Verbo Capital Review 2025: Everything You Need to Know

Executive Summary

Verbo Capital (Pty) Ltd presents serious concerns for potential investors. Multiple regulatory warnings and negative user feedback support this conclusion. This verbo capital review reveals that the Hong Kong Securities and Futures Commission (HK SFC) has flagged the company as an unauthorized entity. This raises serious questions about its legitimacy and regulatory compliance.

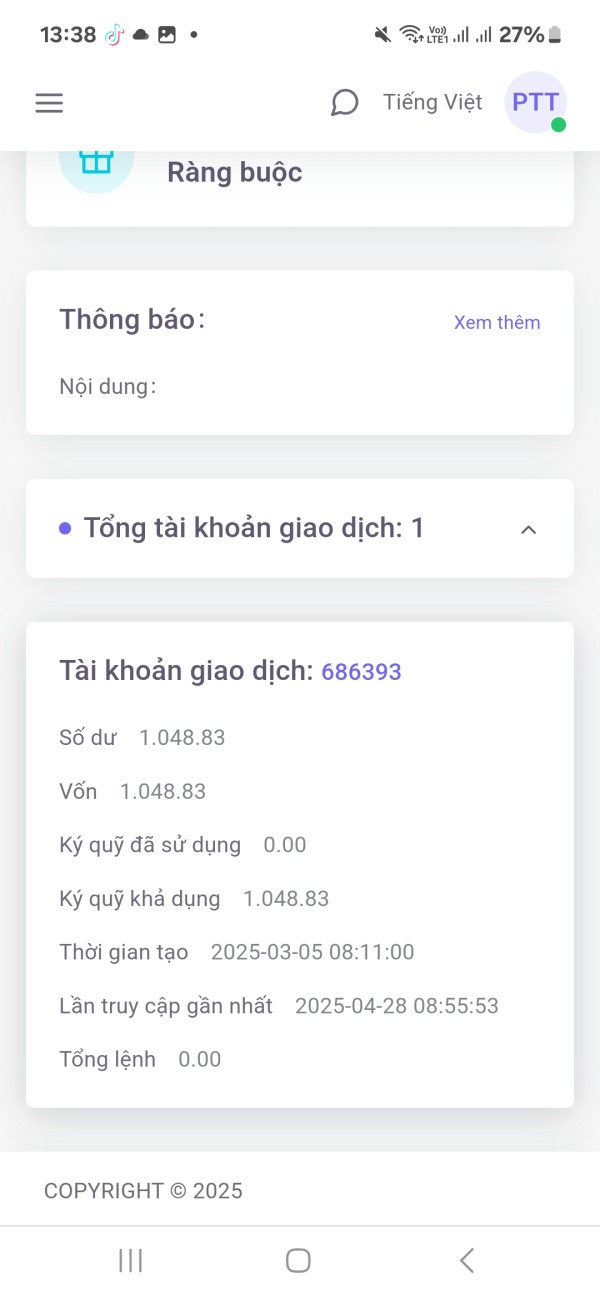

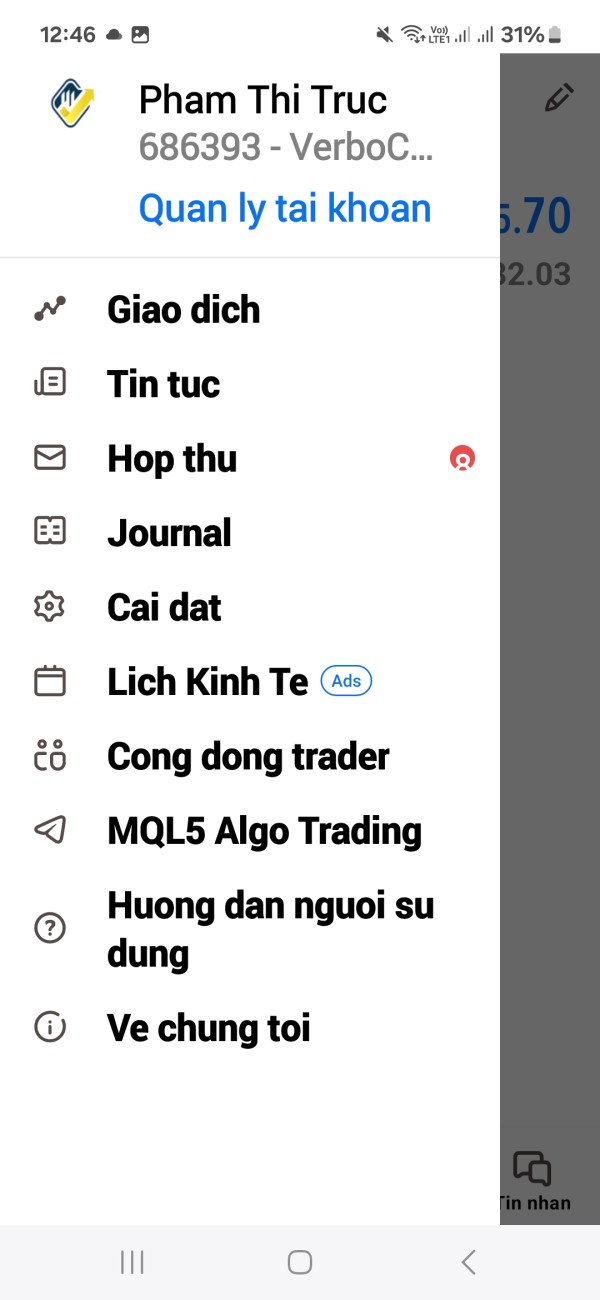

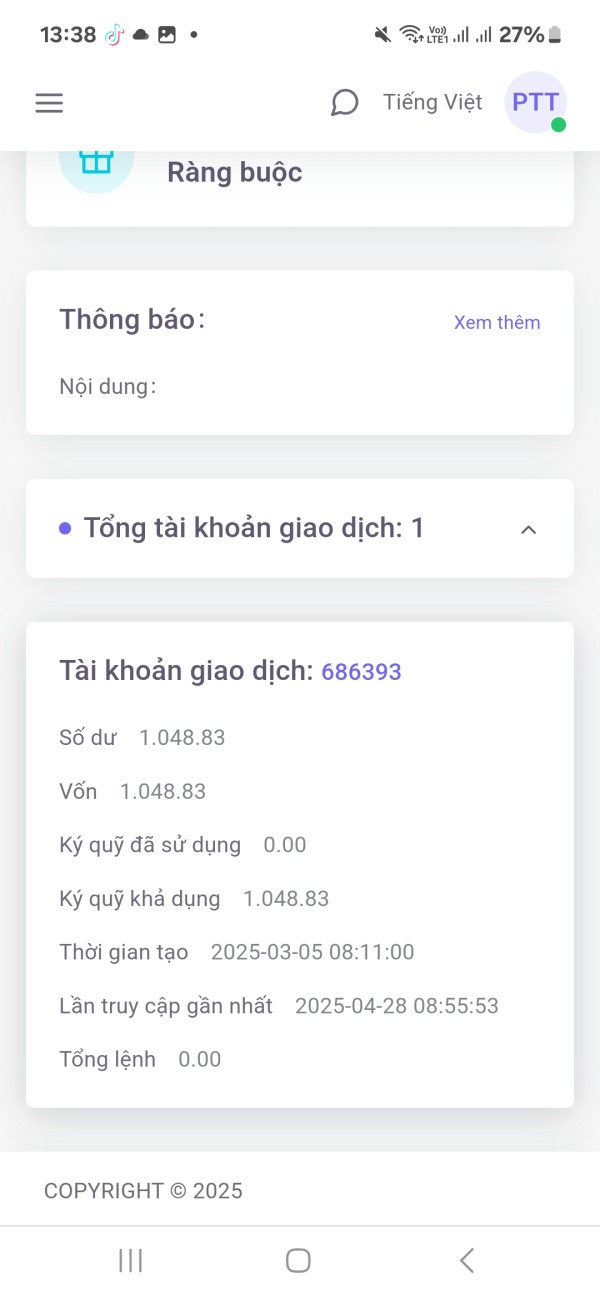

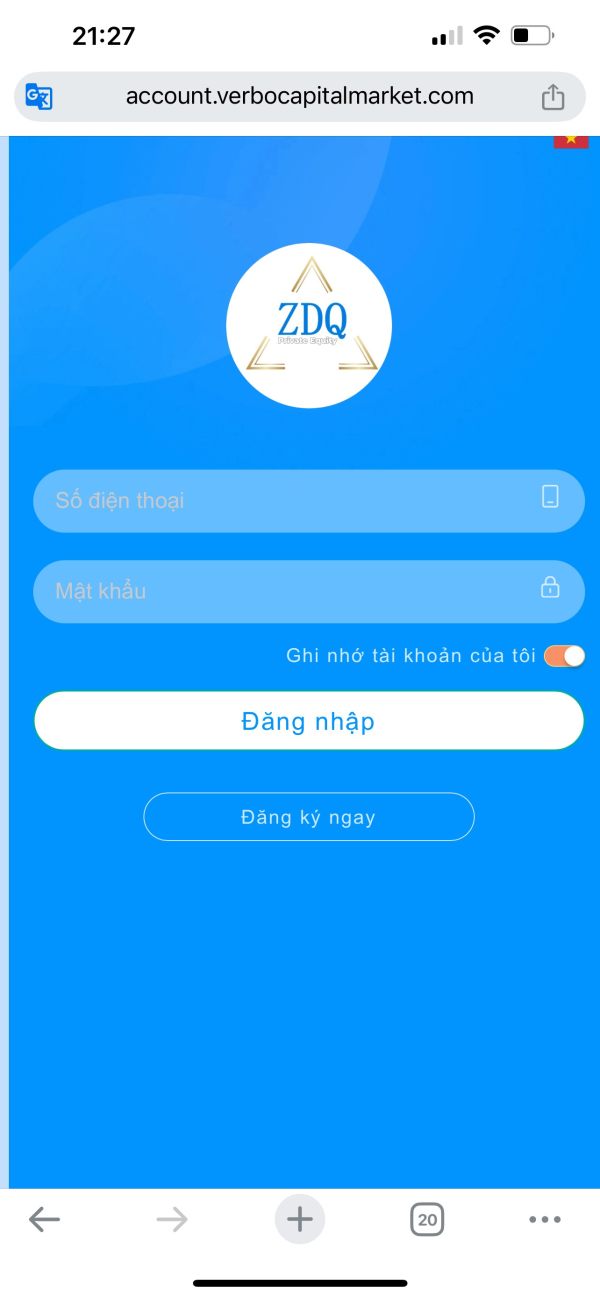

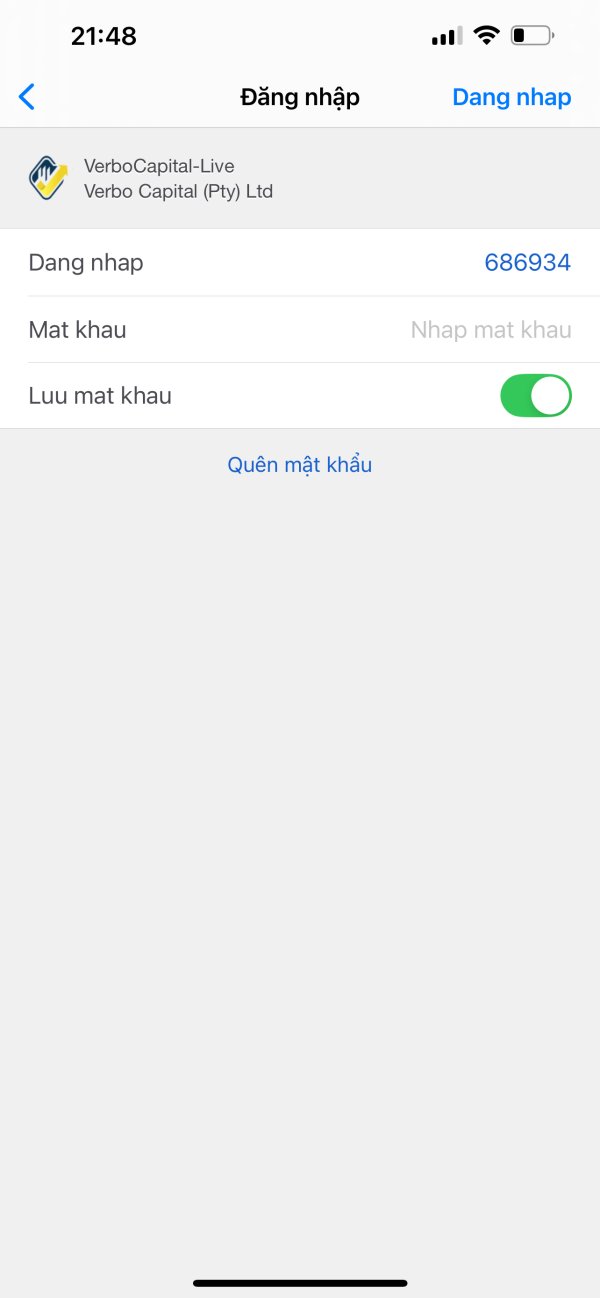

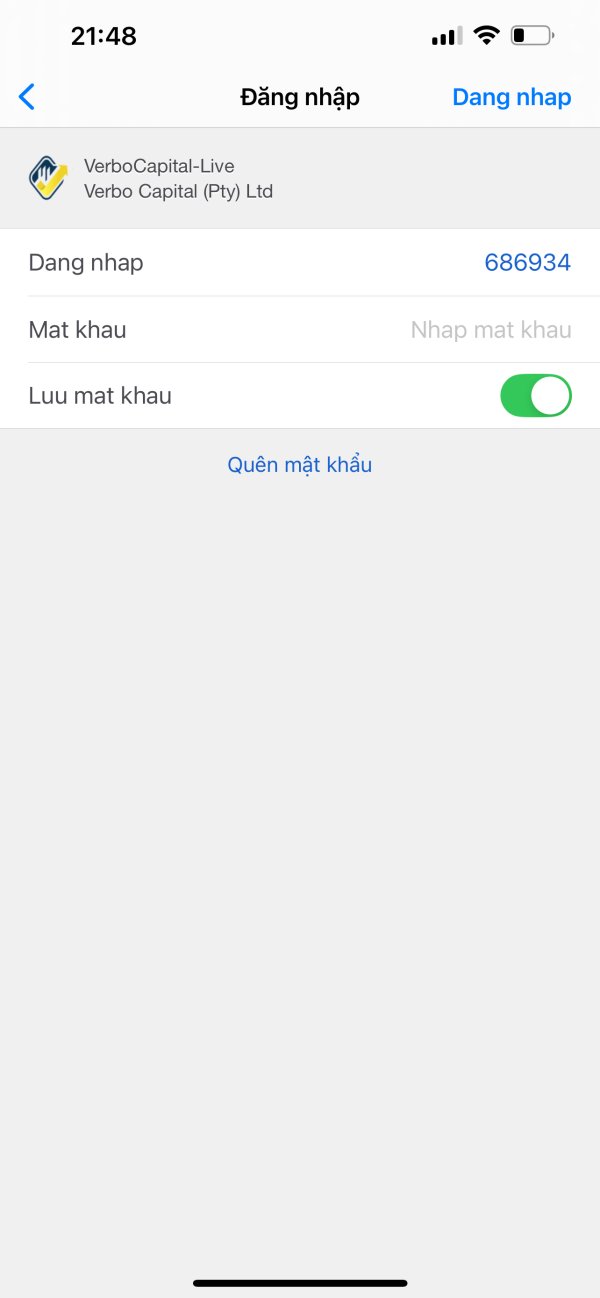

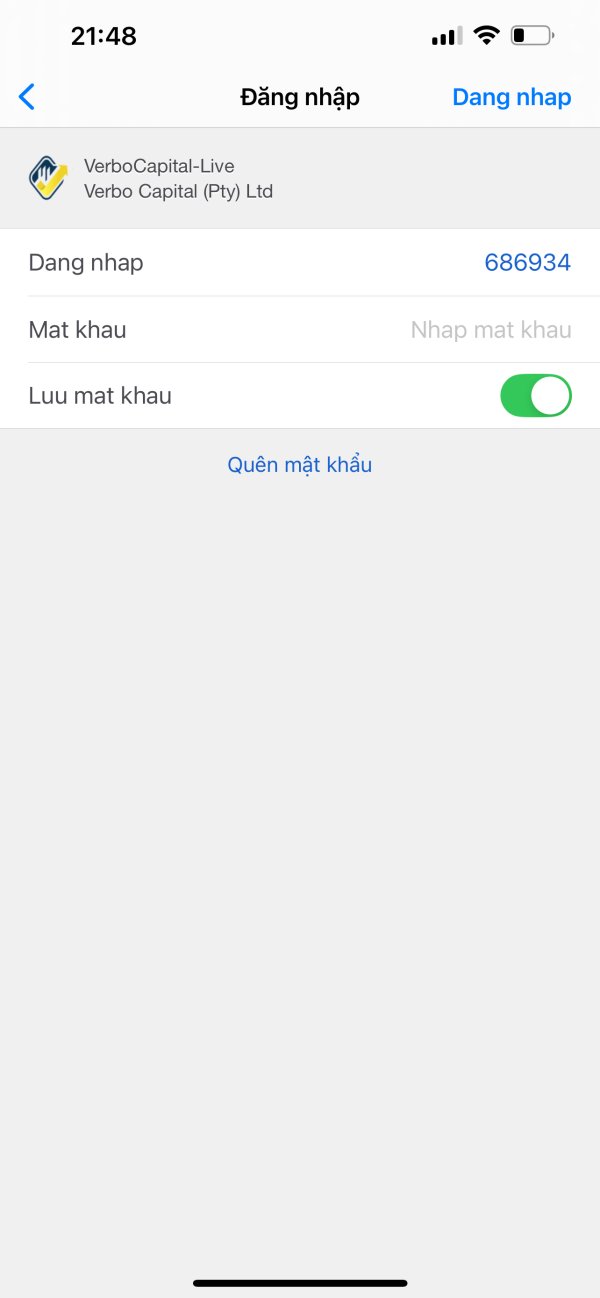

The company claims to operate under South African Financial Sector Conduct Authority (FSCA) regulation, but verification of this authorization remains problematic. The broker offers MT5 trading platform access and claims to provide trading opportunities across various asset classes including forex and cryptocurrencies. However, user feedback consistently highlights issues with hidden fees, poor customer support, and unreliable platform performance.

The company's establishment in 2024 means it lacks the operational track record necessary to build investor confidence. Given the regulatory warnings, negative user experiences, and lack of verifiable authorization, Verbo Capital poses considerable risks for traders seeking reliable brokerage services. This review examines all available evidence to provide a comprehensive assessment of the broker's offerings and associated risks.

Important Notice

This evaluation is based on publicly available regulatory information and user feedback collected from multiple sources. Verbo Capital (Pty) Ltd claims to be regulated by the South African Financial Sector Conduct Authority (FSCA), but this authorization cannot be effectively verified through standard regulatory databases.

The Hong Kong Securities and Futures Commission (HK SFC) has specifically identified Verbo Capital as an unauthorized entity, warning investors about potential risks. Readers should note that regulatory status can vary significantly across different jurisdictions, and what may be claimed as legitimate in one region might be flagged as unauthorized in another.

