Finova Trade 2025 Review: Everything You Need to Know

Summary

Finova Trade positions itself as a globally recognized and regulated forex and CFD broker. The company focuses on delivering innovative, secure, and client-centered services to the trading community worldwide. This finova trade review examines a platform that caters to both retail and professional investors seeking exposure to foreign exchange and CFD markets.

The broker's standout features include the proprietary vTrader platform. This platform offers real-time market data, two-factor authentication, and encrypted communications for enhanced security measures. Finova Trade provides access to diverse asset classes including equities, ETFs, and both single-leg and complex options trading, positioning itself as a comprehensive trading solution for various investor needs.

The platform primarily targets self-directed investors who require robust trading tools and portfolio management capabilities. With features like custom watchlists, trend monitoring, and portfolio tracking analytics, Finova Trade appeals to traders who value technological sophistication and security in their trading environment. However, several key areas require further investigation, including specific fee structures, account types, and detailed regulatory information.

This impacts the overall assessment of this broker's complete offering.

Important Notice

This evaluation acknowledges that different regional entities may operate under varying regulatory requirements and fee structures. Traders should verify specific terms applicable to their jurisdiction before opening accounts with any broker.

This review is based on publicly available information and user feedback. While we strive for objectivity, individual experiences may vary, and some subjective elements may influence certain assessments made in this analysis. Potential clients should conduct their own due diligence before making trading decisions.

Rating Framework

Broker Overview

Finova Trade emerges as a broker with ambitious goals to establish leadership in the global trading industry. The company emphasizes its commitment to providing innovative, secure, and client-focused services to traders worldwide. However, specific founding details and company history remain limited in available documentation provided to the public. The broker operates primarily in the forex and CFD trading space, targeting investors seeking comprehensive market access.

The platform's core business model centers around providing sophisticated trading technology through its vTrader platform. This proprietary system offers real-time market data, advanced order management capabilities, and comprehensive portfolio analytics for traders. Finova Trade supports trading across multiple asset classes including equities, ETFs, and various options strategies, from simple single-leg positions to complex multi-leg options trades.

According to available information, Finova Trade maintains regulated status globally. However, specific regulatory bodies and oversight mechanisms require further clarification from potential users. This finova trade review notes that while the broker claims regulated operations, detailed regulatory information and specific licensing jurisdictions are not comprehensively documented in accessible sources.

Regulatory Status: The broker claims globally recognized regulated status. However, specific regulatory bodies and license numbers are not detailed in available materials for public review.

