Valuable Capital 2025 Review: Everything You Need to Know

Executive Summary

This valuable capital review gives you a complete look at Valuable Capital Limited. VBKR is a digital investment company that calls itself a multi-asset trading platform. Based on what we found and user feedback, VBKR gets a neutral rating of 3 out of 5 points. This rating shows both good points and problem areas for people who might want to invest.

The platform's best features include 0% commission trading on different types of assets and complete digital investment services for stocks, forex, and financing loans. VBKR mainly focuses on regular customers who want different investment choices across many markets, including A-shares, Hong Kong stocks, and US stocks. The company uses services from its parent company Sina Group. This gives users extra news and market information.

But the platform has problems with user happiness going down. Ratings dropped 11% in the past 12 months, and only 43% of employees would recommend working there. These facts lead to the neutral rating and show areas that need better service and user experience.

Important Notice

This review uses information that anyone can find and user feedback from different sources. Readers should know that we could not find clear regulatory information for Valuable Capital Limited in the materials we checked. This might affect how we judge if the platform follows rules in different countries.

Our review method looks at user ratings, platform features, and company information that is public. Since regulatory information is not clear, potential users should do more research before using the platform's services.

Rating Framework

Broker Overview

Valuable Capital Limited works as a complete digital investment services provider. It focuses on giving multi-asset and cross-market global investment solutions to customers. The company presents itself as a modern financial services platform that uses digital technology to give regular customers access to different investment opportunities across international markets.

The platform's business plan centers on commission-free trading services that cover different asset classes including stocks, foreign exchange, and special financing products. VBKR's connection with its parent company Sina Group gives extra value through better market news and information services. This creates a more complete investment system for users.

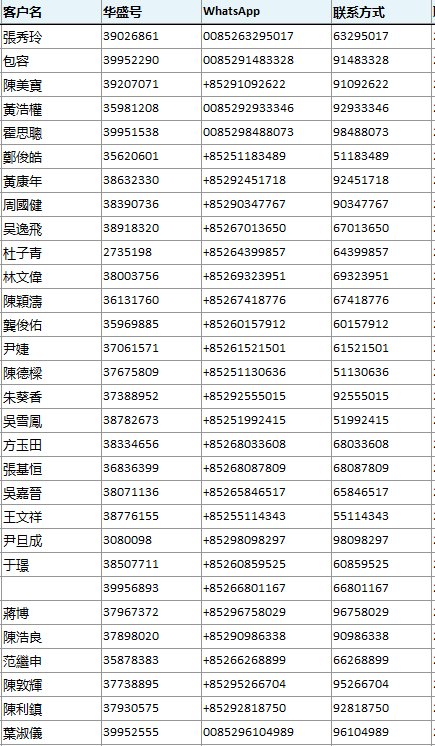

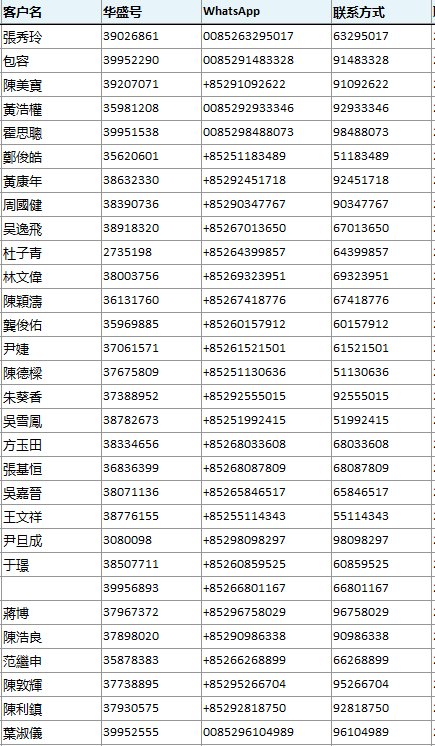

This valuable capital review shows that the platform uses the Huashengtong trading platform to make trades across supported markets. The company's approach focuses on making things easy for regular investors while keeping professional-grade trading abilities. But specific founding details and complete regulatory background information were not clearly shown in available public materials. This may affect how transparent the platform looks to potential users.

Regulatory Framework

We could not find specific regulatory information in available materials. This is something important for potential users to think about when checking if the platform is credible and follows compliance standards.