Rating Framework

Broker Overview

Verbo Capital (Pty) Ltd emerged in 2024 as a newly established online trading broker. The company positions itself to serve traders interested in forex and cryptocurrency markets. The company claims to operate under South African regulatory oversight, specifically stating authorization from the Financial Sector Conduct Authority (FSCA).

However, the broker's brief operational history and regulatory complications have created uncertainty about its legitimacy and long-term viability. The broker's business model centers on providing access to multiple asset classes through the MetaTrader 5 platform, targeting investors seeking diversified trading opportunities. Despite these offerings, significant concerns have emerged regarding the company's regulatory status and operational practices.

The verbo capital review landscape reveals consistent patterns of user dissatisfaction and regulatory scrutiny that potential clients must carefully consider. Multiple financial watchdog organizations have raised alerts about Verbo Capital's operations, with the Hong Kong Securities and Futures Commission explicitly categorizing the entity as unauthorized. This regulatory flagging, combined with user reports of problematic practices, suggests that the broker may not meet the standards expected of legitimate financial service providers in the current market environment.

Regulatory Status: The Hong Kong Securities and Futures Commission (HK SFC) has officially marked Verbo Capital as an unauthorized entity. This creates significant concerns about the broker's regulatory compliance across different jurisdictions.

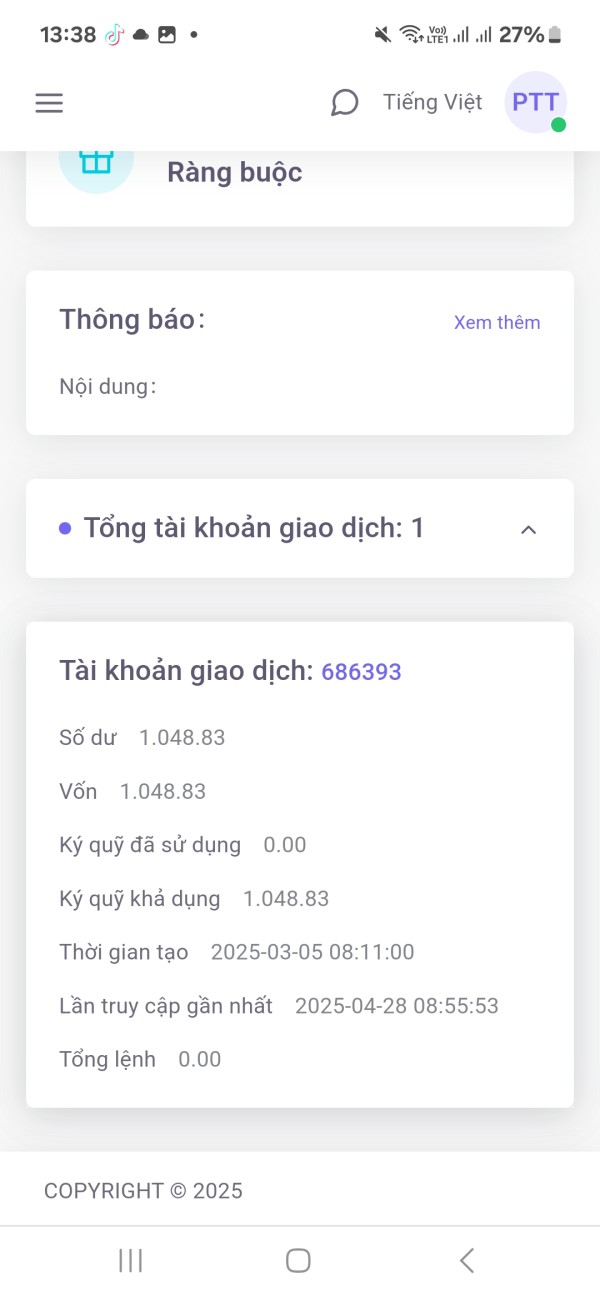

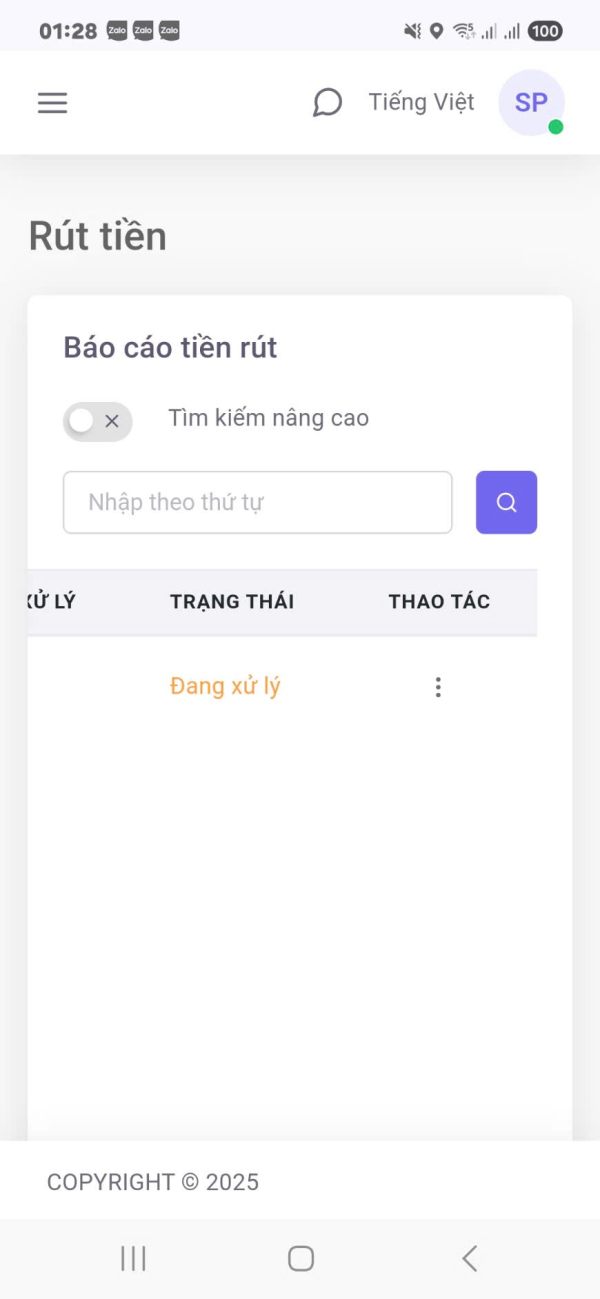

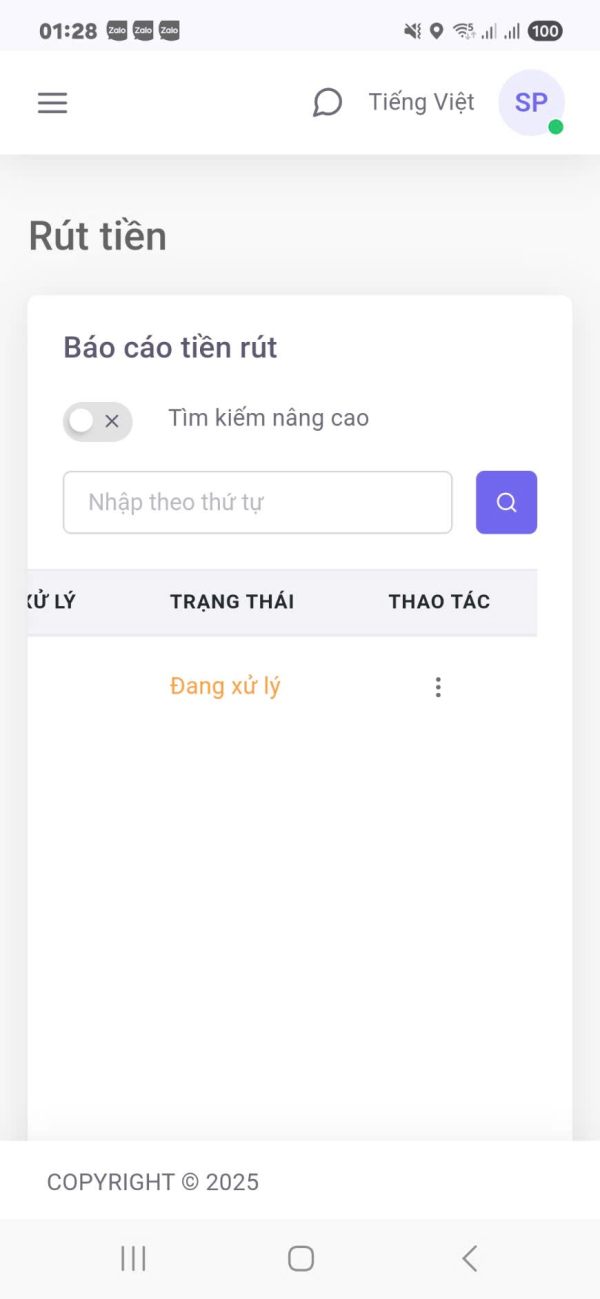

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available sources, representing a transparency gap that potential clients should investigate before committing funds. Exact minimum deposit amounts were not specified in the reviewed materials, which raises questions about the broker's transparency regarding entry-level investment requirements.

Promotional Offers: Details about bonus programs or promotional incentives were not mentioned in available documentation. This suggests either absence of such programs or lack of transparent communication about available offers.

Tradeable Assets: The broker provides access to forex and cryptocurrency markets, along with other asset classes, though comprehensive details about the full range of available instruments require further investigation. User feedback indicates the presence of hidden fees, though specific information about spreads, commissions, and other trading costs was not explicitly detailed in available sources.

This lack of transparency regarding pricing represents a significant concern for potential traders. Leverage Ratios: Specific leverage offerings were not mentioned in the reviewed materials, which is unusual for forex brokers and may indicate inadequate disclosure of trading terms.

