SOLTCL Review 3

they are big scammer and cheater they restricted withdrawal

This is a fraudulent company

Don't be fooled, they stole from me on this platform. They ask me for another deposit in order to withdraw my money. It's fake.

SOLTCL Forex Broker provides real users with * positive reviews, * neutral reviews and 3 exposure review!

Business

License

they are big scammer and cheater they restricted withdrawal

This is a fraudulent company

Don't be fooled, they stole from me on this platform. They ask me for another deposit in order to withdraw my money. It's fake.

SOLTCL has been flagged by multiple sources as a potentially fraudulent trading platform. This comprehensive review gives the broker an overwhelmingly negative assessment. Reports from Scams Report, Broker Watch Dog, and Scam Victims Help show that this broker presents significant red flags. Traders should be aware of these warnings before considering any investment.

The platform reportedly requires a minimum deposit of $25,000 USD. It claims to offer spreads starting from 1 pip. However, these seemingly competitive features are overshadowed by serious concerns about the broker's legitimacy and regulatory status. Multiple fraud reporting websites have issued warnings about SOLTCL. Users report difficulties in fund recovery and poor customer service responses.

This soltcl review reveals that the platform may target traders with substantial capital due to its high minimum deposit requirement. However, the potential risks far outweigh any advertised benefits. The lack of transparent regulatory information and numerous scam alerts make this broker unsuitable for traders seeking a reliable trading environment.

SOLTCL has not provided clear regulatory information. Traders from different regions should exercise extreme caution when considering this platform. The absence of proper licensing details raises serious questions about the broker's compliance with international trading standards and investor protection measures.

This evaluation is based on multiple user feedback reports, fraud alert websites, and market analysis information available as of December 2024. According to Scams Report and other watchdog organizations, SOLTCL has been consistently flagged as a potentially fraudulent operation. This makes it crucial for potential investors to understand these risks thoroughly.

Based on available information and user reports, here are the ratings for SOLTCL across six key dimensions:

| Dimension | Score | Justification |

|---|---|---|

| Account Conditions | 3/10 | High minimum deposit of $25,000 USD severely limits accessibility |

| Tools and Resources | 2/10 | No specific trading tools or educational resources mentioned |

| Customer Service | 2/10 | Multiple reports of unresponsive customer support |

| Trading Experience | 4/10 | Claims 1 pip spreads but lacks platform details |

| Trustworthiness | 1/10 | Multiple fraud warnings from reputable sources |

| User Experience | 2/10 | Negative user feedback regarding fund safety concerns |

SOLTCL operates in what appears to be a highly questionable manner. It shows limited transparency regarding its corporate structure, founding date, and regulatory compliance. The available information suggests this entity presents itself as a forex trading platform. However, specific details about company background, establishment year, and operational history remain conspicuously absent from public records.

The broker's business model appears to target high-net-worth individuals through its substantial minimum deposit requirement. This strategy is undermined by widespread warnings from fraud detection services. According to multiple sources including Broker Watch Dog and Scam Victims Help, SOLTCL has been identified as operating without proper regulatory oversight. This raises serious concerns about client fund protection and operational legitimacy.