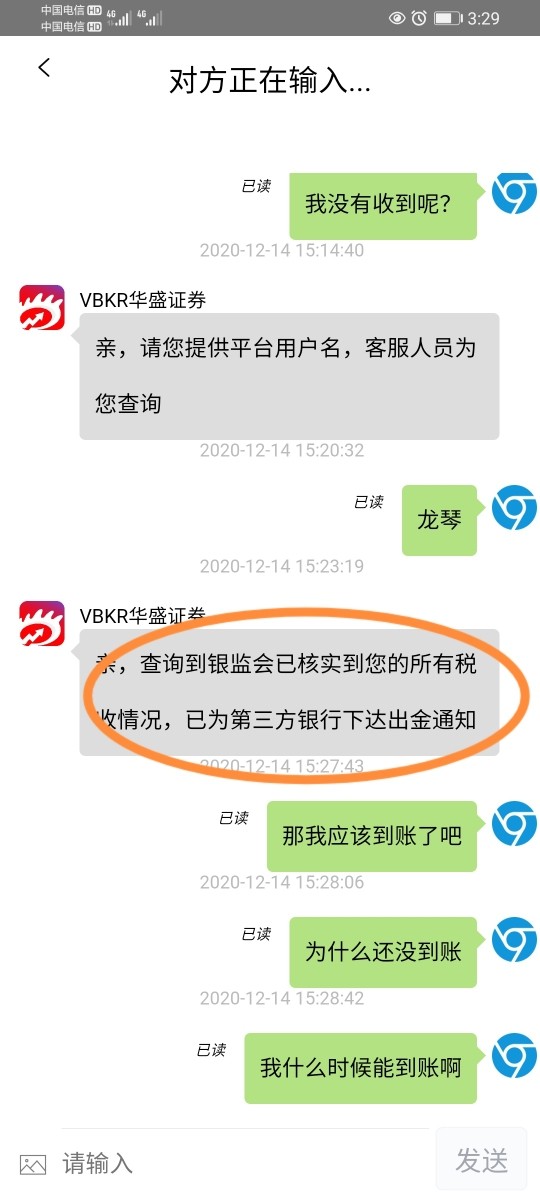

Deposit and Withdrawal Methods

We did not find detailed information about supported deposit and withdrawal methods in available documentation. You need to ask the platform directly for complete details.

Minimum Deposit Requirements

Specific minimum deposit amounts were not clearly shown in materials we could access. This means potential users should contact the platform directly for account opening requirements.

Current bonus and promotional structures were not detailed in available information. This shows you need to talk to the platform directly about available incentives.

Tradeable Assets

VBKR supports trading across A-shares, Hong Kong stocks, and US equities, along with foreign exchange services and special financing loans. The platform also helps with IPO subscription services. This gives complete market access for regular investors.

Cost Structure

The platform features 0% commission rates on supported trading activities. IPO subscription services have a 1% funding rate. This competitive pricing structure is a key advantage for traders who care about costs.

Leverage Options

We did not find specific leverage ratios and margin requirements in available materials. You need to ask the platform directly for complete trading terms.

Trading operations happen through the Huashengtong trading platform. This serves as the main interface for market access and order execution across supported asset classes.

This valuable capital review shows that while the platform offers different services, several operational details need direct checking with the company for complete clarity.