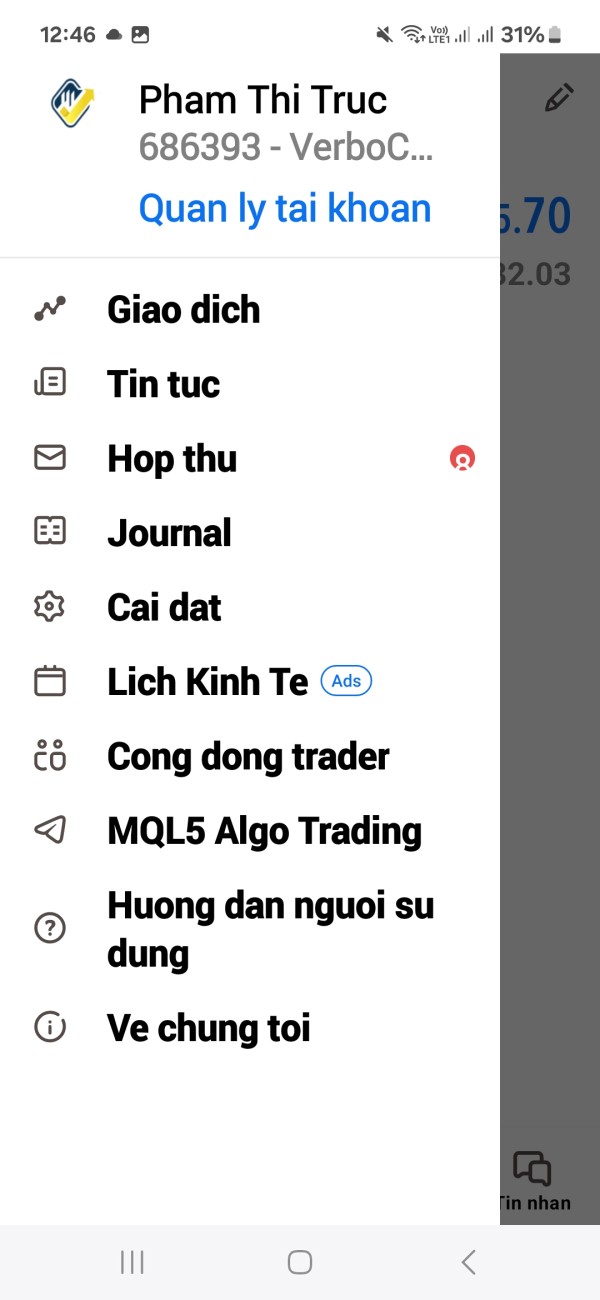

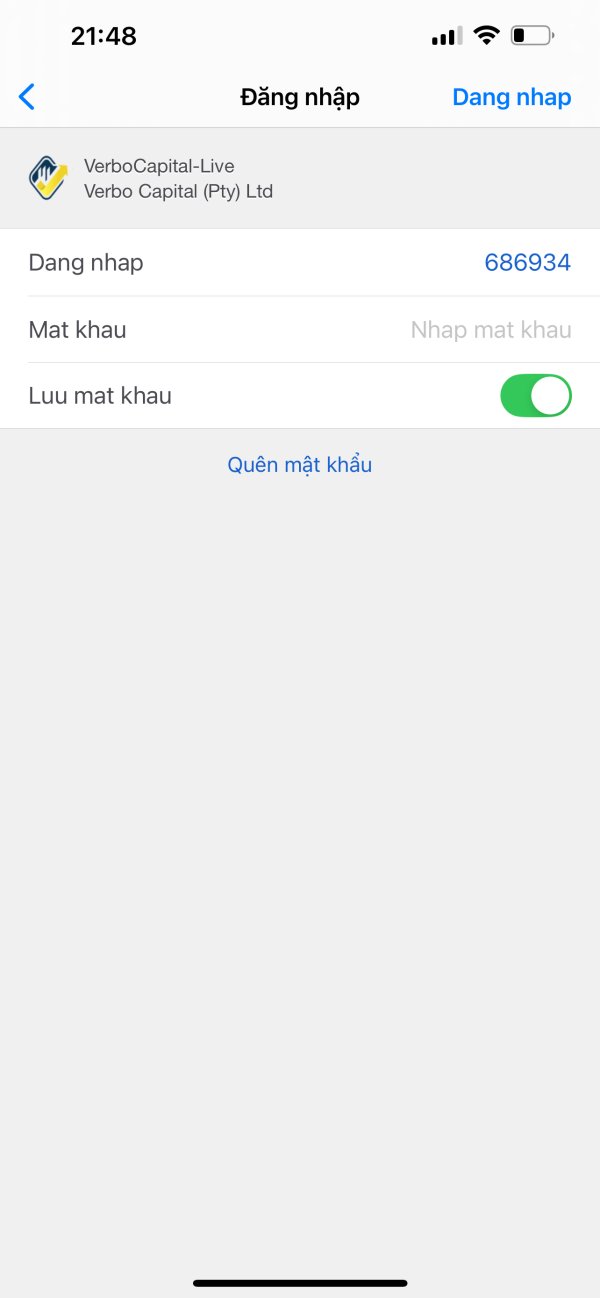

Platform Options: The broker offers the MetaTrader 5 (MT5) trading platform, which provides access to standard trading functionalities and technical analysis tools. Geographic Restrictions: Information about specific regional limitations or restricted countries was not detailed in available sources.

Customer Support Languages: The range of supported languages for customer service was not specified in the reviewed materials, representing another area where transparency could be improved. This verbo capital review section highlights numerous information gaps that potential clients should address through direct inquiry before considering any investment.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

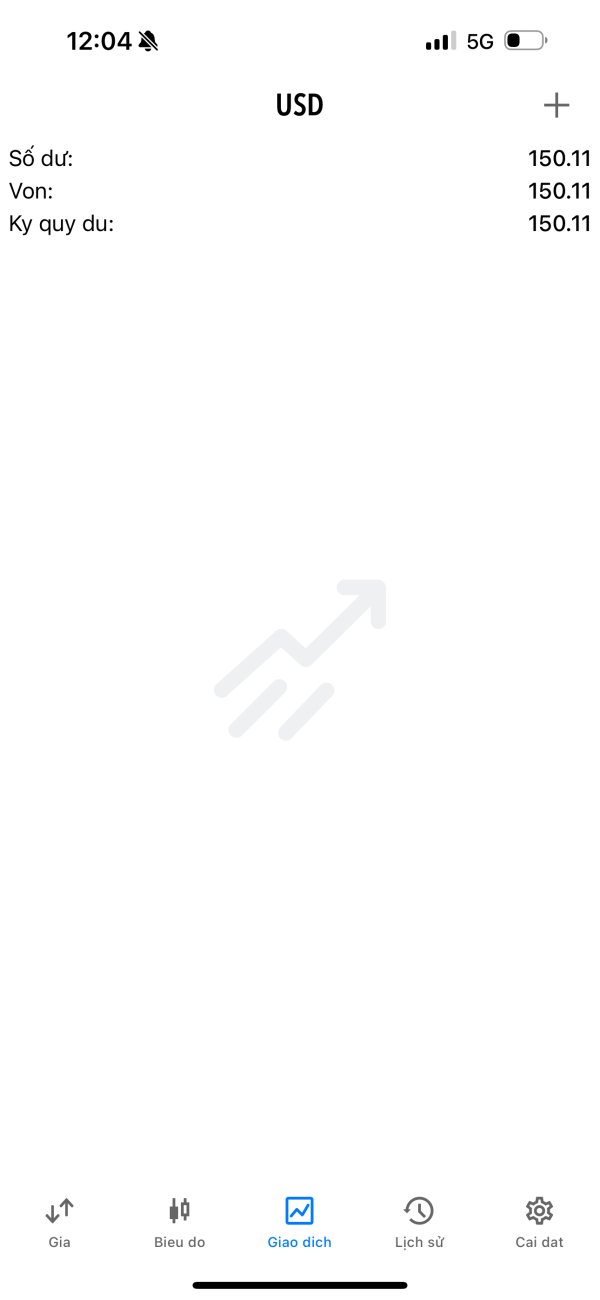

Verbo Capital's account conditions receive a poor rating primarily due to the lack of transparent information about account types, requirements, and features. The available materials do not specify different account tiers, minimum deposit requirements, or special account features that traders typically expect from legitimate brokers.

This information gap creates uncertainty for potential clients trying to understand what they can expect from the service. The absence of clear account opening procedures and verification requirements raises additional concerns about the broker's operational standards. Most reputable brokers provide detailed information about their account structures, including any Islamic accounts, VIP tiers, or specialized trading conditions.

The lack of such transparency suggests either inadequate disclosure practices or potentially non-standard operational procedures. User feedback indicates general dissatisfaction with account conditions, though specific complaints about account-related issues were not detailed in available sources. The combination of poor transparency and negative user sentiment contributes to the low rating in this category.

Potential clients should demand comprehensive information about account terms before proceeding with any registration process. When compared to established brokers in the market, Verbo Capital's lack of clear account information represents a significant disadvantage. This verbo capital review emphasizes the importance of transparent account conditions for building trader confidence and ensuring regulatory compliance.

