Founded over a decade ago, Wonder Market Ltd. is headquartered in a jurisdiction recognized for its regulatory framework. Its product offerings have evolved, focusing on providing traders with an array of trading instruments, including forex and CFDs. The company prides itself on catering to experienced traders who can navigate the complexities of the forex market while offering educational resources to enhance their trading expertise.

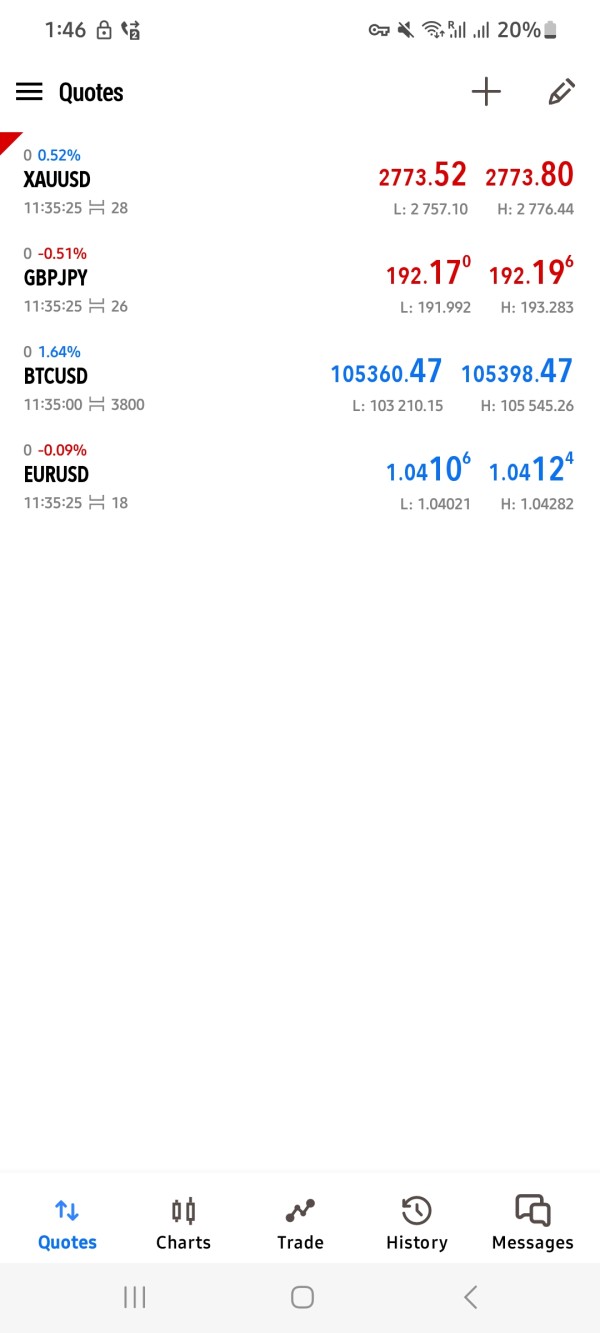

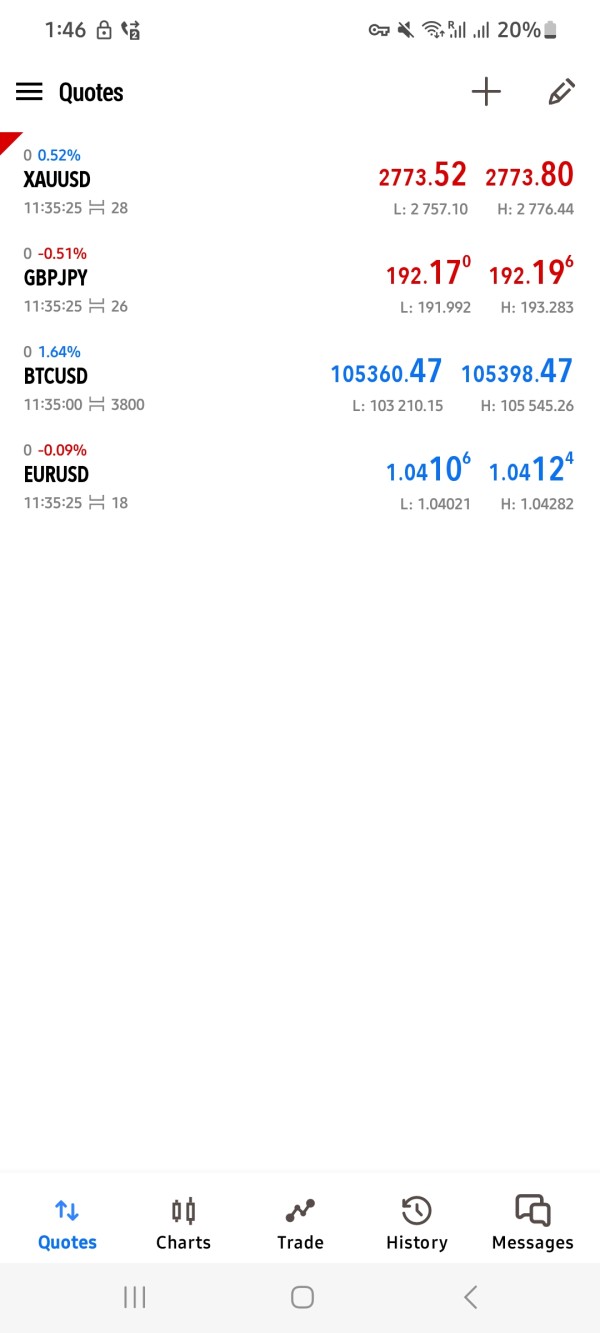

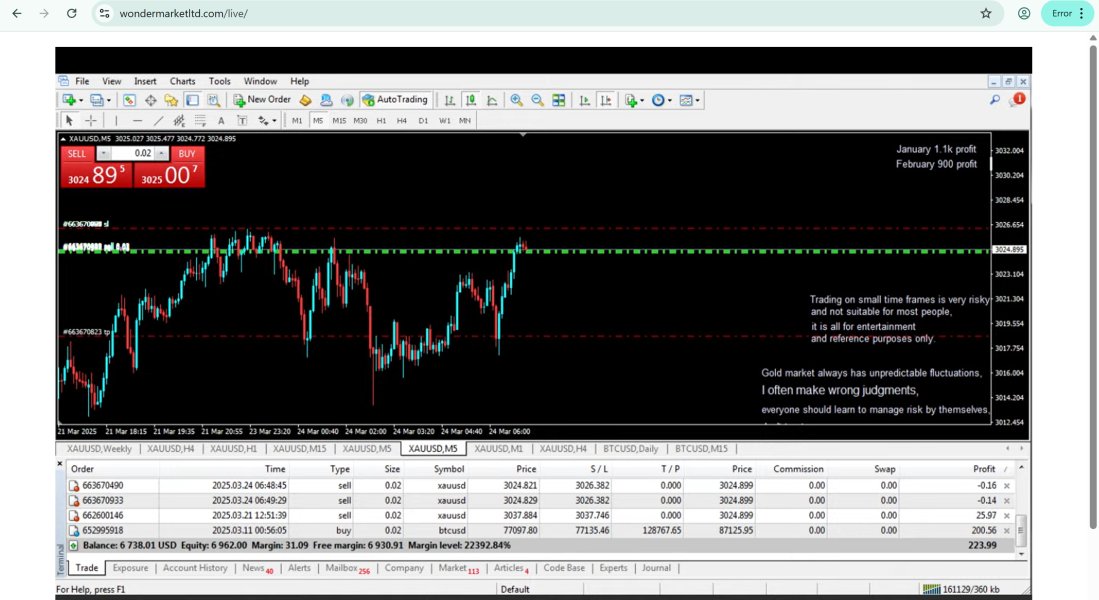

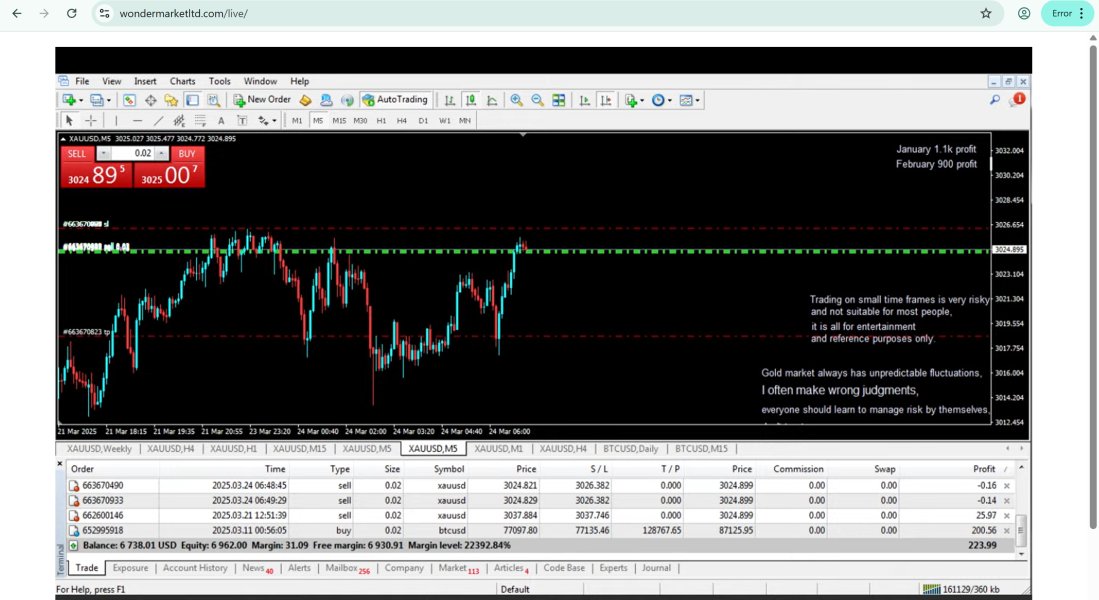

Wonder Market specializes in forex trading and offers a variety of account types. Each account caters to different trader needs, with features that evolve based on the level of investment. The trading is facilitated via its proprietary platform, which provides access to a wide range of asset classes, including forex, indices, commodities, and cryptocurrencies. Regulatory oversight, primarily under CySEC, aims to instill confidence among potential traders regarding the safety of their investments.

The trustworthiness dimension of Wonder Market can be scrutinized through its regulatory claims and user experiences.

"I had a great experience using Wonder Market Ltd. The platform is user-friendly, and the customer support is very helpful.

- Verify the company's regulatory status through official channels, ensuring that it adheres to proper procedures.

- Check for online user reviews on trading platforms and forums such as Trustpilot.

- Review regulatory history with CySEC to find out if there are outstanding complaints against the broker.

Industry Reputation and Summary: Although regulatory recognition exists, caution is encouraged due to the mixed reviews from users, highlighting the necessity of self-verification before engaging.