Detailed Rating Analysis

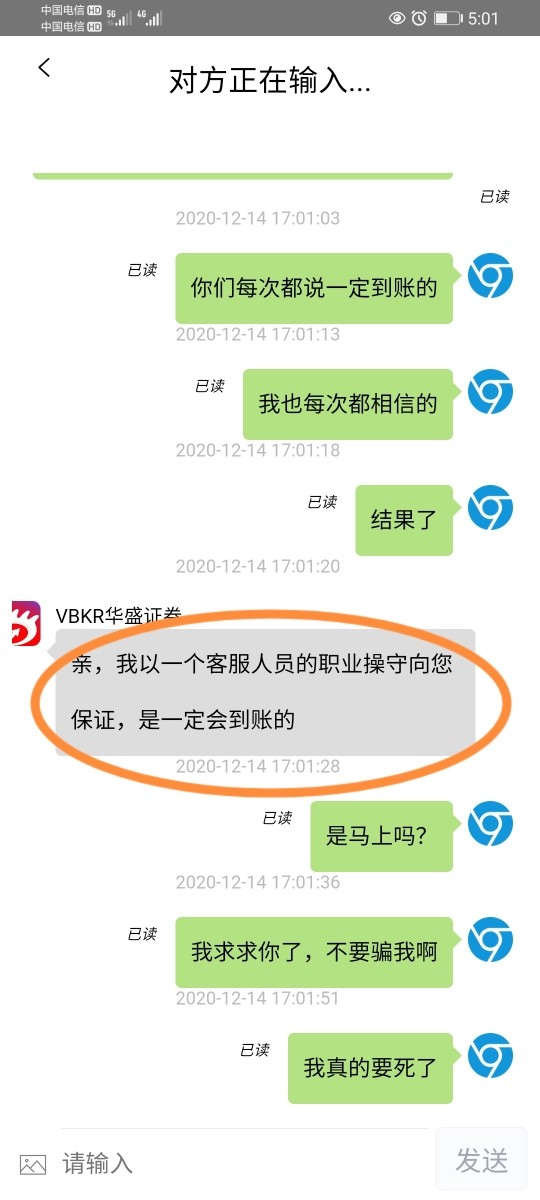

Account Conditions Analysis

The account conditions evaluation for Valuable Capital gets a 7/10 rating. This rating comes mainly from the platform's competitive 0% commission structure across supported trading activities. This fee-free approach is a big advantage for regular traders who want to keep transaction costs low. It especially helps people who trade often or have smaller accounts where commission fees usually hurt overall returns.

The platform's IPO subscription services feature a 1% funding rate. This seems reasonable within industry standards for special investment products. But we did not find complete details about account types, minimum balance requirements, and specific account features in available materials. This lack of detailed account information makes it hard to fully judge how competitive the platform is against other companies in the industry.

We could not find detailed information about account opening procedures, verification requirements, and special account options such as Islamic accounts. This shows a notable gap in transparency. Potential users who want specific account setups may need to talk directly with the platform for complete details.

This valuable capital review suggests that while the commission-free structure gives clear value, the limited transparency about account details and requirements may affect how users make decisions.

Valuable Capital receives an 8/10 rating for tools and resources. This reflects the platform's complete digital investment services spanning multiple asset classes and markets. The connection with parent company Sina Group gives better market news and information resources. This creates extra value for users who want complete market intelligence along with trading abilities.

The platform's multi-asset approach supports stocks, forex, and financing loans. This gives different investment opportunities within a single platform environment. This combined approach reduces the complexity that usually comes with managing multiple broker relationships across different asset classes.

But we did not find specific details about research abilities, analytical tools, educational resources, and automated trading support in available materials. The quality and depth of these resources greatly affect the overall user experience. This is especially true for less experienced traders who need educational support and market analysis.

The Huashengtong trading platform serves as the main technological foundation. But detailed feature specifications and advanced trading tools availability need more investigation. The platform's integration abilities and third-party tool support remain unclear based on available information.