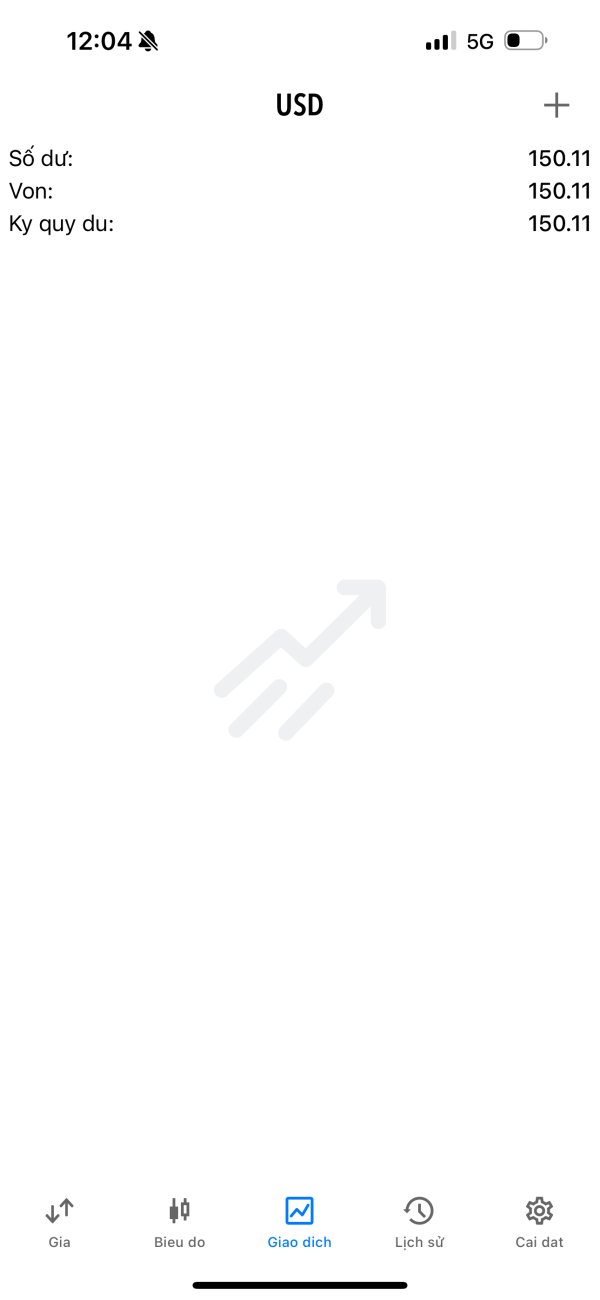

Despite other significant concerns, Verbo Capital receives a relatively positive rating for tools and resources, primarily due to its provision of the MetaTrader 5 platform. MT5 is a well-established and feature-rich trading platform that provides comprehensive charting capabilities, technical analysis tools, and automated trading support.

The platform's inclusion represents one of the few positive aspects of the broker's offering. The MT5 platform offers access to multiple asset classes and provides the technical infrastructure necessary for both beginner and advanced traders. Users can access various timeframes, technical indicators, and expert advisors through this platform.

However, information about additional research resources, educational materials, or proprietary analysis tools was not detailed in available sources. While the MT5 platform provides solid foundational trading capabilities, the absence of additional educational resources or market analysis materials limits the overall value proposition. Many competitive brokers supplement their platform offerings with daily market updates, educational webinars, and comprehensive trading guides.

The positive rating in this category should be viewed within the context of the broker's other significant limitations. While the trading tools may be adequate, the overall service quality and regulatory concerns overshadow this particular strength.

Customer Service and Support Analysis (2/10)

