering any unregulated forex broker, as these entities operate outside the protective framework of financial regulations designed to safeguard client funds and ensure fair trading practices.

Rating Overview

Broker Overview

Bebor Limited presents itself as a forex broker claiming headquarters in Hong Kong. The exact establishment date remains unspecified in available documentation, which raises immediate concerns about transparency. According to BrokersView analysis, the company operates as an unregulated entity, which immediately raises red flags about its legitimacy and operational standards.

The broker's business model centers on forex trading services, offering multiple account configurations to attract different trader segments. The company's background information reveals significant concerns about its operational legitimacy, with BrokersView reports classifying Bebor Limited as a potential scam operation and advising traders to maintain distance from this unregulated entity. The lack of proper licensing from recognized financial authorities in Hong Kong or other jurisdictions creates substantial risks for potential clients.

WikiFX data indicates that Bebor operates in the forex brokerage space, providing trading services through various account types. However, the absence of regulatory oversight means clients lack the standard protections typically associated with licensed financial service providers, creating an environment where fund safety cannot be guaranteed. The broker's main business activities focus on facilitating currency trading, though specific details about trading instruments, execution models, and operational procedures remain unclear from available sources.

The regulatory landscape surrounding Bebor Limited shows no evidence of proper licensing or oversight from established financial authorities. This regulatory gap represents a fundamental weakness in the broker's operational framework, as regulated brokers typically provide client fund segregation, dispute resolution mechanisms, and operational transparency that unregulated entities cannot guarantee.

Regulatory Status: Bebor Limited operates without regulatory authorization from recognized financial authorities. This creates significant risks for potential clients who lack standard protections typically provided by regulated brokers.

