Sun Long Bullion 2025 Review: Everything You Need to Know

Executive Summary

This sun long bullion review shows concerning findings about this Hong Kong-based forex broker that started in 2021. WikiFX gives Sun Long Bullion an extremely low rating of 1/10, which means there are major red flags for traders who might want to use this broker. The company works as a forex trading service provider but lacks important regulatory oversight and clear information about how it operates.

Sun Long Bullion offers high leverage up to 400:1, which is the most notable feature they provide. However, this high leverage brings major risks, especially since the broker's regulatory status is questionable. The company gives limited information about important trading conditions like spreads, commissions, minimum deposits, and trading platforms.

Sun Long Bullion seems to focus on Chinese-speaking traders since they offer customer support only in Simplified Chinese. This narrow language support shows they have a limited geographical focus and mainly serve Asian markets. However, the lack of complete service information and poor industry ratings create serious concerns about whether the broker is reliable and safe for traders' money.

The extremely low WikiFX rating and lack of clear regulatory information mean this broker is only suitable for experienced traders who fully understand the risks of unregulated brokers and specifically want ultra-high leverage trading opportunities.

Important Notice

Forex broker regulations differ significantly between countries because regulatory frameworks vary across different jurisdictions. What may be acceptable in one region could be prohibited or heavily restricted in another place. This difference is particularly important for Sun Long Bullion since the broker's regulatory status remains unclear across different markets.

This review uses available information from broker review platforms and public sources. Some aspects of the broker's services could not be thoroughly evaluated because of limited user feedback and comprehensive data availability. Traders should do additional research and consider getting advice from licensed financial professionals before making any trading decisions.

Overall Rating Framework

Broker Overview

Company Background and History

Sun Long Bullion appeared in the forex trading world in 2021 when it set up headquarters in Hong Kong. The company is a relatively new player in the competitive forex brokerage industry and positions itself as a provider of foreign exchange trading services. However, the broker has failed to build a strong reputation or gain significant market recognition despite being operational for several years.

The company's business model focuses mainly on forex trading services, but detailed information about their operational structure, company leadership, and business philosophy is notably missing from public sources. This lack of transparency concerns potential clients who want to understand the broker's long-term viability and commitment to excellent client service.

Service Offering and Market Position

Sun Long Bullion operates only in the forex trading sector and offers currency pair trading services to retail clients based on available information. The broker's main selling point seems to be providing high leverage ratios up to 400:1, which significantly exceeds the leverage limits that many regulated jurisdictions impose. This sun long bullion review finds that while high leverage can increase profits, it equally increases potential losses, making it a double-edged sword for traders.

The broker's market positioning suggests they focus on traders who want maximum leverage flexibility, particularly those operating in markets where such high ratios remain allowed. However, the lack of information about trading platforms, asset diversity beyond forex, and additional financial instruments limits the broker's appeal to traders who want comprehensive trading solutions.

Regulatory Status and Licensing

The complete absence of regulatory information for Sun Long Bullion is one of the most significant concerns identified in this analysis. No mention of licensing from recognized financial authorities such as the Securities and Futures Commission of Hong Kong, or any other international regulatory body, could be found in available sources. This regulatory gap presents major risks for trader fund security and legal protection.