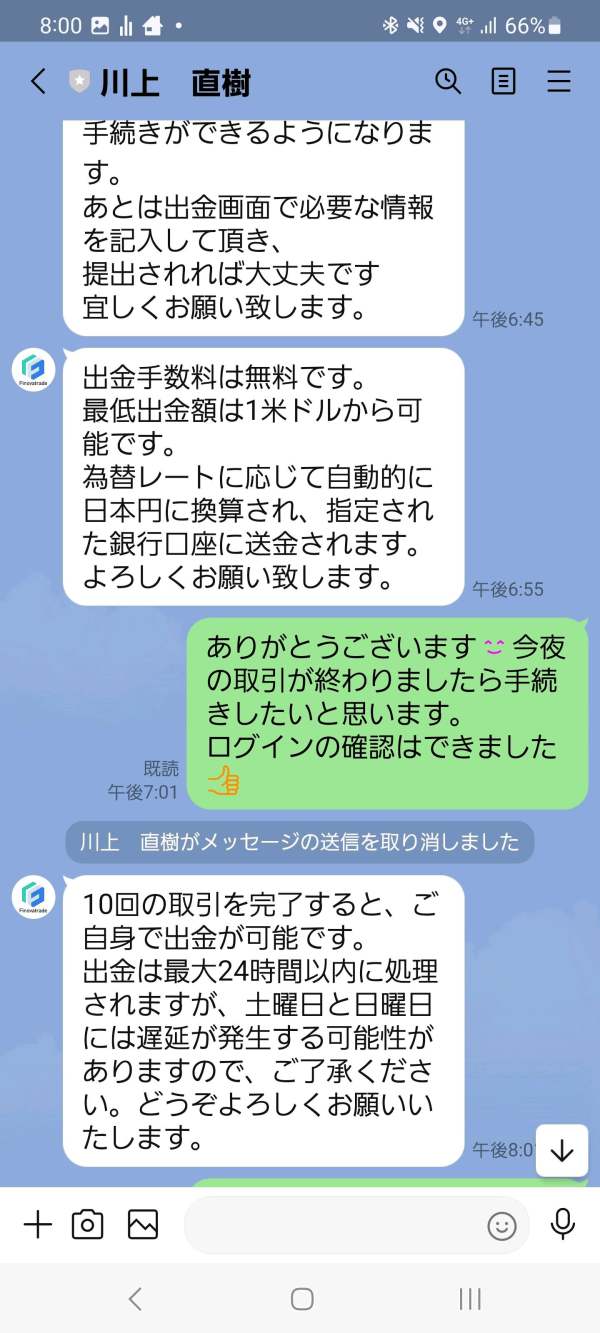

Deposit and Withdrawal Methods: Specific funding methods and withdrawal processes are not comprehensively outlined in current documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available information.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in accessible sources.

Tradeable Assets: The platform supports equities, ETFs, single-leg options, and complex options strategies. This provides diverse trading opportunities across multiple asset classes for various investor preferences.

Cost Structure: Detailed information about spreads, commissions, and fee schedules requires further clarification. However, the broker does maintain a fee structure as referenced in available materials.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in current documentation.

Platform Options: Primary trading occurs through the vTrader platform. This platform is designed specifically for self-directed investors with advanced functionality requirements.

Geographic Restrictions: Specific regional limitations and availability are not comprehensively documented.

Customer Support Languages: Available support languages and communication options require clarification from the broker directly.

This comprehensive finova trade review acknowledges significant information gaps. Potential clients should address these gaps through direct broker contact before making decisions.

Account Conditions Analysis

The account structure at Finova Trade requires deeper investigation. Specific account types and their corresponding features are not thoroughly documented in available materials for review. While the broker operates through its vTrader platform designed for self-directed investors, the exact account categories, minimum balance requirements, and tier-specific benefits remain unclear to potential users.

Available information suggests the platform accommodates various investor types. These range from individual retail traders to more sophisticated market participants with advanced needs. However, without detailed account specifications, potential clients cannot adequately assess which account type might suit their trading style and capital requirements.

The account opening process and required documentation are not explicitly outlined in accessible sources. This lack of transparency regarding KYC procedures, verification timeframes, and account activation steps presents challenges for prospective clients. These clients seek to understand the onboarding experience before committing to the platform.

Specialized account features are not mentioned in available documentation. These might include Islamic-compliant accounts for Muslim traders or institutional account options for larger clients. This finova trade review notes that such omissions may limit the broker's appeal to specific demographic groups or institutional clients requiring customized account structures.

Finova Trade's technological offering centers around the vTrader platform. This platform appears to provide comprehensive functionality for self-directed investors seeking advanced trading capabilities. The platform includes real-time market data access, order creation and modification capabilities, and portfolio tracking analytics, suggesting a robust trading environment for various user needs.

Security features represent a notable strength in the platform's design. The platform implements two-factor authentication and encrypted communications to protect user data and transactions. These security measures address growing concerns about cybersecurity in online trading, potentially appealing to security-conscious traders who prioritize data protection.

The platform supports custom watchlists and trend monitoring functionality. This enables traders to track preferred instruments and identify market opportunities based on their specific interests. Portfolio analytics features suggest sophisticated reporting capabilities, though specific analytical tools and reporting formats are not detailed in available information.

Research and analysis resources are not comprehensively documented in accessible materials. This leaves questions about market commentary, technical analysis tools, and fundamental research availability for users. Educational resources, including webinars, tutorials, and trading guides, are similarly not detailed in accessible materials.

Automated trading support and API access for algorithmic traders are not mentioned in available documentation. This potentially limits appeal to technologically sophisticated trading strategies that require automated execution capabilities.

Customer Service and Support Analysis

Customer service capabilities at Finova Trade require further investigation. Specific support channels, availability hours, and response timeframes are not detailed in accessible documentation for review. The absence of clear customer service information presents challenges for potential clients seeking to understand support quality and accessibility.