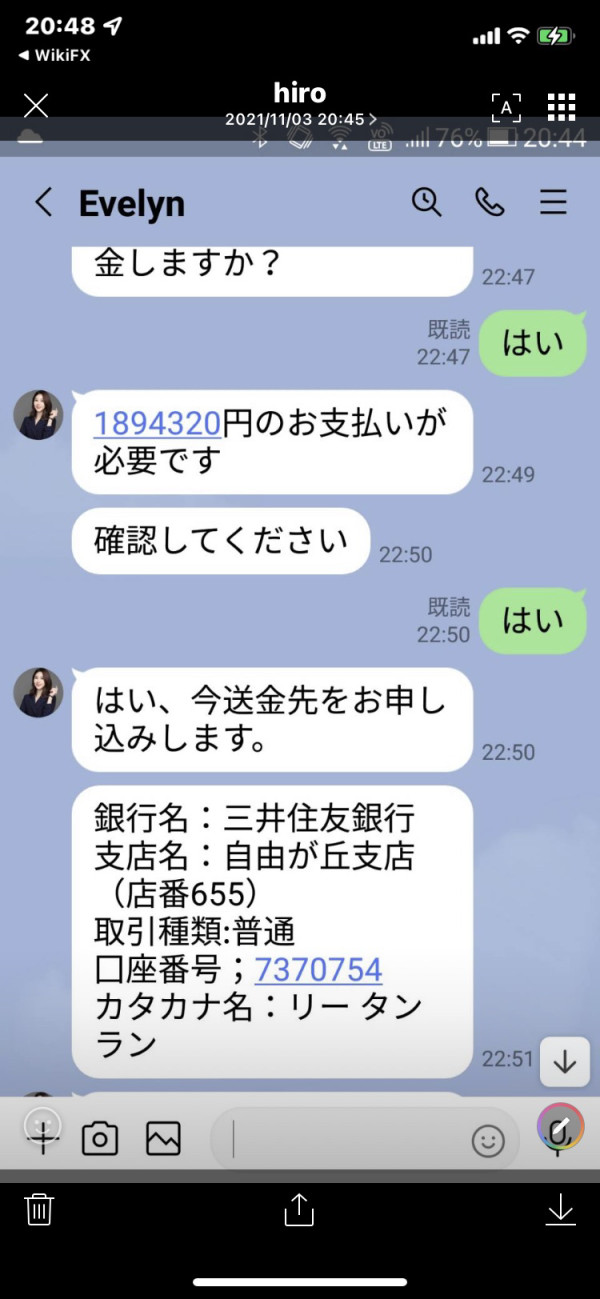

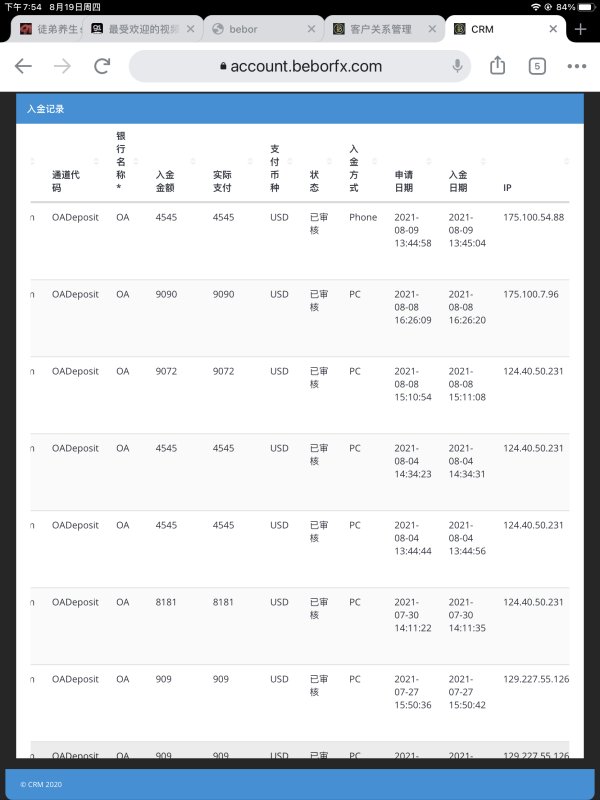

Deposit and Withdrawal Methods: Specific information about payment processing options, supported currencies, and transaction procedures was not detailed in available sources. This raises questions about operational transparency and creates uncertainty for potential clients regarding funding options.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts for different account types. This limits traders' ability to assess accessibility and account planning requirements, which is concerning for transparency.

Bonus and Promotions: Available sources do not mention specific promotional offers, welcome bonuses, or ongoing incentive programs. This suggests limited marketing transparency and makes it difficult to assess potential value propositions.

Tradeable Assets: While the broker focuses on forex trading, detailed information about specific currency pairs, exotic options, or additional asset classes remains unspecified. Current documentation lacks comprehensive asset listings that would help traders evaluate trading opportunities.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs was not available in the reviewed sources. This hinders accurate cost analysis and makes it difficult for traders to assess the true cost of trading.

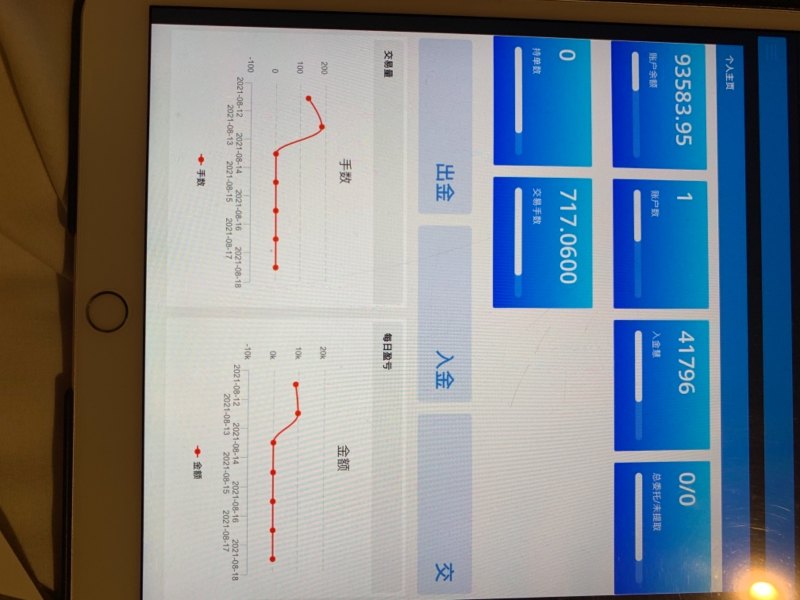

Leverage Options: According to WikiFX reports, Bebor offers maximum leverage of 1:200. This provides substantial position sizing flexibility but also increases potential risk exposure for traders who must carefully manage their risk.

Platform Options: Specific details about trading platforms, mobile applications, or web-based trading interfaces were not mentioned in available source materials. This lack of information makes it impossible to assess technological capabilities and user experience quality.

Geographic Restrictions: Information about country-specific limitations or restricted territories was not specified in the reviewed documentation. This creates uncertainty for international traders who need to understand service availability in their jurisdictions.

Customer Service Languages: Available support languages and communication options were not detailed in the accessible information sources. This makes it difficult for non-English speaking traders to assess service accessibility.