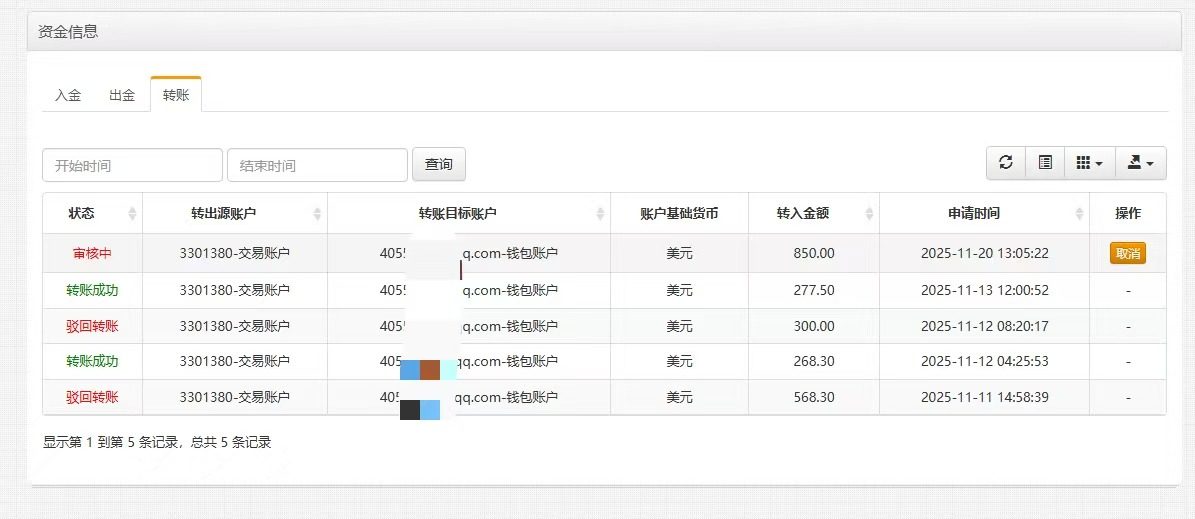

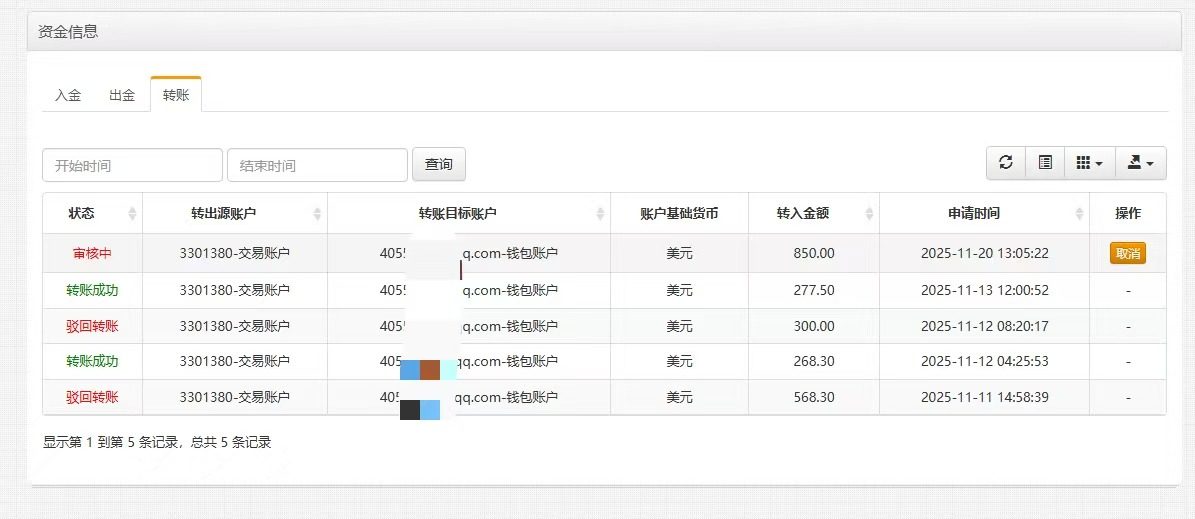

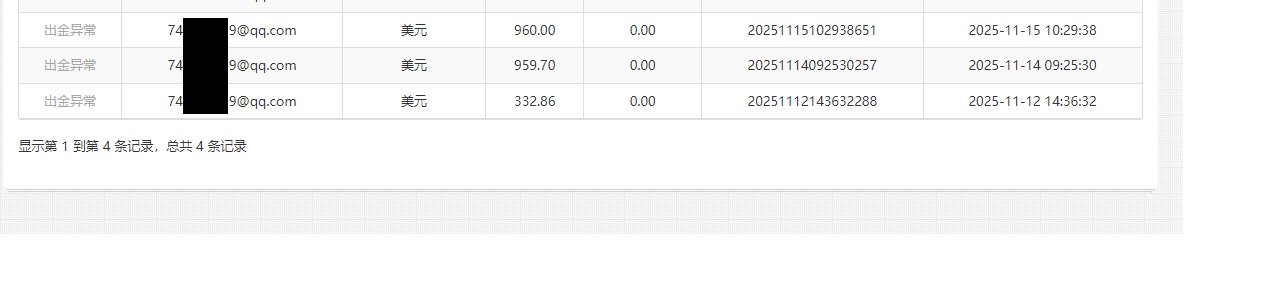

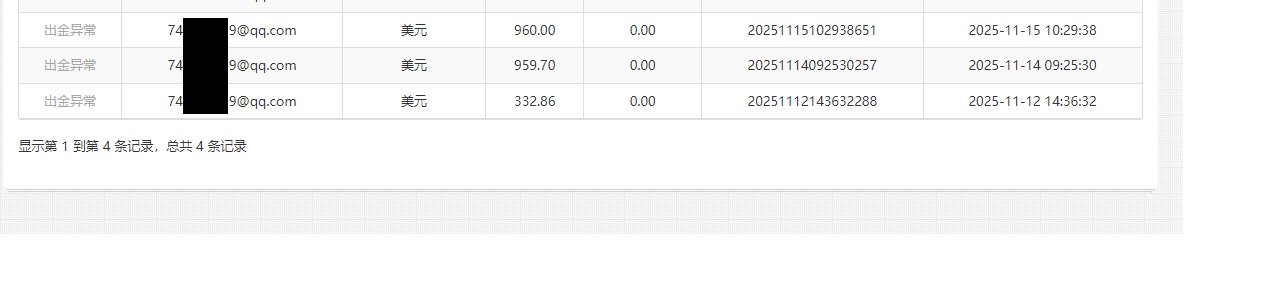

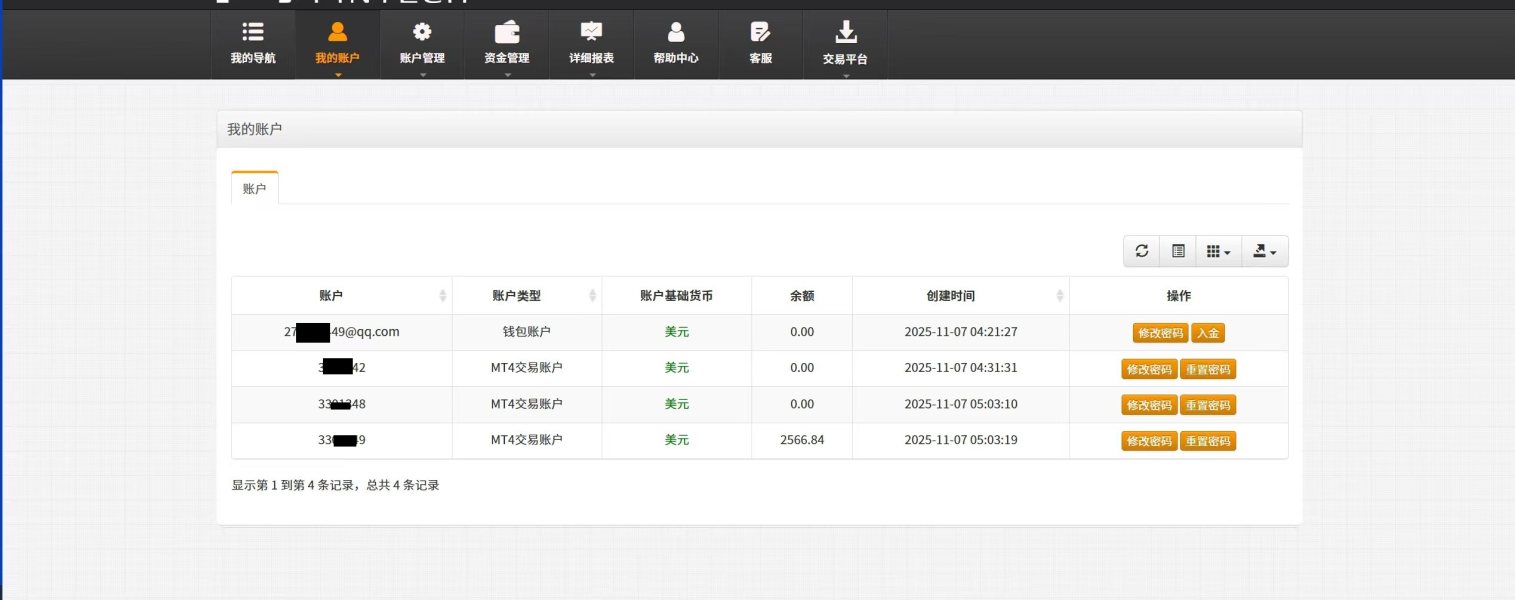

