Regarding the legitimacy of trade245 forex brokers, it provides FSCA and WikiBit, .

Is trade245 safe?

Pros

Cons

Is trade245 markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Red Pine Capital (PTY) LTD

Effective Date:

2015-12-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

FLOOR 9,ATRIUM ON 5TH5TH STREETSANDTON,GAUTENG2196Phone Number of Licensed Institution:

010 9003184Licensed Institution Certified Documents:

Is Trade245 A Scam?

Introduction

Trade245 is a relatively new player in the forex and CFD trading landscape, having been established in 2020 and headquartered in Johannesburg, South Africa. Positioned as a broker that offers a wide range of trading instruments, including forex pairs, indices, commodities, and cryptocurrencies, Trade245 aims to attract both novice and experienced traders. Given the volatile nature of the forex market, it is crucial for traders to thoroughly evaluate the credibility and reliability of any broker before committing their funds. This article seeks to objectively assess the legitimacy of Trade245 by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The analysis is based on a review of multiple sources, including user testimonials, regulatory databases, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is one of the most important factors that determine its credibility. Trade245 claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. This regulatory body is responsible for overseeing the financial services industry in South Africa and aims to protect investors from fraudulent activities. Below is a summary of Trade245s regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 46044 | South Africa | Active |

While the FSCA is a recognized regulatory authority, there are concerns regarding the legitimacy of Trade245‘s claims. Some sources suggest that the company may be operating under a suspicious clone license, implying that it may not have a genuine association with the regulatory body. The FSCA's oversight is crucial for ensuring that brokers adhere to strict operational standards, including the segregation of client funds and the provision of investor protection measures. A history of compliance is also essential, as it builds trust among traders. Unfortunately, the lack of transparency regarding Trade245’s regulatory history raises questions about its legitimacy.

Company Background Investigation

Trade245 is operated by Red Pine Capital (Pty) Ltd, which is registered in South Africa. The company‘s formation in 2020 means it lacks an extensive operational history compared to more established brokers. Understanding the ownership structure and management background is vital for assessing the broker's reliability. The management team’s experience in the financial sector can significantly influence the broker's operational integrity and service quality.

However, the information available about the management team of Trade245 is limited, which raises concerns about transparency. A broker‘s credibility is often bolstered by a well-known and experienced management team, but the absence of detailed information about Trade245's leadership may deter potential traders. Furthermore, the company’s affiliation with other brokers, such as Zuma Markets, which reportedly operates under the same license, adds to the uncertainty. The lack of clear information and potential conflicts of interest could undermine the trustworthiness of Trade245.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Trade245 presents a variety of account types, including standard, swap-free, and zero-spread accounts, catering to different trading strategies. However, the overall fee structure and any unusual charges need careful consideration.

| Fee Type | Trade245 | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1 pip | 0.7 - 1.5 pips |

| Commission Model | $10 per lot | $5 - $10 per lot |

| Overnight Interest Range | 2.5% - 5% | 2% - 3% |

The spreads offered by Trade245 appear to be competitive, particularly for a new broker. However, the commission structure, which charges $10 per lot, may not be as appealing when compared to industry standards. Additionally, the overnight interest rates can be a significant cost for traders holding positions long-term.

While Trade245 does not impose minimum deposit requirements, the lack of clarity regarding additional fees, such as withdrawal charges or inactivity fees, could lead to unexpected costs for traders. This ambiguity can be a red flag, as it may indicate a lack of transparency in the broker's operations.

Customer Fund Safety

The safety of customer funds is paramount when selecting a broker. Trade245 claims to implement several safety measures, including the segregation of client funds from the company's operational funds. This practice is crucial for ensuring that client assets are protected in the event of financial difficulties faced by the broker. Additionally, Trade245 offers negative balance protection, which prevents traders from losing more than their deposited funds.

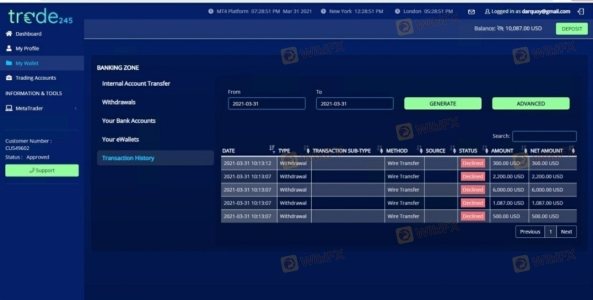

However, the effectiveness of these measures depends on the broker's adherence to regulatory standards. Given the concerns regarding the legitimacy of Trade245's regulatory status, potential clients may question the effectiveness of these safety measures. There have been reports of withdrawal issues and client complaints regarding fund access, which could indicate underlying problems with fund management and security.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Trade245 has received mixed reviews from users, with some praising its trading conditions while others have reported significant issues, particularly related to withdrawals. Common complaints include difficulties in accessing funds and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Limited Availability |

| Account Blocking | High | Inconsistent Communication |

Several users have shared experiences of being unable to withdraw their funds, which raises serious concerns about the broker's reliability. In one instance, a trader reported multiple rejected withdrawal requests despite providing the necessary documentation. Such experiences can be detrimental to a broker's reputation and indicate potential operational issues.

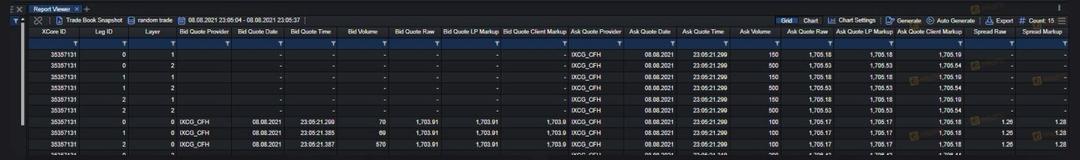

Platform and Trade Execution

The trading experience on Trade245 is facilitated through the widely used MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their user-friendly interfaces and robust trading tools. However, the performance of the trading platform, including order execution speed and slippage, is critical for traders, particularly in fast-moving markets.

Feedback regarding Trade245's execution quality has been varied. While some users report satisfactory execution speeds, others have highlighted issues such as slippage and rejected orders. Any signs of manipulation, such as frequent re-quotes or unexpected price changes, should be closely monitored, as they can significantly impact trading outcomes.

Risk Assessment

Using Trade245 comes with a set of risks that potential traders should consider. The combination of its regulatory status, customer feedback, and operational transparency contributes to an overall risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Suspicious licensing claims and potential clone status. |

| Fund Safety | Medium | Segregated accounts but reports of withdrawal issues. |

| Customer Support | High | Limited availability and responsiveness. |

To mitigate these risks, traders should conduct thorough due diligence before committing funds to Trade245. It is advisable to start with a demo account to assess the platform's functionality and customer support responsiveness before transitioning to live trading.

Conclusion and Recommendations

In conclusion, while Trade245 is regulated by the FSCA, concerns regarding its legitimacy and operational transparency cannot be overlooked. The potential for withdrawal issues and mixed customer feedback raises red flags for prospective traders.

For those considering trading with Trade245, it is crucial to proceed with caution. New traders or those risk-averse may want to explore alternative brokers with a stronger regulatory standing and a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com, which are regulated by top-tier authorities, may offer more robust protections and a better overall trading experience.

Ultimately, thorough research and careful consideration of personal trading needs and risk tolerance are essential before engaging with Trade245 or any other broker in the forex market.

Is trade245 a scam, or is it legit?

The latest exposure and evaluation content of trade245 brokers.

trade245 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

trade245 latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.