DOO FINANCIAL Review 1

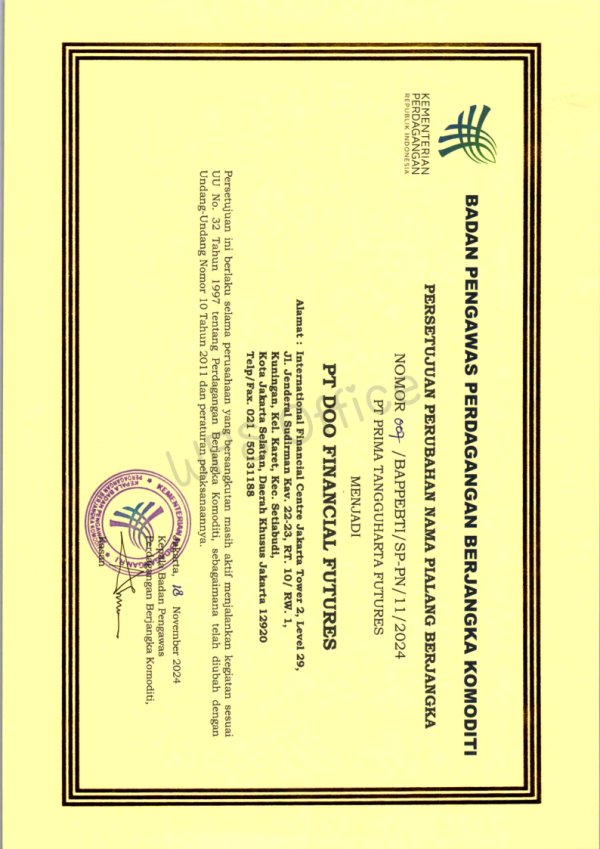

keren dooprime is now local, already has permission from bappebti

DOO FINANCIAL Forex Broker provides real users with 1 positive reviews, * neutral reviews and * exposure review!

keren dooprime is now local, already has permission from bappebti

This doo financial review gives you a clear look at Doo Financial. The company works under the Doo Group umbrella and operates as a trading platform. Doo Financial shows a neutral profile in the busy online brokerage world, with regulatory oversight from the US Securities and Exchange Commission and the Financial Industry Regulatory Authority providing compliance foundations for US operations.

The broker sits within the diverse Doo Group system. This group includes many financial service brands like Doo Clearing, Doo Wealth, Doo Payment and Exchange, and other related companies. The platform helps investors who want access to global securities, futures, and CFD trading chances. But this review finds limited public user feedback and detailed trading information, which makes it hard to give a complete assessment of the broker's real trading environment and how happy users are.

The broker seems ready to serve traders who want to access international markets. Still, potential clients should do careful research since there's limited transparency in public trading details and user experience data.

Regional Entity Variations: Doo Financial works across multiple areas, and trading conditions, regulatory protections, and available services may change a lot between different regional entities. Traders should check which specific entity they will trade with and understand the regulatory framework and investor protection measures in their area.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and limited market data. The assessment recognizes big gaps in user feedback, detailed trading conditions, and complete performance metrics. Readers should add more research to this review and consider direct contact with the broker for current terms and conditions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available on account types, minimum deposits, and specific terms |

| Tools and Resources | 4/10 | Insufficient data on trading platforms, analytical tools, and educational resources |

| Customer Service | 5/10 | Lack of user feedback and detailed support channel information |

| Trading Experience | 5/10 | Missing platform performance data and user experience testimonials |

| Trustworthiness | 7/10 | Regulatory oversight by SEC and FINRA provides credibility foundation |

| User Experience | 4/10 | Limited user feedback and interface usability information available |

Doo Financial works as a subsidiary within the broader Doo Group system. The company represents one of several financial service brands under this corporate umbrella. According to available information, the Doo Group includes multiple trading names and intellectual properties, including Doo Clearing, Doo Financial, Doo Wealth, Doo Payment and Exchange, LessPay, FinPoints, Doo Academy, Doo Health, Peter Elish, and Doo Consulting.

This diverse structure suggests a complete approach to financial services. However, specific operational details for each entity remain limited in public documentation. The broker's business model focuses on providing online brokerage services with attention to global securities and futures trading.