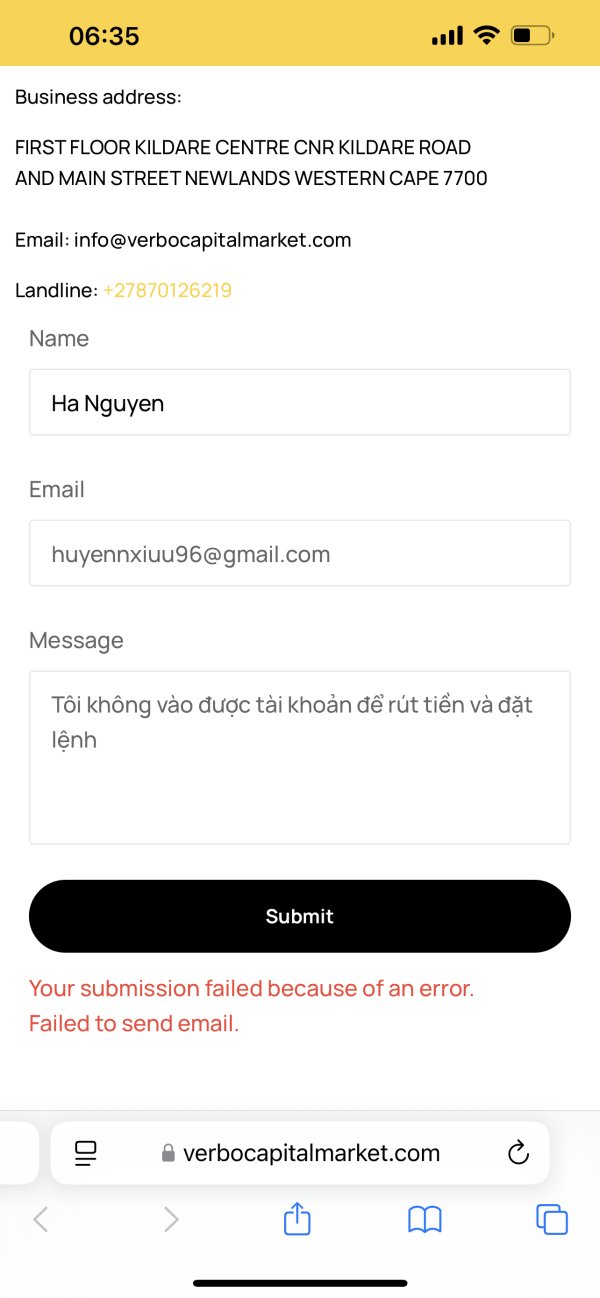

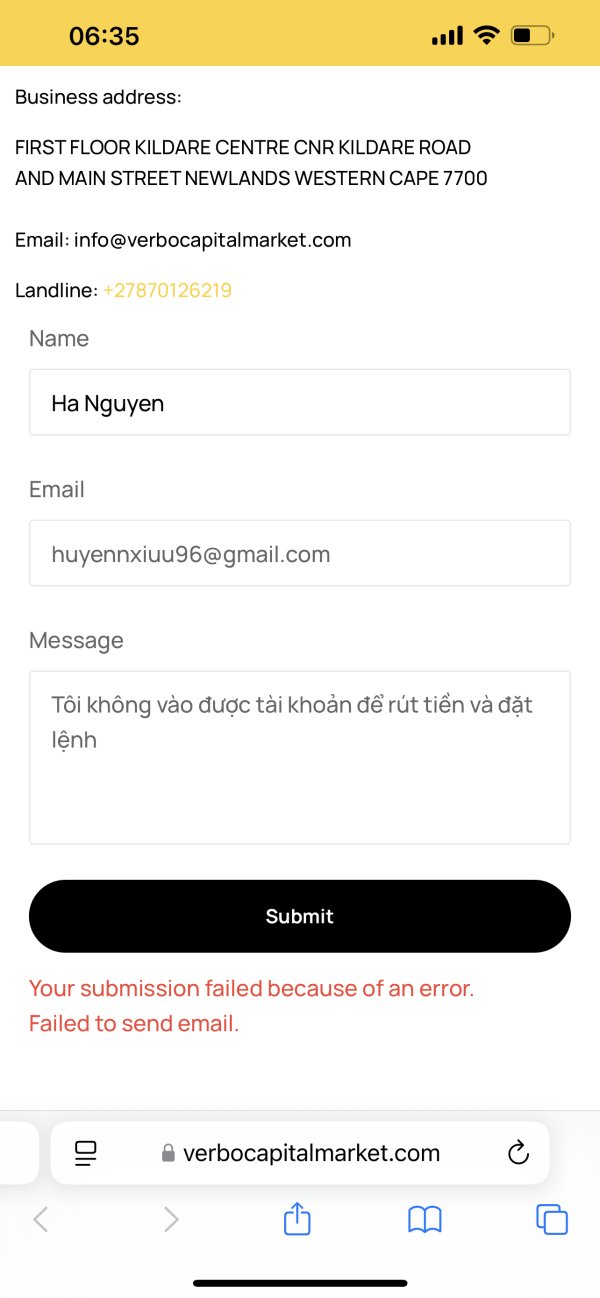

Customer service represents one of Verbo Capital's most significant weaknesses, with user feedback consistently highlighting poor support quality and responsiveness. Reports indicate that customer service representatives are slow to respond to inquiries and demonstrate limited problem-solving capabilities when issues arise.

This poor service quality creates additional risks for traders who may need urgent assistance with their accounts or trading activities. The lack of detailed information about available customer support channels, operating hours, and language support further compounds these concerns. Most legitimate brokers provide clear information about how clients can reach support teams and what level of service they can expect.

The absence of such transparency suggests potentially inadequate support infrastructure. User complaints about customer service appear to be widespread, with multiple sources indicating systematic problems rather than isolated incidents. This pattern of poor service quality is particularly concerning given the broker's other regulatory and operational issues.

Traders relying on responsive customer support for their trading activities would likely face significant frustration with this broker. The combination of slow response times, poor problem resolution, and lack of transparency about support services contributes to the very low rating in this category. Potential clients should consider whether they can afford to trade with a broker that may not provide adequate support when needed.

Trading Experience Analysis (3/10)

The trading experience with Verbo Capital receives a below-average rating due to user reports of platform unreliability and execution issues. While the MT5 platform itself is technically sound, user feedback suggests that the broker's implementation may suffer from stability problems that affect trading performance.

Reports of slippage and requoting issues indicate potential problems with order execution quality. Platform reliability is crucial for successful trading, particularly in fast-moving markets where execution speed and accuracy can significantly impact trading results. User complaints about platform performance suggest that traders may face technical difficulties that could interfere with their trading strategies and potentially result in financial losses.

The verbo capital review feedback indicates that despite having access to a professional trading platform, the overall trading environment may not meet the standards that experienced traders expect. Issues with platform stability and execution quality can be particularly problematic for traders employing short-term strategies or trading during high-volatility periods.

While the MT5 platform provides basic trading functionality, the reported reliability issues and execution problems significantly detract from the overall trading experience. Traders considering this broker should carefully evaluate whether the potential technical problems align with their risk tolerance and trading requirements.

Trust and Safety Analysis (1/10)

Trust and safety represent the most critical concern with Verbo Capital, earning the lowest possible rating due to multiple regulatory warnings and user reports of fraudulent behavior. The Hong Kong Securities and Futures Commission's classification of the entity as unauthorized provides official regulatory confirmation of legitimacy concerns.

