Is Verbo Capital safe?

Pros

Cons

Is Verbo Capital A Scam?

Introduction

Verbo Capital is a forex broker that has recently emerged in the trading landscape, offering a range of financial products including forex, commodities, and cryptocurrencies. As the forex market continues to evolve, traders are presented with numerous options for brokers, making it essential for them to conduct thorough evaluations before committing their funds. The rise of online trading has also led to an increase in fraudulent schemes, making it crucial for traders to scrutinize brokers for legitimacy and reliability.

In this article, we will assess Verbo Capital's credibility by examining various factors, including its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. Our investigation is based on information gathered from credible sources, including reviews from financial regulatory bodies and user feedback. By utilizing a structured framework, we aim to provide a comprehensive evaluation of whether Verbo Capital is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment plays a pivotal role in determining the trustworthiness of a forex broker. A well-regulated broker is typically subject to strict oversight, ensuring that they adhere to industry standards and protect client funds. In the case of Verbo Capital, there are significant concerns regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | N/A | Hong Kong | Warning Issued |

Verbo Capital has been flagged by the Securities and Futures Commission of Hong Kong, indicating that it may operate without the necessary licenses. The lack of proper regulatory oversight raises serious concerns about the broker's legitimacy and the protection of client funds. Moreover, the absence of a credible regulatory framework means that traders may have limited recourse in the event of disputes or financial mismanagement.

The importance of regulation cannot be overstated; it serves as a safeguard for traders against potential fraud. Brokers under the supervision of reputable authorities are required to maintain transparency, adhere to ethical practices, and ensure the segregation of client funds. The warning issued by the SFC suggests that Verbo Capital may not comply with these essential regulations, thereby increasing the risk for potential investors.

Company Background Investigation

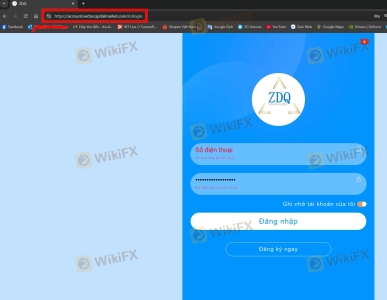

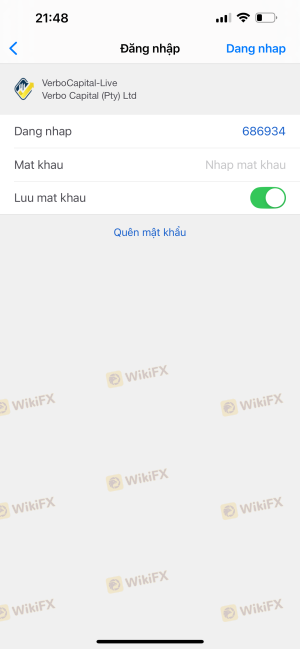

Understanding a broker's company background is crucial for assessing its reliability. Verbo Capital (Pty) Ltd was established in 2024, and its operational history is relatively short, which can be a red flag for potential investors. The company's ownership structure and management team are not well-documented, leading to concerns about transparency and accountability.

The lack of publicly available information regarding the management team's experience and qualifications further exacerbates these concerns. A credible broker typically provides detailed information about its leadership, including their backgrounds in finance and trading. This transparency is essential for building trust with clients.

Moreover, the absence of a clear office location on its website raises questions about the company's operational legitimacy. Without a physical presence, it becomes challenging for clients to hold the broker accountable for its actions. Overall, the limited information available about Verbo Capital's history and management raises significant doubts about its credibility in the forex market.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is vital for understanding the potential costs and risks involved. Verbo Capital presents a range of trading products, but there are concerns regarding its fee structure and the transparency of its trading conditions.

| Fee Type | Verbo Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - 10 USD) |

| Overnight Interest Range | N/A | Varies (0.5% - 3%) |

The lack of specific information about spreads and commissions on Verbo Capital's website is alarming. Traders need to be aware of the costs associated with their trades, as hidden fees can significantly impact profitability. The absence of clear pricing information may indicate a lack of transparency in the broker's operations, which is often a characteristic of less reputable firms.

Furthermore, the absence of detailed information about overnight interest rates and potential additional charges raises concerns about the broker's intention to provide a fair trading environment. Traders should be cautious of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs and financial losses.