Reports show that Doo Group aims to deliver "a highly efficient and more reliable investment experience" in volatile market conditions. The company particularly notes increased activity in EUR, JPY, and GBP-related products during periods of forex market acceleration. The organization appears to position itself as responsive to global economic pressures and market opportunities, though specific trading infrastructure details require further investigation.

Regulatory compliance represents a key aspect of Doo Financial's operations. The company has oversight from the US Securities and Exchange Commission and the Financial Industry Regulatory Authority. This doo financial review notes that while regulatory supervision provides important credibility, the specific scope of services and trading conditions under these regulatory frameworks requires verification directly with the broker.

Regulatory Jurisdictions: Doo Financial operates under supervision from the US Securities and Exchange Commission and the Financial Industry Regulatory Authority. This provides regulatory oversight for US-based operations.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in available public materials. Users need to contact the broker directly for this information.

Minimum Deposit Requirements: Current minimum deposit thresholds for different account types are not specified in accessible documentation.

Bonus and Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs are not available in current public information.

Tradeable Assets: The broker provides access to global securities, futures contracts, and contracts for difference. However, specific instrument availability and market coverage require verification.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not fully available in public materials. This makes direct broker contact necessary for current pricing.

Leverage Ratios: Maximum leverage levels for different instrument categories are not specified in available documentation.

Platform Options: Specific trading platform offerings, including proprietary solutions or third-party integrations, are not detailed in accessible public information.

Geographic Restrictions: Service availability limitations for different countries and regions are not clearly outlined in current materials.

Customer Support Languages: Available support languages and communication channels require direct verification with the broker. This doo financial review emphasizes the importance of confirming service accessibility for international clients.

The evaluation of Doo Financial's account conditions faces big limitations due to insufficient publicly available information about specific account types, terms, and features. Available documentation does not provide clear details about the range of account categories offered. The broker may provide different tiers based on deposit levels or trading volume, but this information is not confirmed.

It's unclear if specialized account types such as Islamic accounts are available for clients with specific requirements. Minimum deposit requirements remain unspecified in accessible materials, making it difficult to assess the broker's accessibility for different trader segments. The absence of clear information about account opening procedures, required documentation, or verification timelines presents challenges for potential clients seeking to understand the onboarding process.

Additionally, details about account maintenance fees, inactivity charges, or other ongoing costs are not readily available. The lack of complete account condition information impacts the ability to compare Doo Financial's offerings against industry standards or competitor services. Without specific data on leverage limits for different account types, margin requirements, or position sizing rules, traders cannot properly assess whether the broker's terms align with their trading strategies and risk management approaches.

This doo financial review recommends that prospective clients directly contact the broker to obtain current account terms, conditions, and requirements before making any commitment. The limited transparency in publicly available account information makes thorough due diligence through direct communication channels necessary.

Assessment of Doo Financial's trading tools and resources encounters significant information gaps that limit complete evaluation. Available public materials do not provide detailed specifications about the broker's trading platform offerings. The platforms may be proprietary or third-party solutions, making it difficult to assess the technological infrastructure available to clients.

Research and analytical resources, including market analysis, economic calendars, trading signals, or technical analysis tools, are not described in accessible documentation. The absence of information about educational resources, webinars, tutorials, or market commentary limits understanding of the broker's commitment to client development and market education. Automated trading capabilities, including expert advisor support, algorithm trading infrastructure, or copy trading services, remain unspecified in available materials.

This gap is particularly significant for traders seeking sophisticated trading automation or social trading features that have become standard in the modern brokerage landscape. Mobile trading capabilities, platform compatibility across different devices, and user interface design quality cannot be assessed based on current information availability. The lack of detailed platform specifications or user interface screenshots limits the ability to evaluate the practical trading experience offered by Doo Financial's technological infrastructure.

Evaluation of Doo Financial's customer service capabilities is limited by insufficient publicly available information about support channels, response times, and service quality metrics. Available contact information includes a Singapore phone number and an email address. These suggest basic communication channels, though complete support infrastructure details remain unclear.

Service availability hours, including whether 24/7 support is provided to accommodate global trading schedules, are not specified in accessible materials. The absence of information about live chat functionality, callback services, or priority support tiers makes it difficult to assess the broker's commitment to responsive client service. Multilingual support capabilities, crucial for international brokers serving diverse client bases, are not detailed in available documentation.