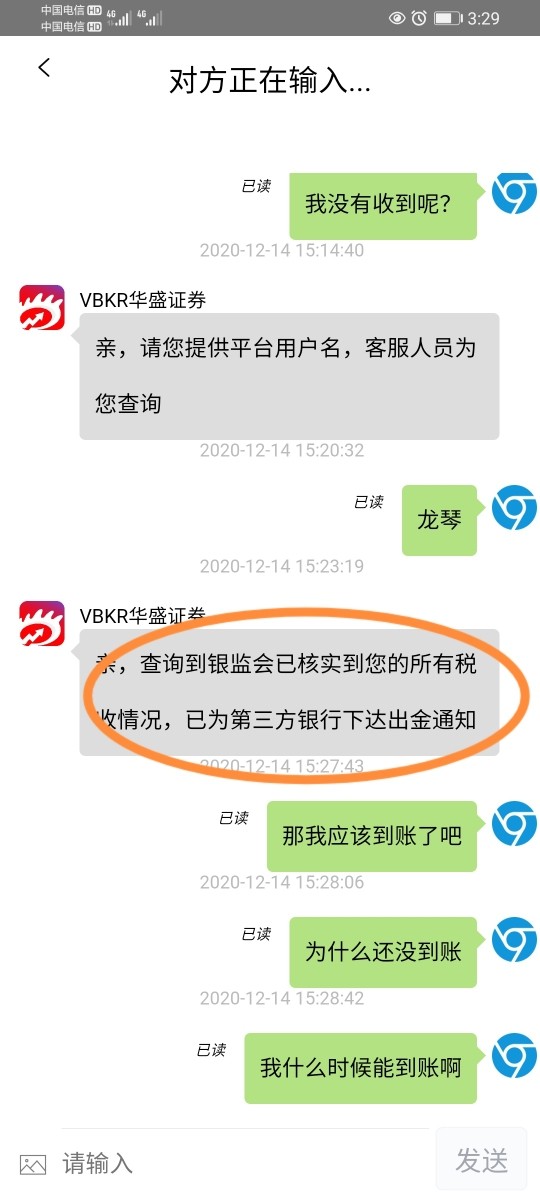

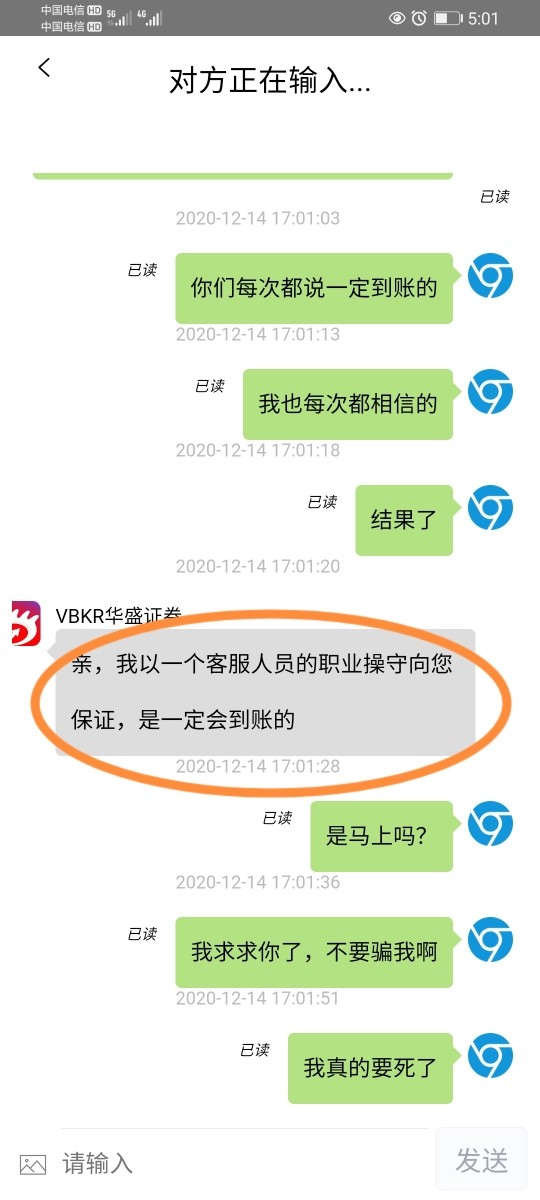

Customer Service and Support Analysis

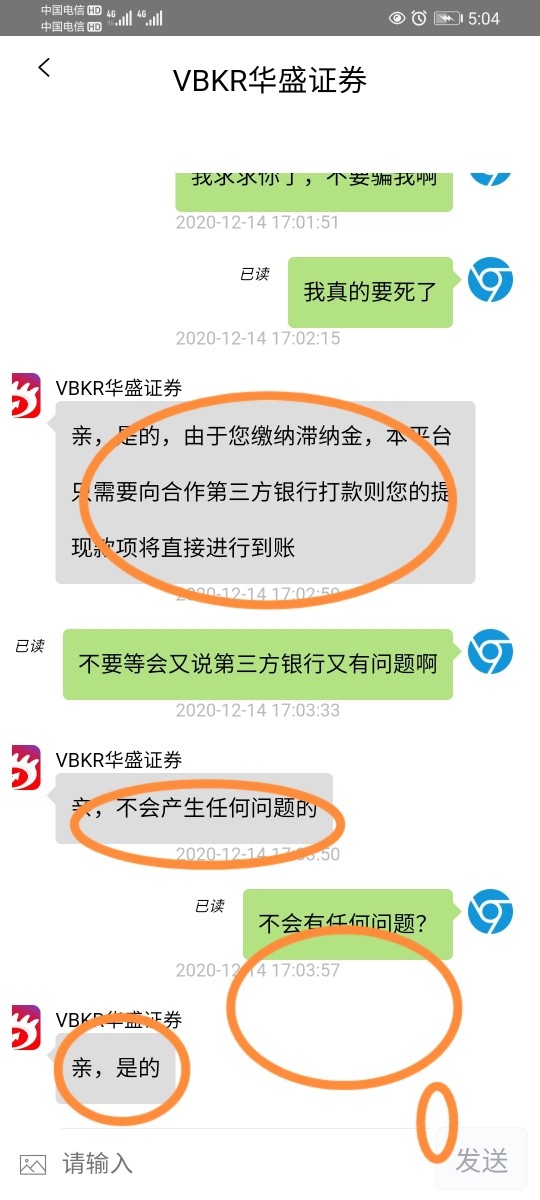

The customer service evaluation gets a 6/10 rating. This rating is greatly influenced by the concerning 43% employee recommendation rate. This suggests potential internal service quality challenges that may affect customer experience delivery.