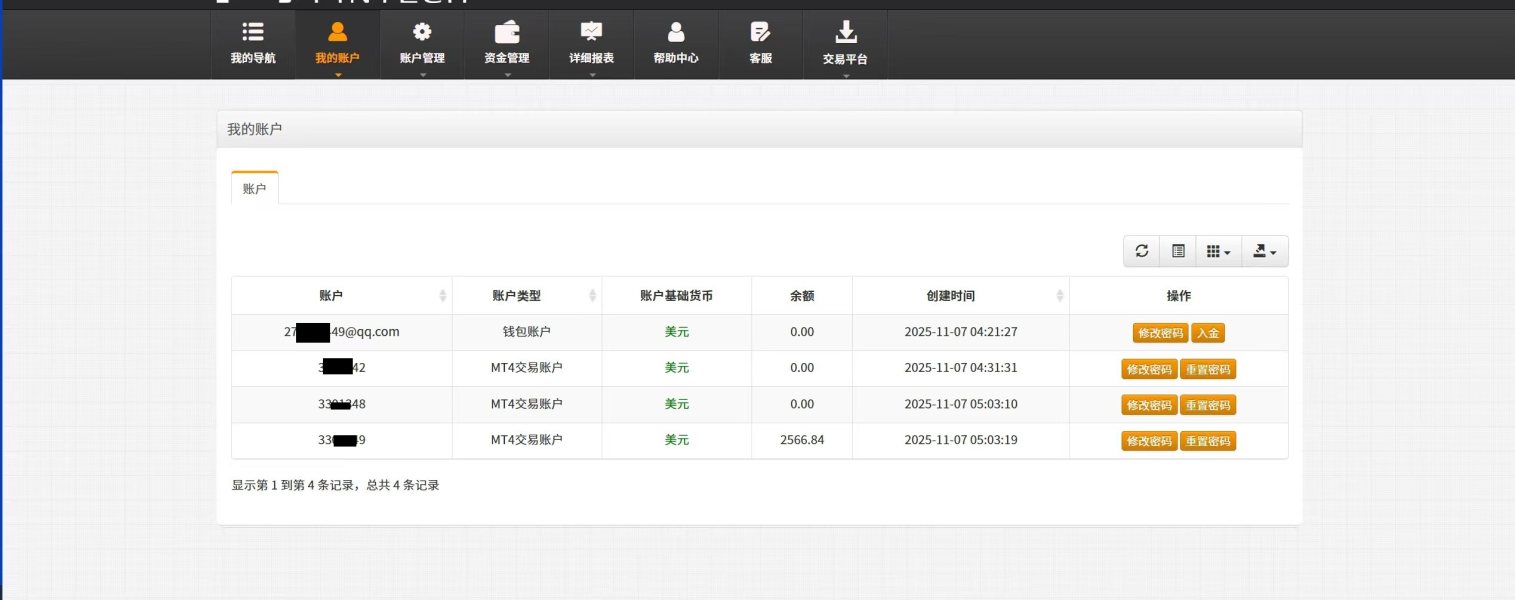

Deposit and Withdrawal Methods

Information about deposit and withdrawal methods remains unavailable in current sources. This lack of transparency about payment processing, supported currencies, processing times, and potential fees creates uncertainty for prospective clients who are trying to evaluate the broker's operational capabilities.