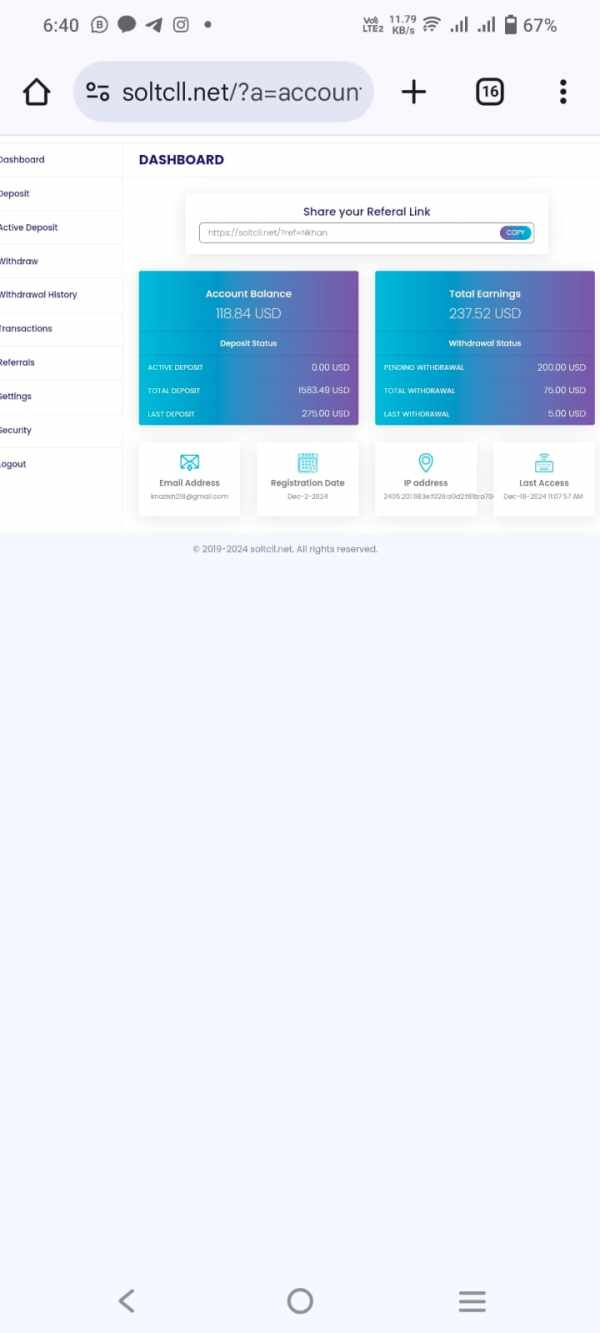

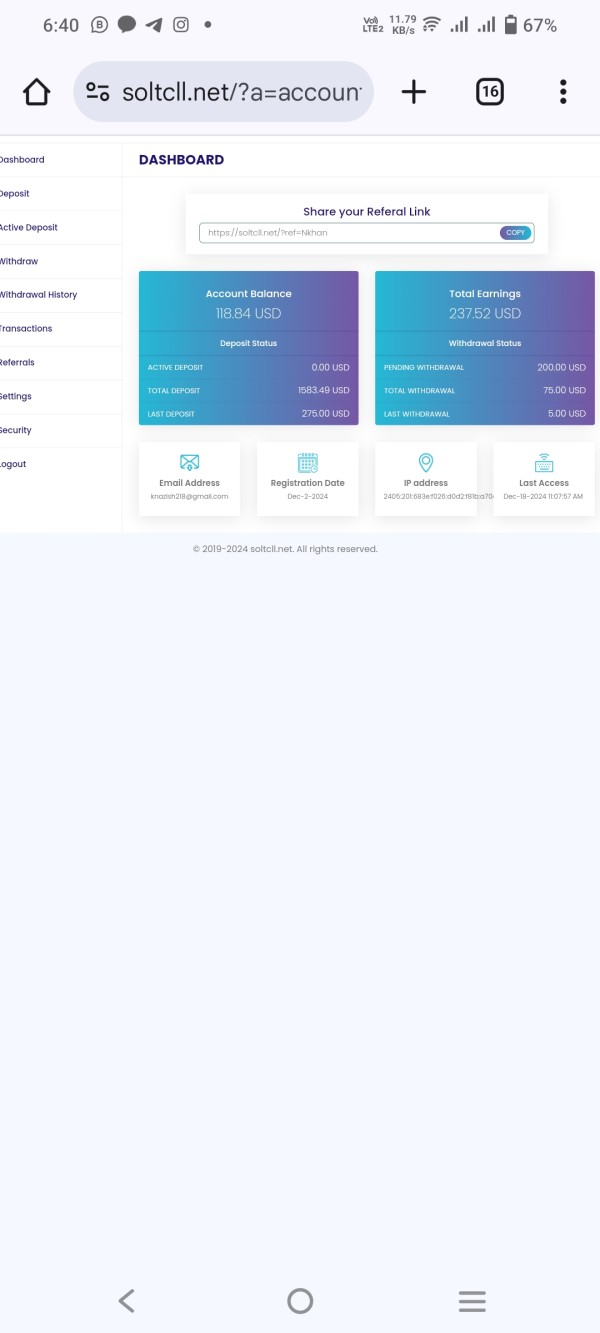

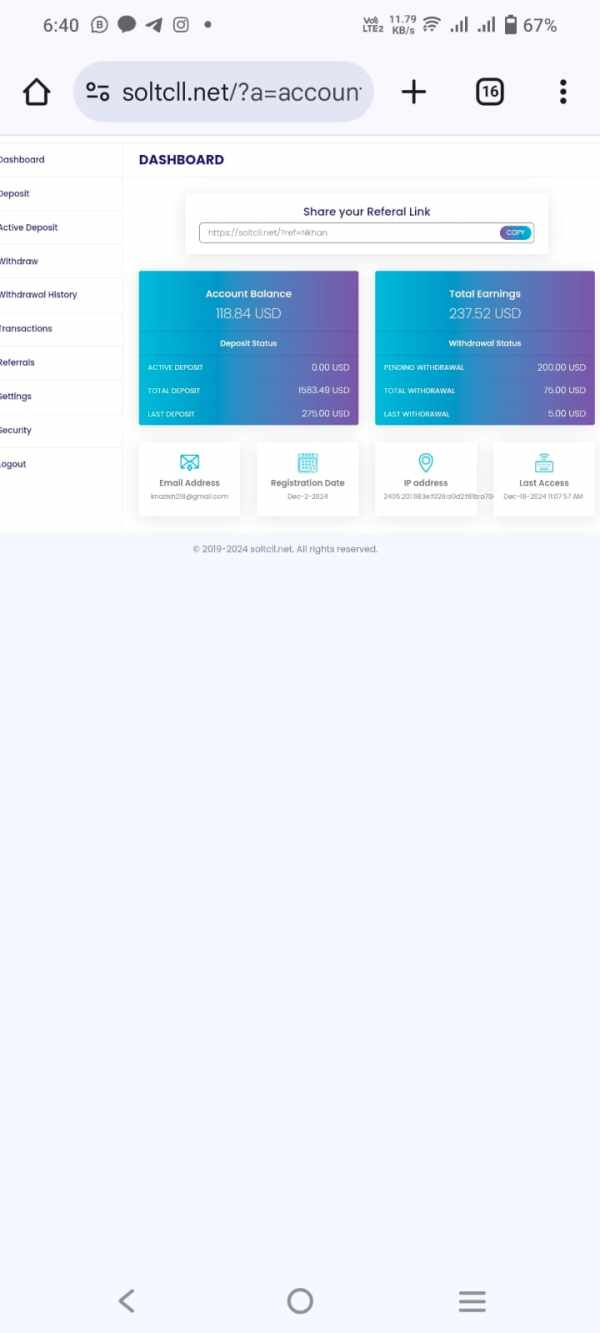

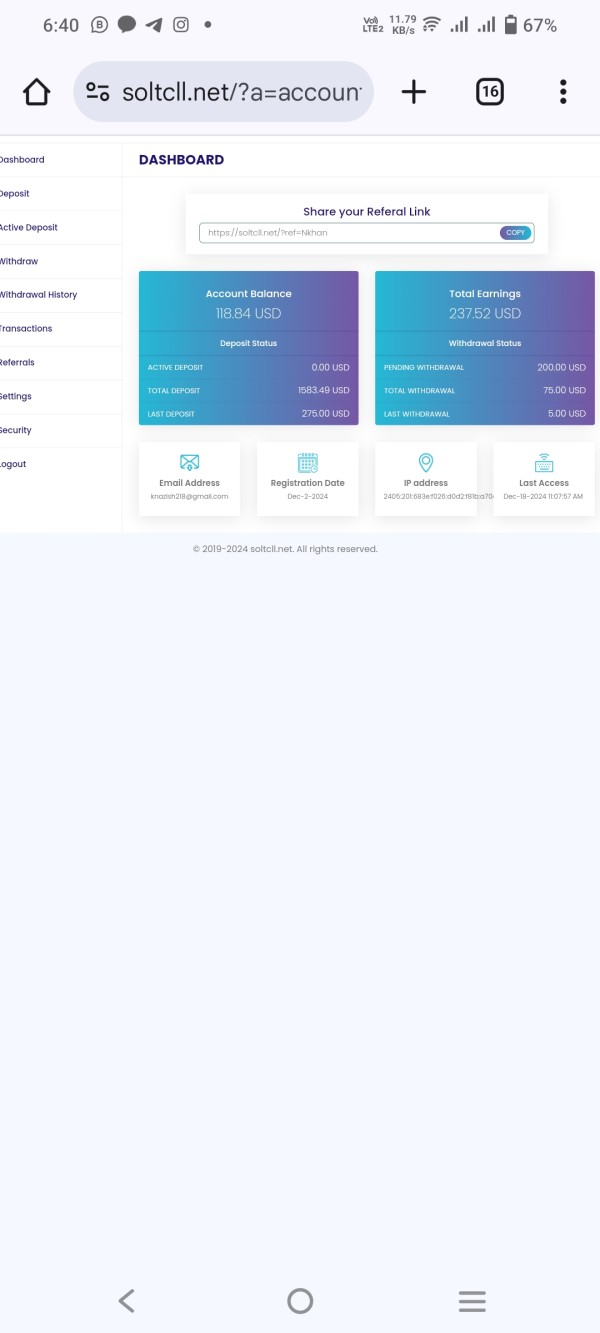

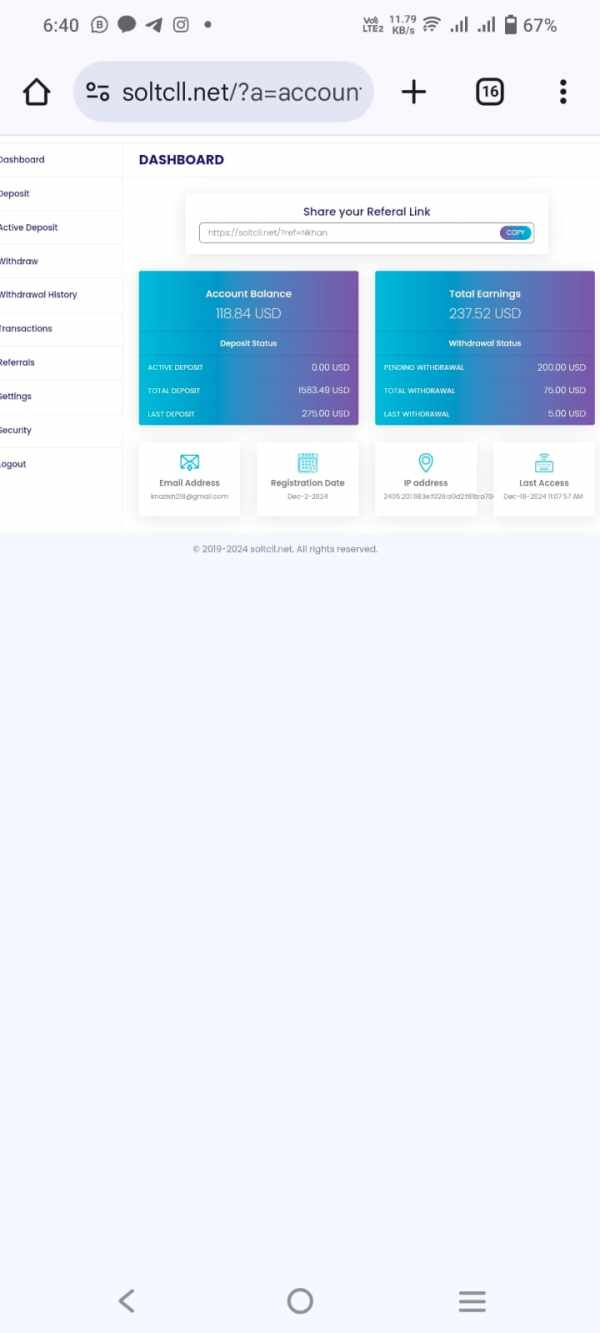

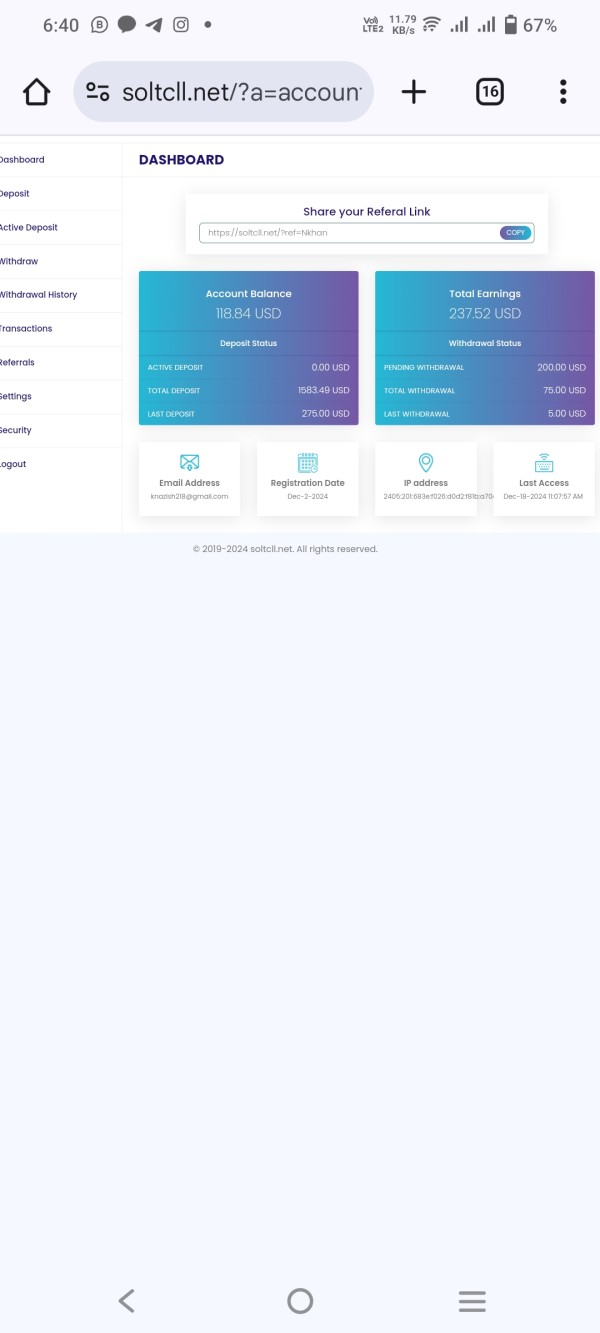

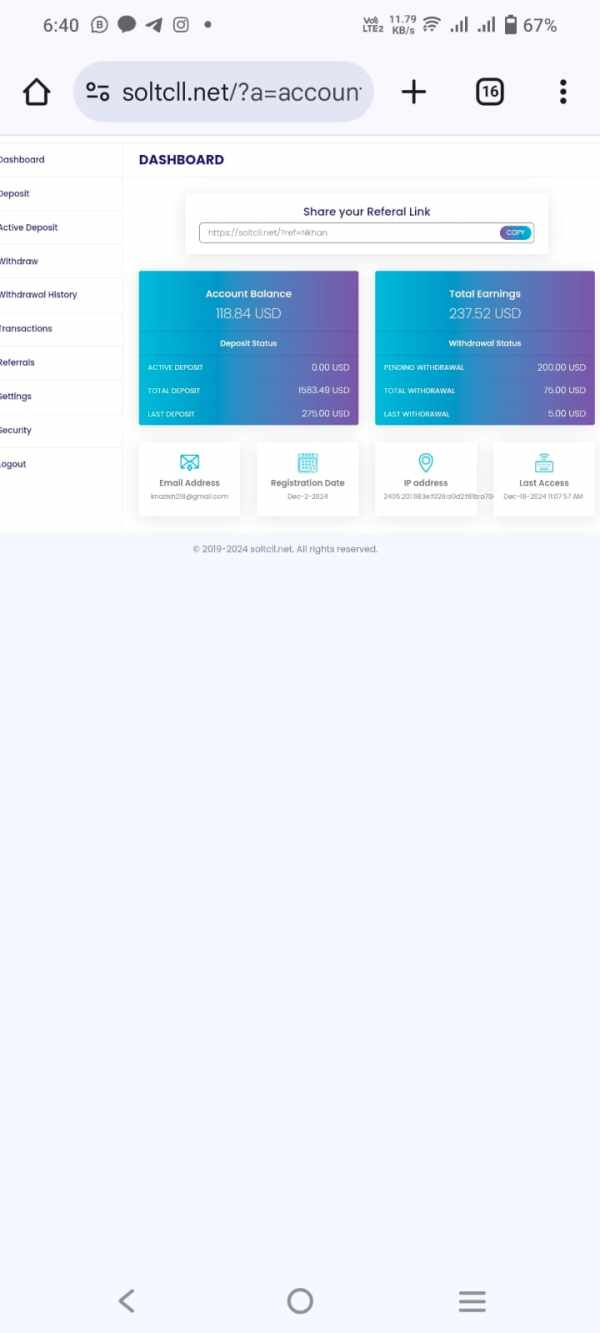

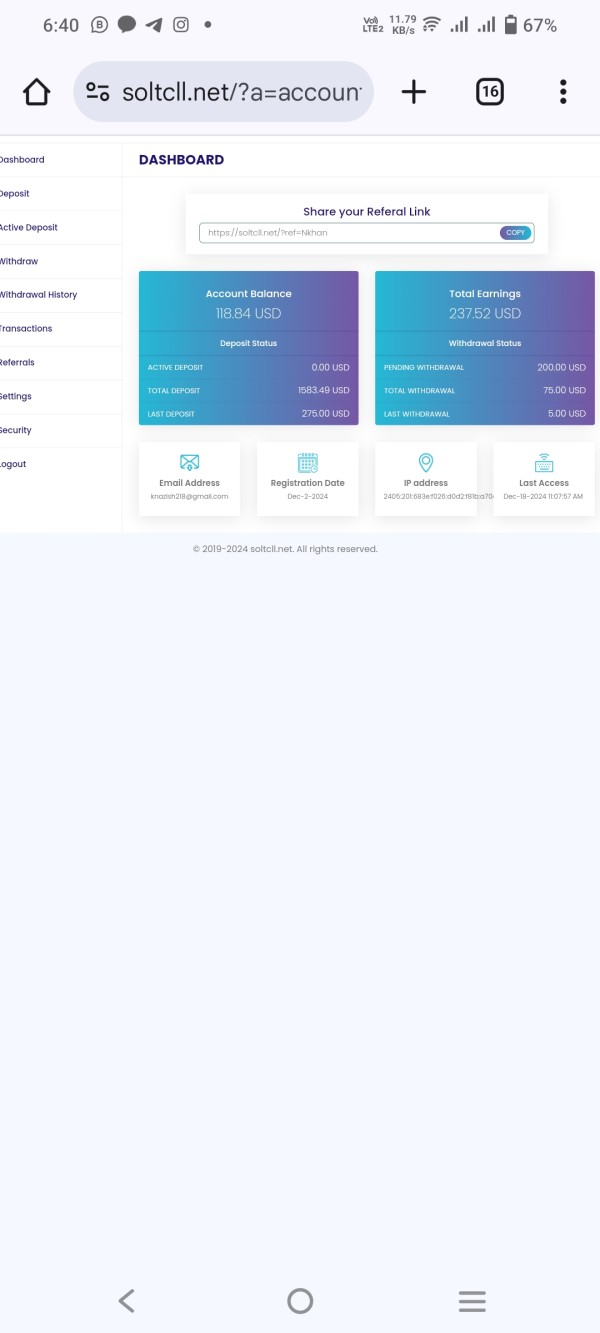

The platform's soltcl review profile across various watchdog websites consistently highlights red flags. These include lack of regulatory disclosure, poor customer service responsiveness, and difficulties users face when attempting to withdraw funds. These factors combine to create a highly concerning picture for potential investors considering this platform for their trading activities.

Regulatory Status: Available information indicates SOLTCL lacks proper regulatory authorization from recognized financial authorities. This represents a significant risk factor for potential clients.

Deposit and Withdrawal Methods: Specific payment methods and withdrawal procedures are not clearly disclosed in available sources. This adds to transparency concerns.

Minimum Deposit Requirement: The platform reportedly requires a minimum deposit of $25,000 USD. This is substantially higher than industry standards and may indicate targeting of high-value victims.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available reports.