The broker's inability to provide verifiable regulatory authorization despite claims of FSCA oversight creates significant uncertainty about investor protection measures. Legitimate brokers typically maintain clear regulatory status that can be independently verified through official regulatory databases. The lack of such verification suggests potential compliance issues that could affect client fund security.

User feedback consistently characterizes the broker as fraudulent, with reports of scam-like behavior that extend beyond typical service quality issues. These reports, combined with regulatory warnings, create a pattern of evidence suggesting that the broker may not operate according to industry standards for client protection and regulatory compliance.

The absence of information about client fund segregation, insurance coverage, or other standard safety measures further compounds trust concerns. Reputable brokers typically provide clear information about how client funds are protected and what recourse is available in case of problems. The lack of such transparency represents a significant red flag for potential investors.

User Experience Analysis (2/10)

Overall user experience with Verbo Capital receives a poor rating based on widespread negative feedback and reported operational problems. User satisfaction appears to be consistently low across multiple aspects of the service, from account management to customer support and platform performance.

The presence of hidden fees, as reported by users, creates additional frustration and suggests potentially deceptive business practices. Common user complaints center around lack of transparency, poor communication, and unexpected costs that were not clearly disclosed during the account opening process. These issues create a negative experience that extends beyond simple service quality problems to potentially deceptive practices that could result in financial losses.

The broker's target demographic appears to be traders seeking access to multiple asset classes, but the poor user experience makes it unsuitable for risk-averse investors or those requiring reliable service quality. New traders, in particular, would likely face significant challenges due to the combination of poor support and unclear terms.

Based on user feedback analysis, the broker fails to meet basic expectations for transparency, reliability, and customer service quality. Potential clients should carefully consider whether they can accept the high likelihood of poor user experience and associated risks before proceeding with this broker.

Conclusion

This comprehensive verbo capital review reveals significant concerns that potential investors should carefully consider before engaging with this broker. While Verbo Capital offers access to the MT5 trading platform and multiple asset classes, these limited advantages are overshadowed by serious regulatory warnings, poor user feedback, and lack of operational transparency.

The broker is most unsuitable for risk-averse investors, beginners, or anyone requiring reliable customer support and transparent trading conditions. The regulatory warning from the Hong Kong Securities and Futures Commission, combined with consistent user reports of problematic practices, suggests that this broker poses considerable risks that outweigh any potential benefits.

The main advantages include MT5 platform access and multi-asset trading opportunities, while the significant disadvantages encompass regulatory concerns, poor customer service, hidden fees, and unreliable platform performance. Given the available evidence, traders would be well-advised to consider alternative brokers with clearer regulatory status and better user satisfaction records.