This low employee satisfaction number raises questions about service consistency, staff retention, and overall organizational culture. These factors usually connect with customer service quality. High employee turnover and low satisfaction often translate to inconsistent customer support experiences and reduced service quality over time.

We did not find specific information about customer service channels, response times, multilingual support abilities, and service availability hours in available materials. These operational aspects greatly affect user experience. This is especially true for international clients operating across different time zones.

The absence of detailed customer service protocols and support infrastructure information limits our ability to assess the platform's capability to handle user questions, technical issues, and account-related concerns effectively. User feedback about actual service experiences was not available in reviewed materials.

Trading Experience Analysis

The trading experience receives a 7/10 rating. This is based on the platform's use of the Huashengtong trading platform and complete asset class support. The system's ability to handle multiple market access requirements suggests reasonable technological abilities for executing trades across A-shares, Hong Kong stocks, and US equities.

The commission-free trading structure makes the overall trading experience better by removing transaction cost concerns that usually affect trading decisions. This pricing approach especially benefits active traders and those who use frequent rebalancing strategies.

But we did not find critical trading experience factors including platform stability, execution speed, order types availability, and mobile trading abilities in available materials. These technical performance aspects greatly affect user satisfaction and trading effectiveness. This is especially true during volatile market conditions.

The platform's ability to handle high-volume periods, provide real-time market data, and maintain consistent execution quality remains unclear based on available information. User testimonials about actual trading experiences and platform performance were not accessible for this valuable capital review.

Trust and Reliability Analysis

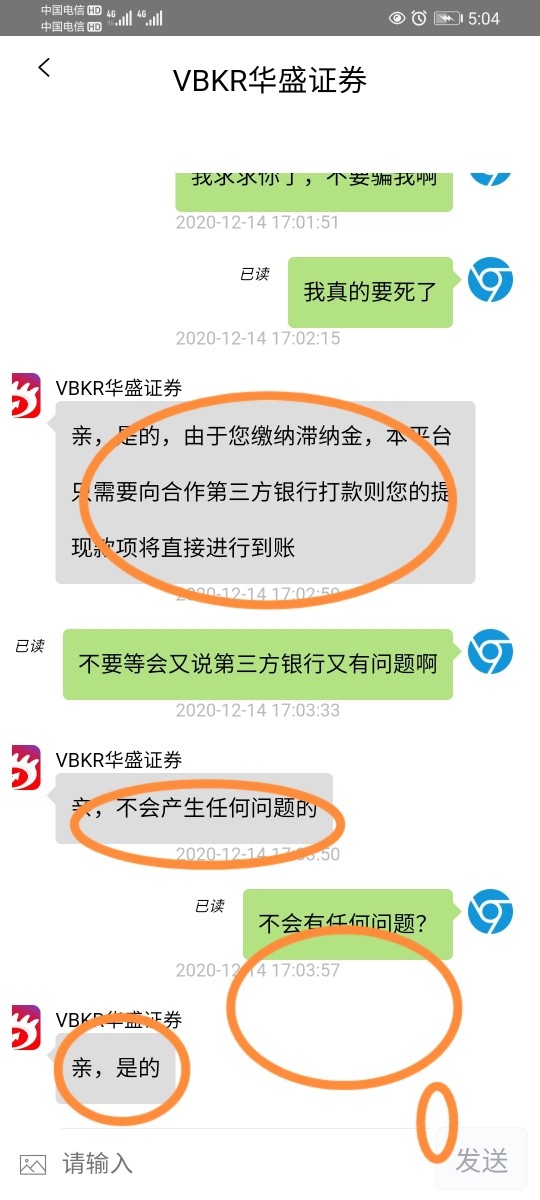

Trust and reliability assessment gets the lowest rating of 5/10. This is mainly due to the absence of clear regulatory information in available materials. Regulatory oversight represents a fundamental component of broker credibility and user protection. This makes this information gap a significant concern for potential users.

