Is SOLTCL safe?

Business

License

Is Soltcl A Scam?

Introduction

Soltcl, short for Solana Trustee Company Limited, is a relatively new player in the forex market, having been established in 2022 in New Zealand. The broker claims to offer a diverse range of investment opportunities, including real estate, private equity, credit, and multi-asset strategies. However, with the rapid growth of online trading platforms, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of any broker they consider. This article aims to investigate whether Soltcl is a safe trading platform or if there are signs of it being a scam. The analysis will be based on various factors, including regulatory status, company background, trading conditions, customer experiences, and risk assessments. By examining these elements, we hope to provide a comprehensive overview that assists traders in making informed decisions.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its legitimacy and safety. Soltcl operates without any regulatory oversight, which raises significant concerns among potential investors. Regulatory authorities are essential for ensuring that brokers adhere to legal and ethical standards, providing a layer of protection for traders. The absence of regulation means that Soltcl is not accountable to any governing body, leaving investors vulnerable to potential risks.

Heres a summary of the regulatory information concerning Soltcl:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework is a major red flag for traders. Without oversight, there is no recourse in case of fraud or disputes. While Soltcl may present an appealing array of services, its unregulated status suggests that it operates independently, which can be risky for users. Therefore, it is vital for potential traders to consider these factors carefully before engaging with Soltcl.

Company Background Investigation

Founded in 2022, Soltcl is based in New Zealand and presents itself as a provider of diverse investment opportunities. However, the company's brief history raises questions about its credibility. The ownership structure is unclear, and there is little publicly available information regarding the management team. Transparency is crucial in the financial services industry, and the lack of information about the people behind Soltcl is concerning.

Moreover, a thorough investigation into the company's history reveals that it has not established a significant market presence since its inception. The absence of a well-documented track record makes it challenging to assess the broker's reliability. Traders should be cautious when dealing with a company that has not demonstrated stability or proven expertise in the industry. Given these factors, the question of is Soltcl safe becomes increasingly relevant.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Soltcl claims to provide various trading assets, but the specifics regarding fees and spreads are critical for potential traders. The overall fee structure can significantly impact a trader's profitability and experience.

Heres a comparison of core trading costs:

| Fee Type | Soltcl | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The lack of specific information about spreads and commissions raises concerns. If a broker does not provide clear details regarding their fees, it may indicate an attempt to obscure potentially unfavorable trading conditions. Traders should be wary of platforms that do not transparently disclose their fee structures, as this can lead to unexpected costs and reduced profitability.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Soltcls lack of regulation raises questions about the measures in place to protect client funds. Regulatory bodies typically require brokers to implement strict security protocols, including segregating client funds and providing investor protection mechanisms. In the case of Soltcl, the absence of such oversight means there are no guarantees regarding the safety of deposited funds.

Additionally, there have been no reported incidents of fund security issues with Soltcl, but the lack of a robust regulatory framework leaves clients vulnerable. Traders should always prioritize brokers that offer clear information about their fund security measures, including segregated accounts and negative balance protection policies. The question of is Soltcl safe becomes increasingly pressing in light of these concerns.

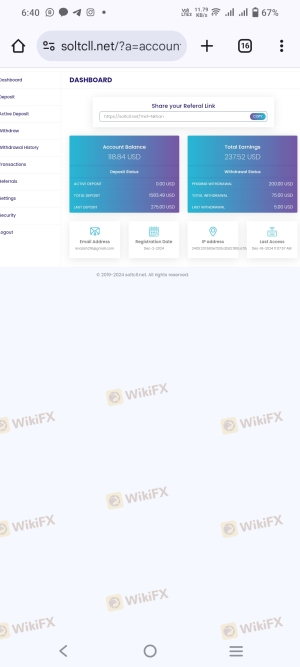

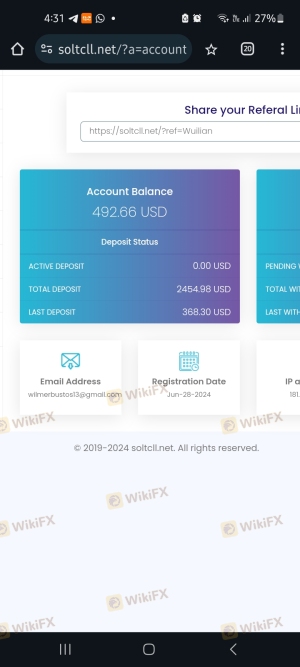

Customer Experience and Complaints

Customer feedback is invaluable when assessing the reliability of a broker. Reviews of Soltcl indicate a mix of experiences, with several users reporting issues related to withdrawal restrictions and customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

Many users have described Soltcl as unresponsive to complaints, which is a significant concern for any potential trader. For example, one user reported that their withdrawal was restricted, while another mentioned that they were asked to deposit additional funds to access their existing balance. Such practices are often indicative of unethical behavior and can lead to significant losses for traders.

Platform and Execution

The performance of a trading platform is crucial for a positive user experience. Soltcl's platform appears to offer standard features, but the lack of detailed information regarding execution quality, slippage, and order rejection rates is concerning. Traders should be cautious if a broker does not provide transparent information about these critical aspects.

A reliable trading platform should ensure quick order execution, minimal slippage, and high reliability. If users experience frequent issues with their trades, it could indicate underlying problems with the broker's operations. Therefore, the question of is Soltcl safe must be considered in light of these factors.

Risk Assessment

Using Soltcl as a trading platform carries several risks, primarily due to its unregulated status and lack of transparency. Heres a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints. |

To mitigate these risks, traders should conduct thorough research, consider using regulated platforms, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Soltcl operates with several concerning factors that raise the question of is Soltcl safe. The lack of regulatory oversight, transparency regarding fees, and negative customer feedback indicate that potential investors should exercise caution. While the platform may offer a variety of investment opportunities, the risks associated with trading through Soltcl outweigh the potential benefits.

For traders seeking safer alternatives, we recommend exploring well-regulated brokers with a proven track record and positive customer reviews. Prioritizing platforms that adhere to strict regulatory standards will provide a greater level of security and peace of mind for your investments.

Is SOLTCL a scam, or is it legit?

The latest exposure and evaluation content of SOLTCL brokers.

SOLTCL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SOLTCL latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.