Account Conditions Analysis

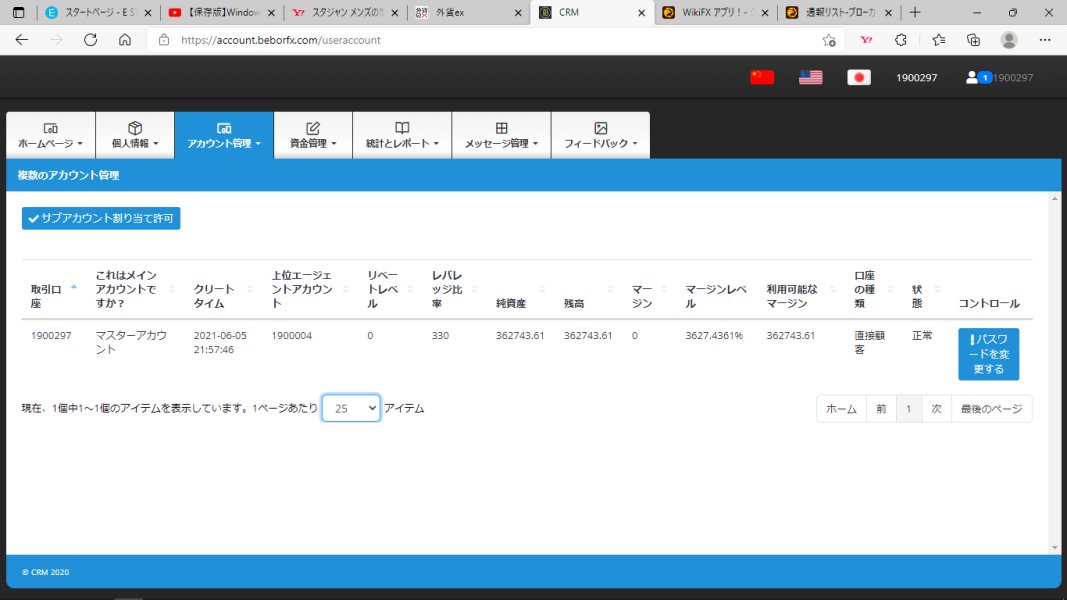

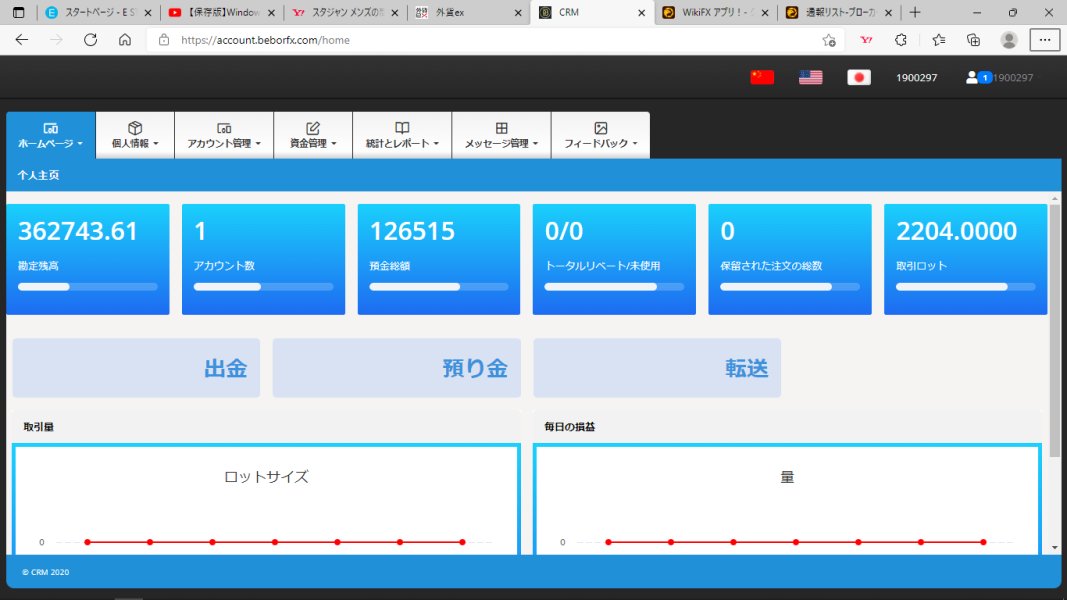

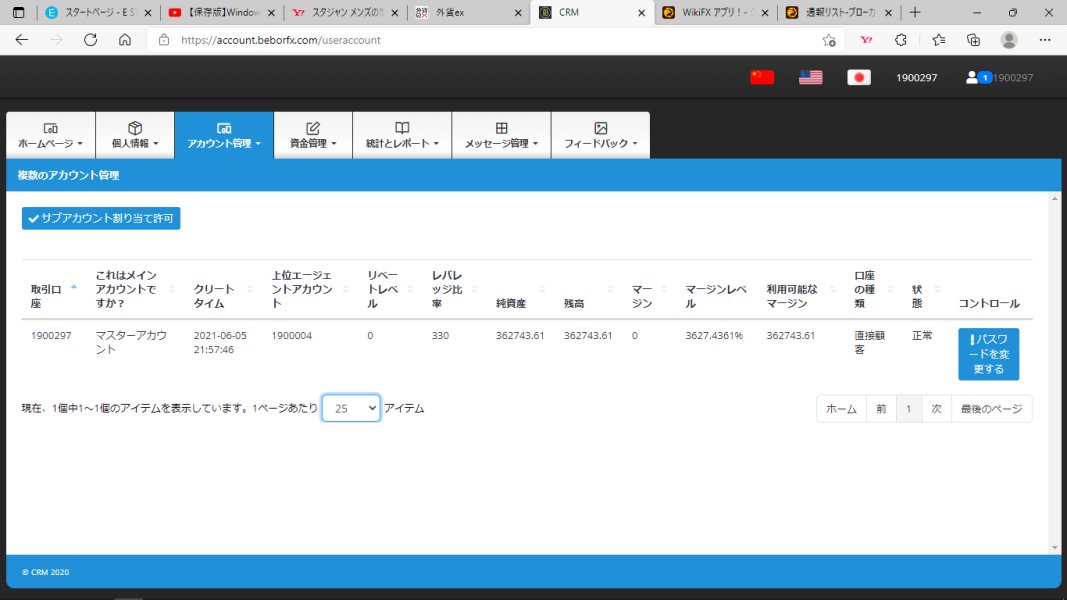

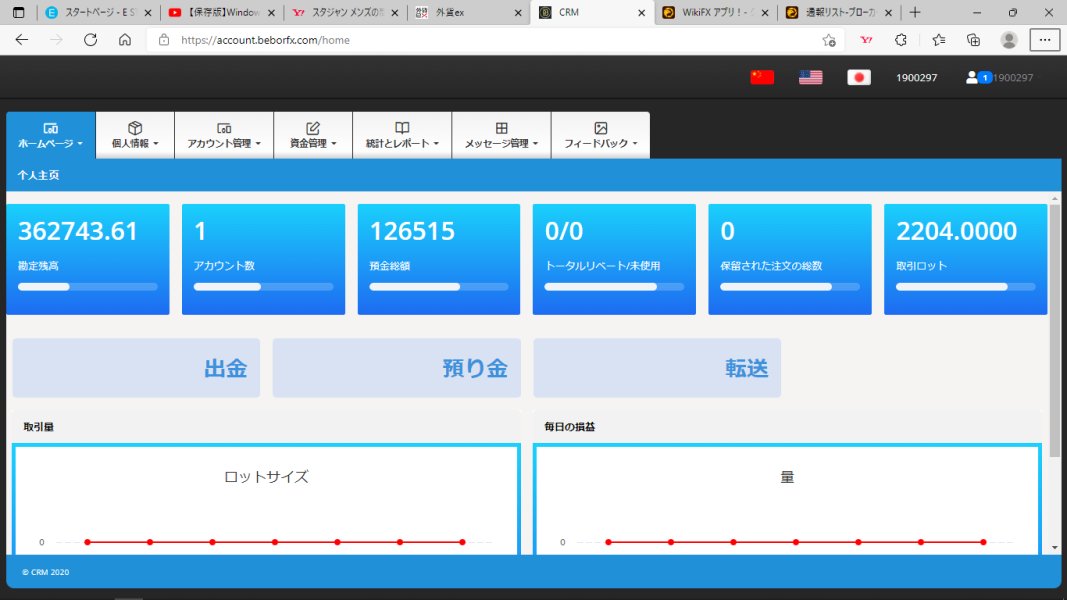

Bebor's account structure includes Standard, ECN Account, Pro, and Plus configurations according to WikiFX data. This suggests an attempt to cater to different trading preferences and experience levels, though the lack of regulatory protection undermines any potential benefits. The variety of account types could potentially appeal to traders seeking specific trading conditions, though detailed specifications for each account remain unclear from available sources.

The Standard account likely serves as the entry-level option for new traders. The ECN Account suggests electronic communication network access for potentially tighter spreads and faster execution, while the Pro and Plus accounts presumably target more experienced traders with enhanced features. However, specific benefits and requirements were not detailed in the reviewed materials, creating uncertainty about what each account type actually offers.

Minimum deposit requirements for different account tiers remain unspecified. This makes it difficult for potential clients to assess accessibility and financial planning requirements, which is a basic transparency issue that professional brokers typically address clearly. This lack of transparency regarding entry-level investment amounts raises questions about the broker's commitment to clear communication with potential clients.

Account opening procedures and verification requirements were not detailed in available sources. This creates uncertainty about onboarding processes and documentation needs, which regulated brokers typically provide clear guidance about during account establishment procedures. The absence of such information from Bebor reflects operational opacity that characterizes unregulated entities.

The leverage offering of 1:200 across account types provides significant position sizing flexibility. However, this high leverage also amplifies potential losses alongside potential gains, requiring traders to carefully assess their risk management capabilities and trading experience before engaging with such conditions.