This gap is particularly relevant given the broker's apparent international scope and the Doo Group's global positioning. User feedback about service quality, problem resolution effectiveness, and overall satisfaction with support interactions is notably absent from public sources. Without testimonials, reviews, or case studies demonstrating the broker's approach to client issue resolution, potential clients cannot gauge the practical quality of customer service delivery.

Assessment of the trading experience offered by Doo Financial faces substantial limitations due to insufficient user feedback and technical performance data. Platform stability, execution speed, and order processing quality cannot be evaluated without access to user testimonials or independent performance testing results. The absence of detailed platform specifications limits understanding of the trading environment's functionality, including order types available, charting capabilities, risk management tools, and market data quality.

Without information about slippage rates, requote frequency, or execution statistics, traders cannot assess the practical trading conditions they might encounter. Mobile trading experience, including app functionality, feature parity with desktop platforms, and user interface design, remains unspecified in available materials. This information gap is significant given the increasing importance of mobile trading capabilities in modern brokerage services.

Market access quality, including the range of tradeable instruments, market depth, and liquidity provision, cannot be fully evaluated without detailed product specifications or user experience reports. The lack of information about trading restrictions, position limits, or scalping policies further limits the ability to assess suitability for different trading styles. This doo financial review emphasizes that potential clients should request detailed platform demonstrations and trial access to properly evaluate the trading experience before committing to the broker's services.

Doo Financial's trustworthiness profile benefits from regulatory oversight by the US Securities and Exchange Commission and the Financial Industry Regulatory Authority. These regulatory relationships provide important credibility foundations and suggest compliance with established financial industry standards and oversight mechanisms, though the specific scope and nature of regulatory supervision require verification.

However, the assessment of trustworthiness faces limitations due to insufficient information about client fund protection measures, segregation policies, or insurance coverage. Details about the broker's approach to client asset security, including the use of segregated accounts or participation in investor compensation schemes, are not clearly outlined in available materials. Corporate transparency, including detailed company information, ownership structure, and financial reporting, is not fully available in public documentation.

The absence of readily accessible information about the company's financial stability, operational history, or management team limits the ability to conduct thorough due diligence. Third-party evaluations, independent audits, or industry awards that might support the broker's reputation are not evident in available sources. Additionally, the lack of detailed user reviews or testimonials from verified clients makes it difficult to assess real-world user trust and satisfaction levels with the broker's services.

Evaluation of user experience at Doo Financial encounters significant challenges due to limited user feedback and detailed interface information. Overall user satisfaction metrics, including retention rates, user ratings, or complete review data, are not available in accessible public sources. This makes it difficult to assess the practical client experience.

Interface design quality, navigation efficiency, and platform usability cannot be properly evaluated without access to detailed platform screenshots, user interface demonstrations, or user experience testimonials. The absence of information about registration and verification processes, including required documentation, processing times, and user-friendliness of onboarding procedures, limits understanding of the initial client experience. Funding operations experience, including deposit and withdrawal processes, processing times, and user satisfaction with financial transactions, is not documented in available materials.

This information gap is particularly significant as funding efficiency often represents a crucial factor in overall broker satisfaction. Common user concerns, complaints, or areas for improvement are not evident in public feedback sources. This prevents identification of potential issues or limitations that might affect client satisfaction.

Without access to user forums, review platforms, or testimonial collections, this doo financial review cannot provide insights into typical user experiences or satisfaction levels.

This complete evaluation of Doo Financial reveals a broker operating within the established Doo Group framework with regulatory oversight from US authorities. However, significant information gaps limit the ability to provide a definitive assessment. The neutral rating reflects the balance between regulatory credibility and insufficient transparency about trading conditions, user experiences, and operational details.

Doo Financial appears most suitable for investors seeking access to global securities and CFD trading opportunities who prioritize regulatory oversight. These clients should be willing to conduct thorough due diligence through direct broker communication. The primary advantage lies in the regulatory supervision by SEC and FINRA, while the main limitation involves the lack of detailed public information about trading conditions, costs, and user satisfaction metrics.

Potential clients should supplement this review with direct broker contact to obtain current terms, platform demonstrations, and detailed service specifications before making trading decisions.

FX Broker Capital Trading Markets Review