The lack of specified regulatory licenses, compliance frameworks, and supervisory authority oversight limits our ability to assess the platform's adherence to industry standards and user protection protocols. This regulatory transparency deficit affects overall trust assessment and may concern users who prioritize platform security and compliance.

We did not find fund security measures, segregation policies, and investor protection protocols in available materials. These safety mechanisms are essential for user confidence. This is especially true when depositing significant funds or engaging in substantial trading activities.

The platform's industry reputation, third-party assessments, and handling of any negative incidents or regulatory actions were not accessible for evaluation. This limited transparency about the company's standing within the financial services industry affects the overall trust assessment.

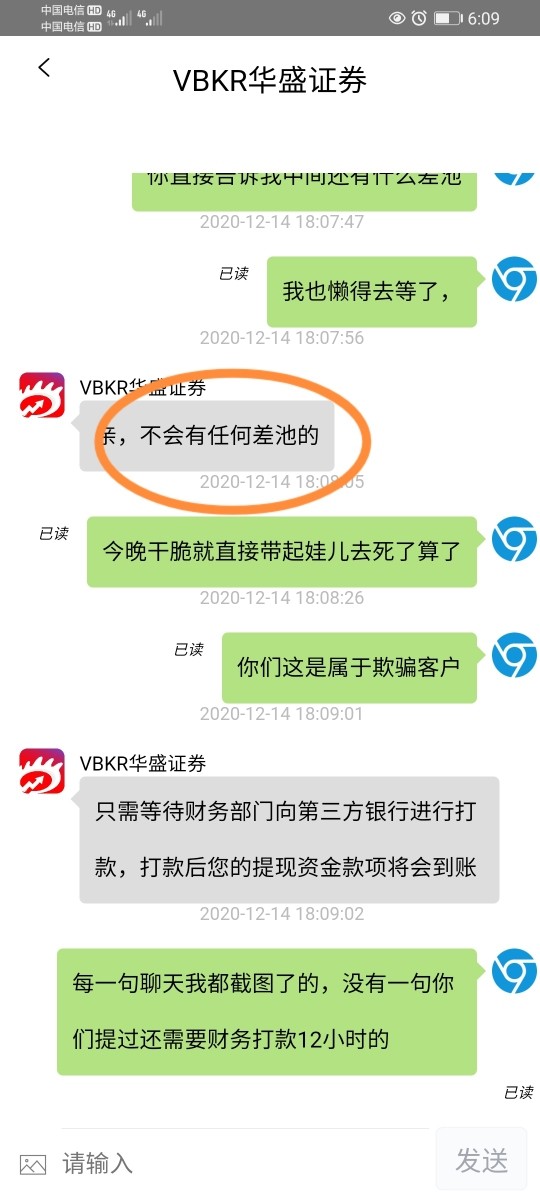

User Experience Analysis

User experience evaluation receives a 6/10 rating. This is influenced by the concerning 11% decline in ratings over the past 12 months. This suggests deteriorating user satisfaction trends. This negative trajectory shows potential issues with service delivery, platform performance, or user expectation management.

The overall 3-point rating reflects moderate user satisfaction levels. It is neither exceptionally positive nor severely negative. But the declining trend suggests users may be experiencing increasing frustrations or unmet expectations over time.

We did not find specific user experience factors including interface design, navigation ease, registration processes, and fund management procedures in available materials. These operational aspects greatly affect daily user interactions and overall platform satisfaction.

User feedback about specific pain points, positive experiences, and improvement suggestions was not accessible for comprehensive analysis. The absence of detailed user testimonials and experience descriptions limits our ability to identify specific areas requiring attention or improvement.

Conclusion

This valuable capital review concludes with a neutral assessment of Valuable Capital Limited. This reflects a platform with notable strengths in pricing structure and service diversity, balanced against concerning transparency gaps and declining user satisfaction trends. The 0% commission structure represents a clear competitive advantage for cost-conscious traders, while the comprehensive multi-asset approach provides valuable diversification opportunities within a single platform environment.

But the absence of clear regulatory information, declining user ratings, and low employee satisfaction numbers raise important concerns about platform reliability and service quality sustainability. The 11% rating decline over the past year suggests underlying issues that may affect future user experiences.

The platform appears most suitable for retail investors who prioritize cost-effective trading across multiple asset classes. This is especially true for those comfortable with platforms offering limited regulatory transparency. Users requiring comprehensive customer support, detailed platform documentation, or strong regulatory oversight may find alternative platforms more suitable for their requirements.