Fintxpert LLC, based in Seychelles, was established in 2024, claiming to offer robust trading solutions across various asset classes. However, the absence of regulatory oversight from any recognized financial authorities raises significant concerns about its legitimacy. Critics suggest that the broker may have fabricated details to project a trustworthy image, creating additional skepticism among potential investors.

The platform offers trading in several areas, including forex, stocks, commodities, and cryptocurrencies, boasting an array of trading tools and educational resources. Despite these offerings, its operational practices lack transparency, with conflicting information about its regulatory status and purported registered locations (one source points to an unverified address, while others highlight operational opacity).

Fintxpert claims to adhere to regulatory guidelines but operates without any legitimate licensing from recognized bodies such as the FCA or ASIC, raising severe red flags. This lack of regulation significantly heightens investor risk.

- Visit official regulatory websites: Check for Fintxpert's regulatory status.

- Search for company reviews: Use reputable review platforms to gauge user feedback.

- Perform WHOIS checks: Look up domain registration and company history.

- Contact support for inquiries: Validate their responsiveness and reliability before trading.

- Stay consistent with your findings: Use uniform sources for a comprehensive understanding.

Industry Reputation and Summary

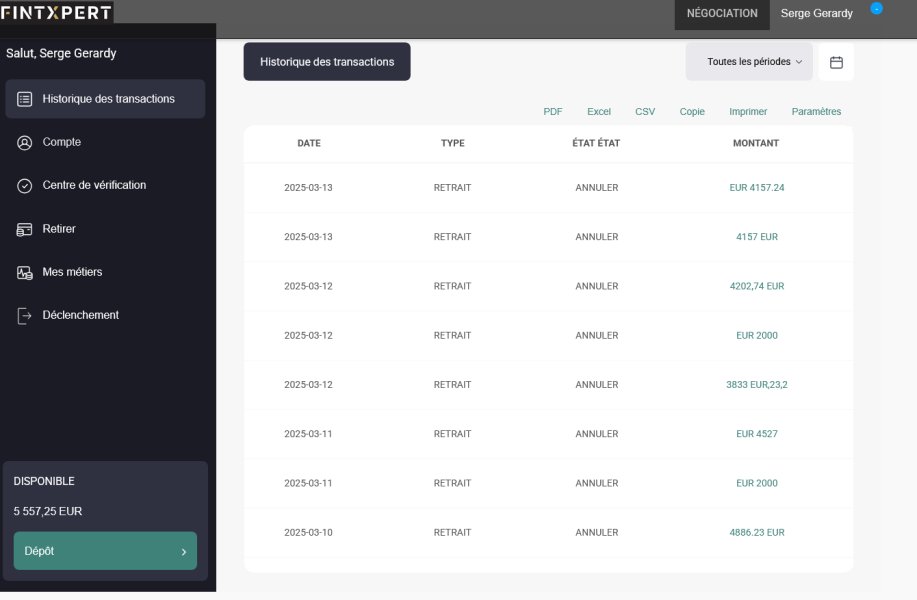

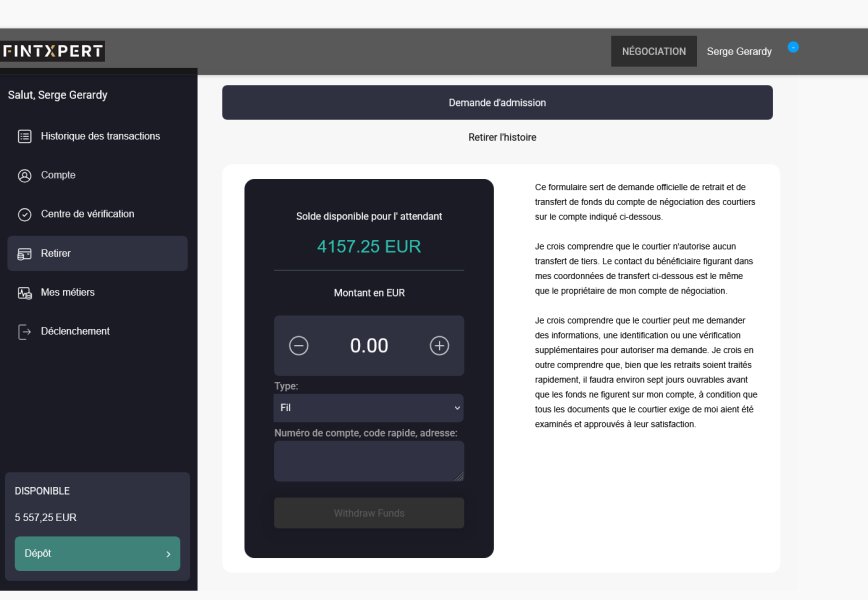

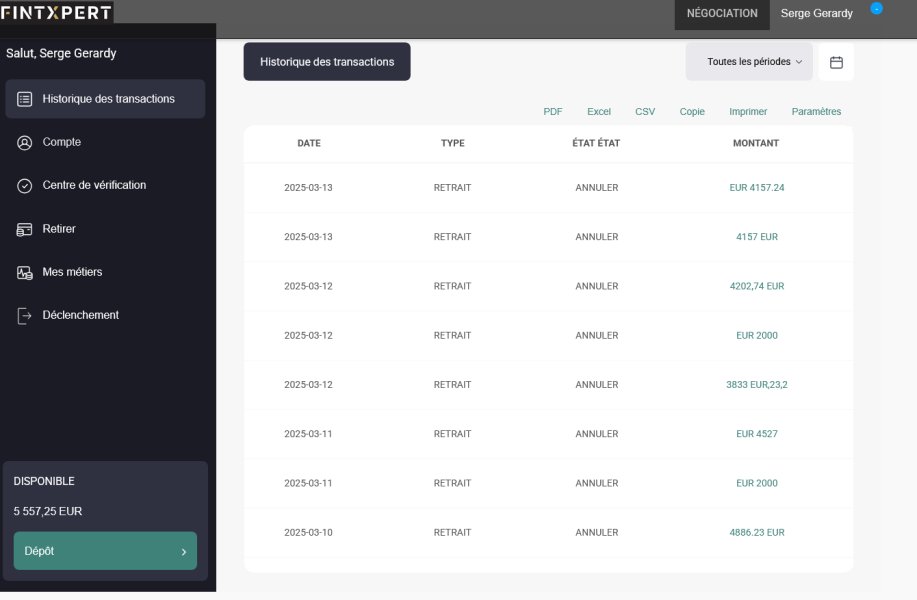

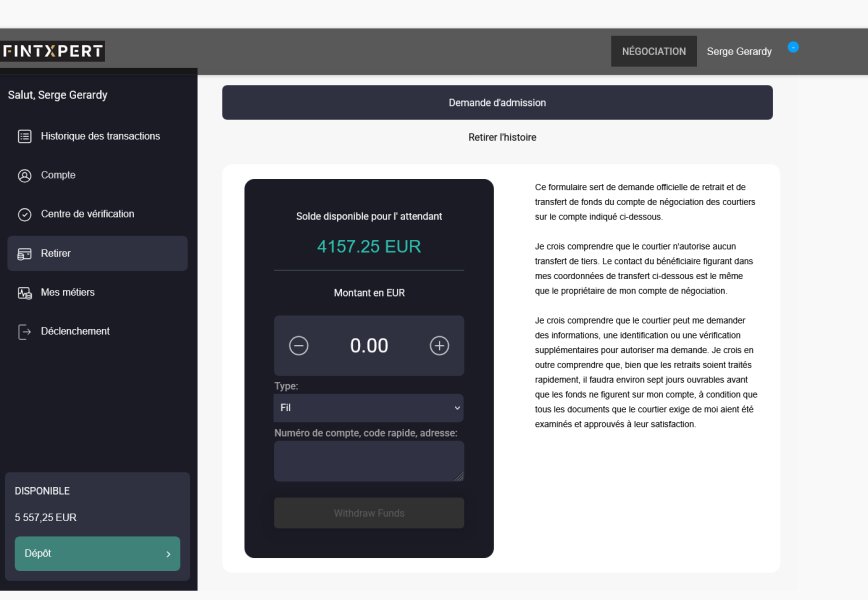

Users have voiced significant concerns about fund safety. One trader noted, >"I started with a small deposit but encountered numerous issues withdrawing funds." Such testimonials highlight the potential hazards of investing based on misleading marketing.