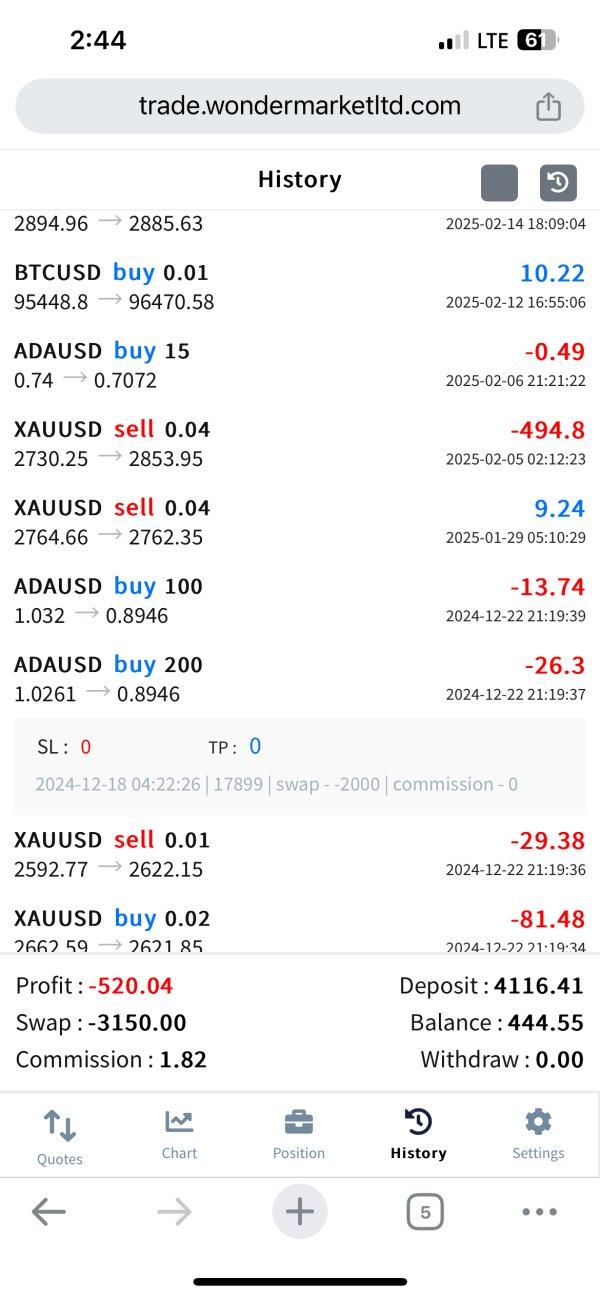

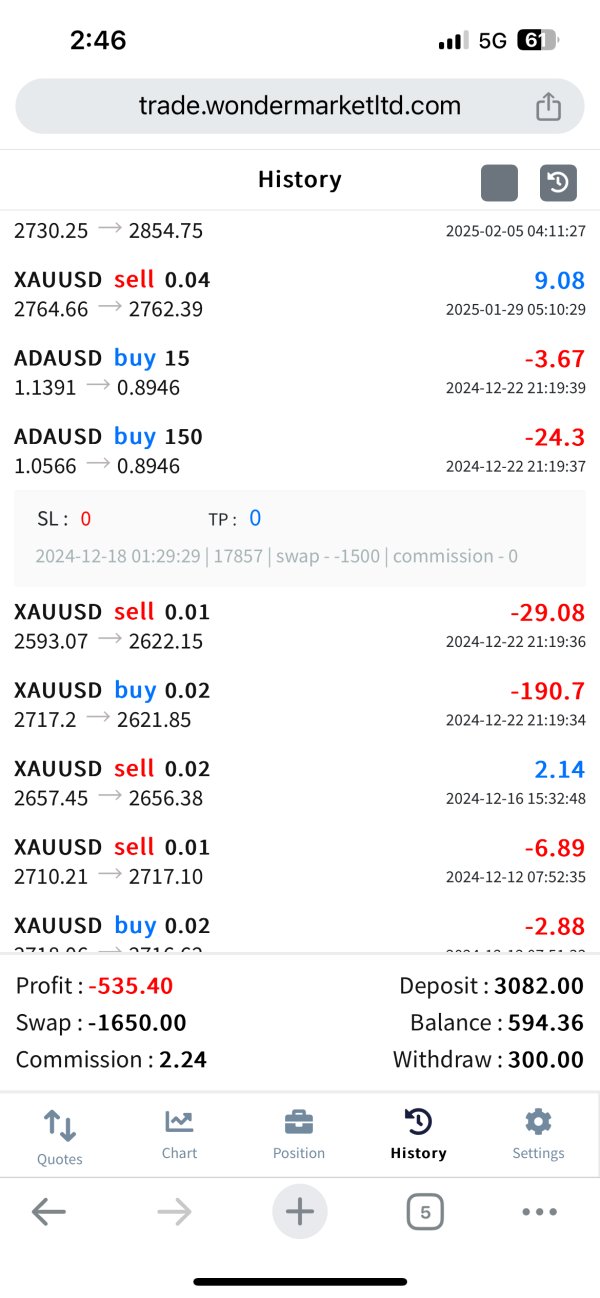

Trading Costs Analysis: The Double-Edged Sword Effect

When evaluating trading costs at Wonder Market, a balance is necessary between the advantages of low commissions and the disadvantages of potential non-trading fees.

Advantages in Commissions: The broker is noted for offering a competitive commission structure. Specific rates depend on the account type, providing flexibility for seasoned traders looking for cost-efficient trading opportunities.