Available contact methods are not comprehensively outlined in current materials. These might include phone support, email assistance, and live chat options for user communication. This lack of transparency regarding customer communication channels may concern traders who prioritize responsive customer service for their trading activities.

Response time commitments and service level agreements are not specified in available documentation. This makes it difficult to assess support efficiency and reliability for users requiring assistance. Professional traders, in particular, may require guaranteed response times for urgent trading-related inquiries that affect their positions.

Multilingual support capabilities remain unclear to potential international users. The absence of detailed language support information may restrict the broker's appeal in diverse global markets. Account management services and dedicated support for high-volume traders are not explicitly mentioned, suggesting potential limitations for institutional clients or high-net-worth individuals requiring specialized assistance.

Trading Experience Analysis

The trading experience at Finova Trade centers around the vTrader platform. This platform appears designed to provide comprehensive functionality for various trading strategies and user preferences. However, specific performance metrics regarding platform stability, execution speed, and order processing efficiency are not documented in available materials for evaluation.

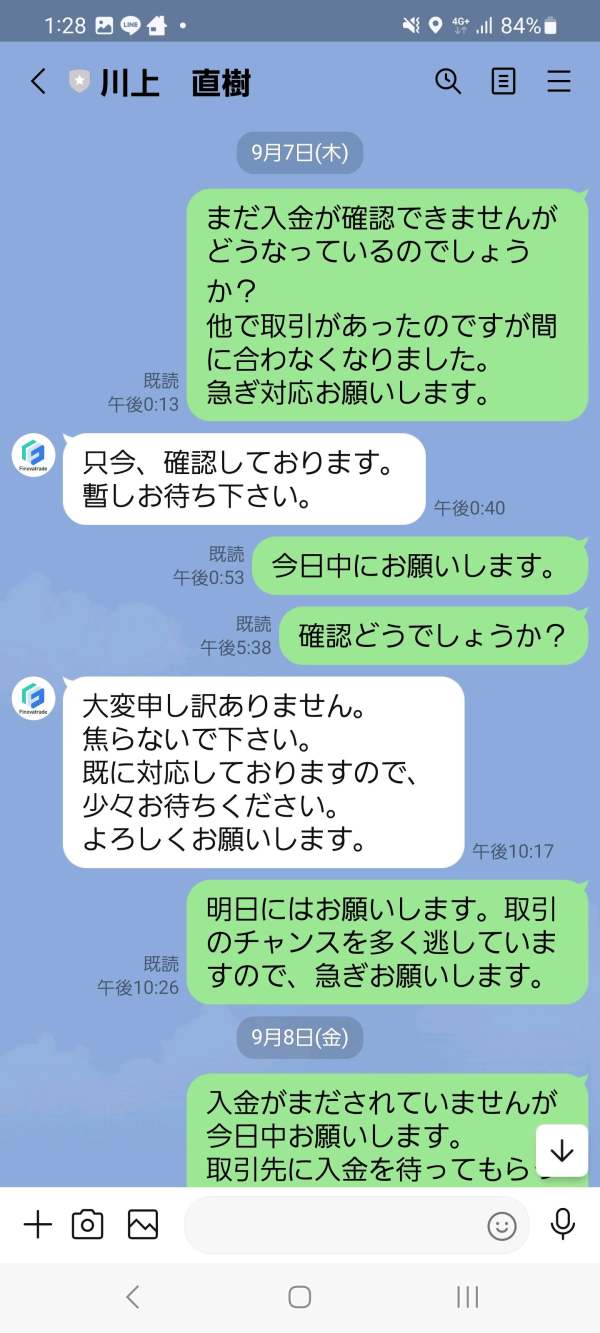

Order execution quality requires further investigation from potential users. This includes fill rates, slippage statistics, and rejection rates that are crucial for trading success. These metrics are crucial for active traders who depend on reliable order processing for their trading strategies and profit potential.

Platform functionality appears comprehensive based on described features. These include real-time data, order management, and portfolio analytics for user convenience. However, detailed user interface descriptions and workflow efficiency assessments are not available in accessible documentation for review.

Mobile trading capabilities and cross-device synchronization are not specifically addressed in available materials. This potentially limits appeal to traders requiring mobile access for their trading activities. In today's trading environment, mobile functionality often determines platform selection for active traders who need flexibility.