Trading Costs Analysis

Advantages in Commissions

While Fintxpert offers low trading commissions designed to attract novice traders, there's often a hidden cost associated with high withdrawal fees, which can undermine the initial allure of lower commissions.

The "Traps" of Non-Trading Fees

Users have noted that, after a seemingly lucrative trading experience, substantial withdrawal fees can be very discouraging. One user mentioned, >"After trading a few hundred euros, I faced a surprise €30 fee just to access my money."

Cost Structure Summary

Ultimately, Fintxperts structure presents a mixed bag; low commission rates appeal to new traders, but hidden costs can dramatically affect overall profitability, pushing it towards a platform more suitable for critical trading situations rather than casual investments. The costs should be considered before deciding on a broker.

Fintxpert claims to provide advanced trading features, including various analytical tools. However, user feedback indicates the actual execution is flawed, with many reporting outdated and unhelpful platforms. Critics emphasize that tools need significant improvement to meet professional standards.

While the broker offers educational resources, many users have complained about the lack of access based on account tiers, causing frustration among those eager to learn and utilize effective strategies. One pointed out that only premium account holders had access to the educational content, saying, >“I felt short-changed, expecting resources that werent available at my account level.”

Overall, despite promising features, the user experience leaves much to be desired. Clients report a clunky interface, complicating trading efforts.

User Experience Analysis

Examination of User Interface

Feedback on the user interface generally conveys dissatisfaction. The website's navigation is deemed convoluted, and the aesthetic leaves something to be desired, diverging from the agile and sleek interfaces found at regulated brokers.

Respondents describe major frustrations around tool accessibility and usability. For example, users noted, >"Switching between instruments is cumbersome, with no user-friendly features to streamline the trading process."

Summation of the User Experience

In summary, the user experience on Fintxpert may be disjointed for many, pointing to a platform that struggles to deliver a seamless trading environment, which can hinder traders overall performance and satisfaction.

Customer Support Analysis

Assessment of Support Channels

Although Fintxpert claims to have robust customer support, testimonies suggest discrepancies in actual service. Reports frequently highlight long wait times or complete unresponsiveness when urgent issues arise.

Feedback on Effectiveness

Aspects of customer service often cause alarm. One user recounted, >"Once I tried to withdraw, I couldn't get anyone on the line, leaving me feeling completely abandoned." Such experiences only amplify concern regarding the broker's commitment to supporting its clients.

Conclusion on Customer Support

In light of the experiences shared, Fintxpert's customer support does not meet acceptable standards, suggesting further scrutiny is warranted by potential clients.

Account Conditions Analysis

Overview of Account Requirements

Fintxpert's varying account types require high minimum deposits, with a standard account starting at €250 but escalating to €100,000 for VIP services. Such high thresholds may limit access to a broader trader demographic.

Comparison of Account Benefits

The disparity in service levels between account types leads to testimonies highlighting confusion over what is actually necessary for effective trading. Existing clients struggle to make sense of the tiered benefit system without adequate transparency.

Recap on Account Conditions

Collectively, potential investors should consider the steep financial commitment alongside limited benefits, resulting in a trial and error atmosphere among different account users.

Conclusion

In light of the analysis presented, it becomes evident that Fintxpert, despite its enticing features and low barrier to entry, poses significant risks insufficiently mitigated by its unregulated status. Investors are strongly encouraged to prioritize thorough research and consider safer, regulated alternatives before committing funds to Fintxpert. The high likelihood of withdrawal issues, unclear fees, and user dissatisfaction should not be overlooked. This platform, while initially seeming appealing, ultimately may represent more of a financial trap than a wise investment choice.