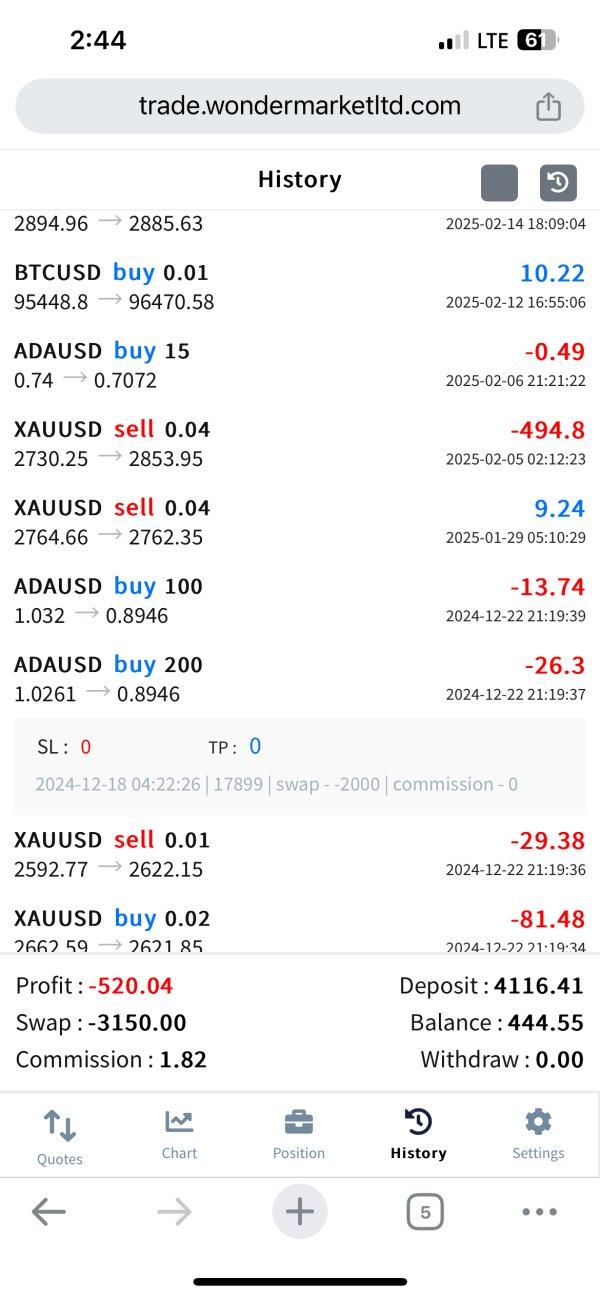

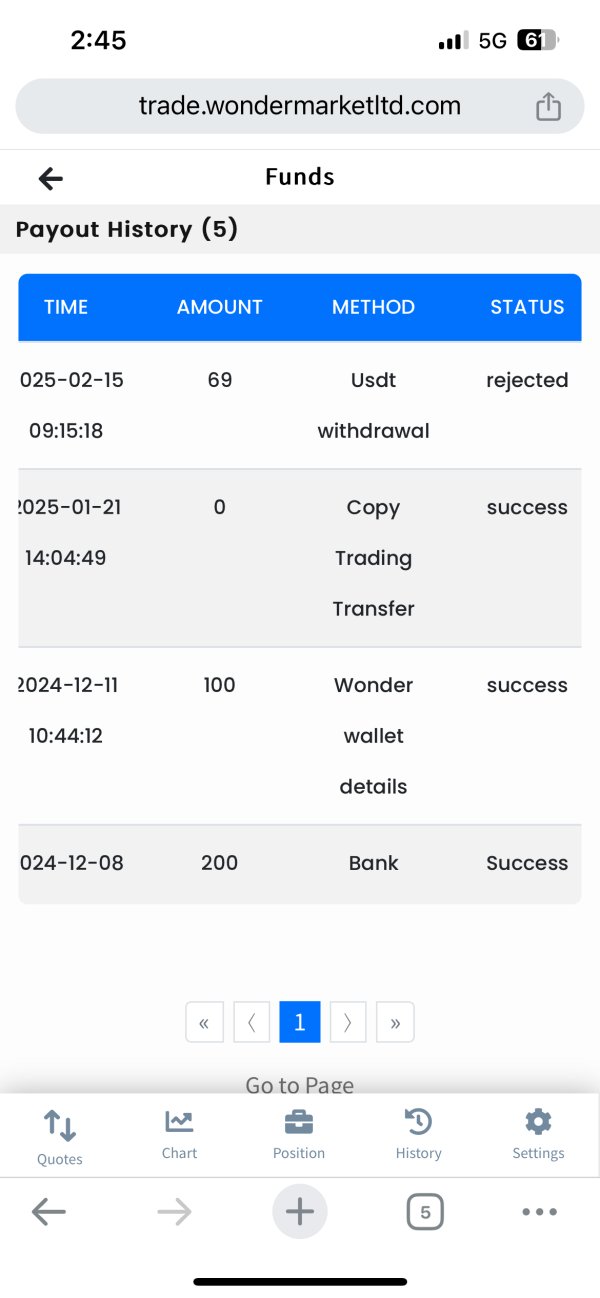

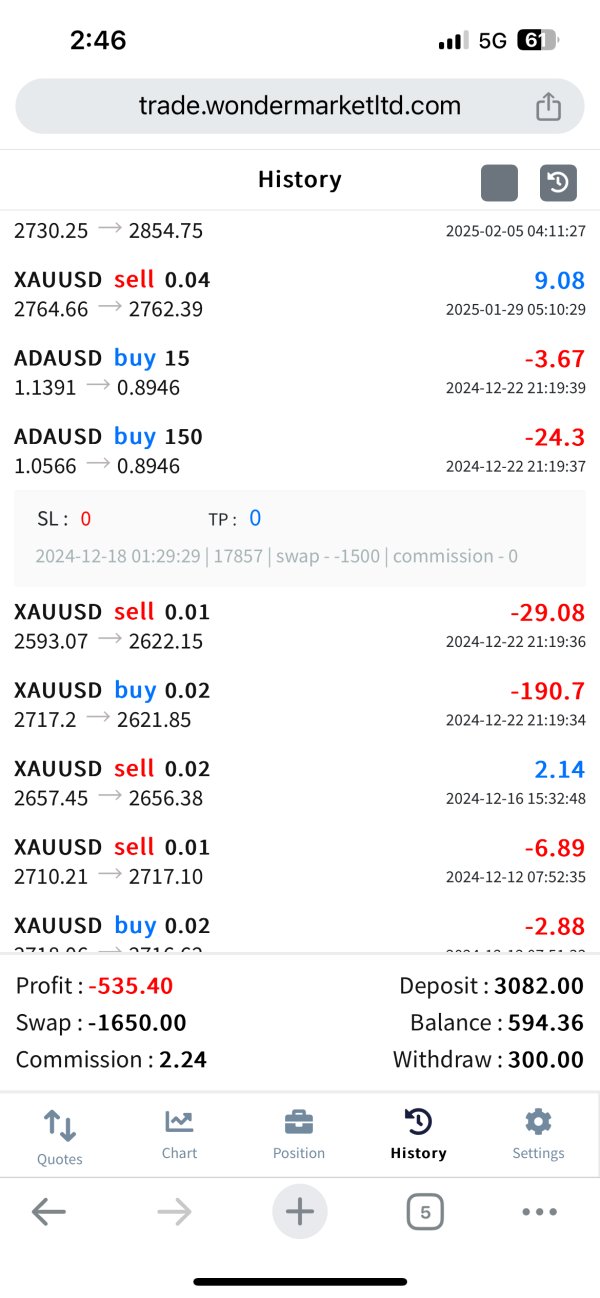

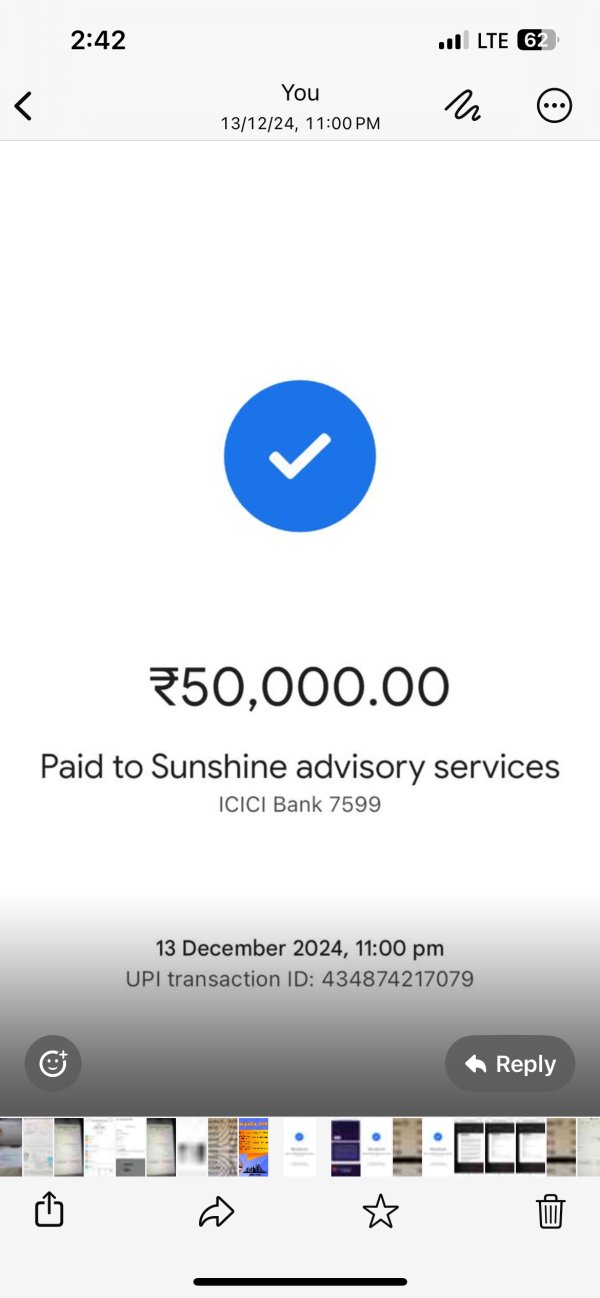

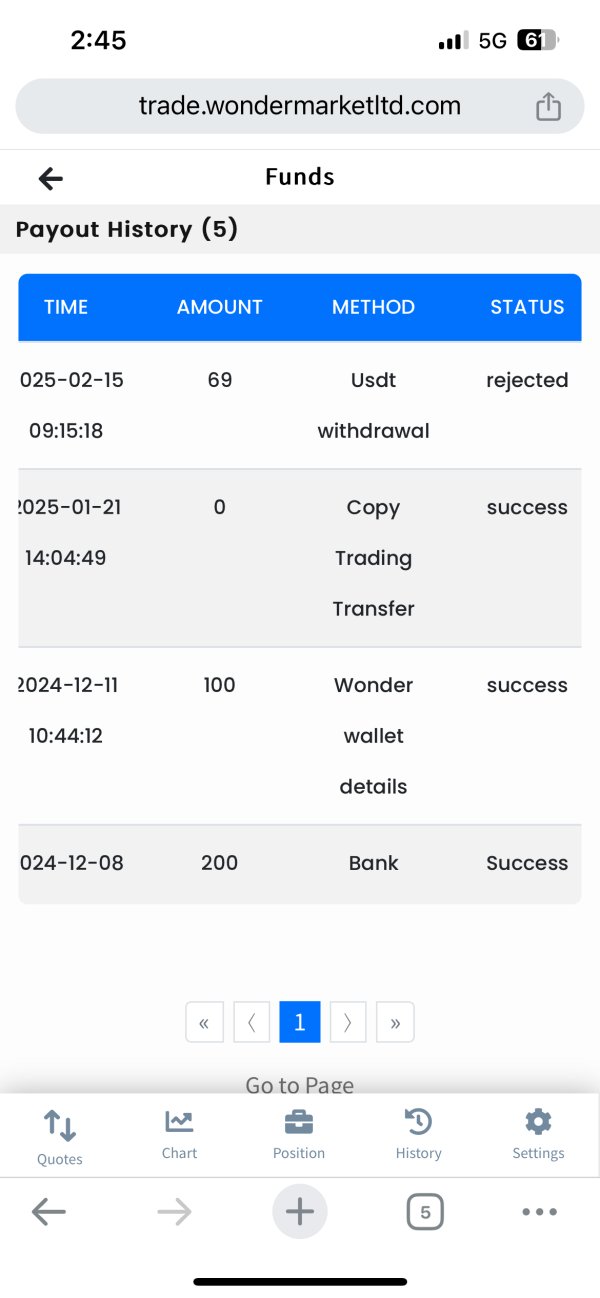

However, the 'traps' of Non-Trading Fees raise red flags: Complaints have surfaced around high withdrawal fees, with some users noting charges upwards of $30 for processing requests.

“I encountered a $30 fee every time I wanted to withdraw funds, significantly impacting my earnings.”

A summary of cost structure highlights this dual nature where trading can be efficient, yet withdrawal processes may introduce hidden costs that lessen the overall experience for different trader types.

In terms of platforms and tools provided by Wonder Market, the focus shifts towards balancing complexity with user accessibility.

Platform Diversity: The broker offers multiple avenues for trading, primarily featuring its proprietary trading platform alongside the popular MetaTrader 5 (MT5). This combination appeals to traders seeking advanced features.