Available information about Bebor's trading tools and analytical resources remains extremely limited. This significantly hampers evaluation of the broker's technological offerings and raises concerns about the quality of services provided to traders. Professional forex brokers typically provide comprehensive charting tools, technical indicators, and market analysis resources, but specific details about Bebor's platform capabilities were not found in reviewed sources.

The absence of detailed information about trading platforms raises concerns about technological infrastructure and user experience quality. Modern forex trading relies heavily on platform stability, execution speed, and analytical capabilities, yet Bebor's technological offerings remain largely undisclosed, which is problematic for traders who depend on reliable technology. Research and market analysis resources appear to be unspecified, which limits traders' ability to make informed decisions based on professional market insights.

Established brokers typically provide daily market commentary, economic calendars, and analytical reports to support client trading decisions. Educational resources and training materials were not mentioned in available documentation, suggesting limited support for trader development and skill enhancement, which quality brokers often invest in through comprehensive educational programs. Quality brokers often invest in comprehensive educational programs to help clients improve their trading knowledge and risk management skills.

Automated trading support, expert advisor compatibility, and algorithmic trading capabilities remain unspecified. This potentially limits options for traders who rely on systematic trading approaches and need advanced technological features for their strategies. The lack of transparency about technological capabilities reflects broader concerns about Bebor's operational sophistication and client service commitment.

Customer Service and Support Analysis

Customer service quality and support availability information for Bebor was not detailed in the reviewed sources. This creates uncertainty about client assistance capabilities and raises questions about the broker's commitment to customer support. Professional forex brokers typically maintain multiple communication channels including live chat, email support, and telephone assistance, but Bebor's specific support infrastructure remains unclear.