Minimum Deposit Requirements

Sun Long Bullion has not disclosed specific minimum deposit requirements. This absence of basic account opening information makes it difficult for potential traders to plan their initial investment or compare the broker's accessibility with industry competitors.

Promotional Offers and Bonuses

No information about welcome bonuses, promotional offers, or incentive programs is currently available. Many established brokers use promotional strategies to attract new clients, but Sun Long Bullion appears to lack such marketing initiatives or has not made them publicly accessible.

Available Trading Assets

Sun Long Bullion focuses exclusively on forex trading based on available information. The specific currency pairs offered, exotic pair availability, and trading conditions for different instrument categories remain unspecified in current sources.

Cost Structure and Fees

Critical information about spreads, commission structures, overnight financing rates, and other trading costs is not provided in available sources. This transparency gap makes it impossible for traders to accurately assess the total cost of trading with this broker or compare it effectively with competitors.

Leverage Options

The most prominently advertised feature is leverage up to 400:1. While this high leverage ratio may attract traders who want maximum market exposure, it also represents significant risk, particularly for inexperienced traders who may not fully understand leverage implications.

Trading Platform Options

Specific information about trading platforms, whether proprietary or third-party solutions like MetaTrader, remains unavailable. Platform stability, features, and mobile accessibility cannot be evaluated based on current information.

Geographic Restrictions

Specific geographic restrictions or service availability limitations are not detailed in available sources, though the Chinese-only customer support suggests primary focus on Chinese-speaking markets. The broker appears to target a specific demographic rather than pursuing global market expansion.

Customer Support Languages

Customer support is available exclusively in Simplified Chinese, which indicates a targeted approach to Chinese-speaking traders but potentially excludes international clients who need multilingual support.

Detailed Rating Analysis

Account Conditions Analysis

The sun long bullion review reveals significant problems in account condition transparency. No information about account types, whether standard, premium, or VIP accounts are available, leaves potential clients without essential decision-making data. The absence of minimum deposit requirements makes it impossible to assess account accessibility for traders with different capital levels.

Account opening procedures, required documentation, and verification processes remain unspecified. This lack of procedural clarity could indicate either poor communication practices or deliberately unclear operations. Additionally, no mention of Islamic accounts for Muslim traders, demo account availability, or account management features suggests limited service customization.

The leverage offering of 400:1, while notable, exists alone without context about margin requirements, margin call procedures, or stop-out levels. Professional traders typically need comprehensive account condition information to make informed decisions, but Sun Long Bullion fails to provide this fundamental transparency.

Traders cannot accurately calculate the total cost of maintaining an account with this broker without clear information about account fees, maintenance costs, or inactivity charges. This information gap significantly hurts the broker's credibility and makes it difficult to recommend their services to serious traders.

The complete absence of information about trading tools and resources represents a major weakness in Sun Long Bullion's service offering. No mention of charting software, technical analysis tools, or market research capabilities suggests either a basic service offering or poor communication of available features.

Educational resources, which are crucial for trader development, appear to be non-existent or poorly promoted. Established brokers typically offer webinars, tutorials, market analysis, and educational content to support client success, but no such resources are evident for Sun Long Bullion.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, or copy trading services, remains unspecified. Modern traders often rely on these advanced features, and their absence could significantly limit the broker's appeal to sophisticated trading strategies.

Market analysis, economic calendars, news feeds, and research reports are standard offerings among reputable brokers but appear to be absent from Sun Long Bullion's service portfolio. This lack of analytical support forces traders to seek third-party resources, reducing the broker's value proposition and potentially increasing trading costs through external service subscriptions.

Customer Service and Support Analysis

Customer service capabilities appear severely limited, with support available exclusively in Simplified Chinese. This single-language approach restricts the broker's international appeal and suggests a narrow target market focus primarily on Chinese-speaking traders.

Response time information, support channel availability, and operating hours remain unspecified. Professional traders often need rapid support resolution, particularly during volatile market conditions, but the broker's support capabilities cannot be evaluated based on available information.