Trading environment factors are not detailed in available information sources. These include spread stability, liquidity provision, and market depth that affect trading costs. These factors significantly impact trading costs and execution quality, making their absence notable in this finova trade review.

Trust and Reliability Analysis

Finova Trade's regulatory status provides a foundation for trust assessment. The broker claims globally recognized regulatory oversight from relevant authorities. However, specific regulatory bodies, license numbers, and compliance details are not comprehensively documented, limiting full credibility evaluation for potential users.

Fund safety measures are not detailed in available materials for review. These include client fund segregation, deposit insurance, and custodial arrangements that protect user funds. These protections are fundamental to broker trustworthiness and client confidence in the platform's reliability.

Company transparency requires improvement regarding ownership structure, financial statements, and operational history. Limited public information about corporate governance and financial stability may concern potential clients seeking comprehensive due diligence. Industry recognition through awards, certifications, or third-party endorsements is not documented in accessible sources for verification.

Such recognition often serves as external validation of broker quality and reliability in the market. Negative event handling is not addressed in available documentation for user review. This includes dispute resolution procedures and regulatory actions that might affect users. The absence of clear complaint handling processes may concern potential clients seeking recourse mechanisms.

User Experience Analysis

Overall user satisfaction metrics for Finova Trade are not comprehensively available for evaluation. The platform appears designed with self-directed investors in mind for optimal functionality. The vTrader interface presumably offers intuitive navigation, though specific usability assessments are not documented in accessible materials.

Interface design and ease of use require direct evaluation from potential users. Detailed user interface descriptions and workflow assessments are not available in accessible materials for review. Modern traders expect intuitive design and efficient navigation, making this assessment crucial for platform selection decisions.

Registration and verification processes are not explicitly outlined in available documentation. This prevents evaluation of onboarding efficiency and user-friendliness for new clients. Streamlined account opening often influences broker selection, particularly for new traders entering the market.