Response time expectations and service level commitments were not specified. This makes it difficult for potential clients to assess support quality and reliability, which are crucial factors in choosing a forex broker. Regulated brokers often provide clear service standards and response time guarantees, while the absence of such information suggests limited commitment to client service excellence.

The quality of customer support interactions cannot be evaluated based on available information. User feedback and service reviews were not found in the accessed sources, making it impossible to assess actual service quality. Professional customer service typically includes knowledgeable staff capable of addressing technical, account, and trading-related inquiries effectively.

Multilingual support capabilities and international service options remain unspecified. This potentially limits accessibility for non-English speaking traders who need support in their native languages. Global forex brokers typically provide support in multiple languages to serve diverse international client bases.

Customer service hours and availability schedules were not mentioned in available documentation. This creates uncertainty about when clients can access assistance, which is particularly important given that the forex market operates 24/5. Quality brokers typically provide extended support hours to match trading activity periods.

Trading Experience Analysis

Platform stability and execution speed information for Bebor was not available in the reviewed sources. This makes it impossible to assess the quality of the trading environment, which is fundamental for successful forex trading. Reliable trade execution and platform performance are fundamental requirements for successful forex trading, yet specific performance metrics remain undisclosed.

Order execution quality, including slippage rates, requote frequency, and fill rates, cannot be evaluated based on available information. Professional brokers typically provide execution statistics and performance data to demonstrate their commitment to fair trading conditions, but this transparency is missing from Bebor's available documentation. Platform functionality and feature completeness remain unspecified, limiting assessment of the trading environment's sophistication and user-friendliness.

Modern trading platforms should provide comprehensive charting, order management, and risk control capabilities. Mobile trading experience and application quality were not detailed in available sources, though mobile accessibility has become essential for contemporary forex trading since traders increasingly rely on mobile platforms for market monitoring and trade management. Traders increasingly rely on mobile platforms for market monitoring and trade management while away from desktop computers.

The overall trading environment quality cannot be properly assessed due to limited information availability. This itself represents a significant concern about the broker's transparency and professionalism. This Bebor review highlights the importance of transparency in trading conditions, which appears lacking in this broker's public communications.

