Regarding the legitimacy of AXION TRADE forex brokers, it provides SERC, FSA and WikiBit, (also has a graphic survey regarding security).

Is AXION TRADE safe?

Pros

Cons

Is AXION TRADE markets regulated?

The regulatory license is the strongest proof.

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AXIONTRADE (CAMBODIA) CO., LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

#No.7 and 8, Street 1003, Bayab Village, Sangkat Phnom Penh Thmei, Khan Sen Sok, Phnom Penh.Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Axion Trade Limited

Effective Date:

--Email Address of Licensed Institution:

enquiry@axiontrade.netSharing Status:

No SharingWebsite of Licensed Institution:

https://www.axiontrade.netExpiration Time:

--Address of Licensed Institution:

Office No. A19B, at the building located in plot No. V16050/V16051 in Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4379846Licensed Institution Certified Documents:

Is Axion Trade a Scam?

Introduction

Axion Trade is a forex brokerage that has emerged in the competitive landscape of online trading. Established in 2015, it positions itself as a platform offering a diverse range of financial instruments, including forex, commodities, and indices. With the allure of low spreads and high leverage, Axion Trade appeals to both novice and experienced traders. However, the forex market is notorious for its share of scams, making it essential for traders to conduct thorough due diligence before committing their funds to any broker.

In this article, we will explore Axion Trade's legitimacy and safety by examining its regulatory status, company background, trading conditions, customer experiences, and more. Our investigation is based on multiple sources, including user reviews, regulatory information, and expert analyses, to provide a comprehensive evaluation of whether Axion Trade is a trustworthy broker or a potential scam.

Regulation and Legitimacy

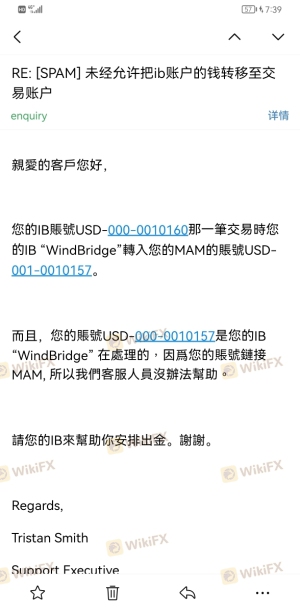

The regulatory status of a forex broker is a crucial factor in assessing its legitimacy. Axion Trade claims to be regulated by several authorities, including the Seychelles Financial Services Authority (FSA) and the Australian Securities and Investments Commission (ASIC). However, the effectiveness and credibility of these regulatory bodies vary significantly.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 175 | Seychelles | Offshore Regulated |

| ASIC | 001293799 | Australia | Revoked |

| SERC | 037 | Cambodia | Exceeded |

The Seychelles FSA is known for its less stringent regulatory framework, which often raises red flags for traders. While it provides a license, the oversight is minimal compared to top-tier regulators like the FCA in the UK or ASIC in Australia. The situation is further complicated by the revocation of Axion Trade's ASIC license, which indicates past compliance issues. Additionally, the SERC license has been marked as exceeded, suggesting that Axion Trade may no longer meet the necessary requirements to operate legally in Cambodia.

Given these factors, the regulatory environment surrounding Axion Trade is concerning. The combination of offshore regulation and revoked licenses casts doubt on the broker's commitment to maintaining a secure trading environment. Traders should be cautious and consider these regulatory shortcomings when deciding whether to engage with Axion Trade.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its reliability. Axion Trade Limited, the operating entity behind the broker, is registered in the United Kingdom, with offices also reported in Seychelles and Cambodia. The company claims to provide a transparent trading environment; however, the lack of detailed information regarding its ownership and management team raises concerns about its transparency.

The management teams background is crucial in evaluating the broker's credibility. Unfortunately, there is limited public information available about the key personnel at Axion Trade. A lack of transparency regarding the management can be a warning sign, as it may indicate that the broker is not fully committed to regulatory compliance or customer protection.