Client Fund Safety

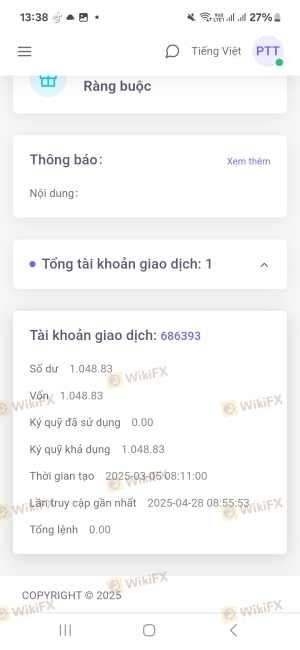

The safety of client funds is a paramount concern for any trader. Verbo Capital's approach to fund safety measures is unclear, which is a significant red flag. A reputable broker typically implements stringent measures to protect client funds, including fund segregation, investor protection schemes, and negative balance protection.

Unfortunately, information regarding Verbo Capital's fund safety policies is lacking. The absence of clear details about how client funds are managed and whether they are kept in separate accounts raises serious concerns about the safety of investments. Without robust fund protection measures, traders risk losing their entire investment in the event of financial mismanagement or insolvency.

Additionally, any historical issues related to fund safety or disputes with clients further complicate the assessment of Verbo Capital's reliability. The lack of transparency surrounding these critical aspects of fund safety makes it difficult for potential clients to make informed decisions about trading with this broker.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of traders with a broker. Numerous reviews and complaints about Verbo Capital have surfaced online, indicating a pattern of negative experiences among clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include difficulties with fund withdrawals, unresponsive customer service, and allegations of misleading information regarding trading conditions. These issues suggest a lack of accountability and transparency on the part of Verbo Capital, which can be detrimental to traders looking for a reliable trading environment.

Several case studies highlight the severity of these complaints, with clients reporting prolonged delays in accessing their funds and inadequate support when seeking assistance. The consistent occurrence of such complaints raises serious doubts about Verbo Capital's commitment to customer service and its ability to provide a satisfactory trading experience.

Platform and Execution

The performance of a trading platform is critical for traders, as it directly affects order execution and overall user experience. Verbo Capital claims to offer a trading platform that supports various financial instruments, but there are concerns regarding its stability and execution quality.

Traders have reported issues with order execution, including slippage and high rejection rates. These problems can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Additionally, any indications of platform manipulation or unfair trading practices should be taken seriously, as they undermine the integrity of the trading environment.

Without a reliable platform, traders may find it challenging to execute their strategies effectively, leading to frustration and potential financial losses. The lack of transparency regarding the platform's performance and execution quality raises questions about Verbo Capital's commitment to providing a fair trading experience.

Risk Assessment

Engaging with a broker like Verbo Capital involves inherent risks that traders must consider. A comprehensive risk assessment is essential for understanding the potential pitfalls associated with trading on this platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns about legitimacy. |

| Fund Safety Risk | High | Unclear fund safety measures increase the risk of loss. |

| Customer Service Risk | Medium | Poor customer support can lead to unresolved issues. |

| Platform Risk | High | Execution issues and potential manipulation raise concerns. |

To mitigate these risks, traders should conduct thorough research before engaging with Verbo Capital. This includes verifying regulatory status, understanding fund safety measures, and assessing customer feedback. Additionally, traders should consider diversifying their investments and using risk management strategies to protect their capital.

Conclusion and Recommendations

In conclusion, Verbo Capital raises several red flags that warrant caution among potential investors. The lack of proper regulation, transparency issues, and negative customer experiences suggest that this broker may not be a safe option for trading. Traders should be particularly wary of the potential risks associated with fund safety and platform reliability.

For those considering trading with Verbo Capital, it is advisable to explore alternative brokers with a proven track record of regulatory compliance and positive customer feedback. Reputable brokers that offer transparent trading conditions, strong customer support, and robust fund protection measures are preferable options for safeguarding investments and ensuring a satisfactory trading experience.

In summary, while Verbo Capital may present itself as a viable trading option, the evidence suggests that it is prudent to exercise caution and consider other, more reliable alternatives in the forex market.

Is Verbo Capital a scam, or is it legit?

The latest exposure and evaluation content of Verbo Capital brokers.

Verbo Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Verbo Capital latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.