Is RIST VERSOS safe?

Business

License

Is Rist Versos Safe or Scam?

Introduction

Rist Versos is a forex broker that has attracted attention in the trading community since its establishment in 2021. Positioned as a platform for retail traders, it offers various trading instruments, including forex currency pairs, commodities, and indices. However, the rapid rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully assess the legitimacy of brokers like Rist Versos. In this article, we will explore the safety and reliability of Rist Versos through a thorough investigation of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

To conduct this analysis, we will utilize multiple sources of information, including user reviews, regulatory databases, and expert opinions. The evaluation framework will cover several key areas, such as regulatory compliance, company history, trading conditions, and customer feedback. By the end of this article, readers should have a clearer understanding of whether Rist Versos is a safe trading option or if it raises red flags that warrant caution.

Regulatory and Legitimacy

Understanding the regulatory landscape is essential for evaluating the safety of any forex broker. Rist Versos claims to operate under the oversight of the National Futures Association (NFA) in the United States. However, investigations reveal a troubling discrepancy: the NFA ID associated with Rist Versos does not appear to be a member of the NFA, raising significant concerns about its regulatory legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0539023 | USA | Not verified |

The lack of credible regulatory oversight is a major red flag for potential investors. Regulatory bodies are crucial for protecting traders from fraud and ensuring that brokers adhere to established standards. Without proper regulation, traders may find themselves vulnerable to misconduct, including the mismanagement of funds and lack of recourse in the event of disputes. Moreover, the absence of any historical compliance records further complicates the trustworthiness of Rist Versos. Overall, the regulatory situation raises serious questions about whether Rist Versos is safe for trading.

Company Background Investigation

Rist Versos was established in 2021, but limited information is available regarding its ownership and management structure. The company claims to have a team of experienced professionals; however, specific details about the management teams backgrounds and qualifications are scarce. This lack of transparency can be concerning for traders who value knowing the people behind the broker they choose to work with.

Additionally, the company's history is relatively short, which means it does not have a long track record of performance or reliability. While new brokers can offer innovative services, they also pose higher risks, especially when they lack adequate regulatory oversight. The absence of detailed information about the ownership structure and the management team raises questions about the company‘s commitment to transparency and accountability. In conclusion, the limited information available about Rist Versos’ company background further complicates the assessment of whether Rist Versos is safe for trading.

Trading Conditions Analysis

When evaluating a broker's safety, it is essential to analyze the trading conditions they offer. Rist Versos provides a range of trading instruments, including over 25 forex currency pairs, indices, and commodities like gold and silver. However, the overall cost structure appears to be less favorable than industry standards, which could be a potential concern for traders.

| Fee Type | Rist Versos | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding spreads, commissions, and overnight interest rates can be alarming. Traders should be cautious of brokers with unclear fee structures, as this can lead to unexpected costs that impact overall profitability. Moreover, if Rist Versos employs unusual or excessive fees, it could indicate a lack of transparency, which is not conducive to a safe trading environment. Therefore, potential investors should carefully scrutinize the trading conditions offered by Rist Versos before committing their funds.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Rist Versos claims to implement several safety measures to protect client deposits, including segregated accounts and investor protection policies. However, there is limited information available regarding the specifics of these measures.

Traders should be aware that without proper regulatory oversight, the effectiveness of such safety measures is questionable. The absence of a reliable regulatory framework means that there may be no guaranteed protection for client funds in the event of financial issues or insolvency. Furthermore, any historical incidents involving fund mismanagement or disputes could further undermine confidence in the broker's commitment to client safety.

In conclusion, while Rist Versos claims to have protective measures in place, the lack of regulatory oversight and transparency raises significant concerns about the safety of client funds. Therefore, traders should consider these factors carefully when assessing whether Rist Versos is safe for trading.