Quality of Tools and Resources: Advanced charting tools and analytics cater to professionals while ensuring that educational materials support those less versed in trading intricacies.

Feedback on usability boils down to differing experiences, with some users indicating that the platforms interface can be complex:

"The educational resources have helped me a lot, but I wish the platform was a bit more user-friendly for beginners."

This dimension underscores the necessity for a platform that can scale with trader competence, incorporating advanced capabilities while making foundational trading accessible.

User Experience Analysis: Crafting a Seamless Journey for Traders

Examining user experience at Wonder Market reveals insight into how the platform is perceived across different trader backgrounds.

Customer Support Analysis: Building Trust Through Interaction

When evaluating customer support, both breadth and depth are crucial.

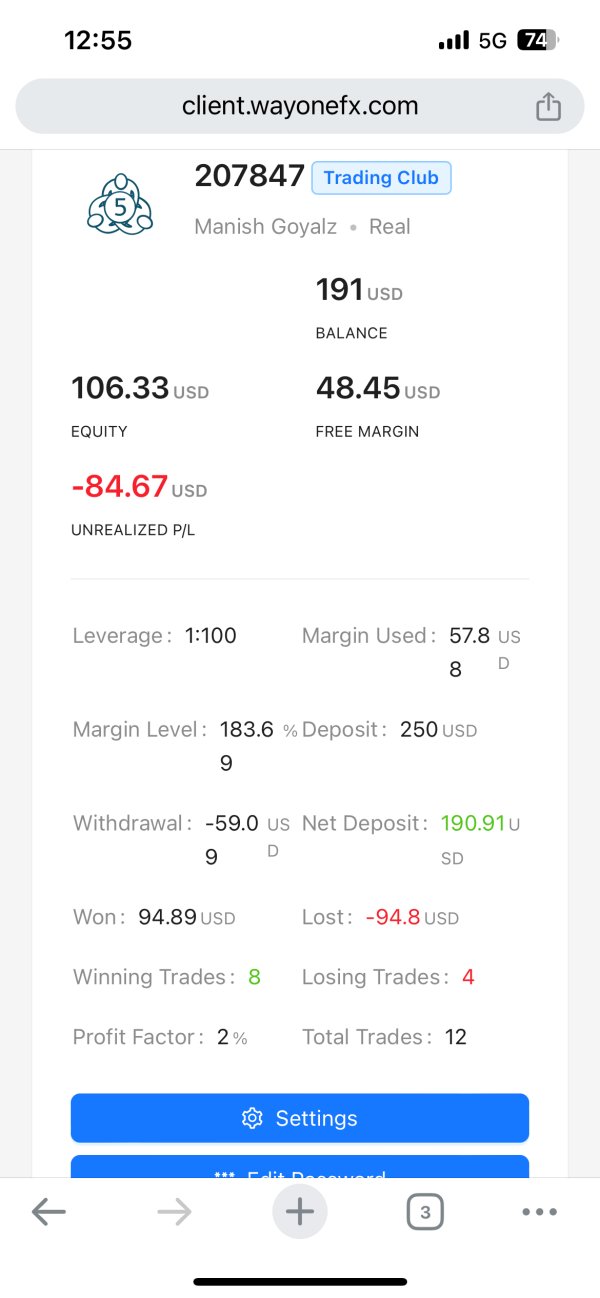

Account Conditions Analysis: Fees and Accessibility

The account conditions present a challenging landscape due to varying deposit requirements that can limit field engagement for newer traders.

Across these dimensions, Wonder Market strives to create an appealing offering for seasoned traders, which, when layed bare, showcases the limitations that can discourage beginner traders.

Conclusion

In this comprehensive review, its clear that Wonder Market Ltd. provides a robust platform for seasoned forex traders with its diverse offerings and educational resources. However, the high minimum deposits and associated withdrawal fees create barriers for new entrants to the trading space.

Traders must carefully weigh these factors against their investment capabilities and appetite for risk. Experienced practitioners may find their niche in this environment, but novices should approach with caution and conduct thorough due diligence before committing.

Given all aspects discussed, conducting research and self-verifying the regulatory and service claims are paramount, thus enabling traders to engage in a well-informed manner.

Wonder Market presents opportunities for experienced users willing to navigate its regulatory landscape and trading structure, but could also serve as a trap for the unwary. Traders should proceed with due diligence and a clear understanding of the risks and costs involved.