Tradeable Assets: The platform appears to focus on forex trading. However, the full range of available instruments remains unclear from current sources.

Cost Structure: SOLTCL claims to offer spreads starting from 1 pip. Commission structures and additional fees are not transparently disclosed.

Leverage Ratios: Specific leverage offerings are not mentioned in available documentation.

Platform Options: While MetaTrader compatibility is suggested, concrete platform specifications are not confirmed in source materials.

Geographic Restrictions: Specific regional limitations are not clearly outlined in available information.

Customer Support Languages: Available support languages are not specified in current soltcl review materials.

SOLTCL's account structure presents several concerning elements that significantly impact its accessibility and appeal to retail traders. The most notable issue is the extraordinarily high minimum deposit requirement of $25,000 USD. This far exceeds industry standards and immediately excludes the vast majority of retail forex traders from consideration.

This substantial barrier to entry raises questions about the broker's target market and business model. While some legitimate institutional brokers do maintain high minimum deposits, the combination of this requirement with the lack of regulatory transparency creates a problematic profile. According to fraud reporting websites, such high minimum deposits are often used by fraudulent operations. They use these requirements to maximize the value extracted from each victim.

The absence of detailed information about account types, tier structures, or special account features further compounds these concerns. Legitimate brokers typically provide comprehensive details about their account offerings. This includes demo accounts, various trading account levels, and specific benefits associated with different deposit amounts.

User feedback referenced in various soltcl review sources suggests that the account opening process lacks transparency. Users report unclear terms and conditions and inadequate disclosure of trading conditions upon registration.

The availability of trading tools and educational resources represents one of SOLTCL's most significant weaknesses. Virtually no concrete information is available about the platform's analytical capabilities or trader support materials. This absence of detailed tool specifications is particularly concerning given the broker's target market of high-deposit clients. These clients would typically expect sophisticated trading infrastructure.