Customer Experience and Complaints

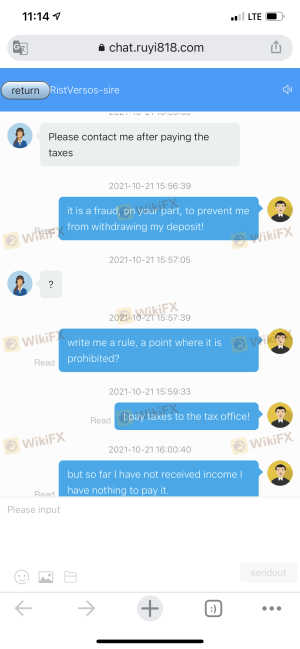

Customer feedback is a critical component in evaluating a broker's reliability. Unfortunately, Rist Versos has received numerous complaints from users regarding issues such as account freezes, withdrawal difficulties, and lack of customer support. Many users have reported that their accounts were frozen, and they were asked to pay additional fees to unfreeze their accounts, a tactic often associated with scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Freeze | High | Poor |

| Withdrawal Issues | High | Poor |

These complaints indicate a troubling pattern that suggests a lack of responsiveness from the company. Additionally, the severity of the complaints raises concerns about the overall customer experience. For potential traders, these negative experiences are significant indicators that Rist Versos may not be a safe option for trading.

Moreover, the absence of effective customer support can exacerbate issues for traders who may find themselves in difficult situations. In light of these complaints, it is essential for traders to approach Rist Versos with caution and consider alternative brokers with better reputations for customer service and reliability.

Platform and Trade Execution

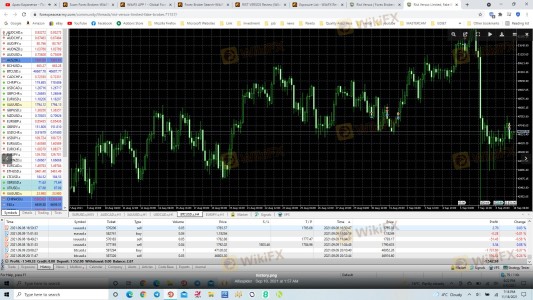

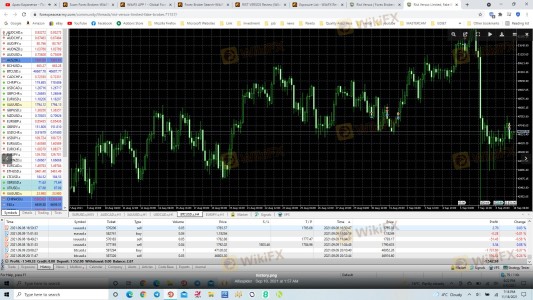

The performance of a trading platform is another crucial factor in assessing a broker's safety. Rist Versos offers the MetaTrader 5 (MT5) platform, which is widely regarded for its user-friendly interface and robust features. However, user reviews suggest that the platform may suffer from stability issues and poor trade execution.

Traders have reported experiencing slippage and order rejections, which can significantly impact trading outcomes. Furthermore, any indications of platform manipulation should be taken seriously, as they can lead to substantial financial losses. Therefore, while Rist Versos provides a popular trading platform, the execution quality and stability issues raise questions about whether Rist Versos is safe for trading.

Risk Assessment

Using Rist Versos comes with various risks that potential traders should consider. The lack of regulatory oversight, coupled with numerous complaints and questionable trading conditions, contributes to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible regulation, potential for fraud. |

| Financial Risk | High | Reports of account freezes and withdrawal issues. |

| Operational Risk | Medium | Potential for platform instability and poor execution. |

To mitigate these risks, traders should conduct thorough research before opening an account with Rist Versos. It would also be prudent to consider alternative brokers with established reputations and regulatory oversight to ensure a safer trading environment.

Conclusion and Recommendations

In summary, the investigation into Rist Versos raises several concerns regarding its safety and reliability. The lack of credible regulatory oversight, coupled with numerous negative customer experiences and questionable trading conditions, suggests that Rist Versos may not be a safe option for traders.

For those considering trading in the forex market, it is advisable to seek out brokers with established regulatory frameworks, transparent fee structures, and positive customer feedback. Alternative options may include well-known brokers that have demonstrated a commitment to client safety and have a proven track record in the industry. Ultimately, traders should prioritize their financial security and carefully evaluate all available options before making a decision.

Is RIST VERSOS a scam, or is it legit?

The latest exposure and evaluation content of RIST VERSOS brokers.

RIST VERSOS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RIST VERSOS latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.