Trust and Safety Analysis

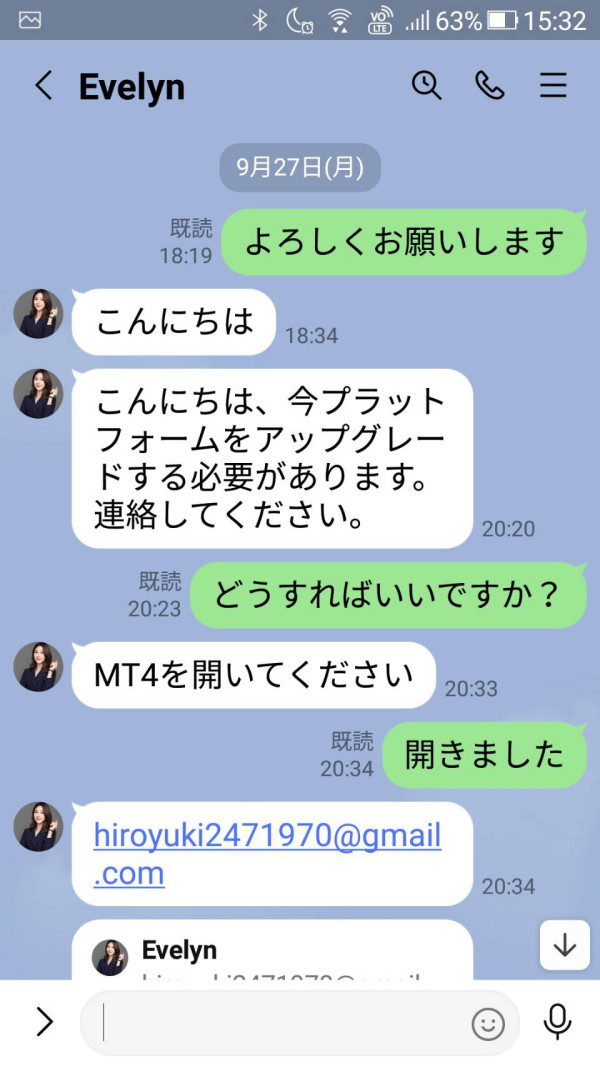

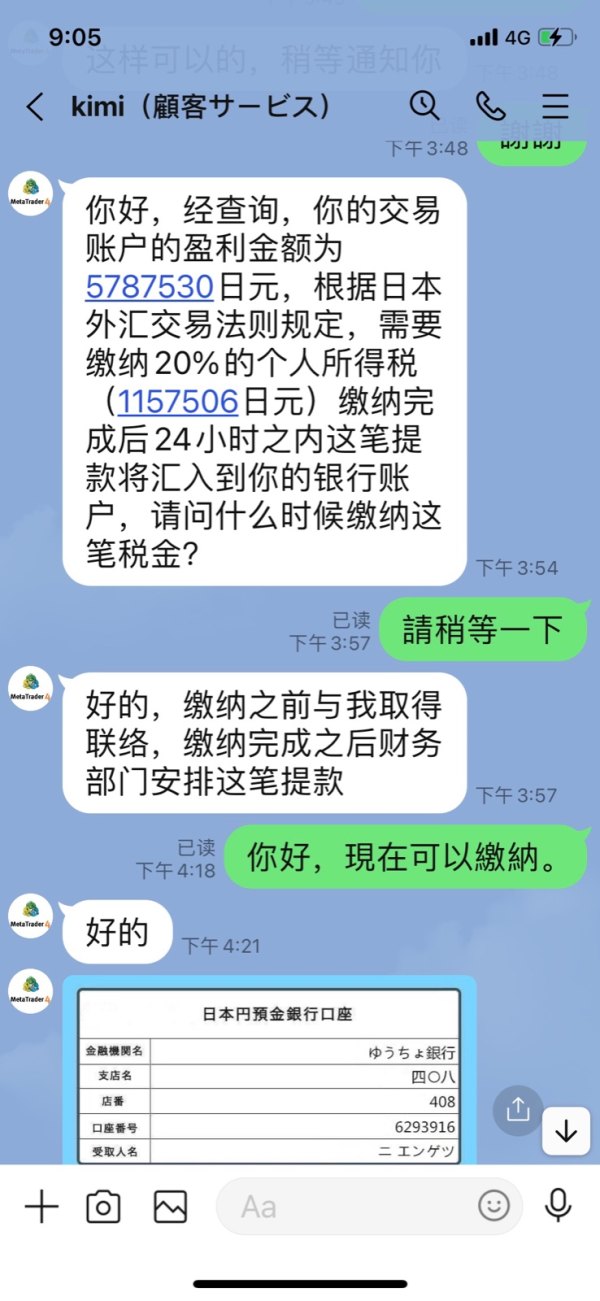

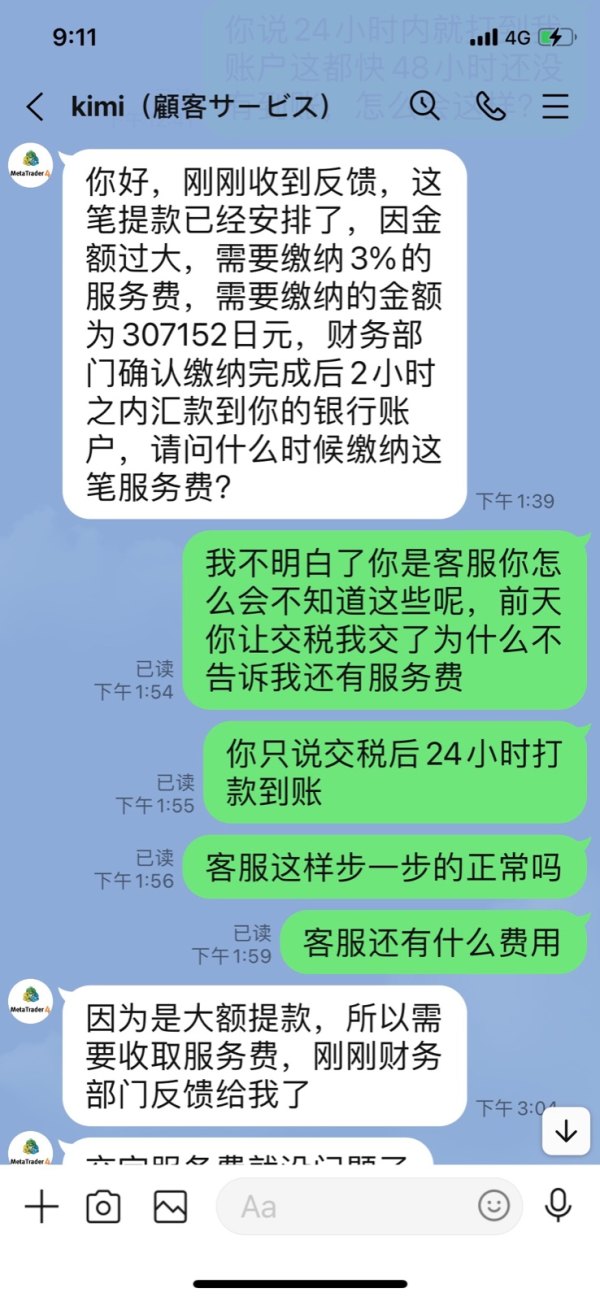

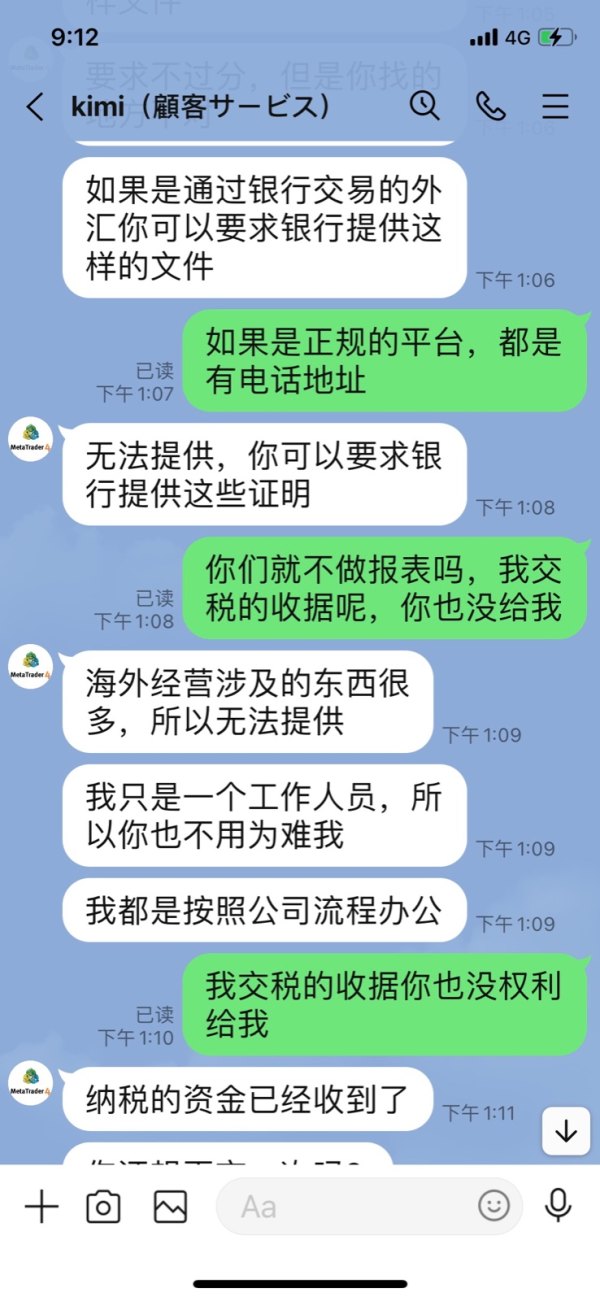

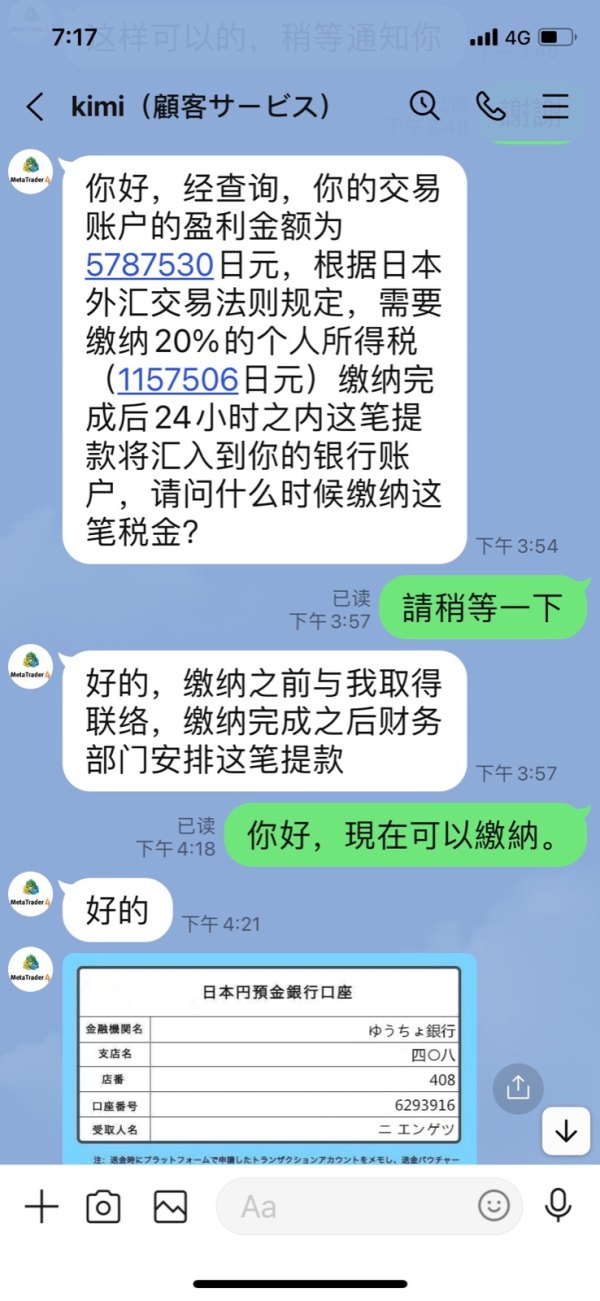

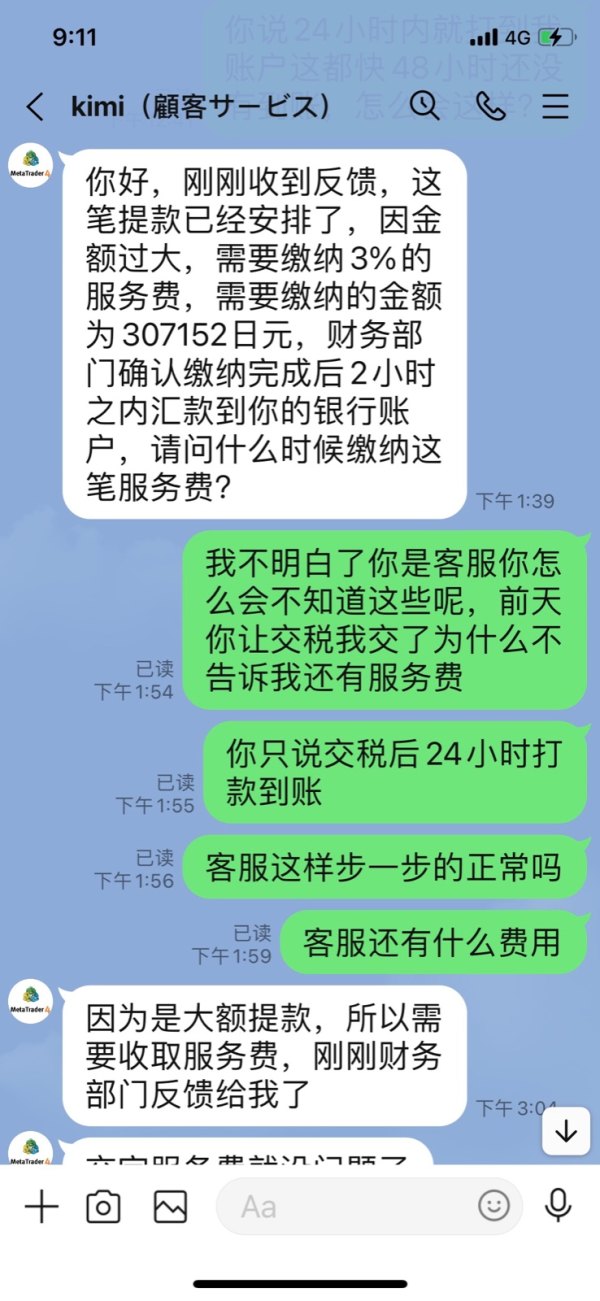

Bebor Limited's regulatory status presents the most significant concern for potential clients. The broker operates without proper authorization from recognized financial authorities, creating substantial risks for anyone considering their services. BrokersView reports explicitly identify the broker as a potential scam operation, strongly advising traders to avoid engagement with this unregulated entity.

Fund safety measures and client money protection protocols remain unspecified. This creates substantial risks for potential depositors who need assurance that their funds will be protected and segregated from company assets. Regulated brokers typically maintain segregated client accounts and provide deposit insurance or compensation schemes, protections that unregulated entities cannot guarantee.

Company transparency and operational disclosure appear limited based on available information. Fundamental details about business operations, financial backing, and regulatory compliance remain unclear, which is concerning for potential clients. Professional brokers typically provide comprehensive company information and regulatory documentation to build trust with potential clients.

Industry reputation and peer recognition evidence was not found in the reviewed sources. The scam allegations from BrokersView significantly damage any potential positive standing in the industry. Reputable brokers typically maintain positive relationships with industry organizations and receive recognition for service quality.