Legitimate forex brokers typically provide comprehensive suites of analytical tools. These include technical indicators, charting packages, economic calendars, market analysis, and educational resources. The lack of any mention of such offerings in available sources suggests either a severely limited platform or inadequate disclosure of available features.

The absence of educational resources is particularly problematic. Even experienced traders benefit from ongoing market analysis, webinars, and research materials. Professional trading platforms typically invest heavily in providing clients with market insights, trading guides, and analytical support. This helps enhance trading success.

User feedback indicates disappointment with the limited resources available. However, specific details about tool availability remain scarce in available reports, further highlighting the platform's lack of transparency about its offerings.

Customer service represents a critical failure point for SOLTCL. Multiple sources report significant issues with support responsiveness and quality. According to various fraud alert websites, users have experienced prolonged periods without responses to inquiries. This is particularly true when attempting to resolve withdrawal issues or account problems.

The lack of clearly published customer service channels, support hours, or contact methods adds to these concerns. Professional brokers typically provide multiple contact options including phone support, live chat, email tickets, and comprehensive FAQ sections. The absence of transparent customer service information suggests either inadequate support infrastructure or deliberate obfuscation of contact methods.

Response time issues appear particularly problematic. User reports suggest that support requests often go unanswered for extended periods. This pattern is especially concerning when combined with user reports of withdrawal difficulties. It suggests a systematic approach to avoiding customer service obligations.

The quality of available support also appears questionable. Users report unhelpful responses and lack of resolution for legitimate concerns about account access and fund recovery.

SOLTCL's trading experience receives a marginally higher rating primarily due to its claimed spread offerings of 1 pip. However, this single positive element is significantly undermined by the lack of comprehensive platform information and user experience data. The spread claim, while competitive if accurate, cannot be properly evaluated without additional context. This includes execution quality, slippage rates, and overall trading conditions.

Platform stability and execution speed information is notably absent from available sources. This is concerning given that these factors are crucial for effective forex trading. Professional traders require reliable platform performance, fast order execution, and minimal downtime. Yet no concrete data about SOLTCL's technical capabilities is available.

The absence of detailed platform functionality information makes it impossible to assess features like order types, risk management tools, automated trading capabilities, or mobile trading options. These elements are essential for modern forex trading. Their omission from available materials suggests either limited capabilities or poor communication about platform features.

User feedback about actual trading experience is limited in available soltcl review sources. However, the overall negative sentiment about the platform suggests that trading conditions may not meet professional standards despite any competitive spread claims.

SOLTCL receives the lowest possible trustworthiness rating due to widespread fraud warnings from multiple reputable sources. The complete absence of verifiable regulatory information also contributes to this rating. According to Scams Report, Broker Watch Dog, and Scam Victims Help, this broker has been consistently flagged as a potentially fraudulent operation. This represents an unacceptable risk level for any trader.

The lack of regulatory authorization from recognized financial authorities represents a fundamental breach of industry standards. Legitimate forex brokers operate under strict regulatory oversight from bodies such as the FCA, ASIC, CySEC, or other recognized authorities. They provide clear disclosure of their licensing status. SOLTCL's failure to provide this basic information immediately disqualifies it from consideration by prudent traders.

Multiple fraud reporting websites have issued specific warnings about SOLTCL. This indicates a pattern of concerning behavior that extends beyond simple regulatory gaps. These warnings typically result from user complaints, investigation by fraud prevention specialists, and identification of operational patterns consistent with fraudulent schemes.

The company's transparency regarding its corporate structure, management team, and operational procedures is notably absent. This further undermines trust. Professional brokers typically provide comprehensive information about their corporate governance, regulatory compliance, and risk management procedures.

User experience with SOLTCL appears consistently negative based on available feedback from fraud reporting websites and user complaint platforms. The overall satisfaction level is extremely low. Users express significant concerns about fund safety, withdrawal processes, and platform reliability.

Registration and verification processes reportedly lack clarity. Users report confusion about account setup procedures and inadequate explanation of trading conditions. Professional brokers typically provide streamlined onboarding processes with clear documentation. They also offer step-by-step guidance for new clients.