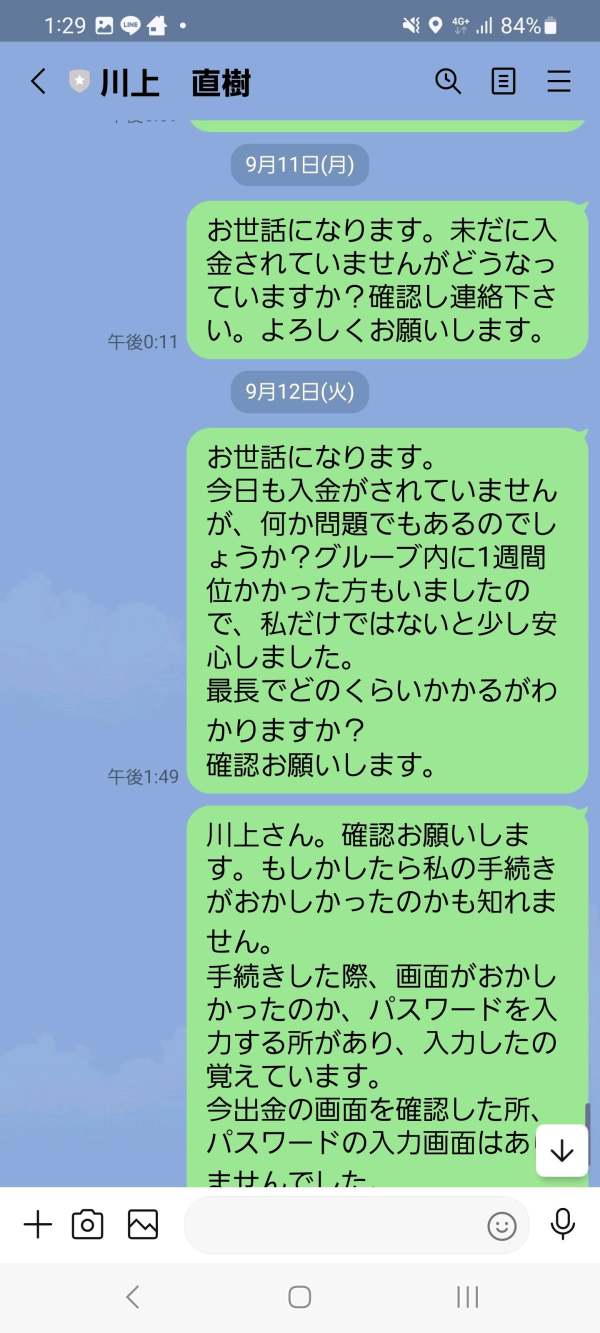

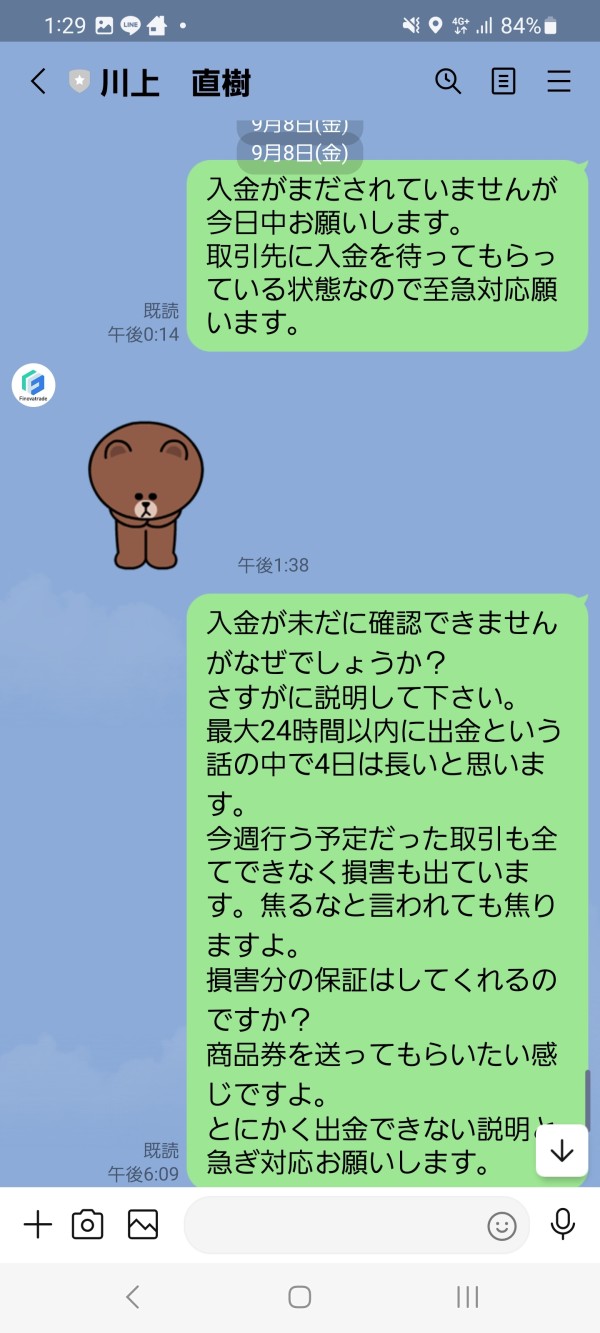

Funding operations experience lacks detailed documentation in accessible sources. This includes deposit processing times and withdrawal efficiency that affect user satisfaction. These operational aspects significantly impact user satisfaction and platform adoption rates among traders.

Common user complaints and satisfaction areas are not systematically documented for review. This limits insight into real-world user experiences and potential platform limitations. These factors might affect trading decisions for prospective clients considering the platform.

Conclusion

Finova Trade presents itself as a regulated forex and CFD broker with technological sophistication. The platform features the vTrader system and maintains commitment to security features for user protection. The broker offers access to diverse asset classes including equities, ETFs, and options trading, potentially appealing to traders seeking comprehensive market access.

However, this evaluation reveals significant information gaps across multiple critical areas. These include fee structures, account types, regulatory details, and customer service capabilities that affect user decisions. These omissions limit the ability to provide a complete assessment and may concern potential clients seeking comprehensive broker evaluation.

The platform appears most suitable for self-directed investors comfortable with technology-driven trading environments. These users typically prioritize security features and advanced functionality in their trading activities. However, traders requiring detailed cost analysis, comprehensive support documentation, or extensive educational resources may need to seek additional information directly from the broker before making platform decisions.