Moreover, the company's historical performance and any past controversies should be taken into account. Reports of customer complaints regarding withdrawal issues and unresponsive customer service have surfaced, indicating potential operational weaknesses. Without a clear understanding of the company's leadership and operational history, traders may find it challenging to trust Axion Trade fully.

Trading Conditions Analysis

Axion Trade advertises competitive trading conditions, which include low spreads and high leverage. However, it is essential to scrutinize these claims to understand the actual costs associated with trading on the platform.

Trading Costs Comparison Table

| Cost Type | Axion Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Structure | Varies | Typically $5-$10 per lot |

| Overnight Interest Range | Varies | Varies |

While the broker claims to offer spreads as low as 0.0 pips, traders should be cautious of hidden fees or unfavorable terms that may apply. The commission structure is also unclear, which could lead to unexpected costs for traders. Additionally, the overnight interest rates can fluctuate, potentially impacting profitability.

Unusual fees or complex commission structures can be red flags for traders, indicating that the broker may not have their best interests in mind. Therefore, it is crucial for potential clients to read the fine print and understand all associated costs before opening an account with Axion Trade.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. Axion Trade claims to implement various measures to protect client funds, but the effectiveness of these measures warrants scrutiny.

The broker states that it segregates client funds from its operational funds, which is a standard practice among reputable brokers. However, the lack of a compensation scheme, such as those offered by FCA-regulated brokers, raises concerns about what would happen to client funds in the event of insolvency. Furthermore, Axion Trade does not provide negative balance protection, which can expose traders to significant risks, especially in volatile market conditions.

Historically, there have been reports of issues regarding fund withdrawals and customer service responsiveness. Instances of clients struggling to withdraw their funds and receiving no response from customer support are alarming. Such issues can indicate a lack of proper fund management and a potential risk to traders' investments.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Axion Trade has received a mix of reviews, with several users reporting negative experiences related to fund withdrawals and customer support.

Common Complaints Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | High | Poor |

| Misleading Information | Medium | Unclear |

Many complaints center around the difficulty in processing withdrawals, with users reporting delays and a lack of communication from the broker. The company's response to these complaints has often been inadequate, leading to frustration among clients. A pattern of unresolved issues can indicate systemic problems within the brokerage, suggesting that potential clients should approach Axion Trade with caution.

One notable case involved a trader who deposited funds but faced challenges when attempting to withdraw their money. Despite multiple attempts to contact customer support, the trader received no response, which raises serious concerns about the broker's operational integrity.

Platform and Execution

A trading platform's performance and reliability are critical for traders. Axion Trade primarily utilizes the MetaTrader 4 (MT4) platform, which is well-regarded in the industry for its user-friendly interface and advanced trading features.

However, there have been mixed reviews regarding the platform's execution quality. Some users report issues with slippage and order rejections, which can hinder trading performance. Additionally, signs of potential platform manipulation have been suggested by users who experienced unusual price movements during high volatility periods.

Risk Assessment

Using Axion Trade presents several risks that potential clients should be aware of.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with revoked licenses. |

| Fund Safety Risk | High | Lack of investor protection and withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Given the high regulatory and fund safety risks, traders must carefully consider their options. It is advisable to implement risk mitigation strategies, such as only trading with funds one can afford to lose and considering alternative brokers with stronger regulatory oversight.

Conclusion and Recommendations

In conclusion, Axion Trade exhibits several warning signs that suggest it may not be a reliable trading partner. The combination of offshore regulation, a lack of transparency, and numerous customer complaints raises significant concerns about the broker's integrity. While the platform may offer attractive trading conditions, the associated risks may outweigh the potential benefits.

For traders seeking a trustworthy forex broker, it is advisable to explore alternatives that are regulated by reputable authorities, such as the FCA or ASIC. Brokers with robust customer support, transparent fee structures, and proven track records of reliability should be prioritized.

Ultimately, conducting thorough research and due diligence is essential for safeguarding investments in the forex market.

Is AXION TRADE a scam, or is it legit?

The latest exposure and evaluation content of AXION TRADE brokers.

AXION TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AXION TRADE latest industry rating score is 3.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.