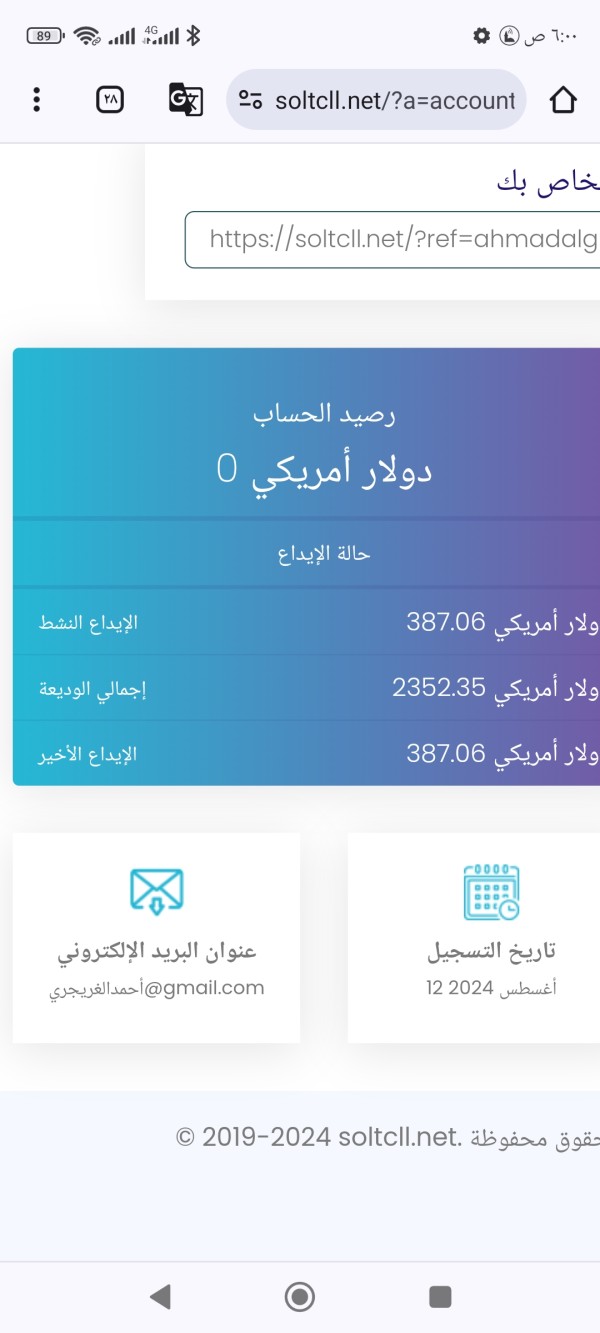

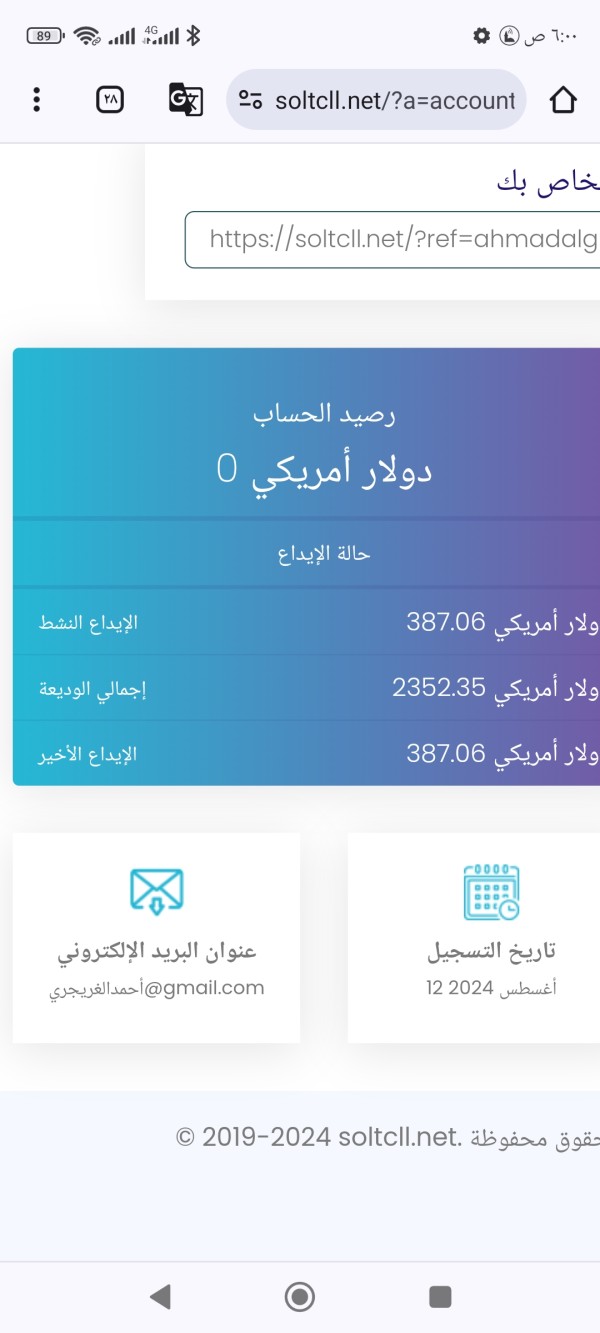

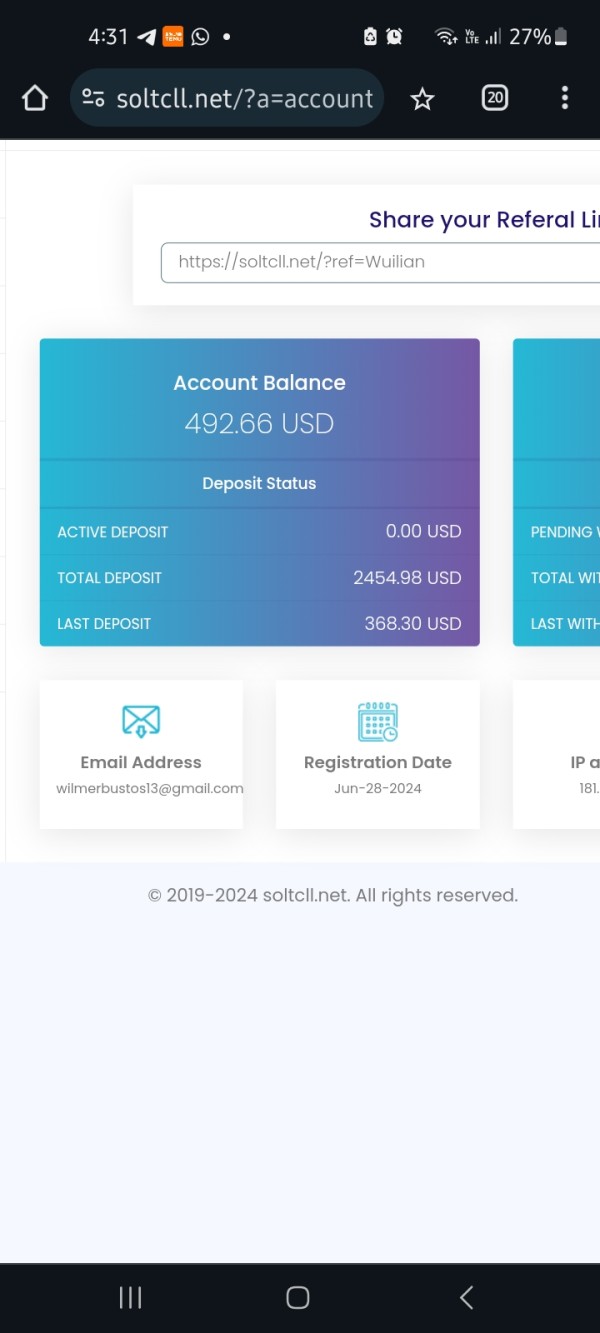

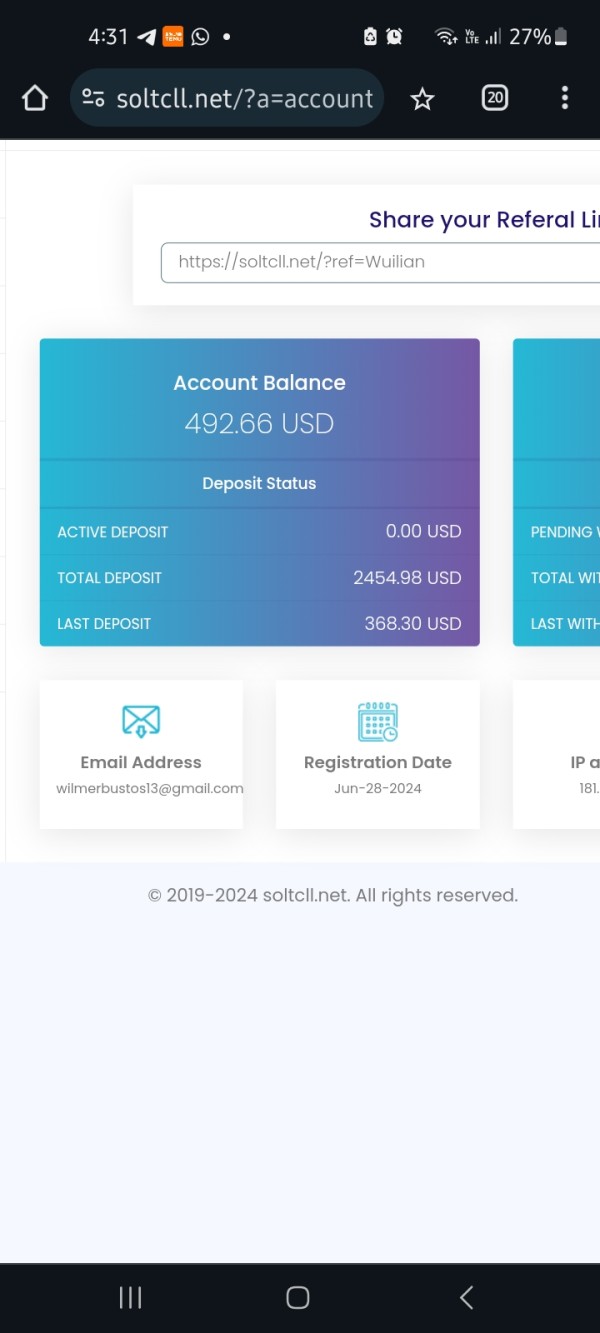

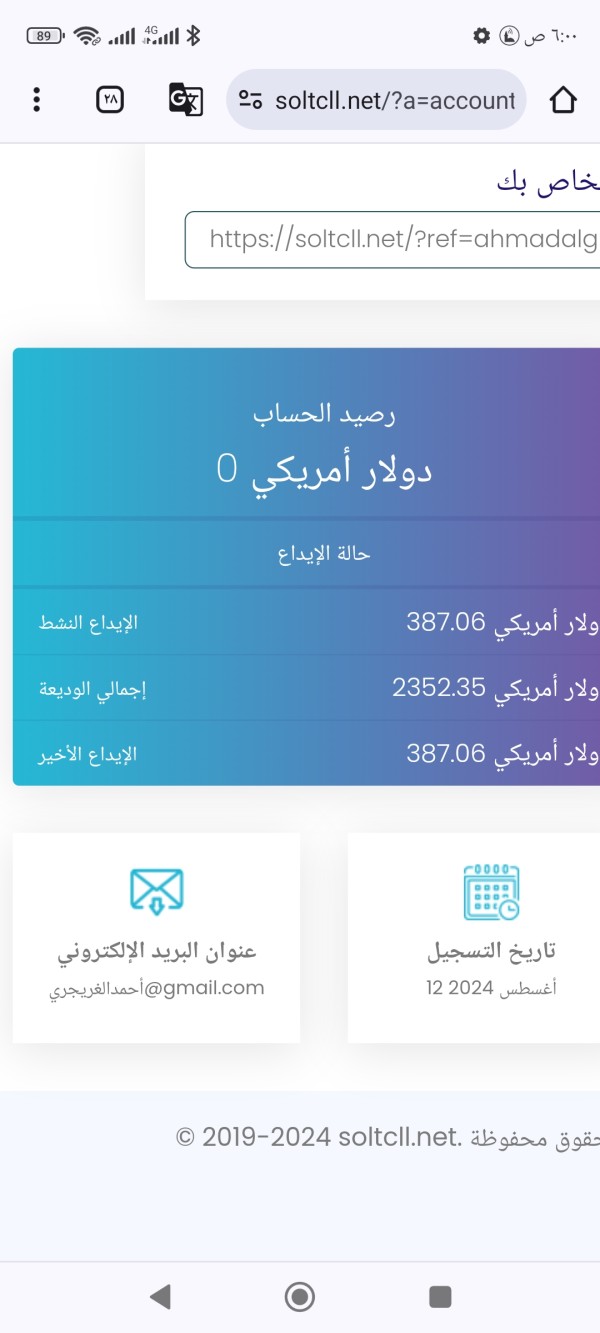

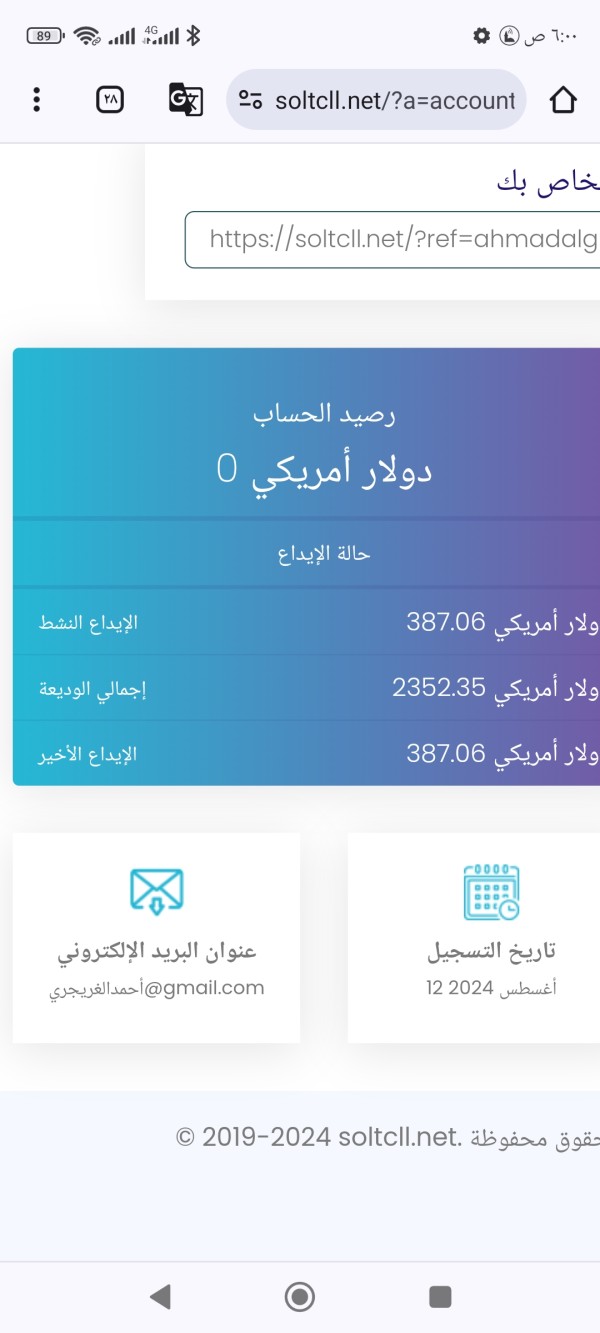

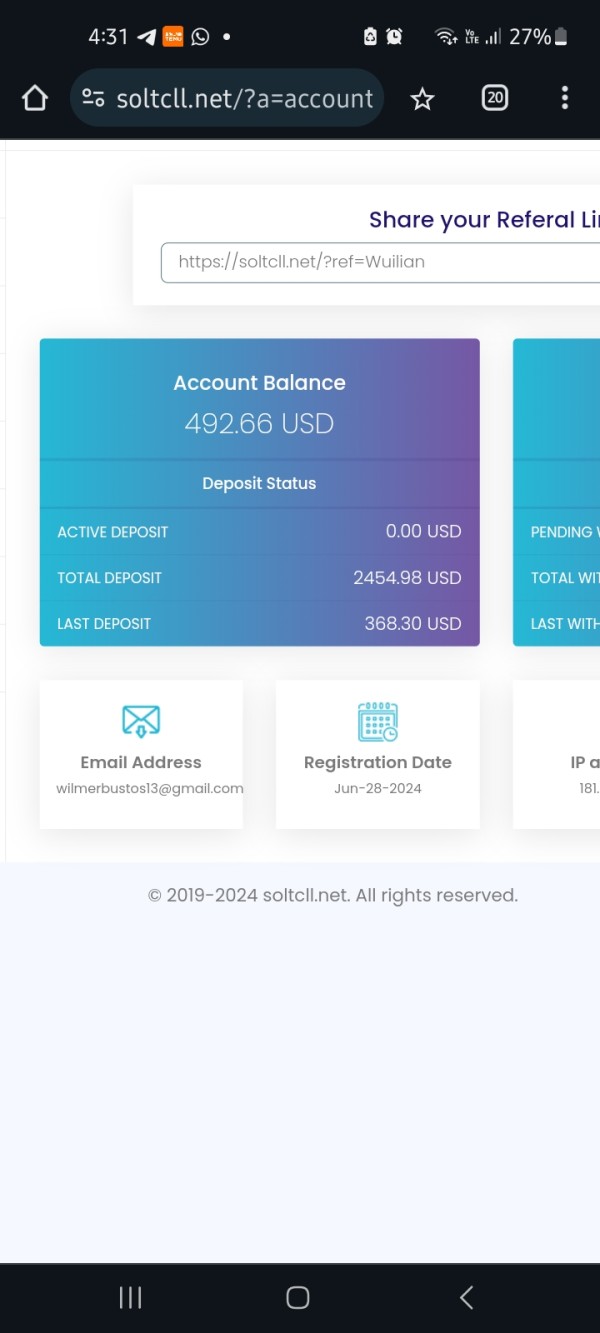

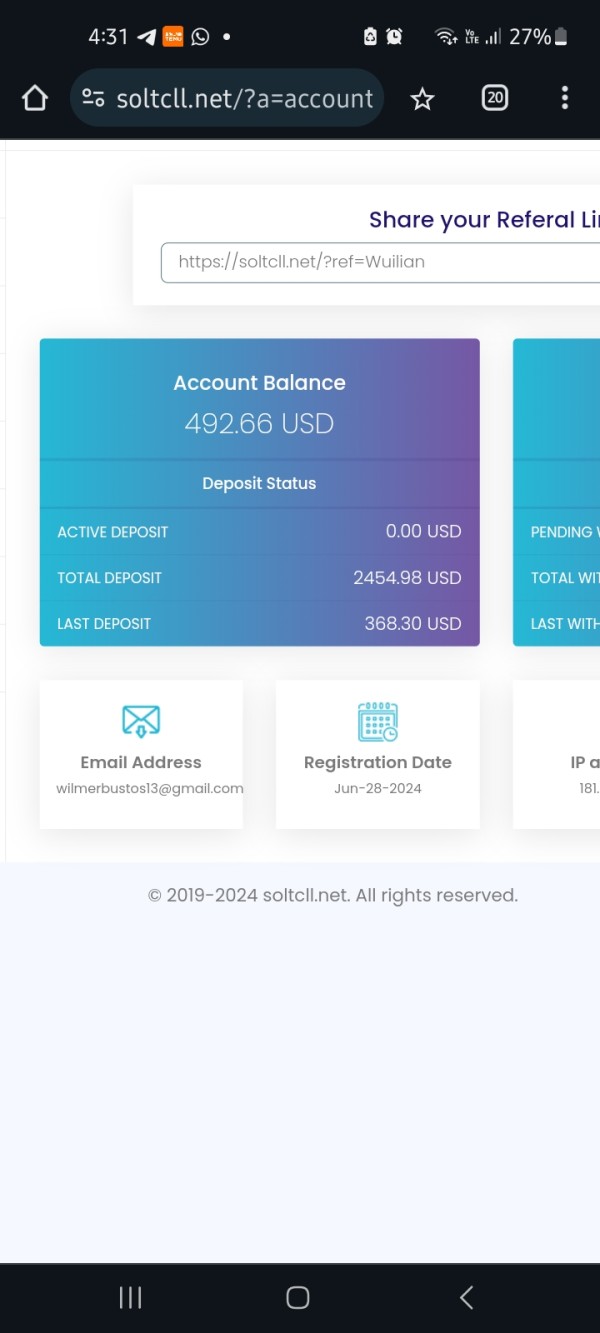

Fund operation experiences represent the most serious user concerns. Multiple reports suggest difficulties in withdrawal processes and concerns about fund security. These issues are particularly serious given the high minimum deposit requirements. Users potentially face substantial losses if unable to recover their investments.

Common user complaints center around unresponsive customer service, unclear trading conditions, and difficulties accessing deposited funds. The pattern of these complaints aligns with typical characteristics of fraudulent trading operations. This makes SOLTCL unsuitable for traders seeking reliable service.

The user demographic that might theoretically benefit from SOLTCL's services would be high-net-worth traders willing to accept substantial risks. However, given the fraud warnings, no user profile can be safely recommended for this platform.

This comprehensive soltcl review reveals a broker that presents unacceptable risks to traders across all experience levels. With multiple fraud warnings from reputable sources, lack of regulatory oversight, and consistently negative user feedback, SOLTCL fails to meet basic standards for a legitimate forex broker.

The platform is not recommended for any trader category. This is particularly true for newcomers to forex trading who may be vulnerable to fraudulent schemes. While the claimed low spreads might appear attractive, this single potential benefit is completely overshadowed by fundamental concerns. These concerns include fund safety and operational legitimacy.

The primary advantages are limited to theoretical low trading costs. Significant disadvantages include extremely high minimum deposits, absence of regulatory protection, poor customer service, and widespread fraud warnings from multiple independent sources.

FX Broker Capital Trading Markets Review