The handling of negative events and dispute resolution capabilities cannot be assessed due to limited information availability. Unregulated status typically means clients have limited recourse in case of problems or disputes. Regulated brokers provide access to ombudsman services and regulatory complaint procedures that unregulated entities cannot offer.

User Experience Analysis

Overall user satisfaction levels cannot be accurately assessed due to the absence of detailed user feedback and review information. Professional broker evaluation typically relies on comprehensive user experience data, which remains unavailable for Bebor, making it impossible to gauge actual client satisfaction. Interface design and platform usability information was not found in the reviewed materials, making it impossible to evaluate the quality of user interaction with the broker's systems.

Modern trading platforms should provide intuitive navigation and efficient workflow design. Registration and account verification processes remain unspecified, creating uncertainty about onboarding experience quality and time requirements, which are important factors for traders choosing a broker. Streamlined account opening procedures with clear documentation requirements typically characterize professional broker operations.

Funding and withdrawal experience quality cannot be evaluated based on available information. This represents a critical aspect of broker-client relationships that affects overall satisfaction and trust. Efficient payment processing and transparent fee structures are essential for positive user experiences.

Common user complaints and satisfaction issues were not documented in the accessible sources. The scam allegations suggest significant problems may exist, though specific user experiences remain undocumented. The target user profile appears to be traders seeking diverse account options, though the regulatory risks make Bebor unsuitable for serious traders prioritizing capital protection.

Conclusion

This comprehensive Bebor review reveals significant concerns about the broker's legitimacy and operational standards. These issues make it unsuitable for serious forex traders who prioritize safety and regulatory protection. The combination of unregulated status, scam allegations from industry watchdogs, and limited operational transparency creates an environment of substantial risk that far outweighs any potential benefits from the multiple account types offered.

While Bebor may attract traders seeking higher leverage options and varied account configurations, the fundamental lack of regulatory protection and questionable reputation make engagement inadvisable. Professional traders should prioritize regulated brokers that provide proper fund protection, transparent operations, and established dispute resolution mechanisms rather than risking their capital with unregulated entities. The main advantages include multiple account types and 1:200 leverage availability, while critical disadvantages encompass unregulated status, scam allegations, operational opacity, and absence of client protections.

Traders seeking reliable forex brokerage services should consider properly licensed alternatives that prioritize regulatory compliance and client safety over potentially attractive trading conditions offered without proper oversight.