Service quality assessments from user feedback are notably absent, which prevents potential clients from understanding the typical support experience. Without testimonials, reviews, or case studies showing problem resolution effectiveness, the support service remains an unknown quantity.

The lack of multilingual support also raises questions about the broker's ability to serve international markets effectively. In today's global trading environment, language barriers can significantly impact trader success and satisfaction, making this limitation particularly concerning for non-Chinese speaking traders considering this broker.

Trading Experience Analysis

Platform stability and execution speed information is completely absent from available sources, making it impossible to assess the technical quality of the trading environment. These factors are crucial for successful trading, particularly in fast-moving markets where execution delays can result in significant losses.

Order execution quality, including slippage rates, requote frequency, and fill rates, cannot be evaluated due to lack of user feedback and performance data. Professional traders need reliable execution to implement their strategies effectively, but Sun Long Bullion provides no evidence of execution quality.

Platform functionality, including order types available, charting capabilities, and mobile trading options, remains unspecified. Modern traders expect comprehensive platform features, but the broker's technological offerings cannot be assessed based on current information.

User experience feedback from actual traders is notably absent, which prevents prospective clients from understanding real-world trading conditions. This sun long bullion review finds that without authentic user testimonials or performance reviews, potential clients must rely on limited promotional information, which significantly increases decision-making uncertainty.

Trust and Safety Analysis

The most concerning aspect of Sun Long Bullion is the complete absence of regulatory oversight information. No licensing from recognized financial authorities such as the Hong Kong SFC, FCA, ASIC, or other major regulators could be identified, creating significant safety concerns for trader funds.

WikiFX's rating of 1/10 represents an extremely poor industry assessment, which suggests serious red flags regarding the broker's operations, reliability, and safety standards. Such low ratings typically indicate regulatory issues, user complaints, or operational concerns that potential clients should carefully consider.

Fund safety measures, including segregated client accounts, deposit insurance, or investor compensation schemes, are not mentioned in available sources. These protections are standard among regulated brokers and their absence suggests elevated risk for client funds.

Company transparency regarding ownership, management, financial statements, and operational procedures appears minimal. Legitimate brokers typically provide comprehensive company information to build client trust, but Sun Long Bullion's lack of transparency in this regard raises additional concerns about operational legitimacy and long-term viability.

User Experience Analysis

Overall user satisfaction appears poor based on the extremely low WikiFX rating, though specific user complaints or satisfaction surveys are not available in current sources. The absence of positive user testimonials or case studies suggests either limited client base or poor service delivery.

Interface design and platform usability cannot be evaluated due to lack of platform information and user feedback. Modern traders expect intuitive, responsive trading interfaces, but Sun Long Bullion provides no evidence of user-friendly design or functionality.

Registration and account verification processes remain unspecified, which prevents assessment of onboarding efficiency and user-friendliness. Streamlined account opening procedures are important for client acquisition, but the broker's approach cannot be evaluated.

Fund operation experience, including deposit and withdrawal efficiency, processing times, and fee transparency, lacks documentation. These operational aspects significantly impact user satisfaction, but their quality remains unknown for Sun Long Bullion clients.

Conclusion

This comprehensive sun long bullion review reveals significant concerns about the broker's suitability for most traders. While the offering of 400:1 leverage may attract some traders who want maximum market exposure, the numerous red flags, including the absence of regulatory oversight, extremely poor industry ratings, and lack of service transparency, create substantial risks that outweigh potential benefits.

The broker appears most suitable for experienced traders who fully understand the risks associated with unregulated brokers and specifically need ultra-high leverage that may not be available through regulated alternatives. However, even experienced traders should proceed with extreme caution given the lack of fund protection measures and regulatory oversight.

Sun Long Bullion cannot be recommended for the vast majority of traders, particularly those new to forex trading or those who prioritize fund safety and regulatory protection. The combination of poor industry ratings, lack of transparency, and absence of regulatory oversight creates an unacceptable risk profile for most trading objectives.